EV Charging Business: 10 Year Scaling Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

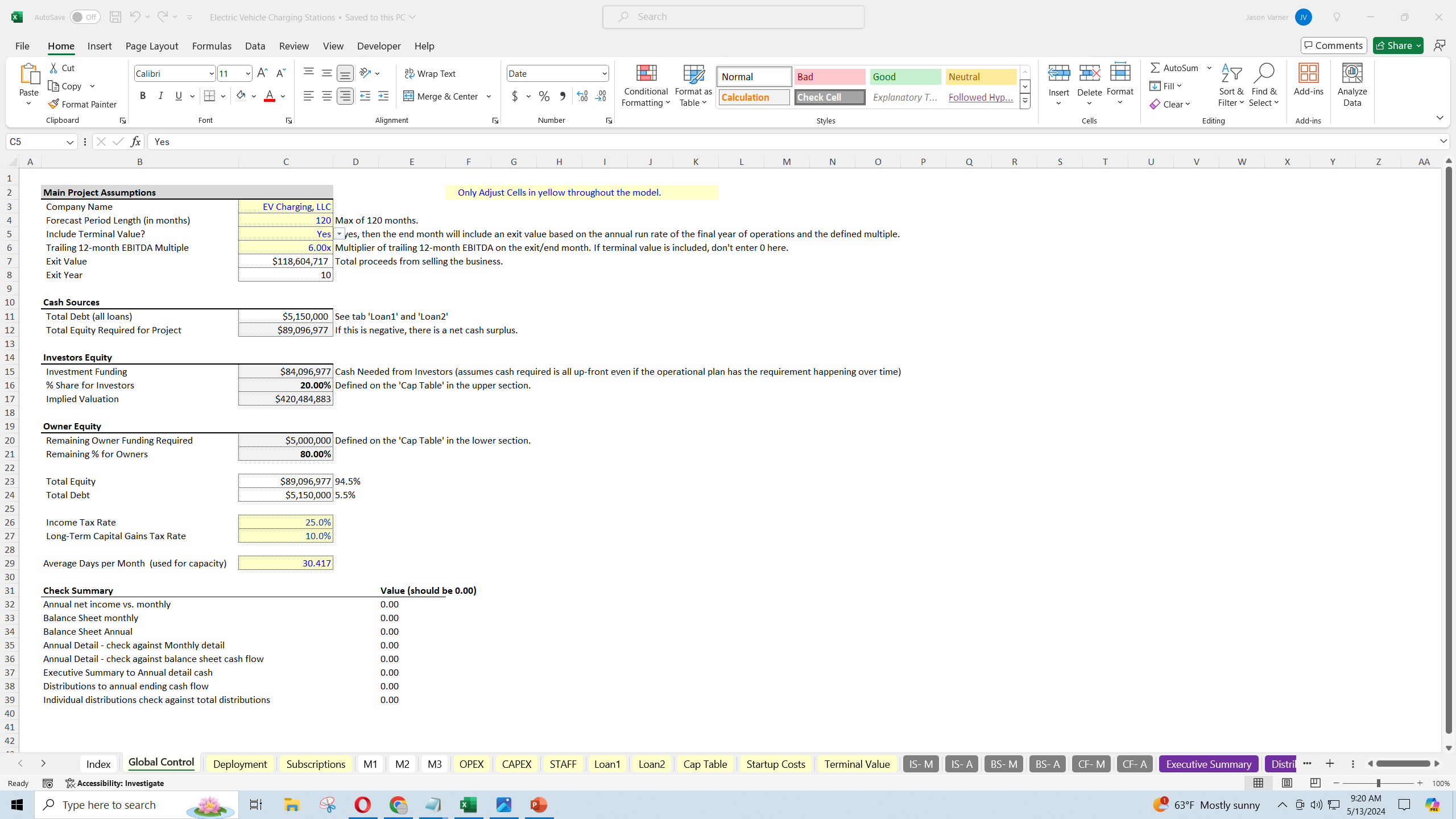

- A model that helps one understand minimum investment requirements and returns for scaling an EV charging station business for up to 10 years.

TRANSPORTATION EXCEL DESCRIPTION

If you were looking into planning the unit economics and potential returns of a large or small-scale electric vehicle (EV) charging station business, this model will be extremely useful. The template is ready to handle any scenario or strategy with bottom-up assumptions that are tailored to this specific type of business. As you adjust key assumptions, the financial statements automatically update (monthly and annual income statement, balance sheet, and cash flow statement).

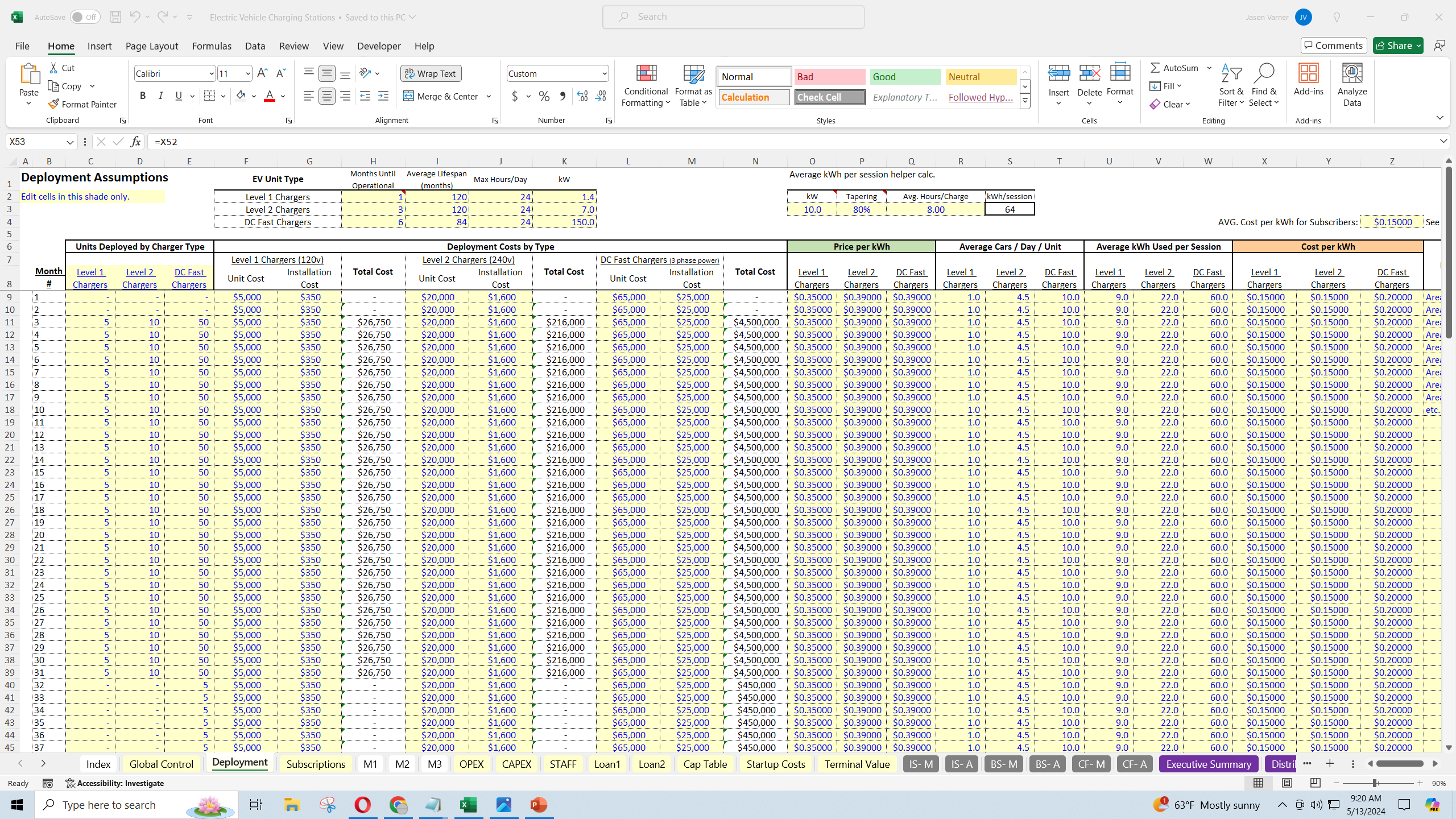

The user can adjust configurations for up to 120 deployment tranches, each with their own count of EV stations. There are 3 types that can be configured (typically referred to as level 1 chargers, level 2 chargers, and DC fast chargers). The concept is straightforward. You build all the infrastructure and install the charging stations, then as cars come up and use the chargers, you make a certain amount per kWh used.

For each deployment, there are inputs for expected car counts, average session duration, and price / cost per kWh. Global assumptions were built for each charger type that define the kw per charger, maximum available hours per day, lifespan, and the number of months it takes to fully install a charger.

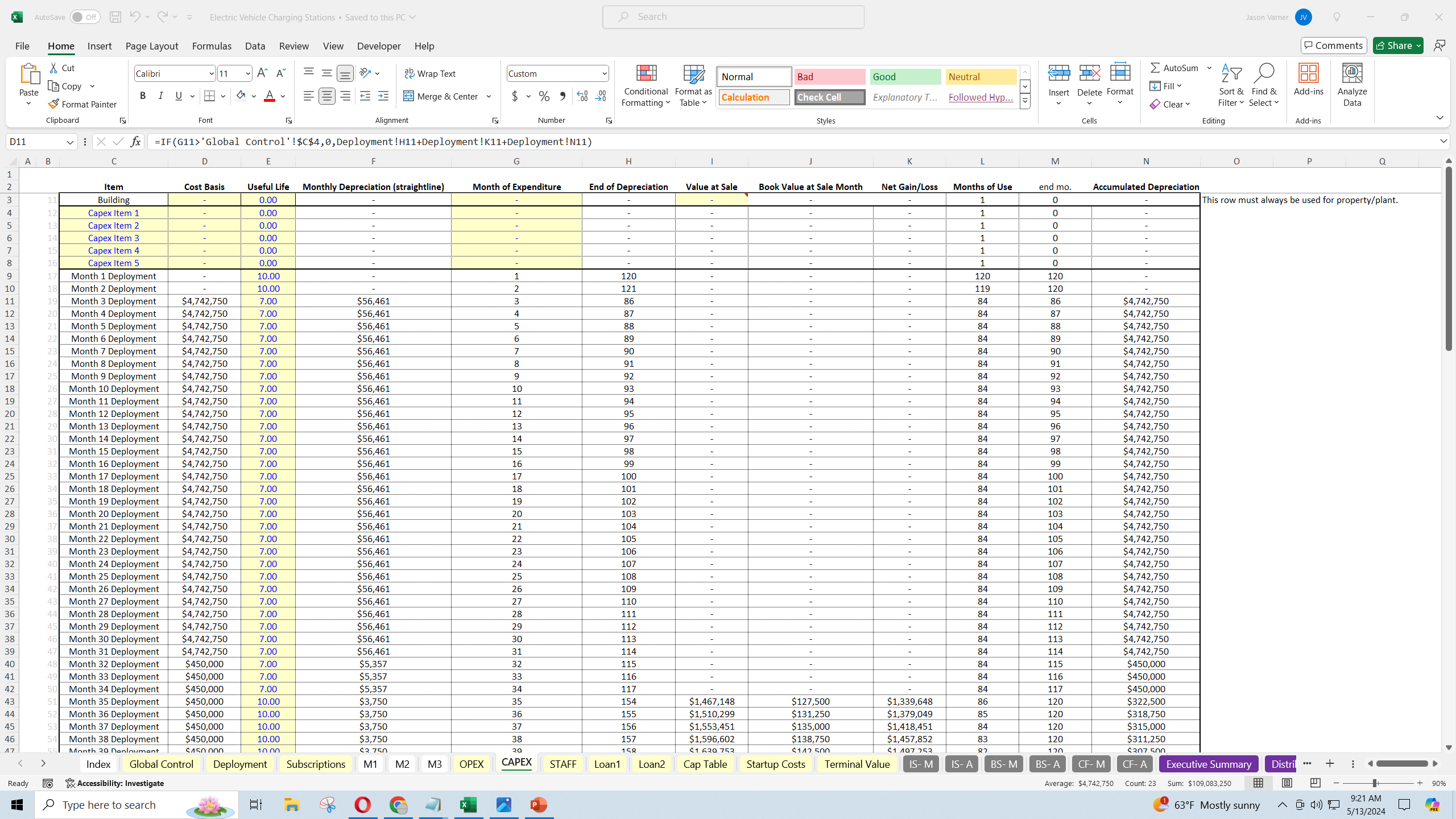

Each individual tranche lets the user enter the total cost per unit (to buy the actual charger) and a cost for installation per unit. That cost multiplied by the total units deployed in that month. Then, based on the length of time it takes to fully install, revenue will begin in a future month. The DC fast chargers can take much longer (3-8 months or longer depending on your specific situation). The level 1 and 2 chargers can usually be installed in 1-2 months.

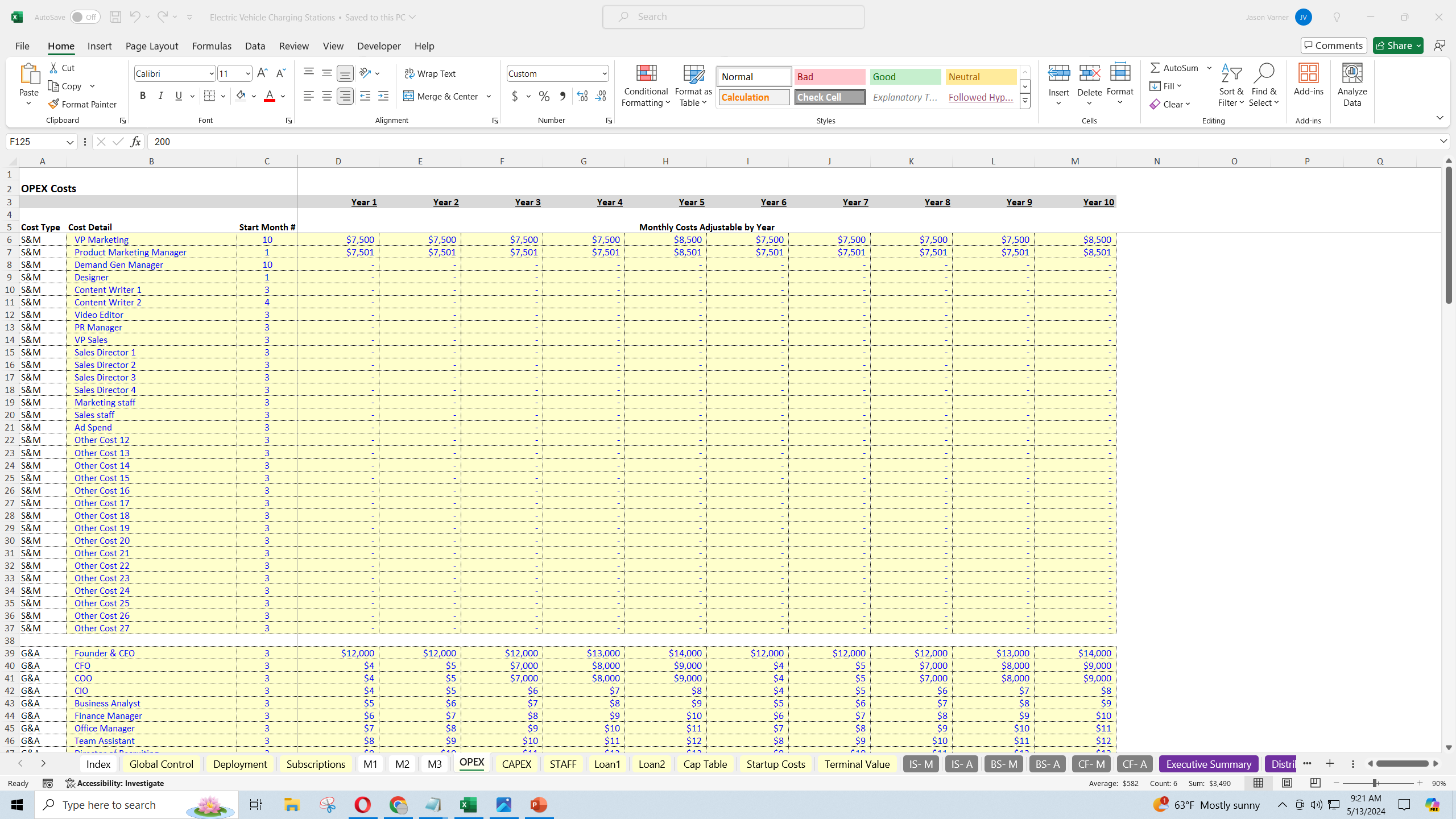

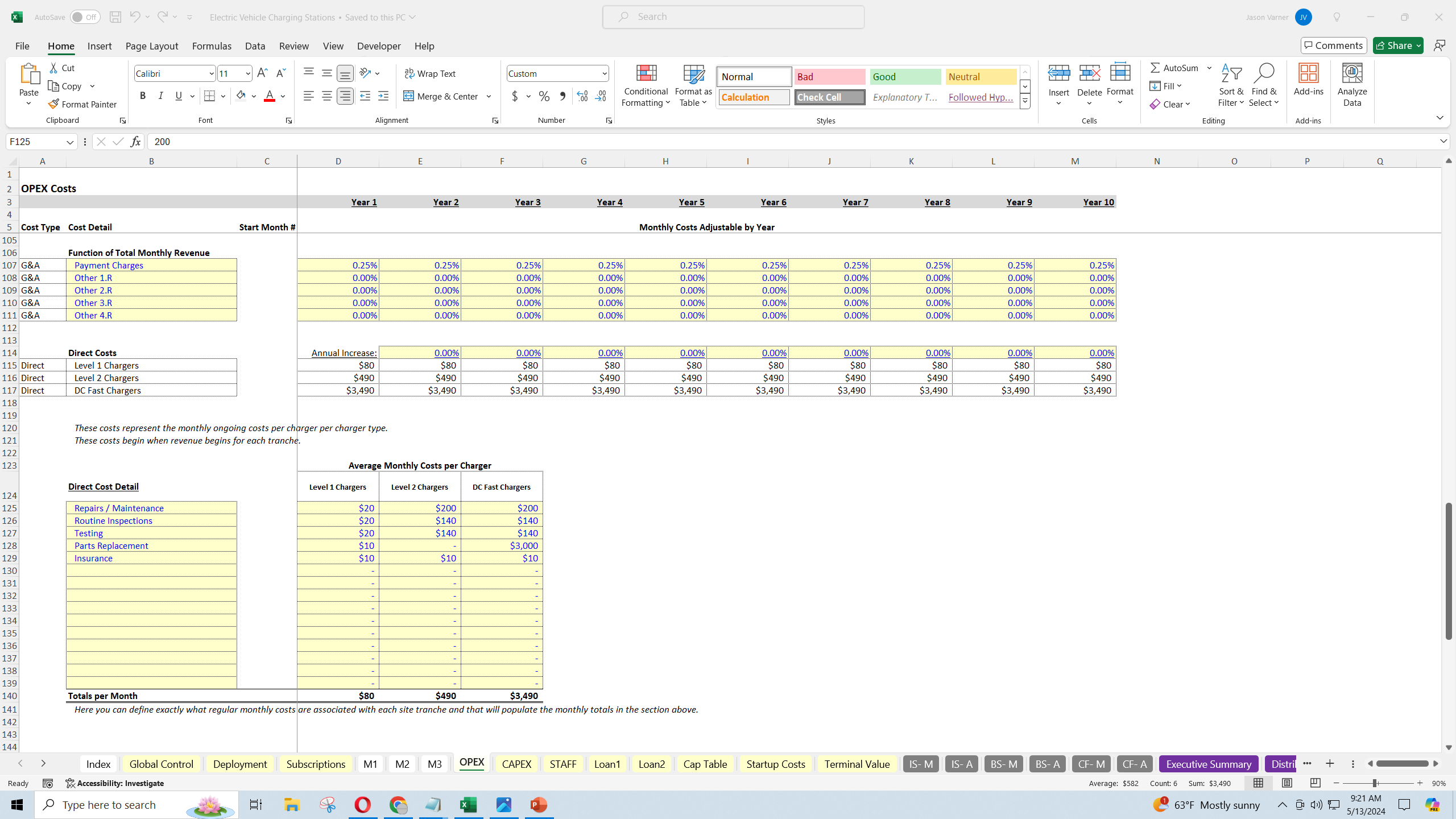

There are also dynamic variable costs based on the cost per unit type per month and other corporate overhead costs that are completely dynamic in terms of start month / monthly cost (adjustable by year).

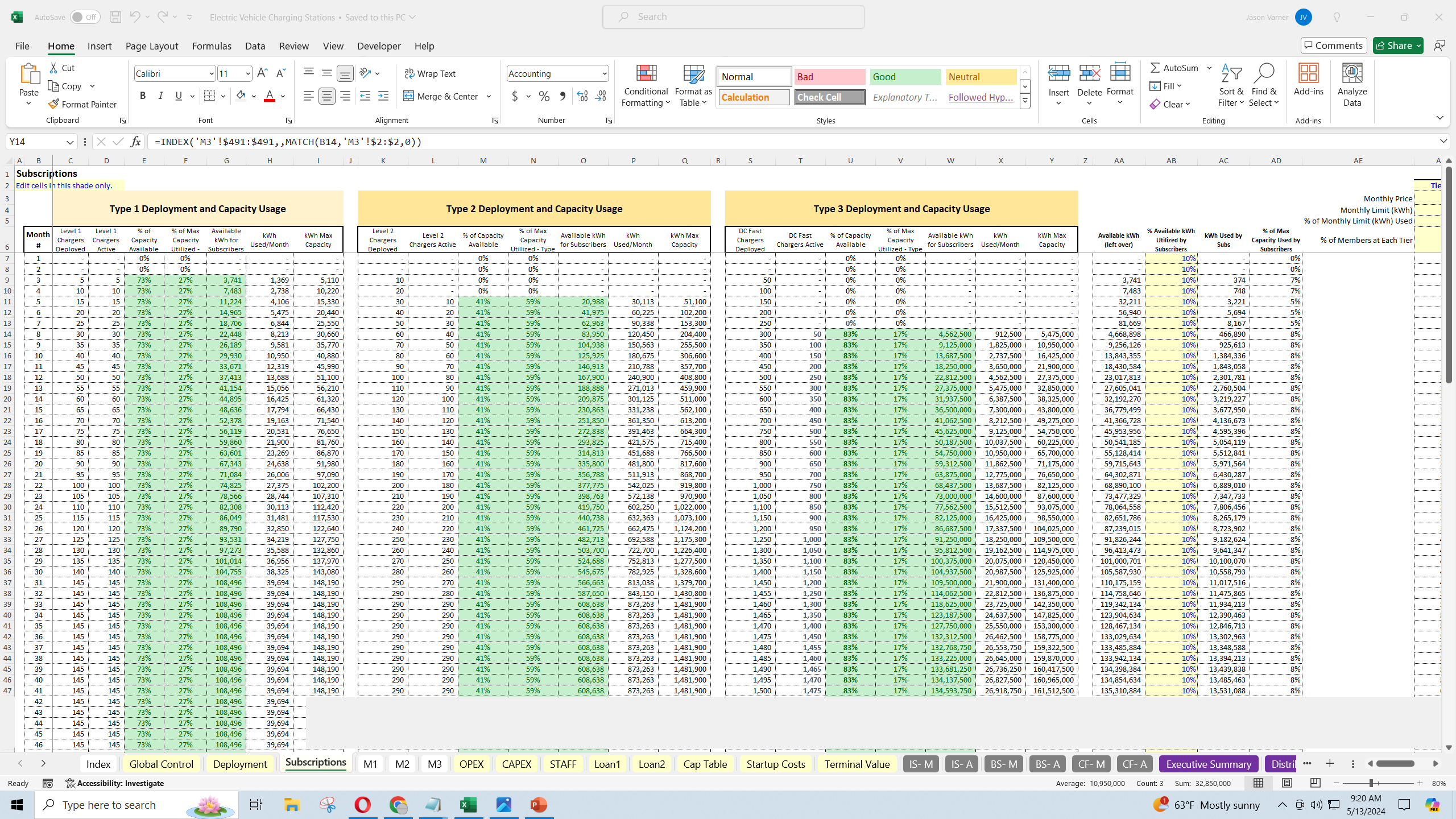

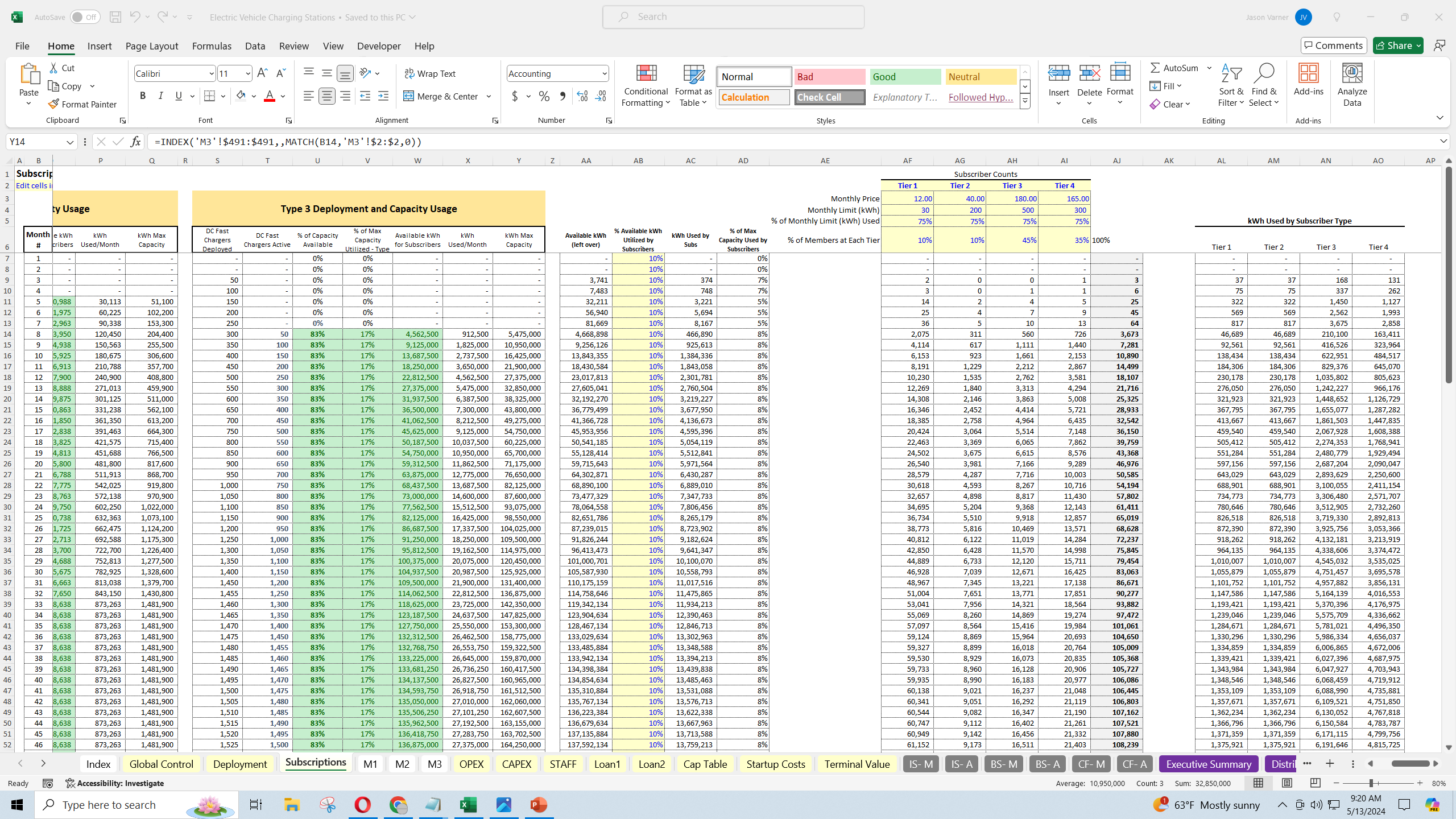

There is a second option for revenue, which is a subscription offering where users can pay a fixed monthly fee to use up to a certain amount of kWh per month. The model will tell you the maximum capacity available after one-time uses to ensure that you are not modeling out more usage than capacity available. You can enter the % of the limit each subscriber is expected to use and there are up to 4 pricing tiers for subscriptions.

To do a proper DCF Analysis, I've included a terminal value that is based on the trailing 12-month EBITDA multiple defined by the user. It is optional to include this exit value or not, for example, you may just want to run a scenario where you scale out for 5 years, and then sell. Most of the charger types have a useful life of 7-10 years. There are a lot of different strategies that can be analyzed with this financial model.

One of the best features of this template is all the KPI visualizations. You will have great insight into the average profit per unit per month, average revenue, and average cost per unit per month as well as average utilization rates, units deployed over time, and cash flow / break even.

I've included the option for joint ventures or single operators on the cap table. The user can define how much of the minimum equity requirement is coming from outside vs inside investors. The final IRR, equity multiple, and ROI will be shown on a project level and investor / operator level.

This type of business falls into the renewable energy sector. I've done a few other models in this sector, including Biogas and Wind Farm startups.

Instructional video included in the file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Transportation, Electric Vehicle, Integrated Financial Model Excel: EV Charging Business: 10 Year Scaling Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping