Hydropower Infrastructure Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

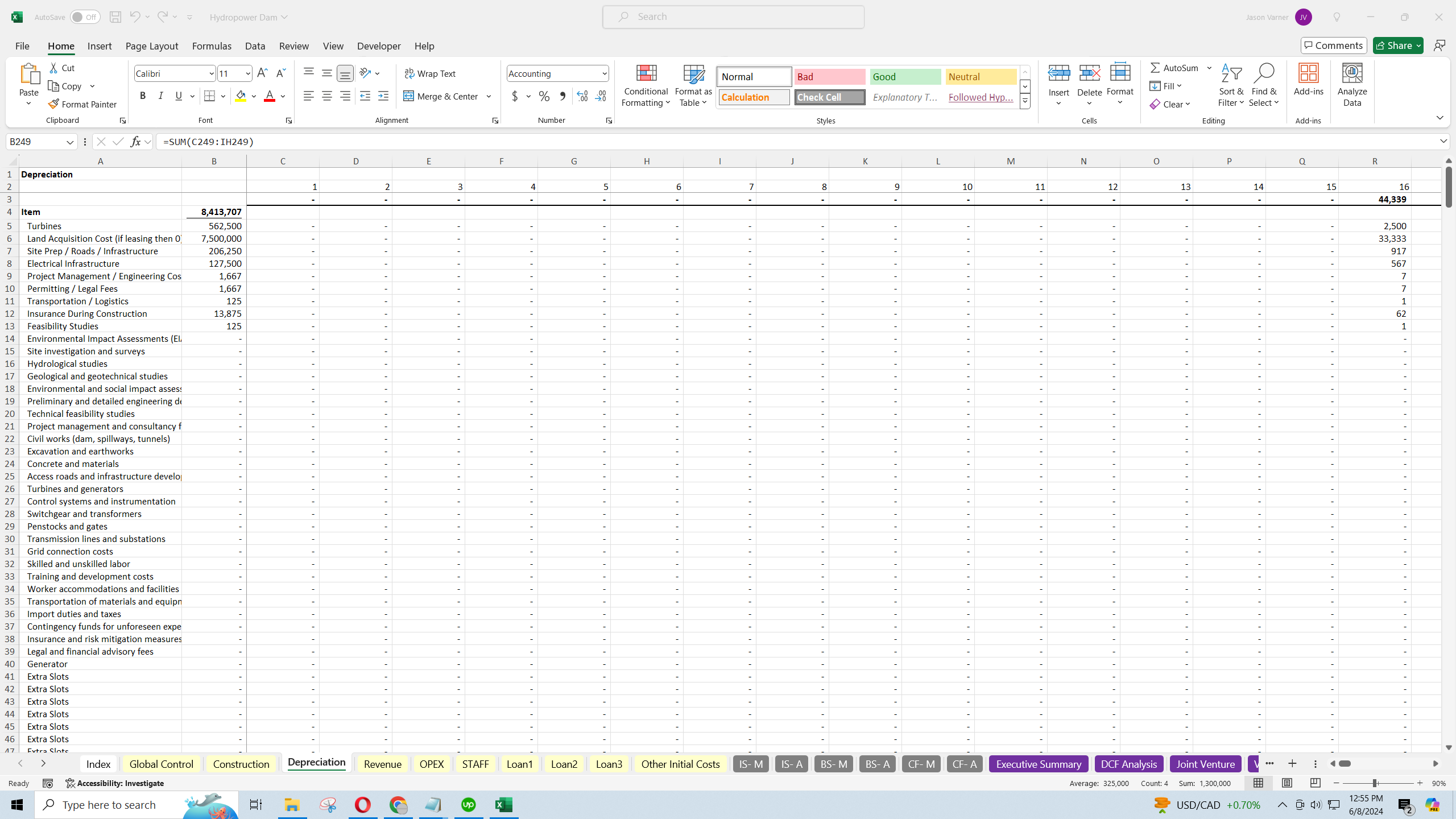

- Infrastructure modeling framework for hydropower construction and operation.

RENEWABLE ENERGY EXCEL DESCRIPTION

I've done quite a bit of research on understanding the nuances of financial planning for an infrastructure project involving hydropower. There are all kinds of structures that essentially get power out of the process of funneling water from a higher location to a lower location. The energy released is captured and used to power grids / towns and so forth. Some countries get over 90% of their energy from dams. Large scale projects can take up to 10 years to complete and produce massive amounts of energy.

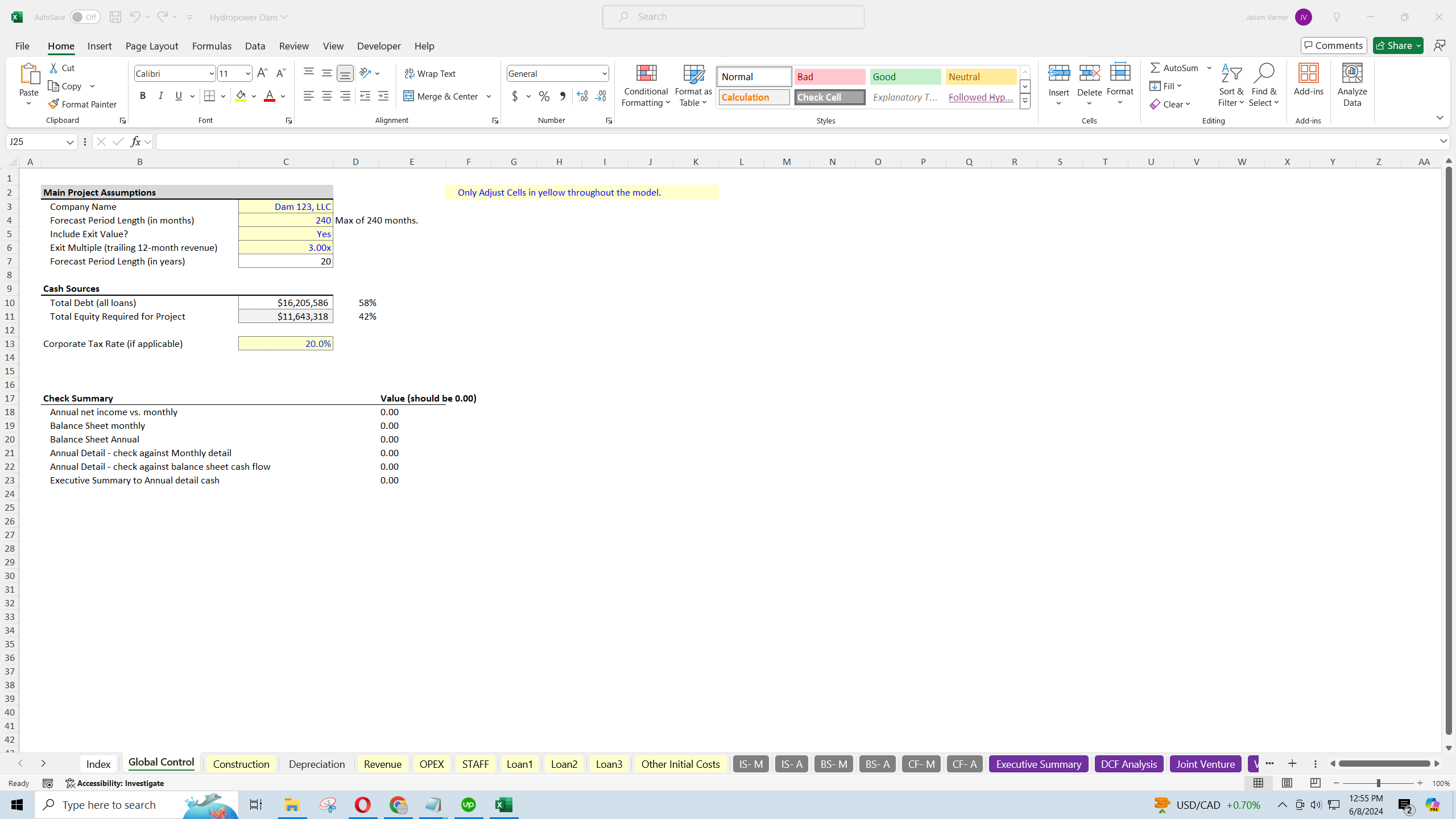

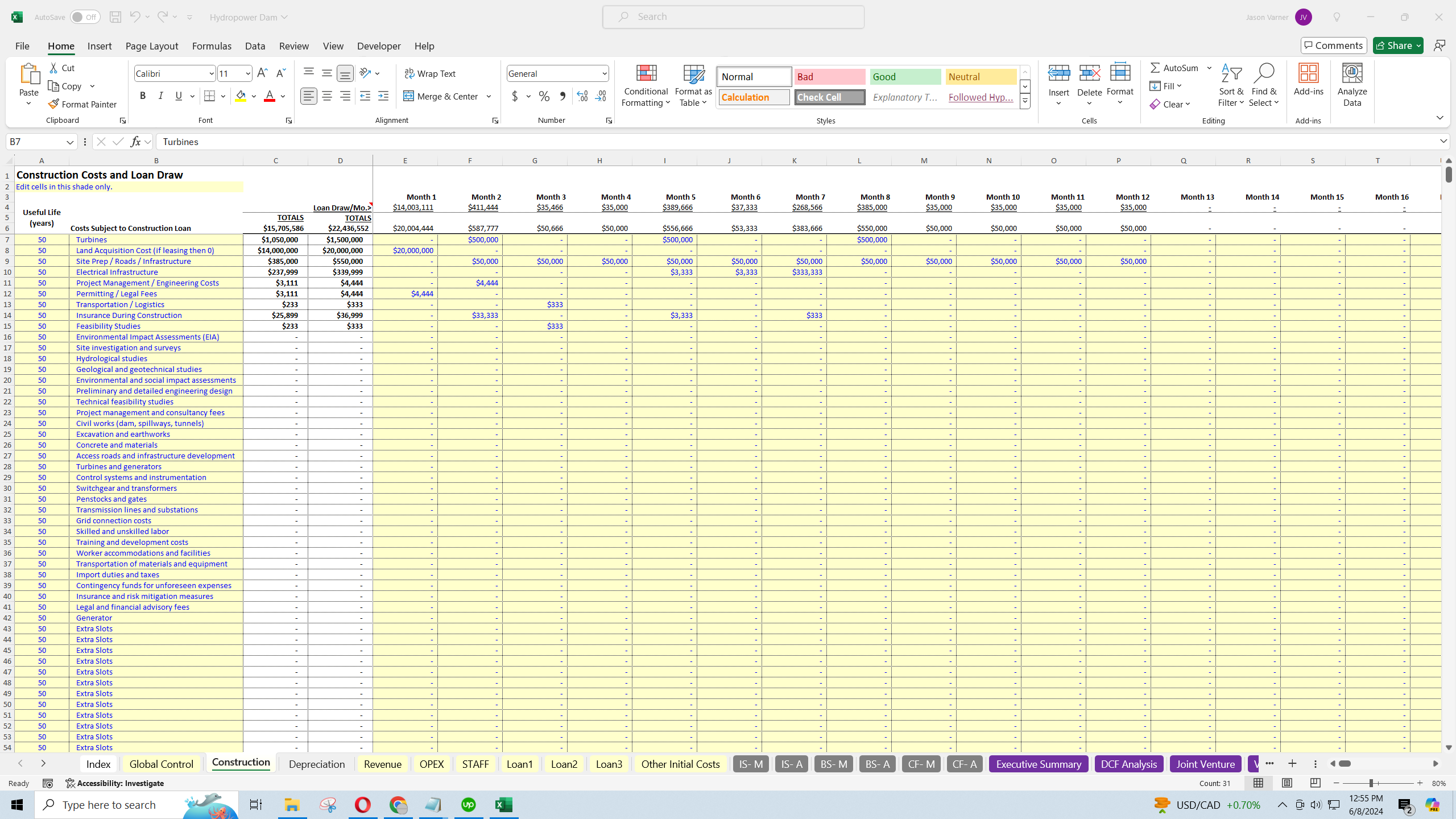

This financial model lets the user plan out investment requirements over time while considering borrowing costs in a dynamic debt schedule that also has a conversion to a term loan. The interest only period can also be accrued or not with a simple yes/no selector.

I've included 100s of rows to get all relevant construction costs entered in monthly. This will primarily affect the amount of interest required. Any cash requirements that are not covered by debt will then come from the operator/GP/LP or whoever is funding the project. The model will solve for a minimum cash requirement.

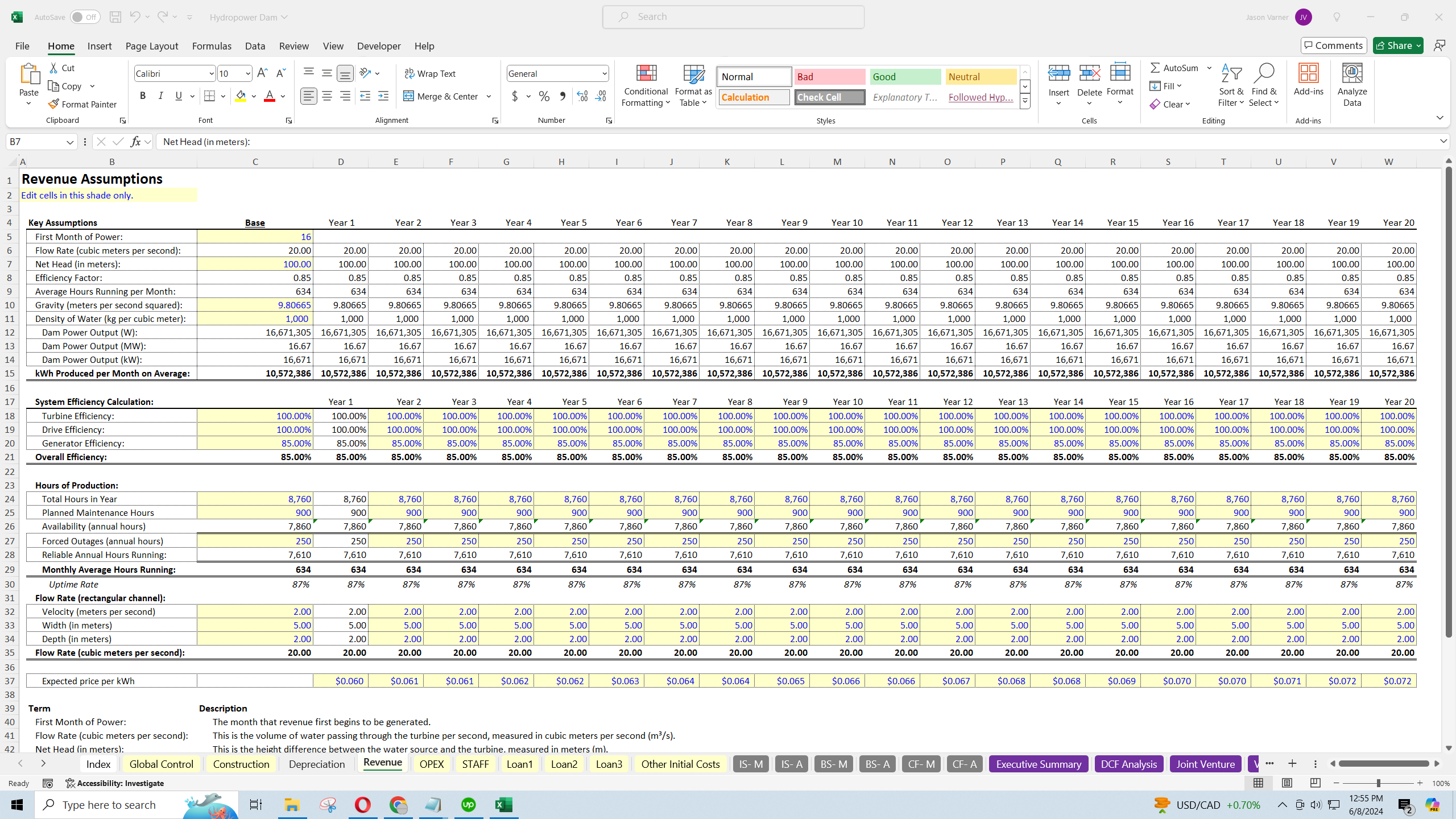

To calculate the power a dam can produce, you need to know the head (net height from top to bottom in meters), flow rate (in cubic meters per second), efficiency, and uptime. Your measurements for the height and size of the area the water is flowing through must be calculating the right units to come to the expected watts of the dam. That is then converted in kWh, a price can be applied to that, and expected revenues as a result. I've done all measures in meters for standardization and ease of checking the calculations.

All the above assumptions can be adjusted over a 20-year period in order to see what happens as various things change, such as pricing, expansion of the dam, and/or efficiency reduction.

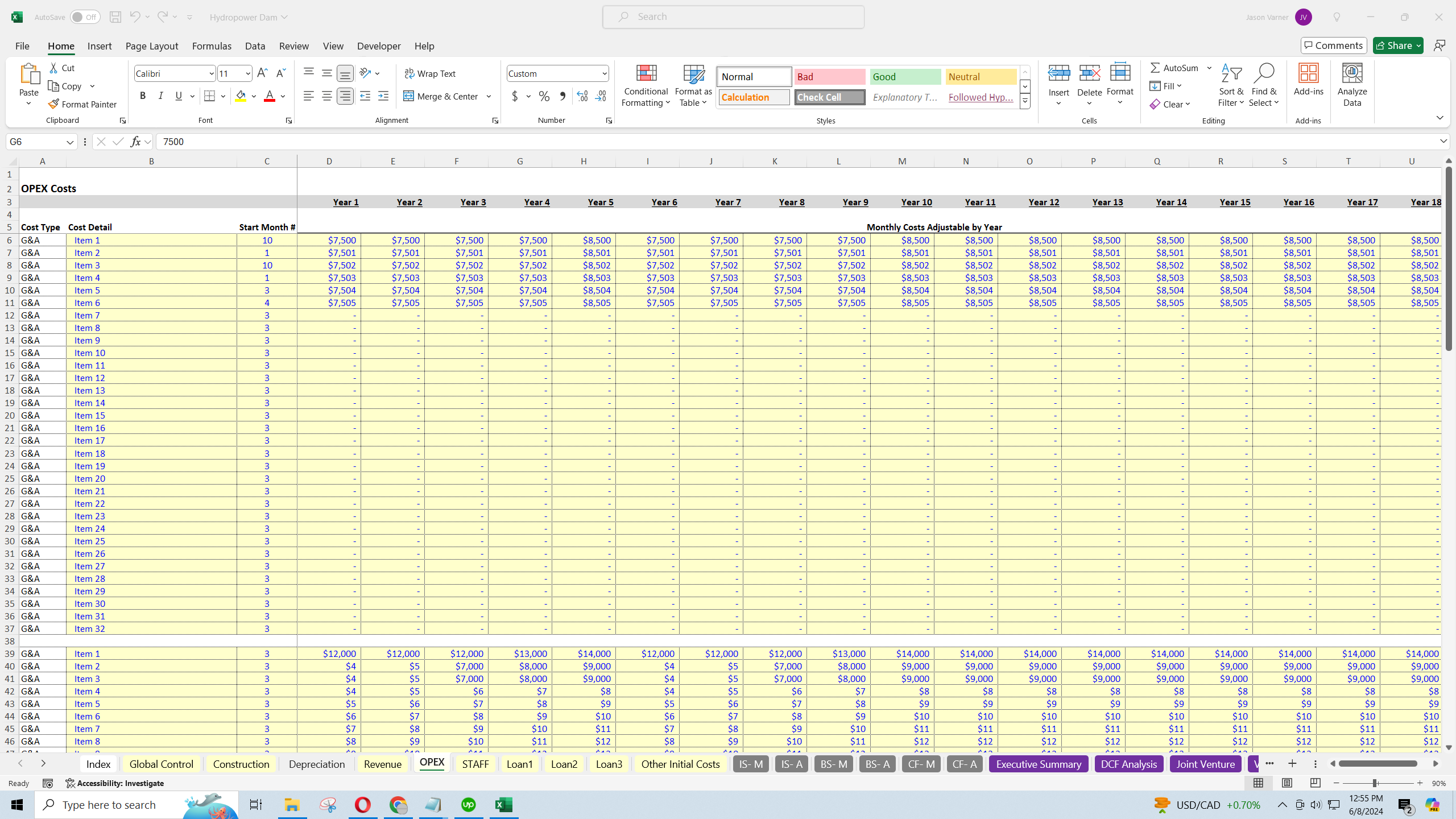

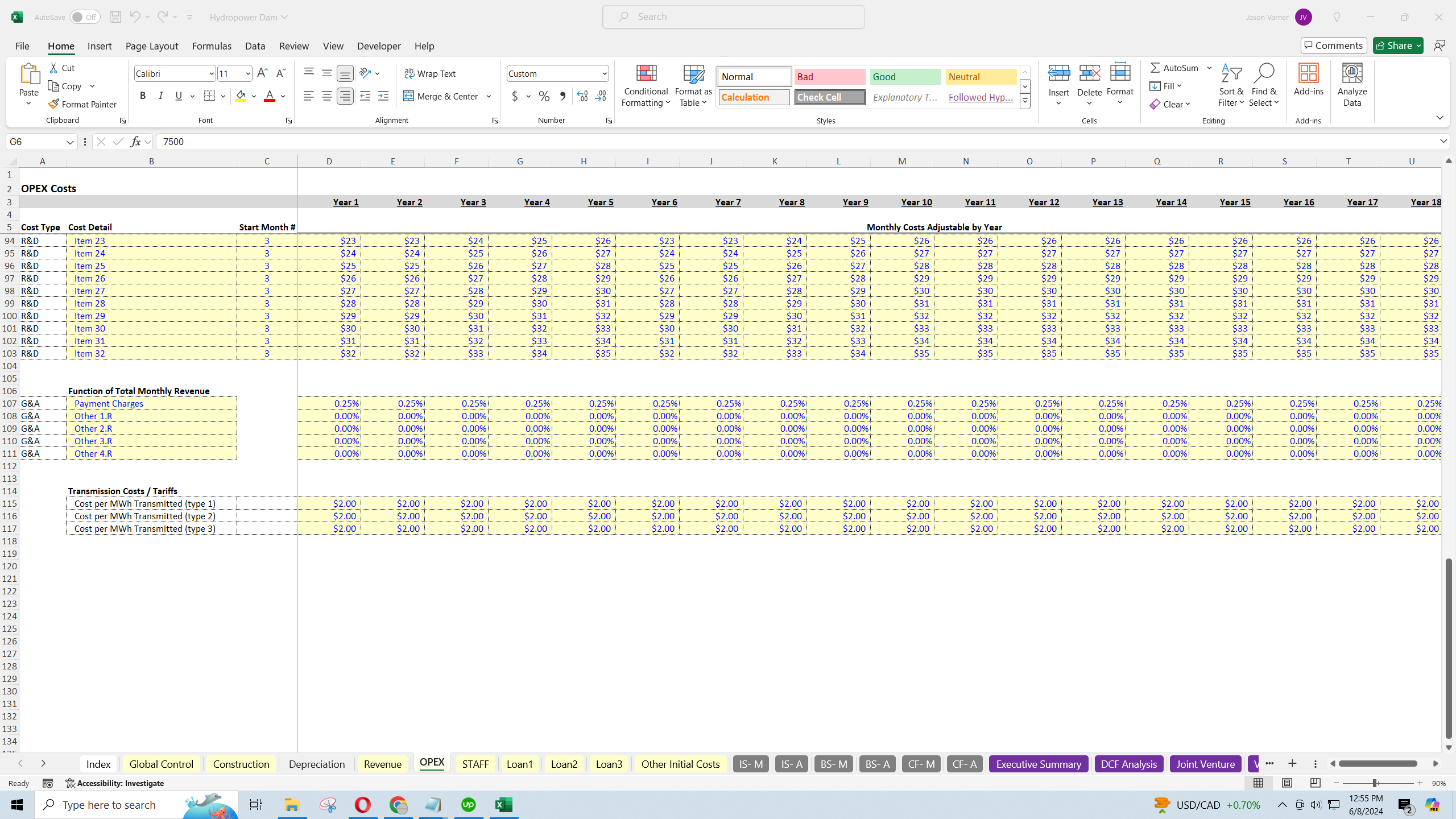

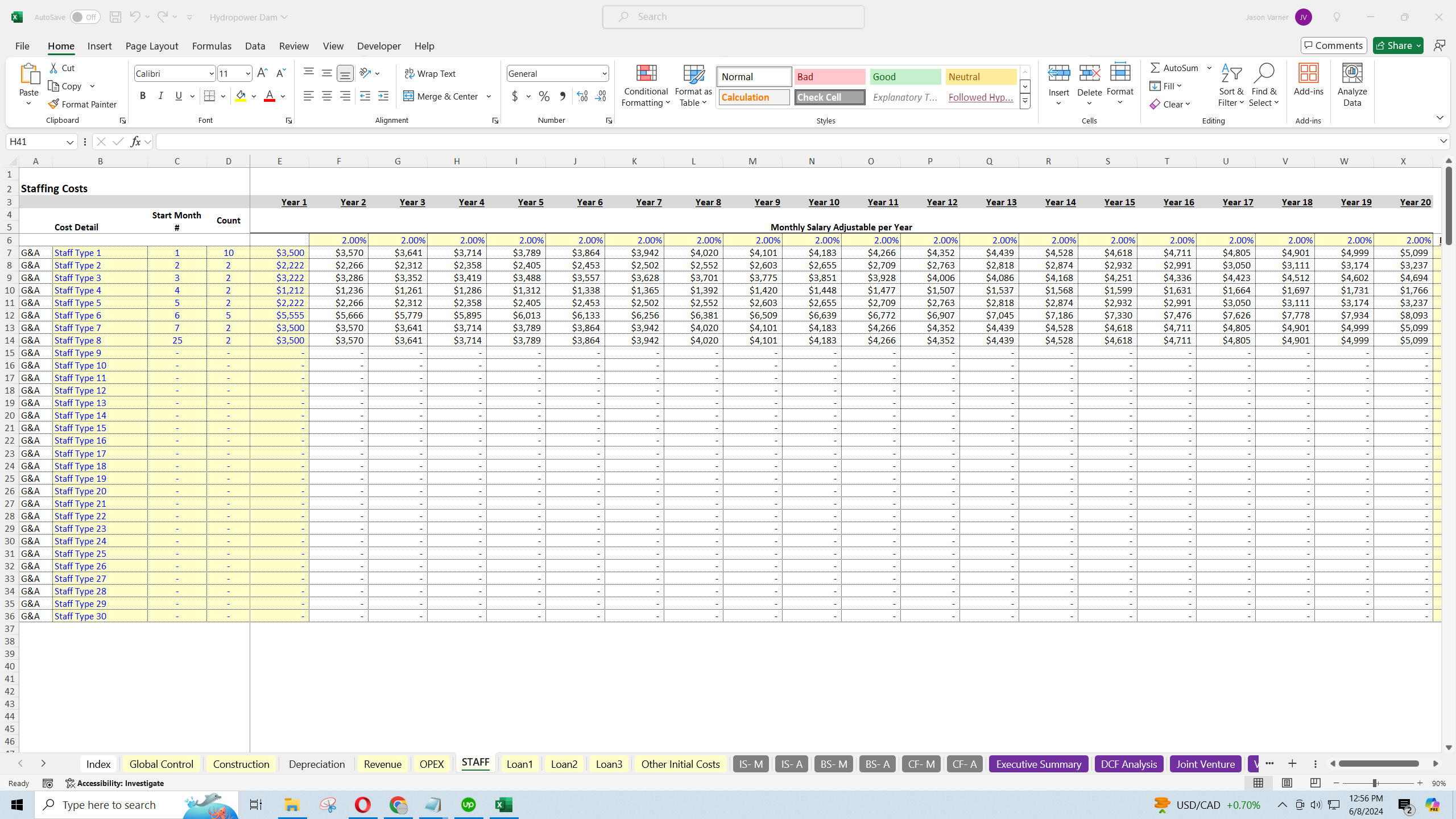

There are also costs that will be derived from the expected amount of kWh sold (3 different slots for that) and the general operating costs required to keep the dam operational over time.

Output reports include a monthly and annual 3-statement model, DCF Analysis, IRR, Equity Multiple, Optional Joint Venture Waterfall with IRR Hurdles, and an Executive summary. As the assumptions are adjusted, all output reports and visuals automatically adjust.

Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Renewable Energy, Integrated Financial Model Excel: Hydropower Infrastructure Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Industry-specific Financial Models (40+)

This bundle contains 67 total documents. See all the documents to the right.