Manufacturing Plant: 10 Year Operating Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

MANUFACTURING EXCEL DESCRIPTION

Recent update: Integrated a 3-statement model (Income Statement, Balance Sheet, Cash Flow Statement) and cap table.

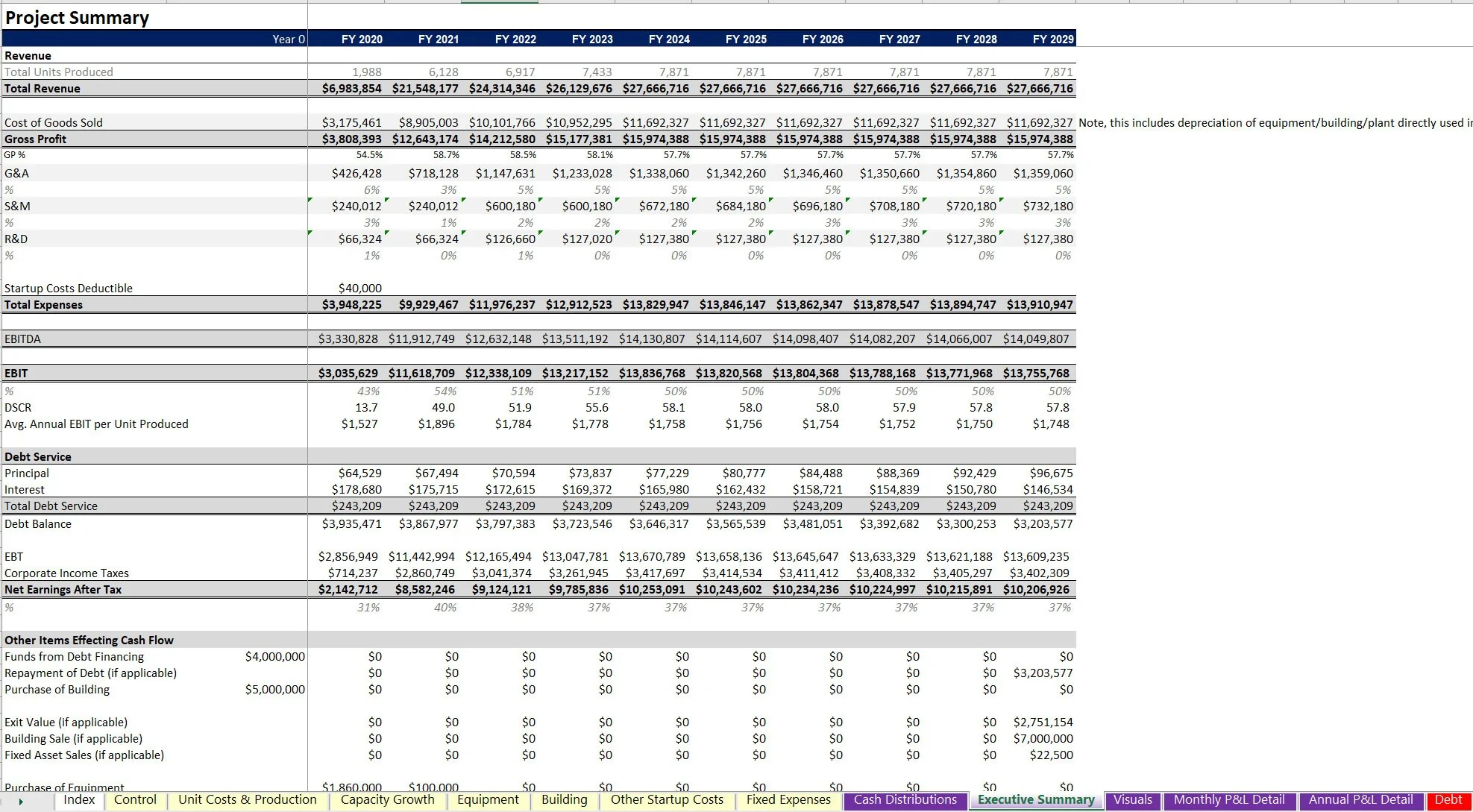

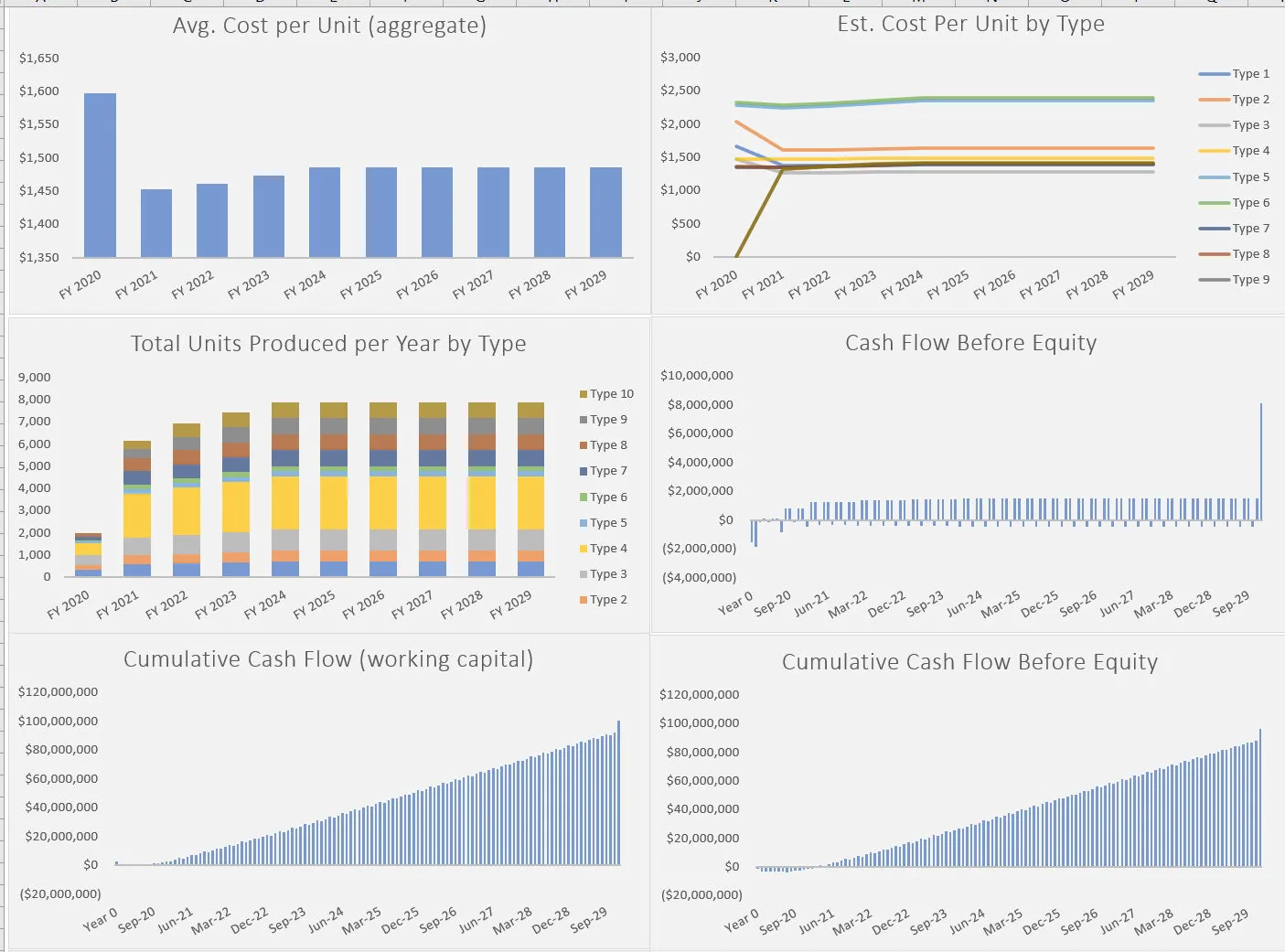

This financial model was designed to help define the financial assumptions that go into starting a manufacturing plant, running it, and producing a 10-year pro forma that drives all the way down to Earnings After Tax on a monthly and annual basis.

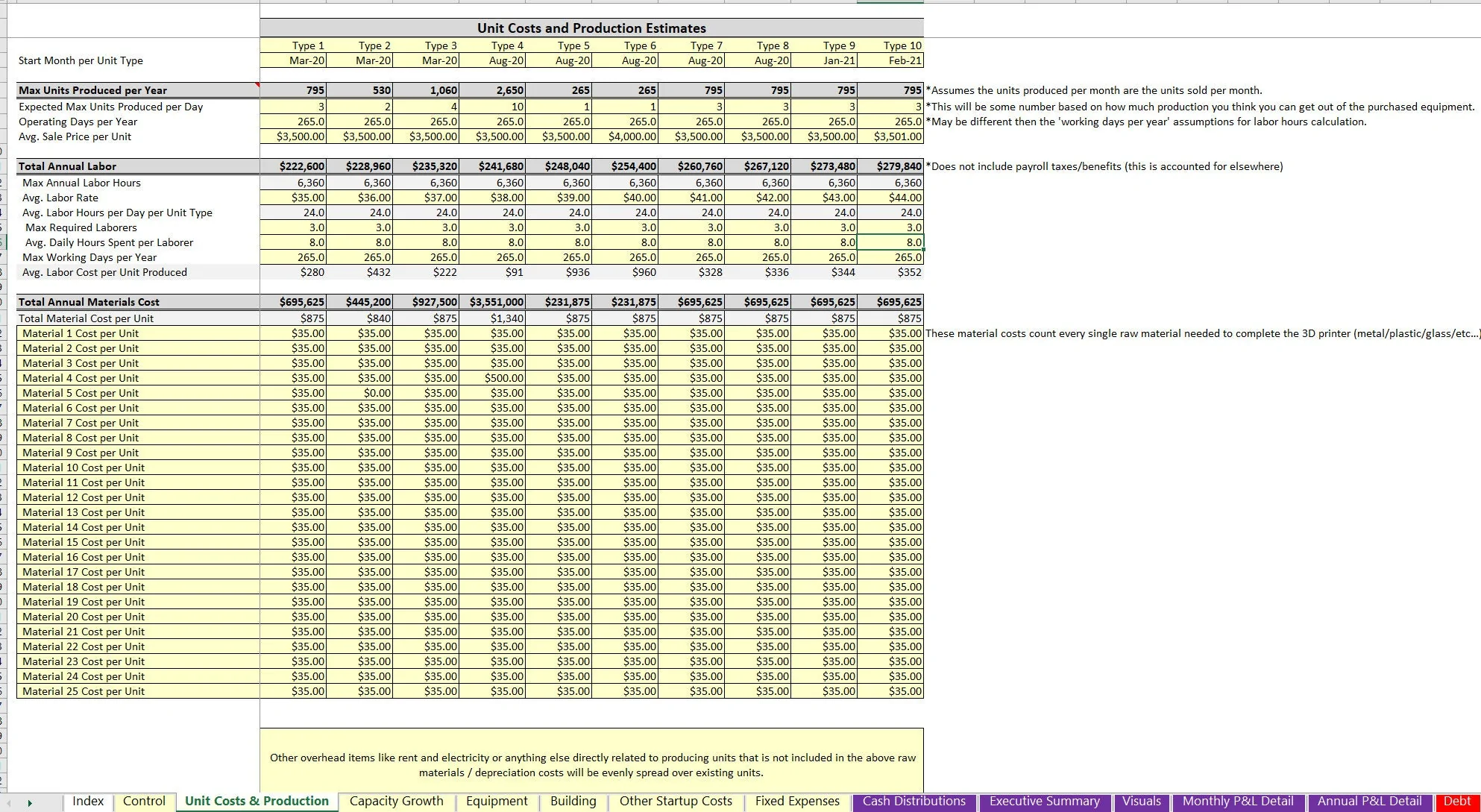

The primary assumptions are driven from up to 10 product categories. They could be groupings or individual SKUs.

Each category is configured based upon the following:

• Expected Max Units Produced per Day

• Operating Days per Year

• Average Sale Price per Unit

• Average Labor Rate

• Average Labor Hours per Unit Type

• Max Required Laborers

• Average Daily Hours Spent per Laborer

• Max Working Days per Year

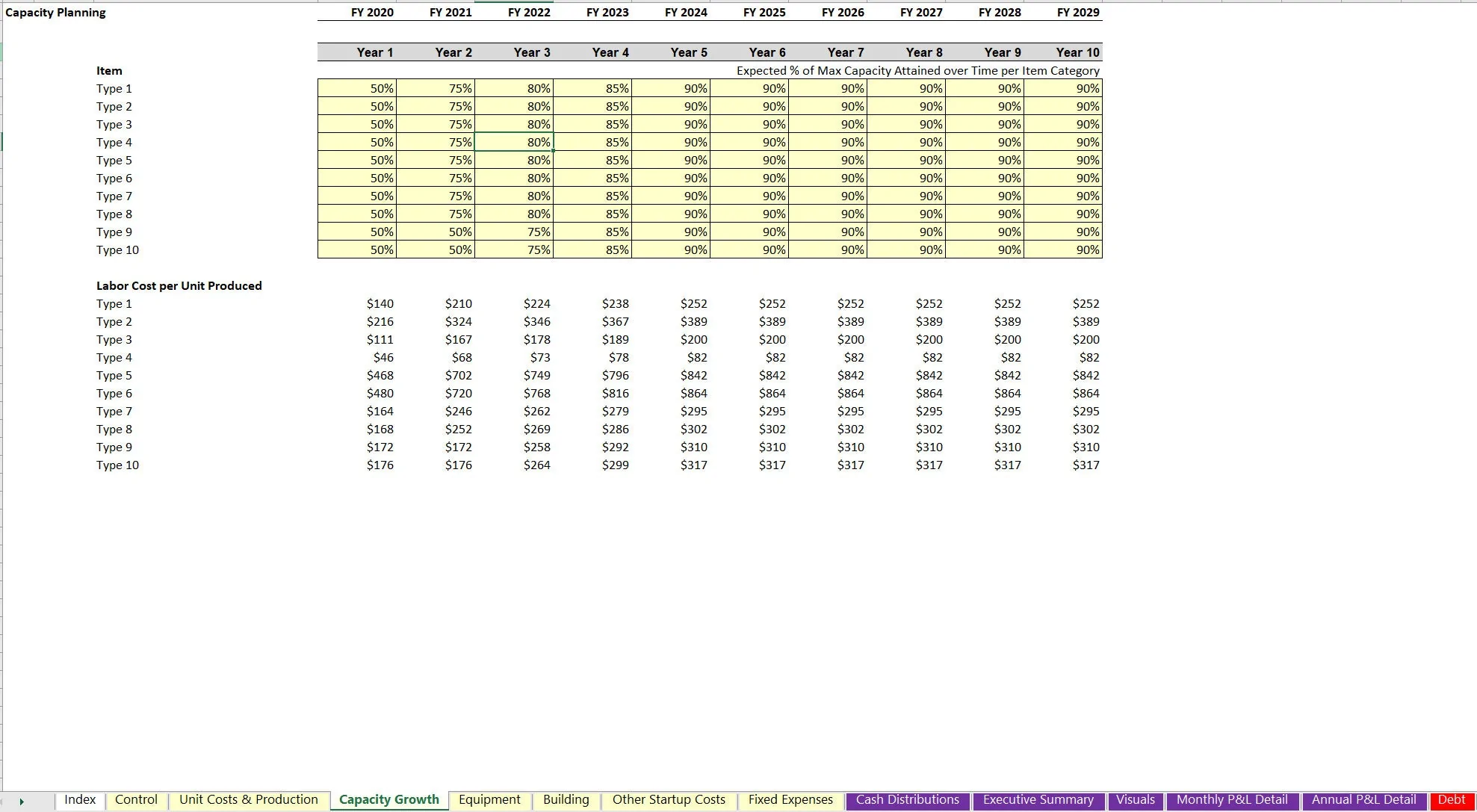

• Average Labor Cost per Unit Produced

For direct material costs per unit per category type, the user can define inputs for up to 25 individual components that make up a given product and each component's cost in order to arrive at material cost per unit.

A capacity schedule is configurable for up to 10 years and the user simply enters the expected percentage of max capacity achieved in years 1 – 10 for each category type.

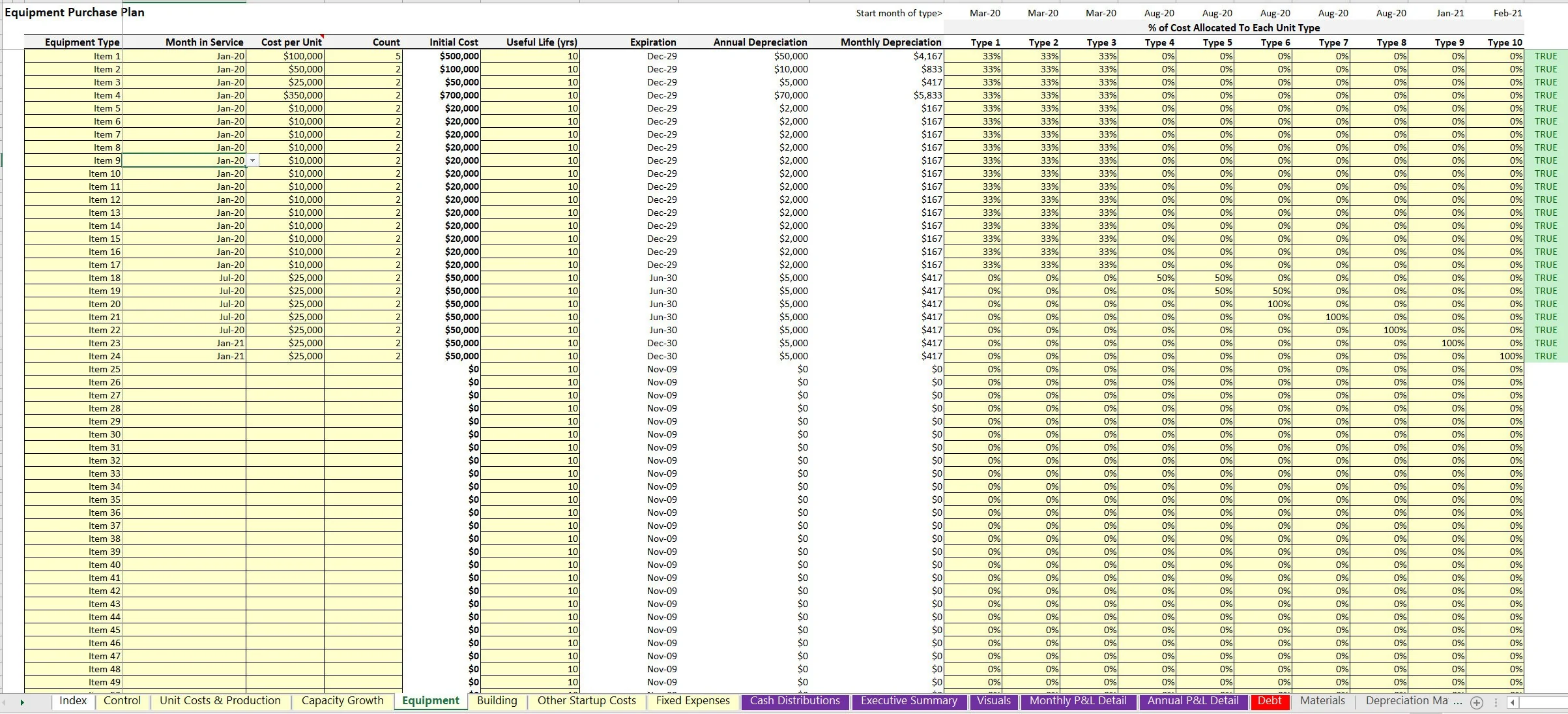

Also, equipment is defined and the percentage of each piece of equipment that is used for each product category is also defined. This is important for accurate cost of goods sold per product category reporting.

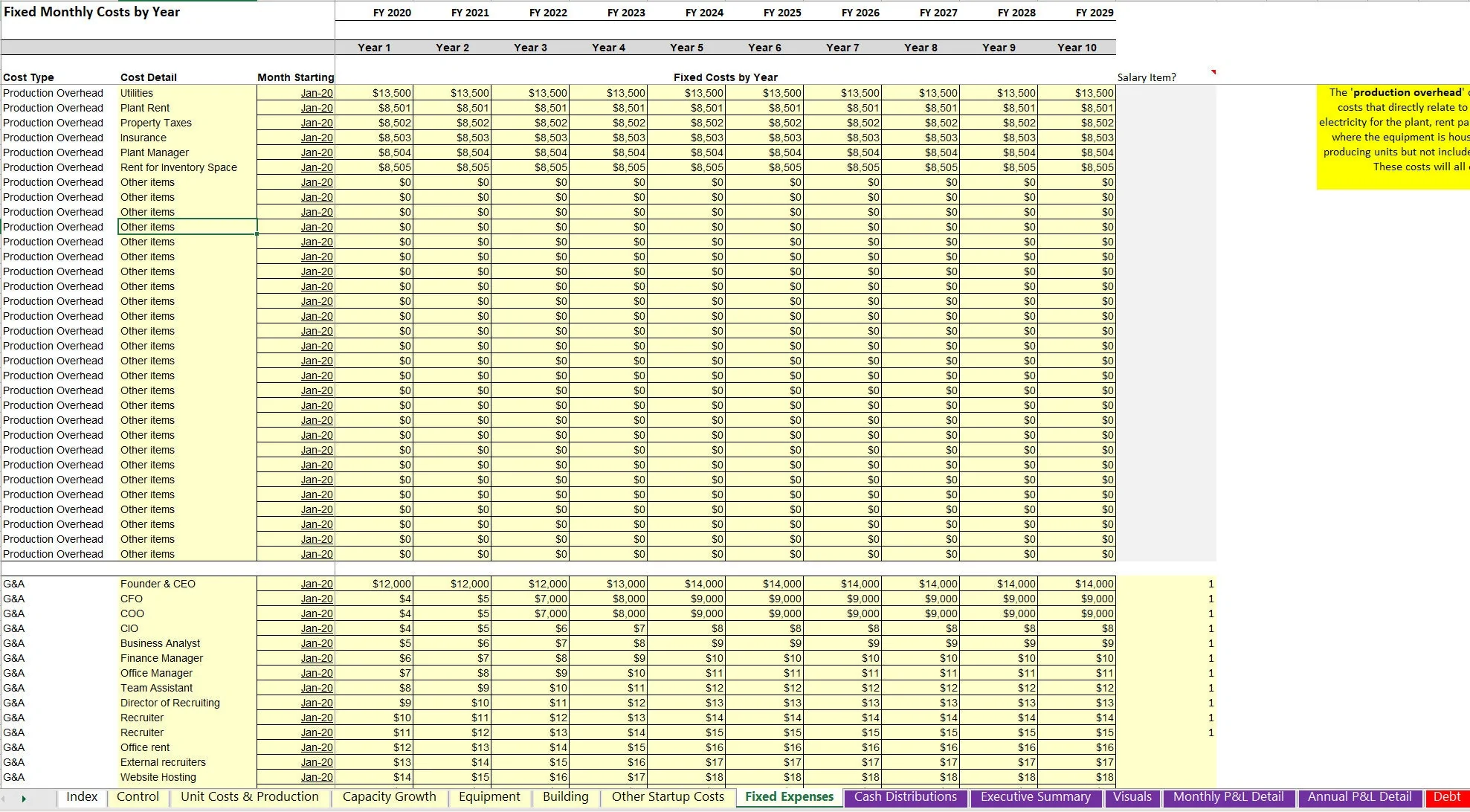

General fixed operating expenses are defined in their own schedule via a cost description, start month, and monthly cost amount over 10 years.

Some of the complexity that goes into the model includes driving down to the correct cash flow vs. net income. This is because depreciation is counted as an expense and that is a non-cash item so it has to be added back.

The actual cash that went to purchase things like materials, equipment, building must be accounted for at the time of purchase, however they affect taxable income on an amortized basis per the depreciation expense they create.

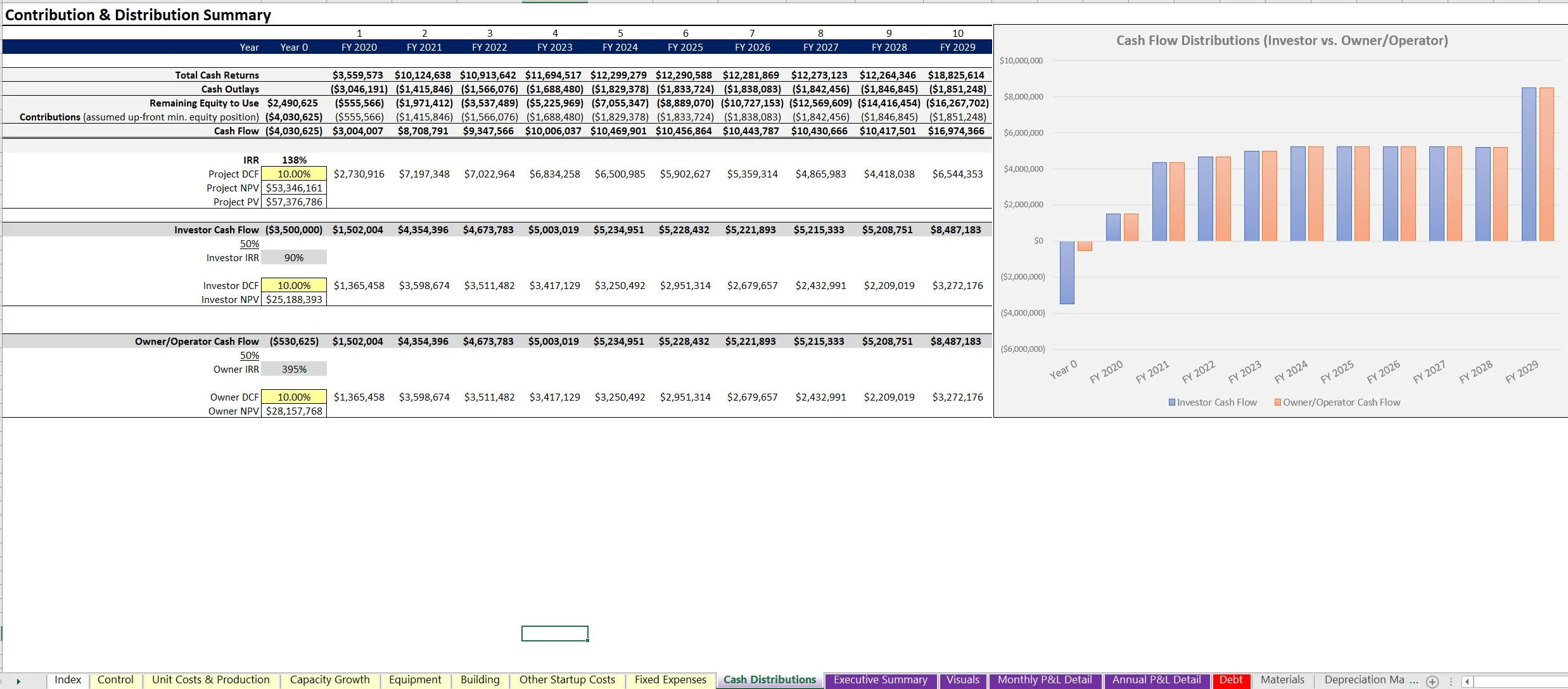

This is all accounted for in the template. Final outputs also include a DCF Analysis, IRR, high level Executive Summary (annual) and plenty of visualizations. The model does allow for funding sources to include senior debt, investors, and any remaining cash requirements will flow to owners.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Manufacturing, Integrated Financial Model Excel: Manufacturing Plant: 10 Year Operating Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping