Short-term Rental Analysis: Up to 20 Properties (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Cash Flow Analysis

- Seasonality Assumptions

- Sensitivity Analysis

REAL ESTATE EXCEL DESCRIPTION

A financial model for short-term rental investment analysis should have several key features to help investors evaluate the potential profitability of their investments. Here are some of the best features that this model includes:

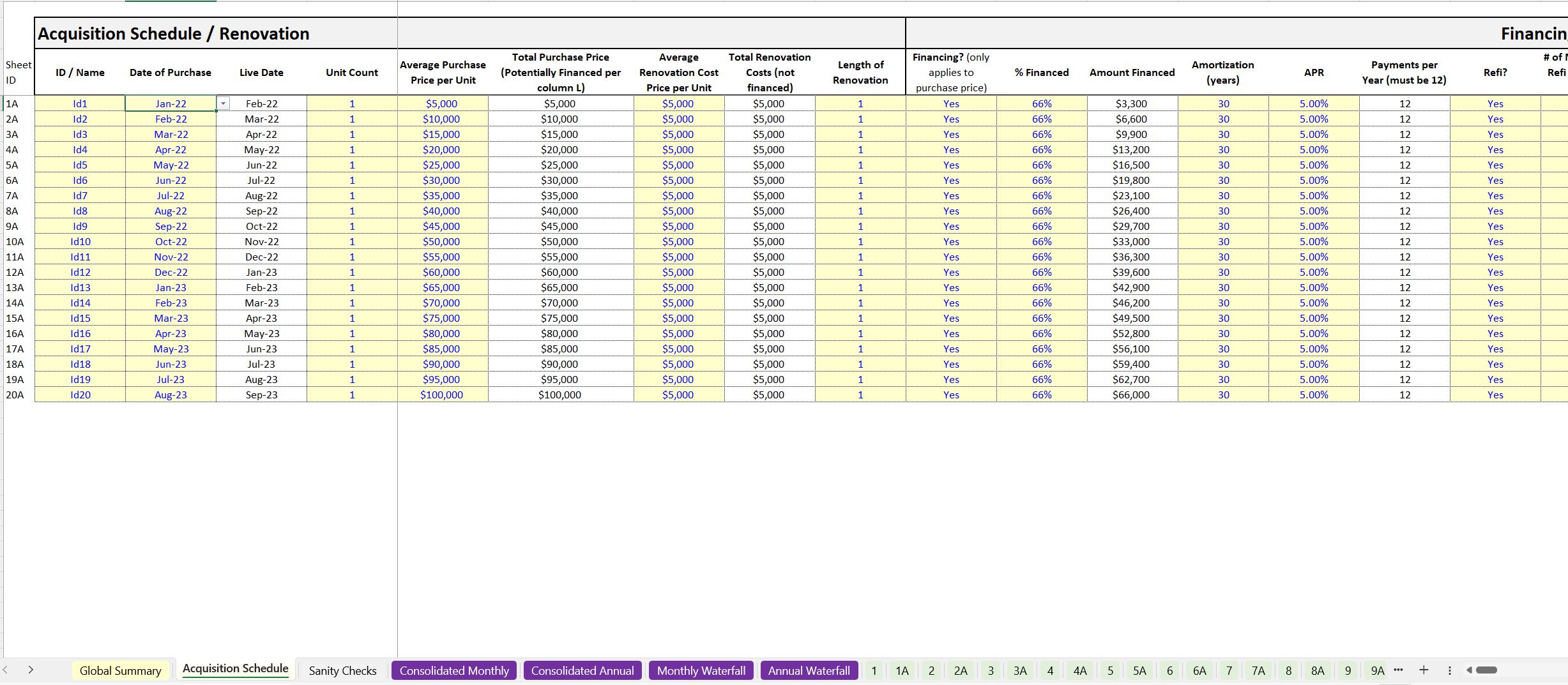

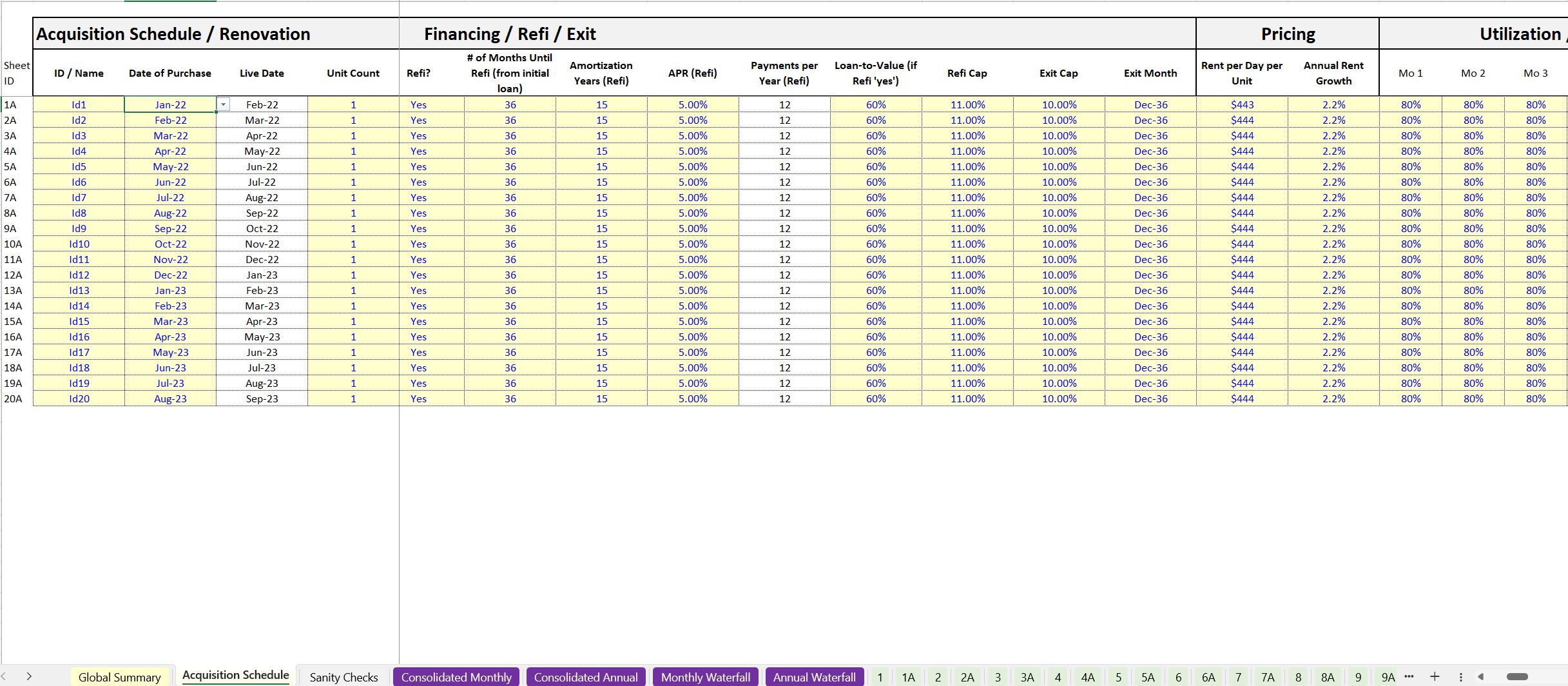

• Accurate revenue projections: The model makes it easy to produce accurate revenue projections based on historical data and market trends. This includes variables like occupancy rates, daily rates, seasonal demand, and competition in the market.

• Expense tracking: The model allows for clear expense entries that are associated with each property investment, including property management fees, maintenance costs, utilities, and other expenses. This will help investors to accurately calculate their net operating income (NOI).

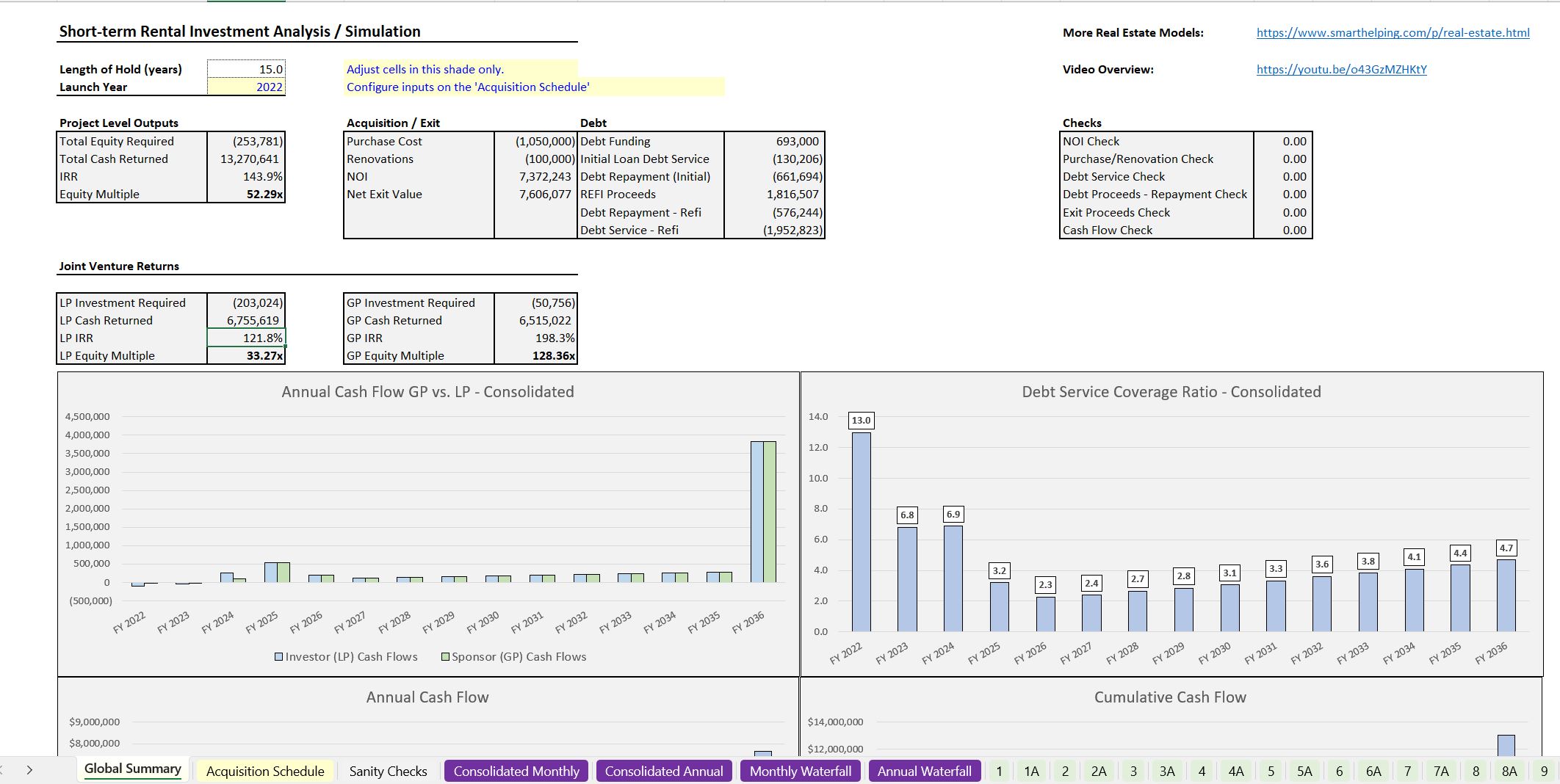

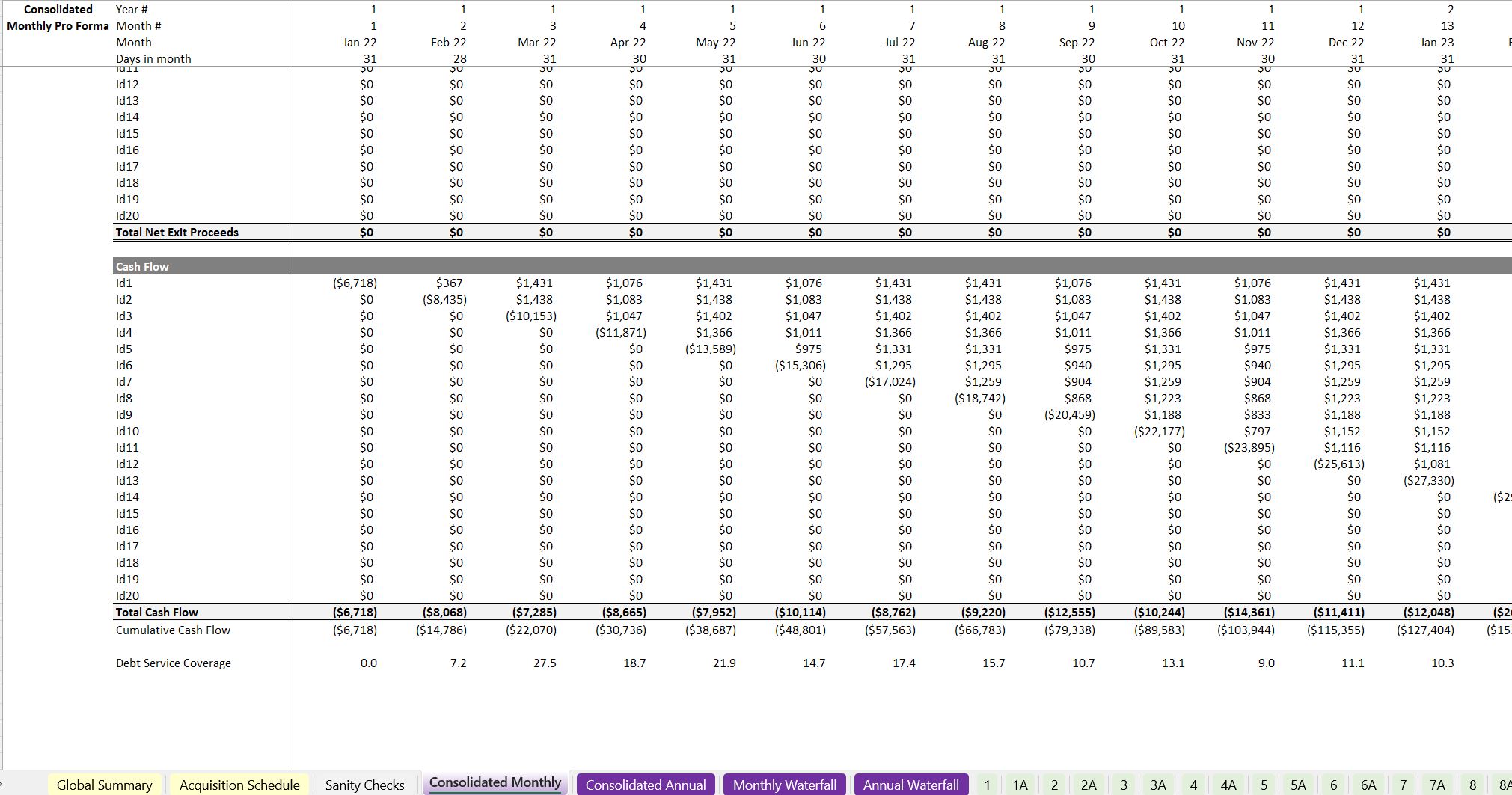

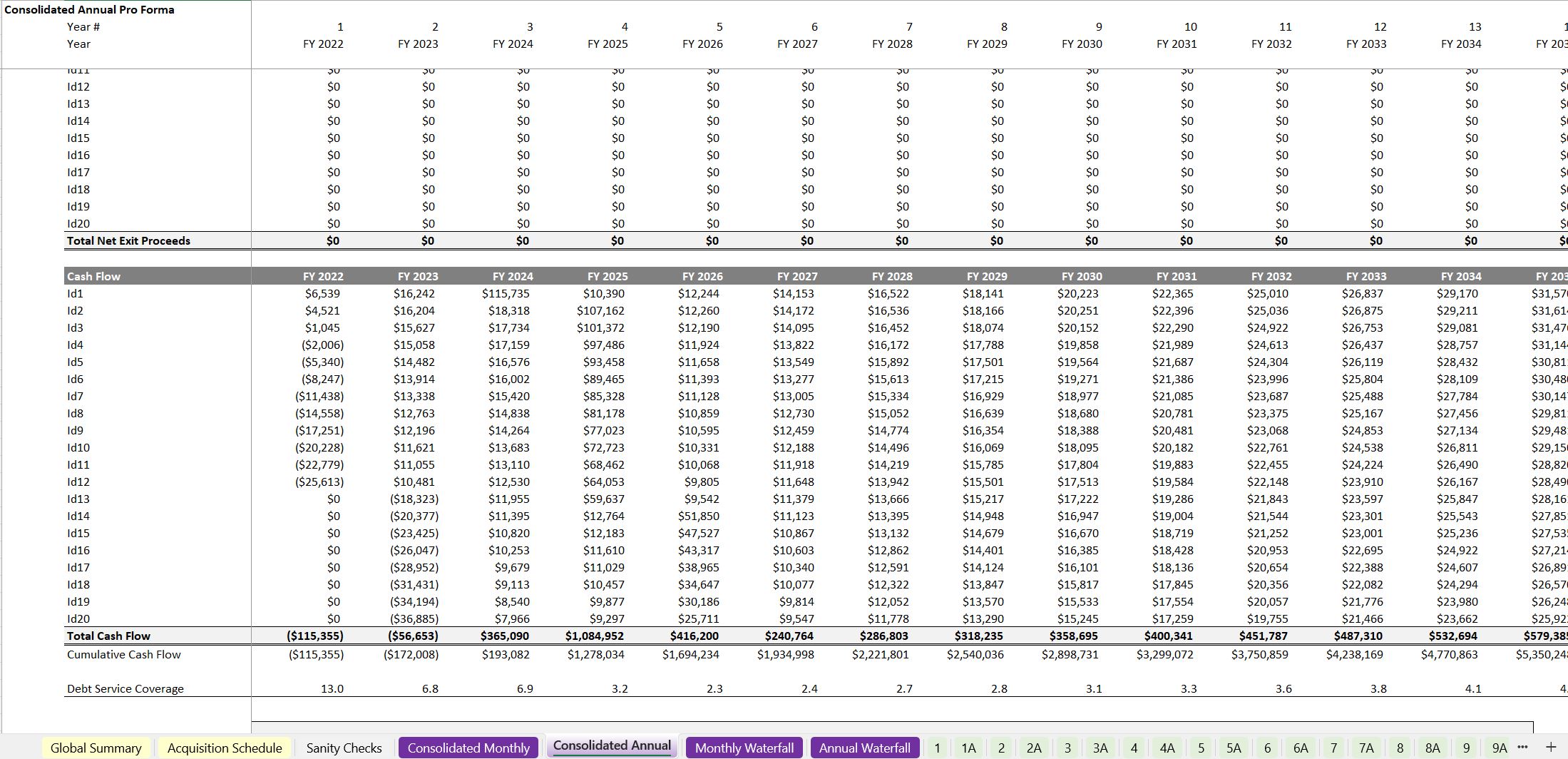

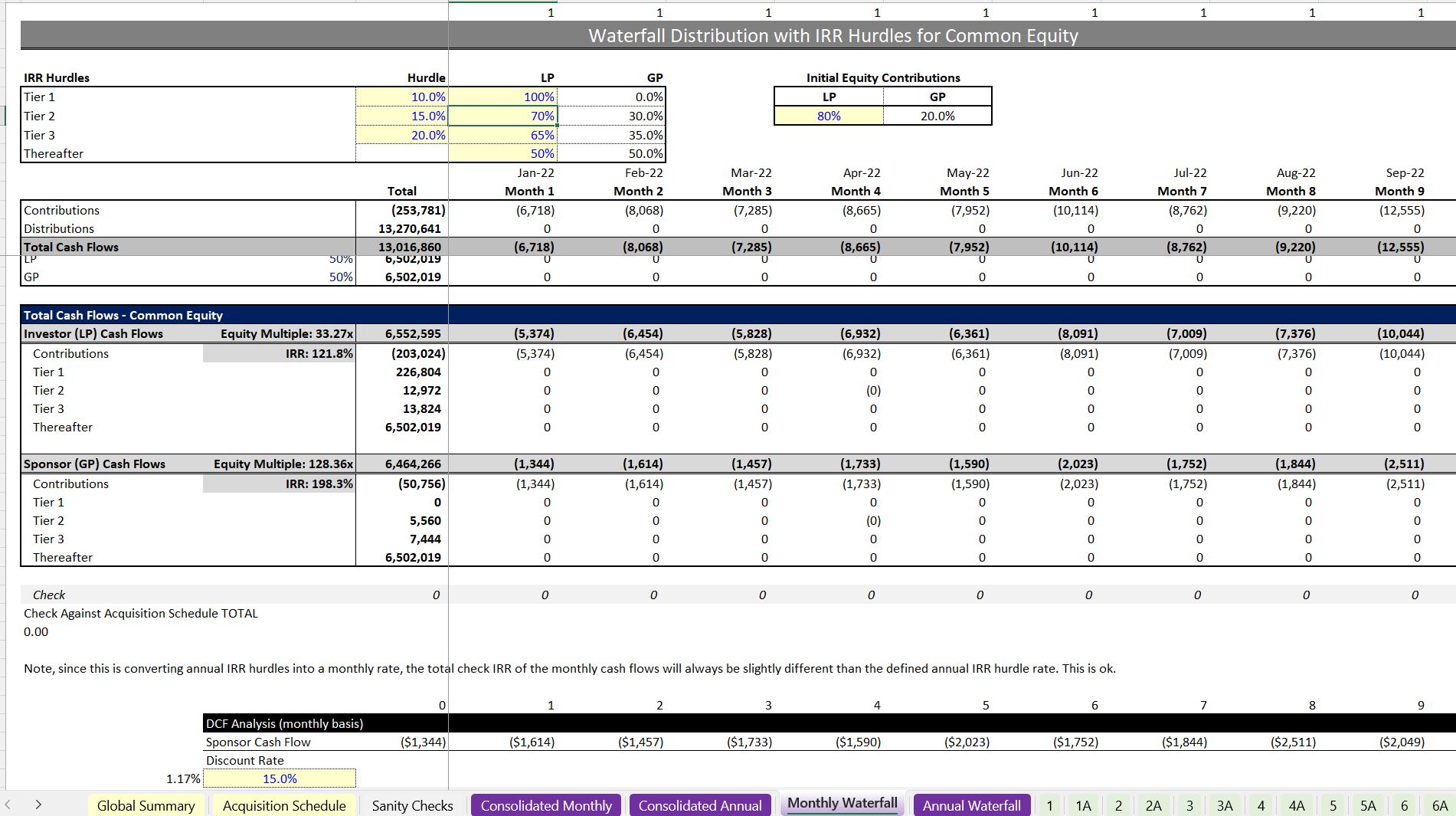

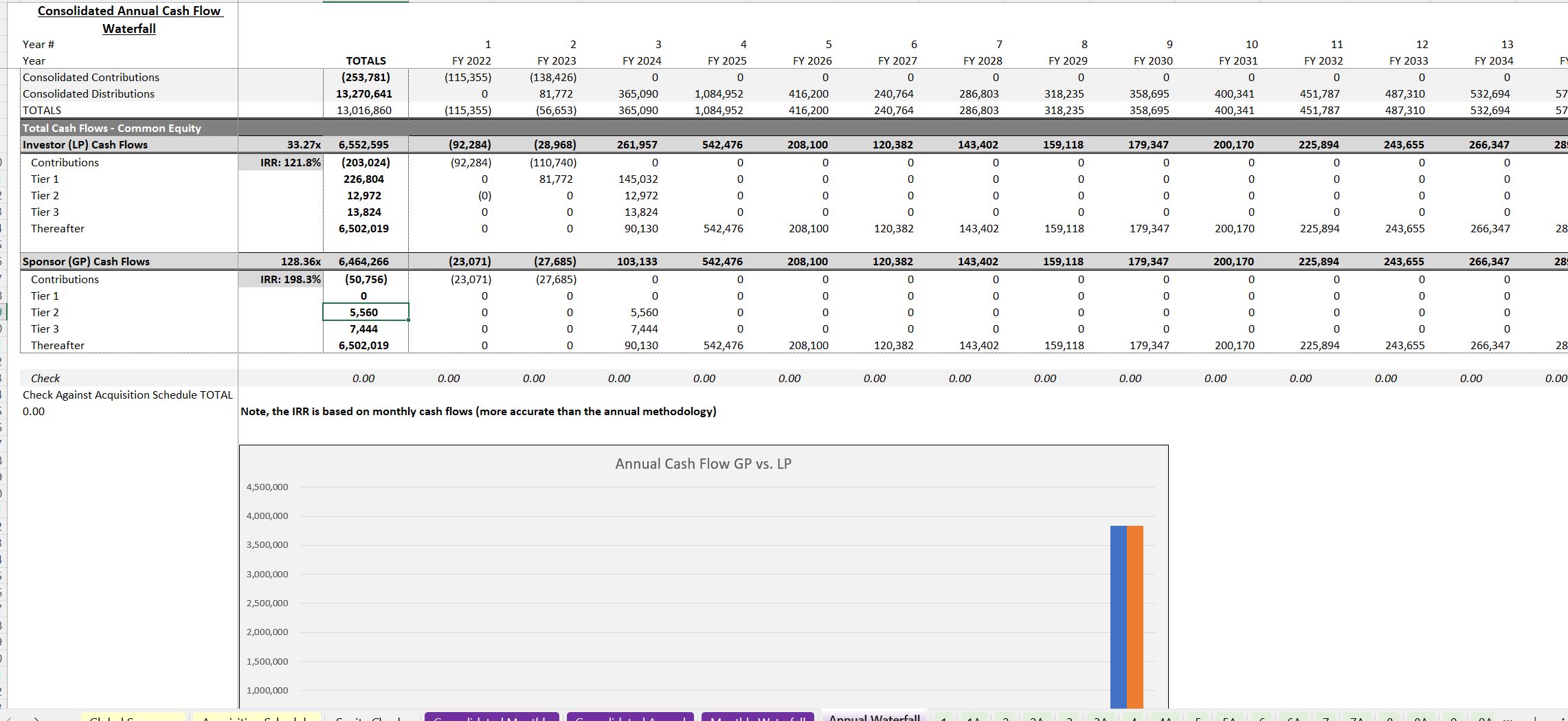

• Cash flow analysis: The model provides a detailed cash flow analysis, including monthly income and expenses, debt service payments, and other cash inflows and outflows. This will help investors to assess the liquidity of their investment. Final output reports include an IRR summary per property as well as a consolidated cash flow analysis that looks at the activity of all properties. Additionally, this model has a joint venture cash flow waterfall for analyzing a syndication deal with GP/LP deals. The waterfall uses 3 IRR hurdles to determine distributions.

• Sensitivity analysis: The model makes it easy to perform a sensitivity analysis to help investors understand how changes in key variables like occupancy rates or daily rates will impact the overall profitability of the investment. All light yellow variable cells are editable.

• Financing analysis: The model includes financing options to help investors understand the impact of different financing options on their returns. This includes scenarios for both traditional mortgages and alternative financing options like private equity waterfalls or a combination of both.

• Scenario analysis: The model allows investors to test different scenarios and assumptions to evaluate the potential risks and rewards of different investment strategies. This will help investors to make more informed investment decisions.

Overall, this financial model for short-term rental investment analysis provides a comprehensive analysis of the potential risks and rewards of an investment, helping investors to make more informed decisions and maximize their returns.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Short-term Rental Analysis: Up to 20 Properties Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping