Apartment Building Acquisition Model - 15 Year (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- An acquisition framework for many types of real estate deals.

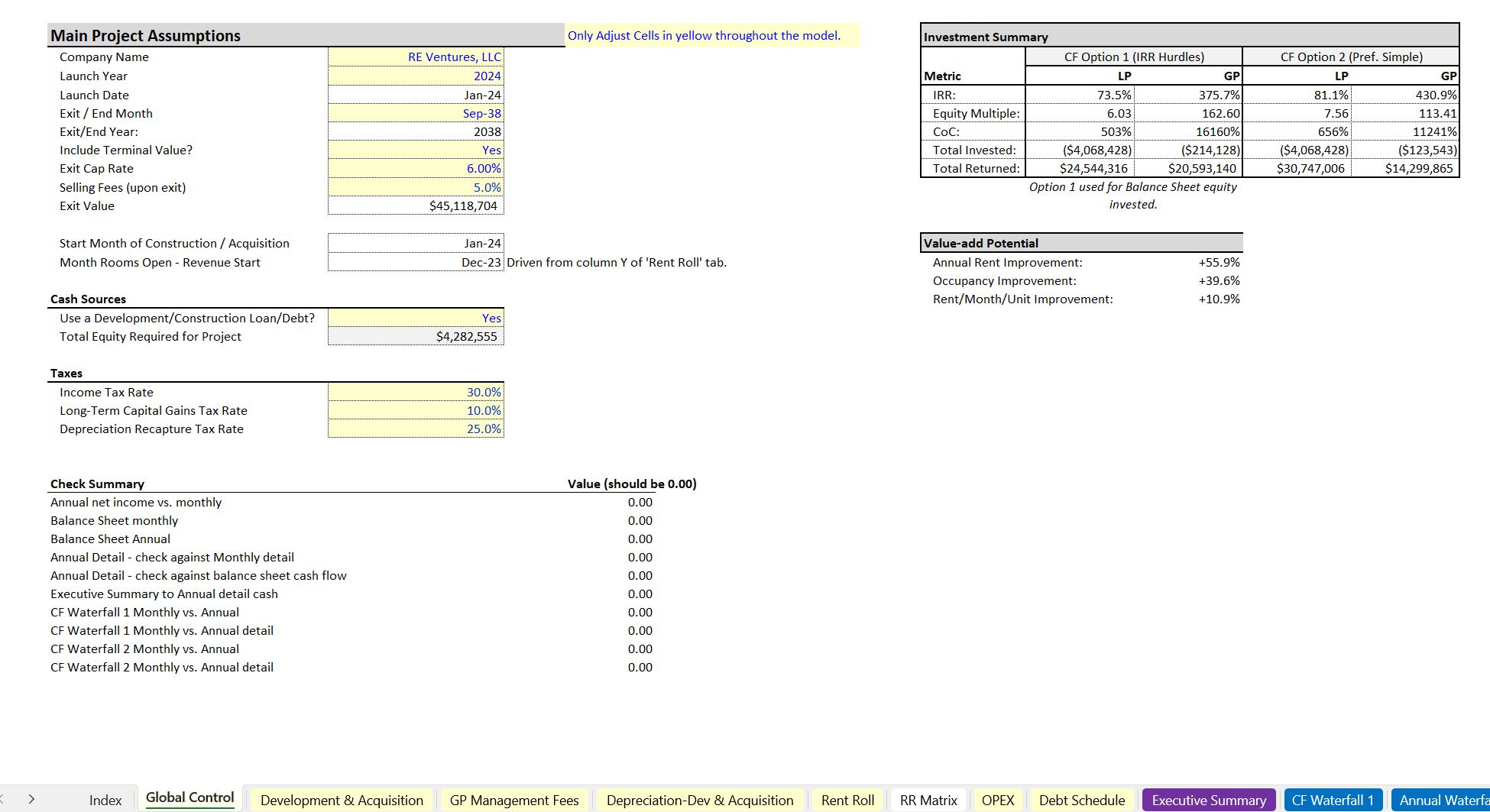

- Includes two types of joint venture waterfall options.

- Evaluate potential cash flows with IRR and DCF Analysis features.

REAL ESTATE EXCEL DESCRIPTION

When analyzing a potential apartment building deal, there are several key factors that should be considered to determine whether it is a good investment opportunity. One of the most important tools for evaluating a potential deal is a spreadsheet that contains detailed financial information about the property. There are many key components a good apartment building deal analyzing spreadsheet should have.

Template Features:

• Monthly granularity

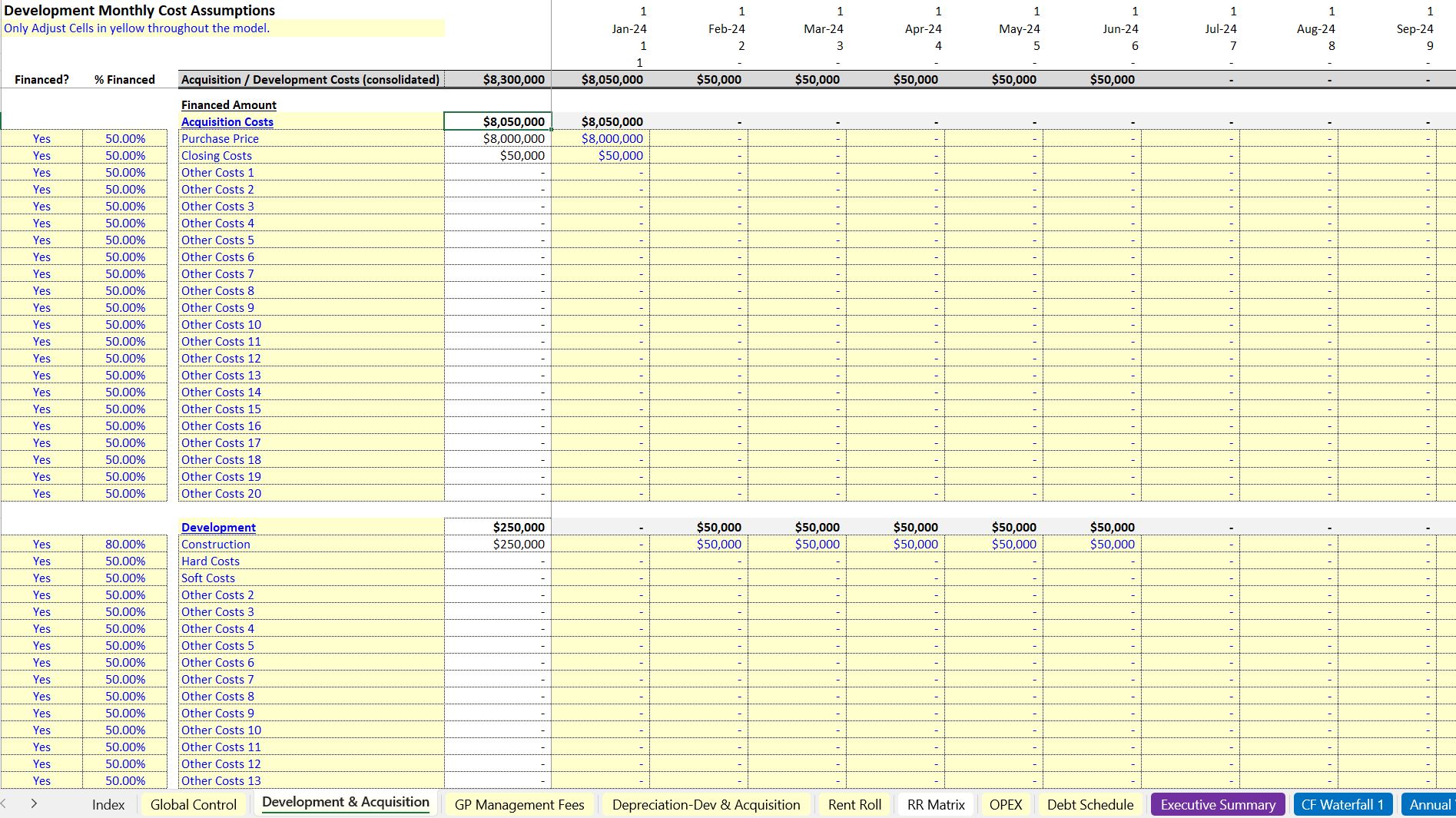

• Robust debt and equity financing assumptions

• DCF Analysis

• Multiple waterfall distribution options (for joint ventures)

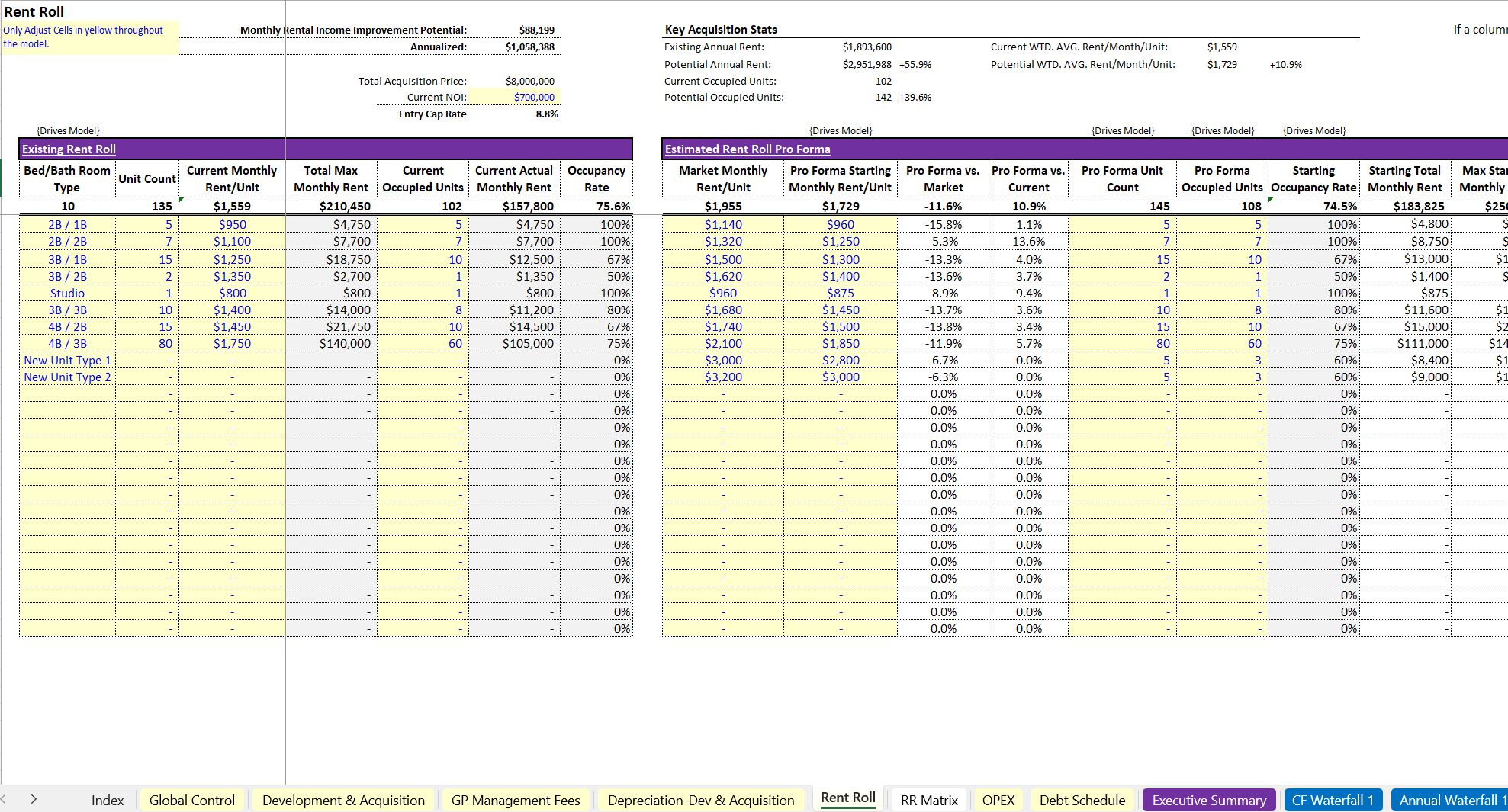

• Value-add focused (rent roll has key metrics showing the opportunities to improve rent/vacancy)

• Up to 15 year summary

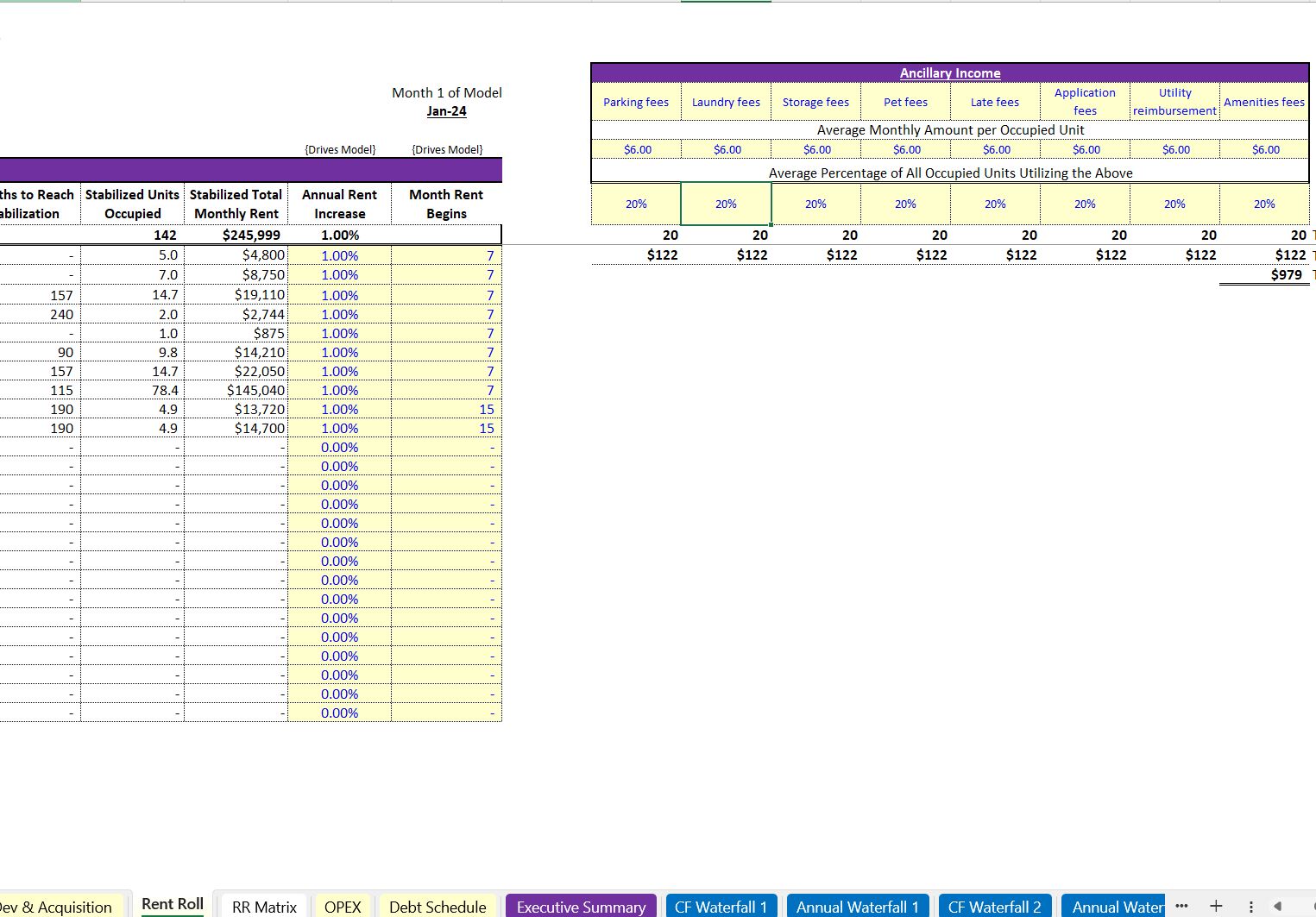

• Up to 25 unit types

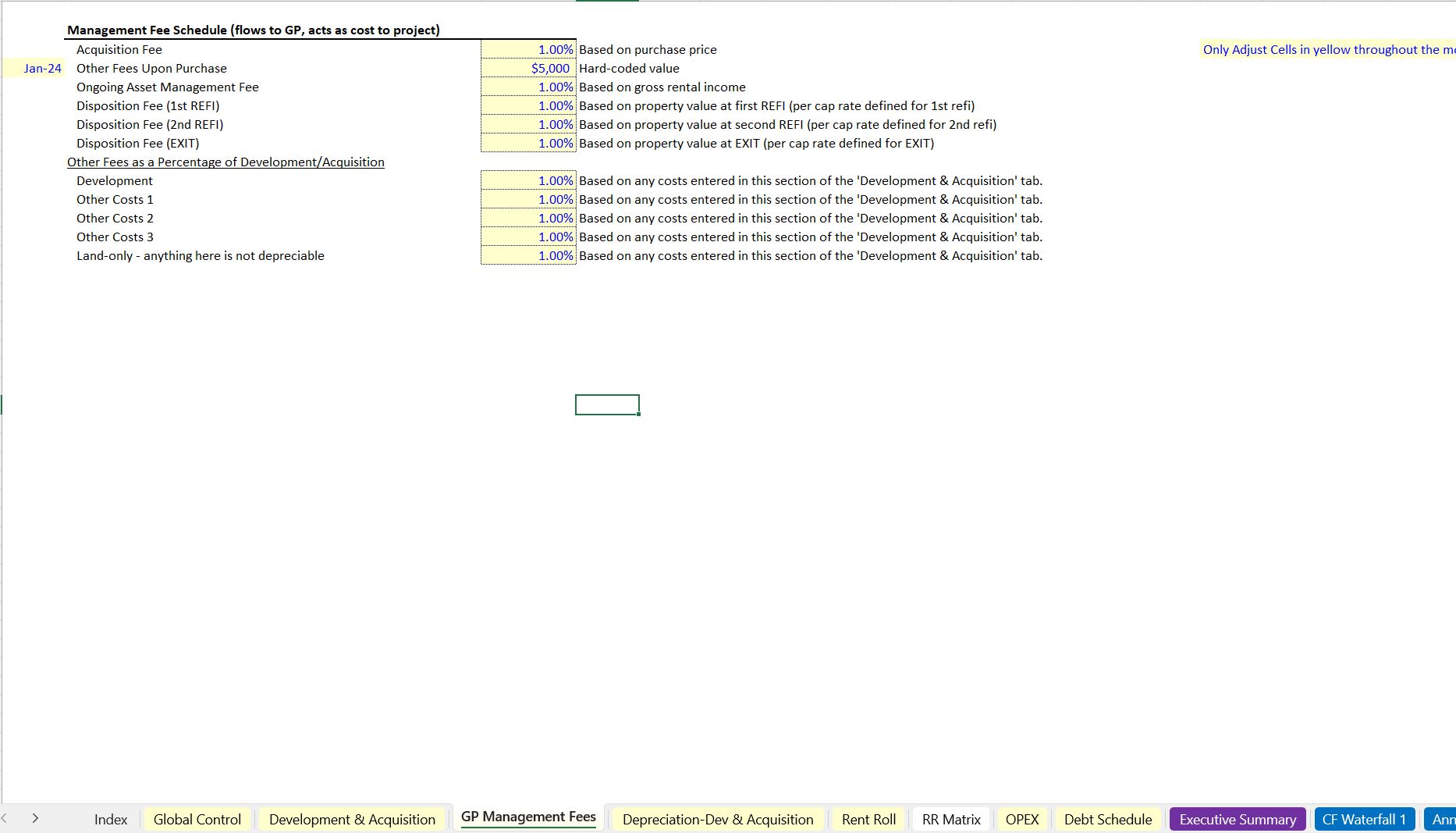

• Robust GP fee schedule (for syndication deals)

• Robust ancillary income schedule

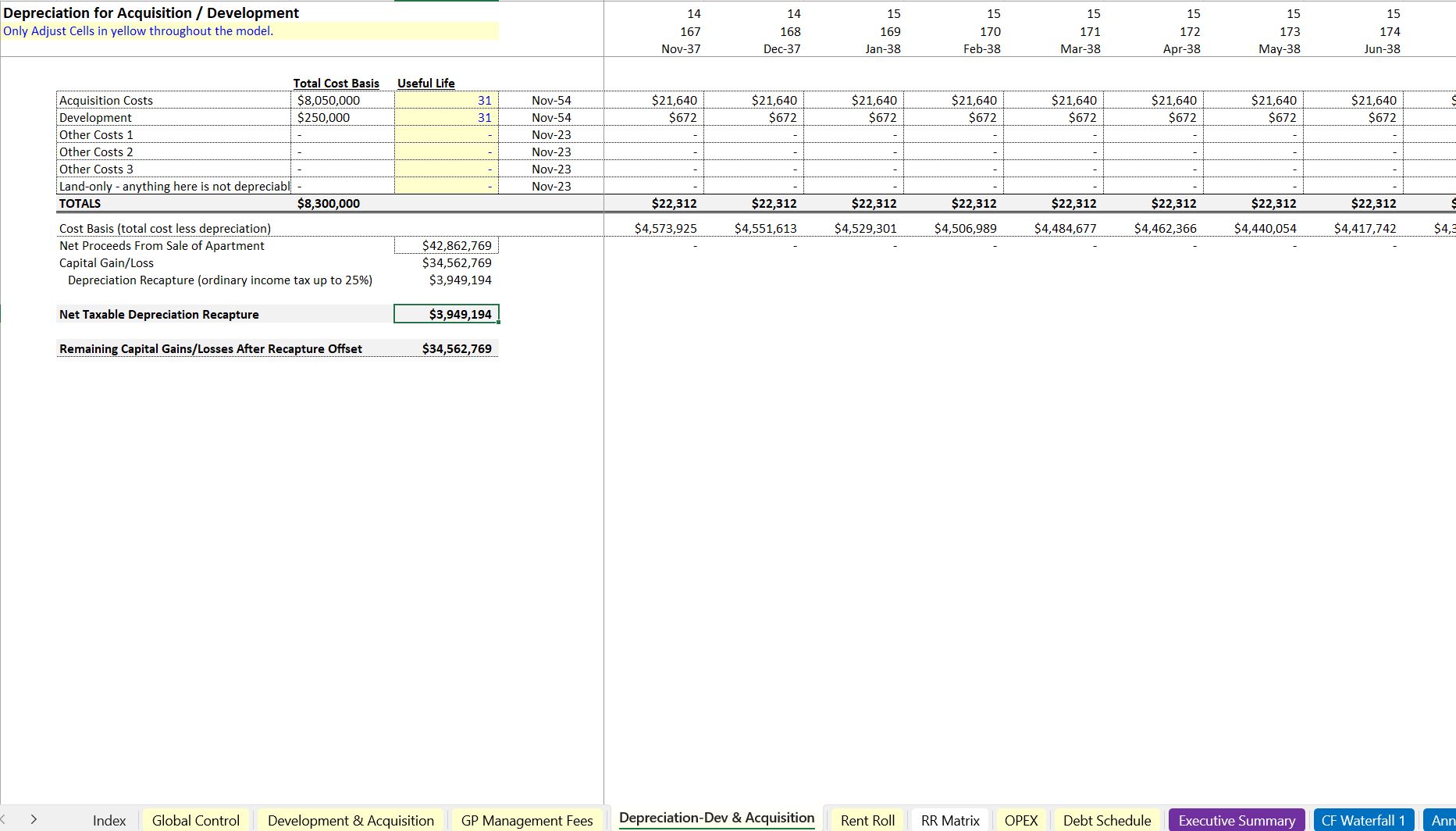

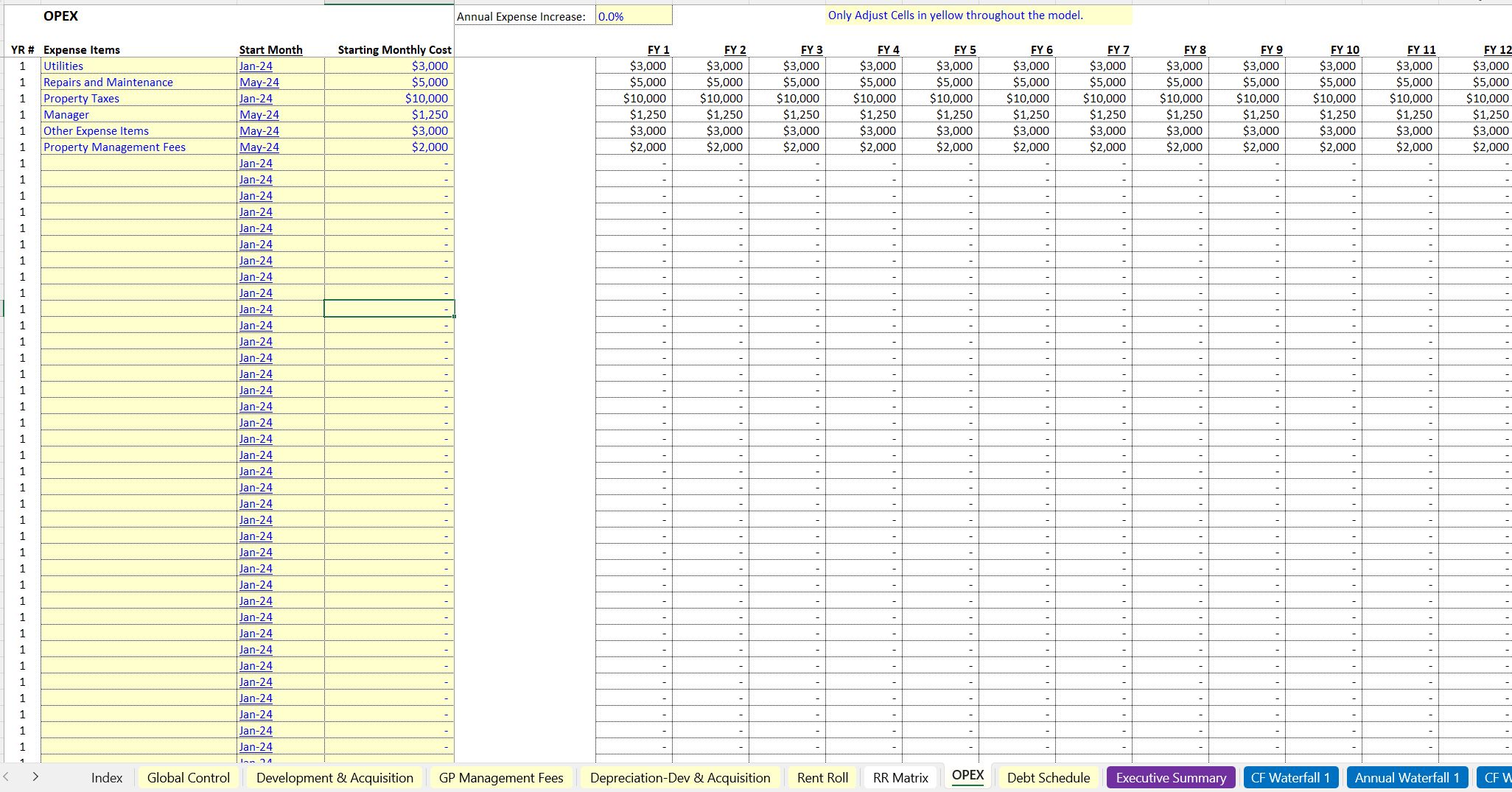

First and foremost, a good apartment building deal analyzing spreadsheet should include accurate and detailed information about the property's income and expenses. This should include information about the current rents being charged, any potential rent increases, the vacancy rate, and the costs of maintaining and operating the property. By analyzing this information, you can get a sense of the property's cash flow and whether it is generating enough income to cover its expenses.

Another important component of an apartment building deal analyzing spreadsheet is the property's financial projections. This should include projections for future income and expenses, as well as estimates of the property's potential appreciation and cash flow. To create these projections, you will need to consider a variety of factors, including the current state of the rental market in the area, the property's location and amenities, and any planned renovations or improvements.

It's also important to include information about the property's financing in your spreadsheet. This should include details about the mortgage, including the interest rate, term, and any fees associated with the loan. You should also consider the impact of the mortgage on the property's cash flow and overall profitability.

In addition to financial information, a good apartment building deal analyzing spreadsheet should also include information about the property itself. This may include details about the property's age, construction type, number of units, and any amenities or unique features that may make it more desirable to renters. This information can help you determine the property's potential for appreciation and long-term value.

Finally, it's important to consider the risks associated with the property when analyzing a potential apartment building deal. This may include risks related to the rental market, such as the potential for increased competition or a decline in demand for rental properties. It may also include risks related to the property itself, such as the need for major repairs or renovations.

The first file is a filled out version and the second is a blank version. Both are fully editable.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Real Estate, Integrated Financial Model Excel: Apartment Building Acquisition Model - 15 Year Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Industry-specific Financial Models (40+)

This bundle contains 67 total documents. See all the documents to the right.