EV Charging Station Finance Model (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Eliminates the need to create project finance trackers from scratch and includes all common EV Charging Station actual and projection components.

ENERGY INDUSTRY EXCEL DESCRIPTION

Here's a 5-Year 3-Statement Financial Model for an EV Charging Station, incorporating various revenue streams and a tiered subscription model:

Structure of the ModelThe model is built on the following statements:

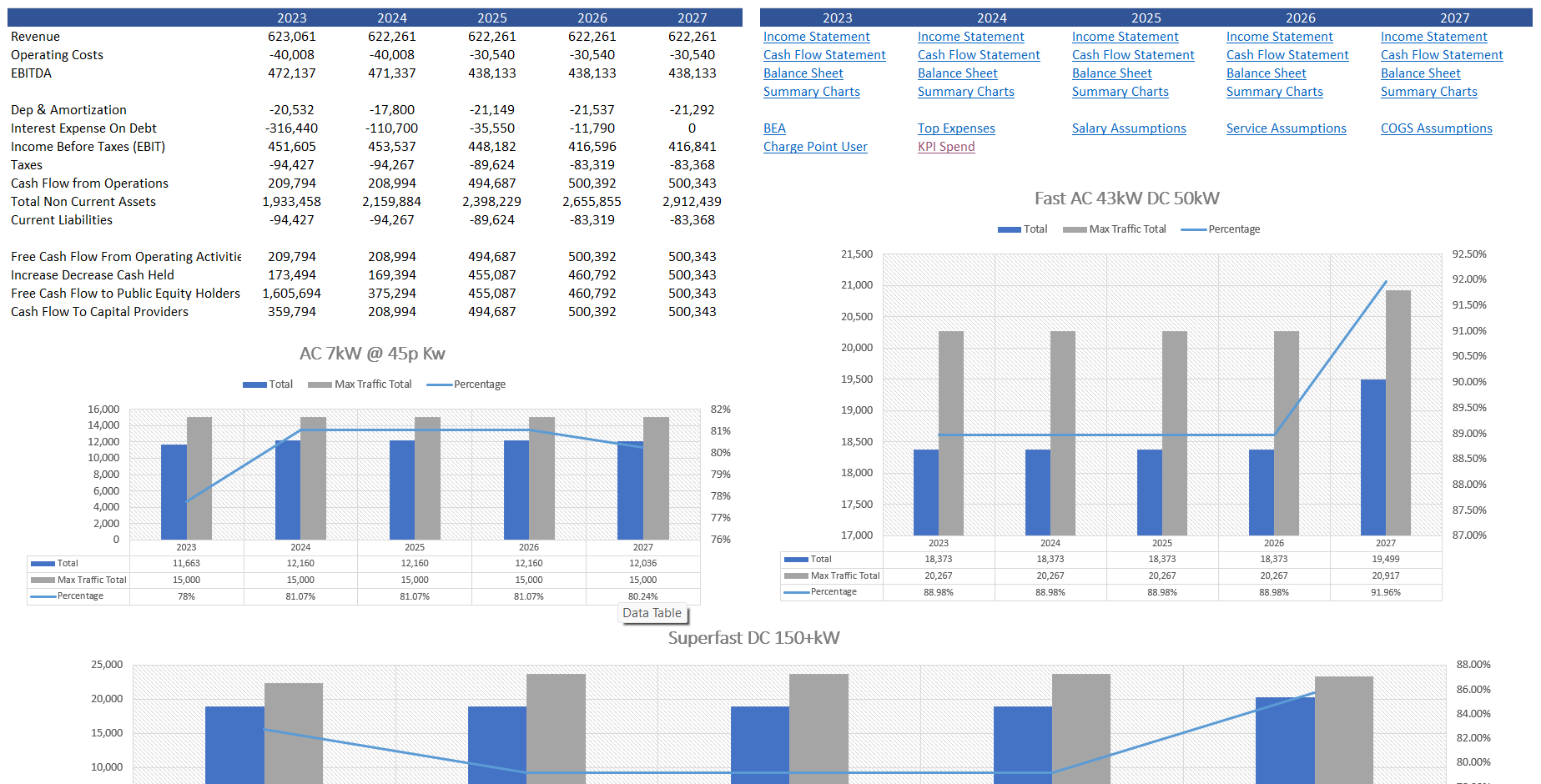

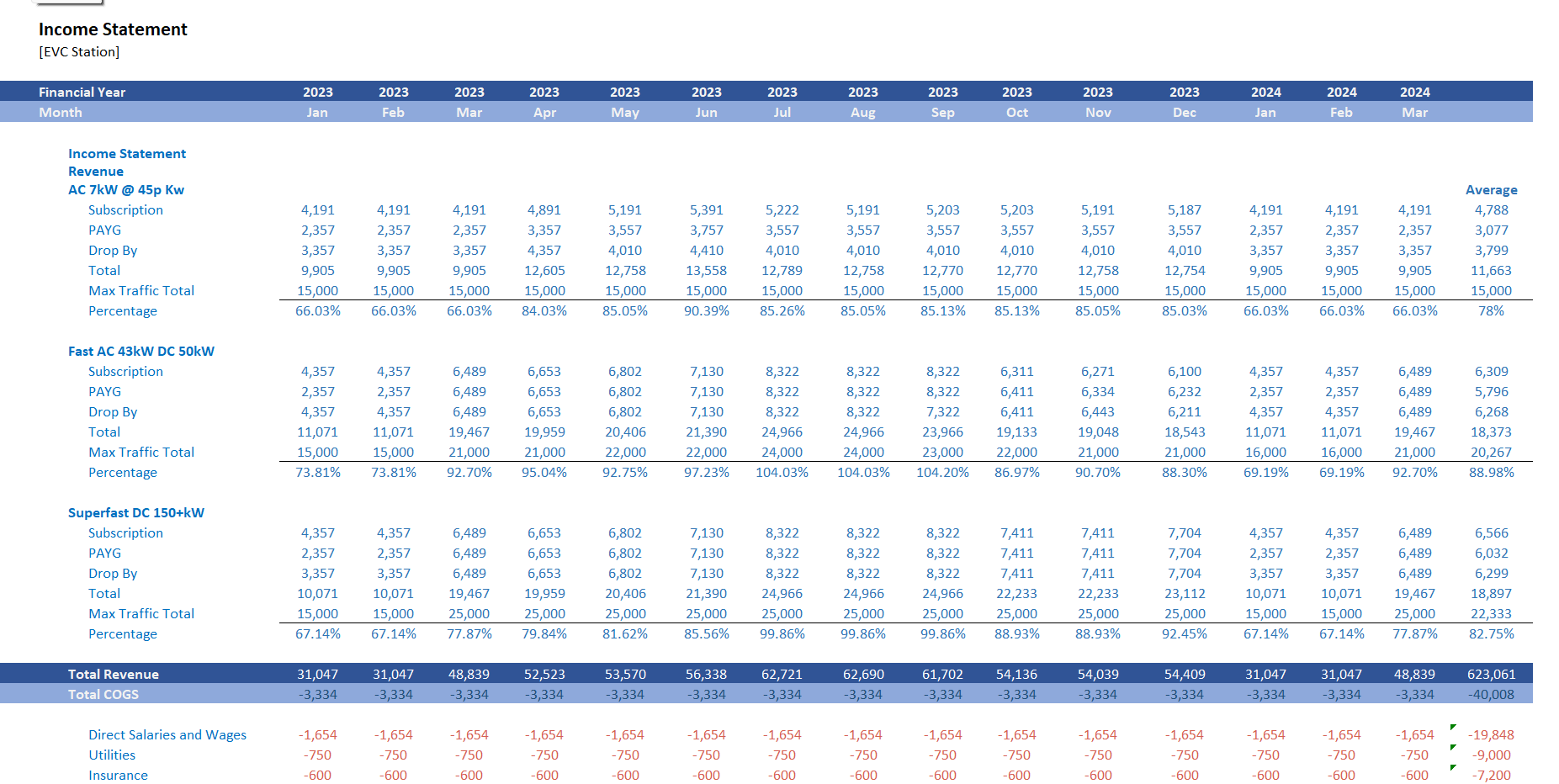

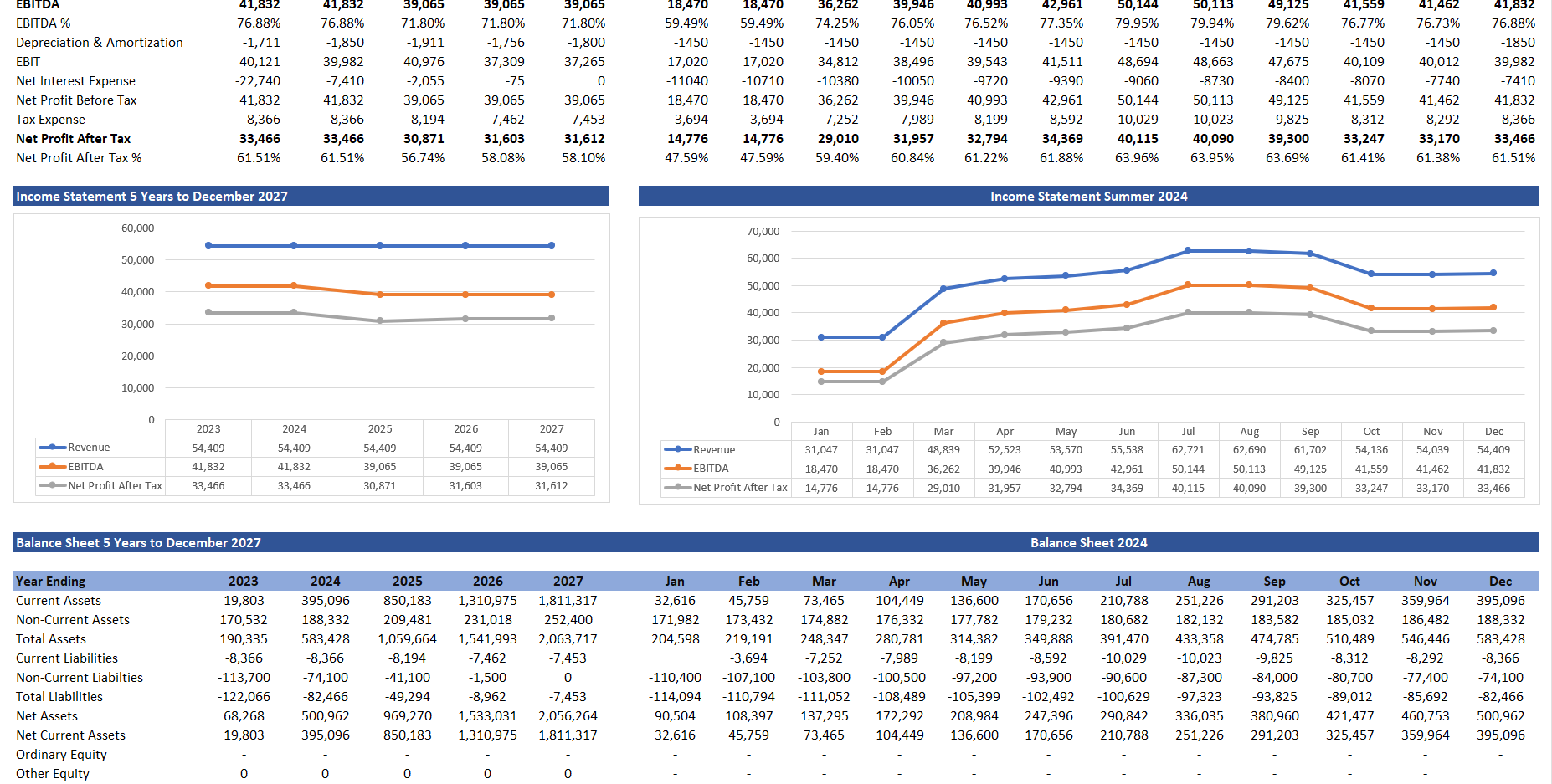

Income Statement – Tracks revenues, cost of sales, and profitability.

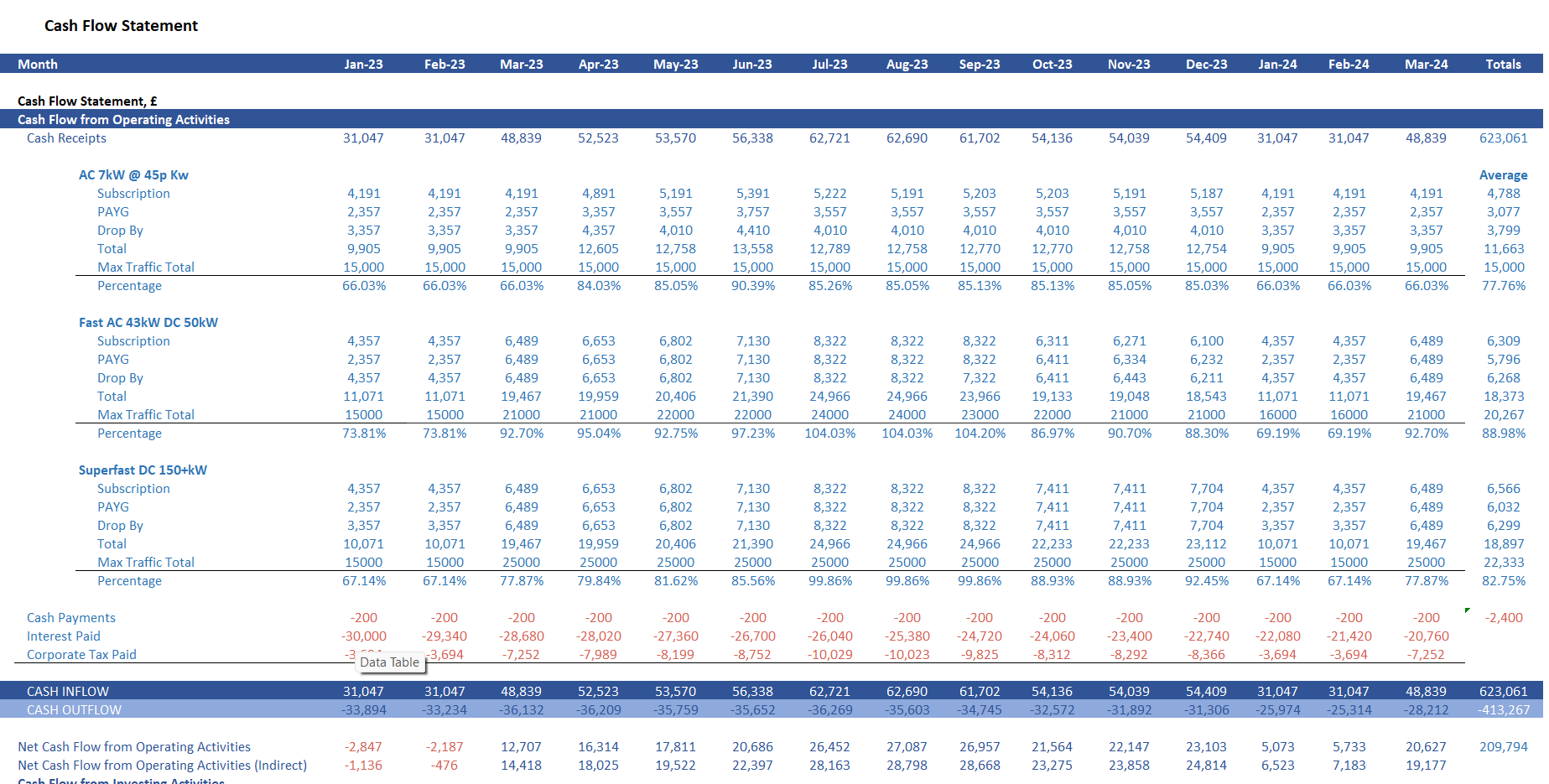

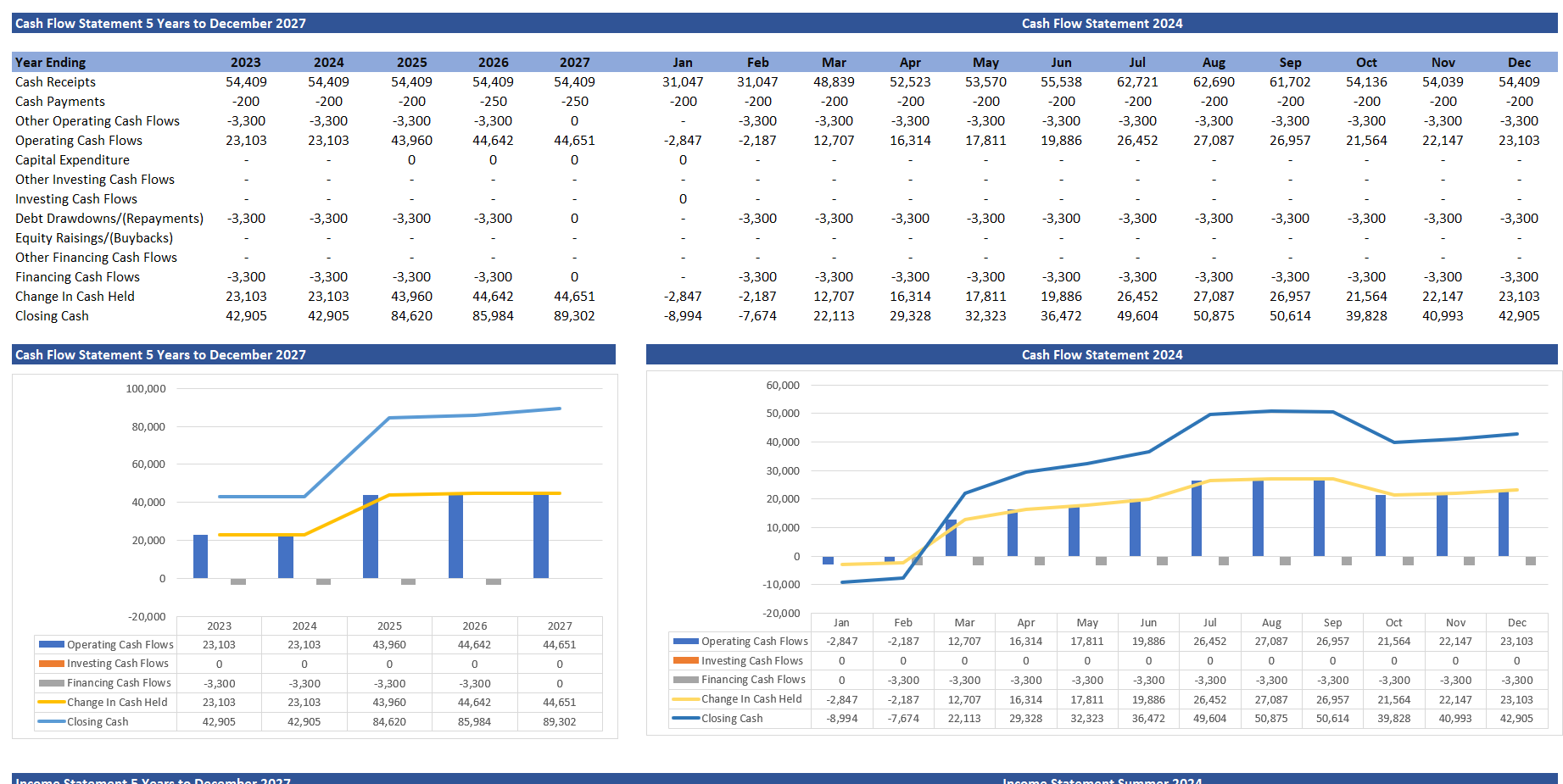

Cash Flow Statement – Monitors cash inflows and outflows to ensure liquidity.

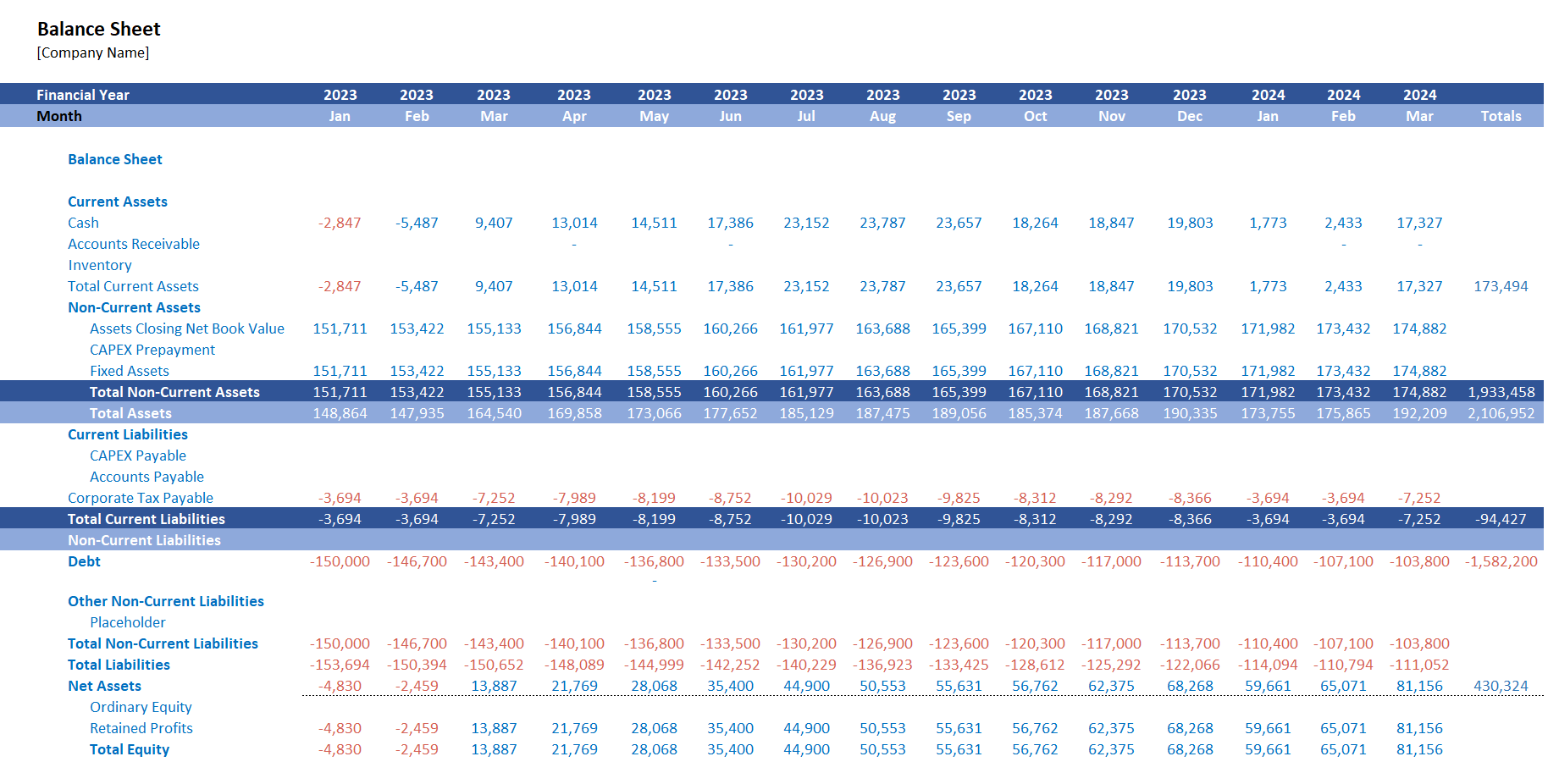

Balance Sheet – Reflects the company's assets, liabilities, and equity at any point in time.

The model also includes:

Detailed assumptions and input sheets.

Separate sections for key revenue streams.

A breakdown of subscription tiers.

1. Income Statement

Revenue Streams

Charging Fees:

Revenue is generated from pay-per-use charging by non-members and members at variable rates.

Assumptions for revenue:

Number of charging sessions/day, utilization rates of chargers, average session duration, and per kWh fee.

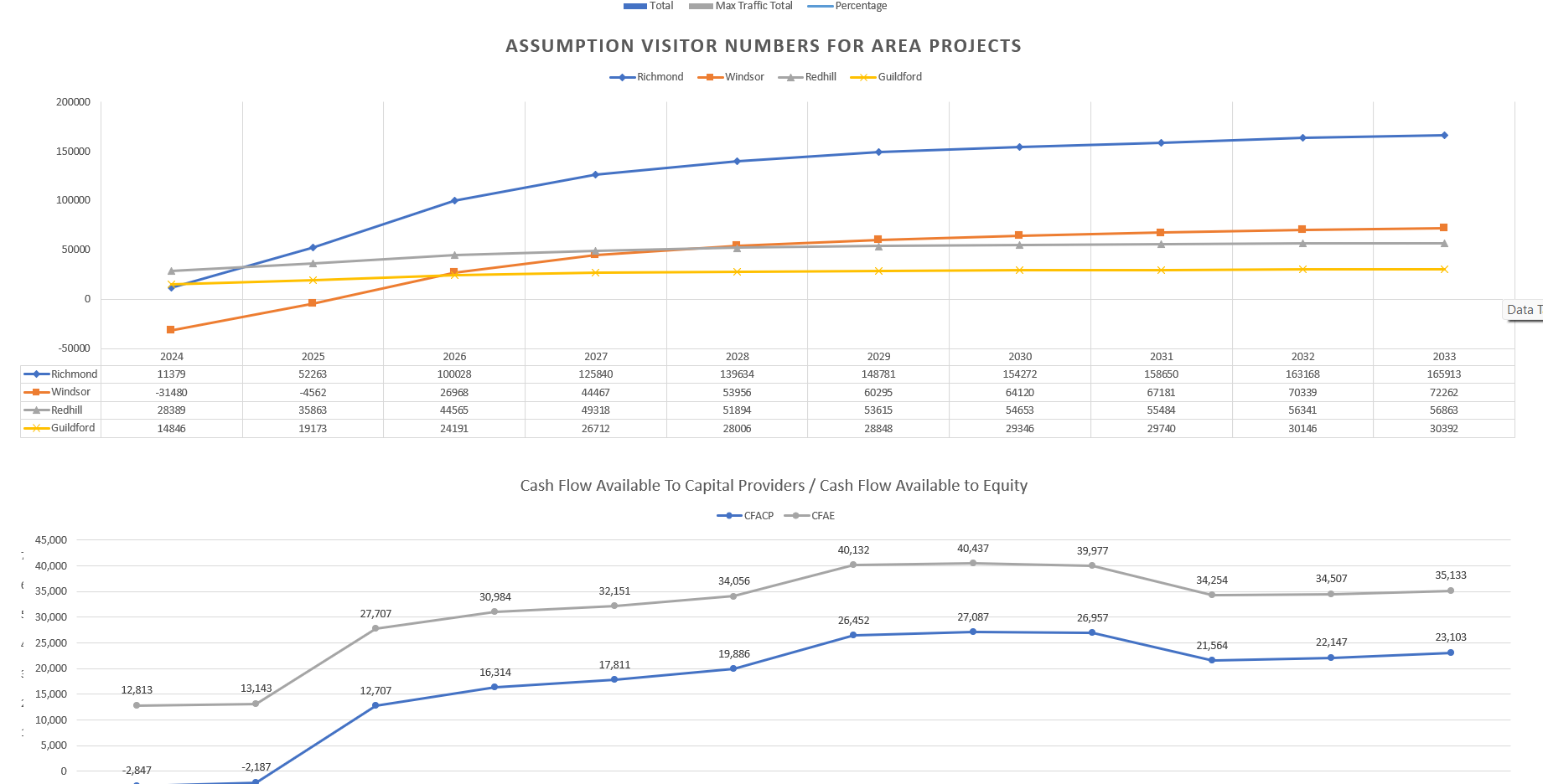

Growth in EV adoption rates over 20 years.

Membership Fees:

6 Tiered subscription model (details below).

Projections based on the percentage of users opting for membership and monthly/annual pricing tiers.

In-Store Sales (Groceries, Coffee, etc.):

Revenue from refreshments and general store sales at the charging stations.

Assumptions: average spend per customer and percentage of visitors utilizing the store.

Charging Accessories:

Revenue from selling branded cables, adapters, and portable chargers.

This includes the volume of units sold, pricing, and replacement frequency for accessories.

Advertising Revenue:

Generated via partnerships with EV-related brands displayed on chargers, in-store displays, or via apps.

Growth assumptions based on reach, impressions, and ad placement cost escalation.

Premium Parking Fees:

Additional fees are charged to users reserving prime parking spots equipped with chargers or quicker chargers.

Energy Resale:

Revenue from selling surplus energy back to the grid or to local businesses.

Based on energy purchase costs and demand in the region.

Licensing Fees:

Generated from proprietary charging software licensed to other businesses.

Cost of Goods Sold (COGS)

Energy Costs:

Includes wholesale energy purchasing costs and transmission losses.

Costs vary based on utilization rates.

Store Inventory Costs:

Direct costs associated with in-store sales and accessory merchandise.

Software Development and Licensing Costs:

Operational costs to maintain and upgrade the proprietary charging management platform.

Operating Expenses

Salaries and employee benefits (managers, technicians, in-store staff).

Rent and utilities for charging station locations.

Marketing and promotions, including tiered subscriptions.

Maintenance costs for chargers and infrastructure.

EBITDA Calculation

Gross revenue minus COGS and operating expenses.

Includes detailed schedules for depreciation (chargers, store interiors) and amortization (software development).

2. Cash Flow Statement

Operating Cash Flows:

Detailed schedules for cash generated from operating revenues like charging fees and in-store sales.

Adjustments for working capital (inventory, payables, receivables).

Investing Cash Flows:

Initial and recurring investments in EV chargers, battery storage systems, and real estate leases.

Capital expenditure schedules include technology upgrades every 5 years.

Financing Cash Flows:

Debt and equity financing schedules.

Projected repayments, dividends, or reinvestments.

Net Cash Flow & Balances:

Projects cumulative cash flow over 20 years to maintain liquidity and achieve sustainable expansion.

3. Balance Sheet

Assets

Fixed Assets:

EV charging infrastructure, land, store fittings, and software development capitalized.

Current Assets:

Cash and equivalents.

Inventory (store and accessories).

Receivables from partnerships or delayed fees.

Liabilities

Short-Term Liabilities:

Accounts payable for energy purchase and inventory.

Long-Term Liabilities:

Loan schedules for initial and expansion capital.

Equity

Paid-up capital and retained earnings over the model's duration.

4. 6 Tiered Subscription Model Add-on

The subscription 6 tiers provide recurring revenue while offering additional benefits:

Tier Structure

1. Basic Membership

Target Audience: Infrequent users or casual EV drivers.

Features:

Flat monthly/annual fee.

5% off charging fees and store items.

Basic app access for viewing charging locations and availability.

No discounts or perks.

Use Case:

Attract new customers and provide flexibility to occasional users.

2. Standard Membership

Target Audience: Regular but non-intensive EV users.

Features:

Affordable monthly/annual fee (e.g., $9.99/month or $100/year).

10% discount on charging fees.

Access to standard chargers (not high-speed).

5% discount on in-store items.

In-app charging session tracking.

Use Case:

Ideal for commuters with predictable charging patterns.

3. Premium Membership

Target Audience: Daily EV users who value speed and convenience.

Features:

Moderate monthly/annual fee (e.g., $19.99/month or $200/year).

20% discount on charging fees.

Access to fast chargers with priority reservations.

10% discount on in-store items and charging accessories.

Complimentary access to app features like charging analytics and route optimization.

Basic roadside assistance (flat battery charging).

Use Case:

Designed for drivers with higher daily mileage or time-sensitive schedules.

4. Family Plan

Target Audience: Households with multiple EVs or shared family vehicles.

Features:

One membership fee (e.g., $39.99/month or $400/year) covers up to 4 vehicles.

20% discount on charging fees for all covered vehicles.

15% discount on in-store items and charging accessories.

Shared usage reports for family members.

One reserved parking spot per session.

Use Case:

Encourages family adoption of EVs by making it cost-effective and convenient.

5. Business/Fleet Plan

Target Audience: Companies with small EV fleets for delivery or employee use.

Features:

Monthly fee based on fleet size (e.g., $99.99/month for 5 vehicles, $199.99/month for 15 vehicles).

Up to 30% discount on charging fees for fleet vehicles.

Dedicated fleet manager portal for managing usage and costs.

Priority access to chargers during peak hours.

On-site charger installation discounts for fleet parking.

Use Case:

Supports businesses in adopting EVs for operational cost reduction and sustainability.

6. Elite Membership

Target Audience: High-income EV users or early adopters who prioritize exclusivity.

Features:

High monthly/annual fee (e.g., $99.99/month or $1,000/year).

Unlimited charging at any station in the network.

Exclusive access to ultra-fast chargers and luxury lounges at select locations.

Reserved premium parking spots at all locations.

Complimentary energy usage report and vehicle diagnostics.

Free roadside assistance, including towing and replacement chargers.

Discounts on partner services (e.g., auto insurance, car washes).

Use Case:

Designed for users who want a VIP experience and prioritize convenience.

Add-ons Available Across All Tiers

Idle Fee Waiver:

Users can pay extra to waive penalties for exceeding charging time limits.

Carbon Offset Contribution:

Voluntary fee to offset the carbon footprint of electricity usage.

Enhanced Support:

Premium customer service with faster response times for urgent issues.

This 6-tier model caters to various user profiles, from first-time EV drivers to power users and businesses, ensuring revenue diversification and customer satisfaction.

Metrics for Subscription Model

Total users, churn rate, acquisition costs, ARPU (Average Revenue Per User).

Target market penetration over 20 years, broken into segments.

Implementation Details

Excel Model Structure:

Assumptions, Input, and Summary Sheets.

Separate schedules for each revenue and cost component.

Scenario analysis for low, medium, and high EV adoption rates.

Dynamic Outputs:

Graphs for EBITDA margins, Net Profit trends, and cumulative cash flow.

Break-even analysis to gauge capital efficiency.

Key KPIs:

ROI on infrastructure, revenue-per-session, membership growth rates, gross and net profit margins, and operating expense ratios.

This model provides a comprehensive tool for analyzing profitability, managing risks, and forecasting long-term growth for EV charging stations. It leverages diverse revenue streams and tiered subscriptions. Let me know if you'd like to explore any specific section.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Energy Industry, Transportation, Electric Vehicle, Integrated Financial Model Excel: EV Charging Station Finance Model Excel (XLSX) Spreadsheet, Willcox PMO