Editor's Note: Take a look at our featured best practice, Five Stages of Business Growth (25-slide PowerPoint presentation). This presentation introduces a framework for entrepreneurs to use when building and navigating their business from a nascent, startup state to an enterprise with a global footprint. This framework, called the 5 Stages of Business Growth, is based on the fact that all businesses experience common [read more]

Entrepreneurs: Here’s How to Start Your Own LLC and File Taxes

* * * *

Whether you’re a small business owner, side hustler, freelancer, or gig economy entrepreneur, operating your business as an LLC has numerous benefits.

Moreover, an LLC is a hybrid business entity that combines the best features and tax benefits of a sole proprietorship, partnership, and corporation.

Fortunately, unlike a decade ago, LLCs are now much easier and cheaper to set up; additionally, thanks to numerous tools, filing taxes for an LLC is also quick and easy. This straightforward guide will walk you through how to do both tasks easily and effectively.

How to Start Your Own LLC: A 4-Step Guide

Although LLC formation laws, requirements, and regulations may vary slightly from state to state, the main steps to forming one are:

Step 1: Name your LLC

This is usually the most creatively-involved step of the LLC formation process because you have to come up with a unique and on-brand business name.

To avoid overthinking this step and getting stuck on the idea of “coming up with the best business name possible,” dedicate only 15 minutes to brainstorming a list of viable business names, then narrow it down to your favorite five that meet the following criteria:

NOTE: Naming conventions and regulations may vary from state to state, but your LLCs business name should be.

- Unique and not used by another LLC/company/business

- Include the phrase LLC, Ltd, or Limited Liability Company (for example, “landscaping maestros LLC”)

- Not misleading/misrepresenting the business

From here, you only need to choose a name for your LLC and roll with it; after all, you can always run your LLC under a “Doing Business As (DBA) trade name.

TIP: While it is not mandatory, it is always a good idea to check domain name availability for your preferred business name, especially if you intend to establish an online presence, perform a business and trademark name search, and file a DBA—if so desired.

Step 2: Choose a registered agent

Technically, you can act as a registered agent and your LLC’s official point of contact because all you need is a physical address in whatever state you want to register your LLC. This option can work if you want to start a single-member LLC. However, the option can be a hassle later. Here is why:

Registered agents should always be available to receive official correspondence during regular business hours. Unless you can always be available, without fail, it is best to appoint a registered agent who will always be available to accept legal correspondence and service of process papers.

Research is the only full-proof way to choose the right registered agent; most states have a list of registered private service companies. Additionally, Forbes has a list of Registered Agent Services providers.

As a pro tip, and if you can afford it, work with a registered agent who offers a full suite of legal services, such as filing your official paperwork —for a fee. It makes things so much easier.

Step 3: File the official paperwork

Your LLC becomes a legal entity when you file your articles of organization — called certificate of formation or organization in some states— with your Secretary of State and pay the filing fee.

States have specific conventions about what to include in Articles of Organization and how to file these articles, but the most basic information needed is:

- The business name and ownership information

- Business address

- A statement of business purpose

- Registered agent name and address

- Duration/dissolution statement —only required in some states

- Management structure —whether managed by members or a designated manager

- Operating Agreement —while an operating agreement is not mandatory in all states, having one is important because it sets out how your business operates.

Check requirements, including submitting and filing fees, which vary from state to state, with your Secretary of State website.

Step 4: Apply for EIN and meet your tax obligations

If you’re establishing a single-member LLC, you do not have to apply for an EIN; you can use your social security number instead.

However, applying for an EIN is a good idea, even if you’re a solopreneur, at-home business owner, or freelancer, especially if you intend to create a revenue-generating LLC or employ people/collaborate with other business entities in the future.

An EIN creates a further distinction between you and your LLC, allowing you to open a separate business bank account, get your business the local and state licenses it needs to operate, file taxes, etc.

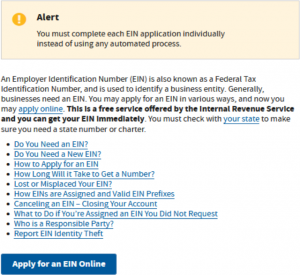

Source: IRS

You can use the IRS website to apply for an EIN.

After getting your EIN, you can use it to open a business account for your LLC and start operating and filing income taxes, which is the final step of running a successful LLC.

How to File LLC Income Taxes

How you file your LLC income taxes depends on your structure. For:

Single-member LLCs

Single-member LLCs can file taxes as sole proprietorships under Schedule C —the IRS considers single-member LLCs disregarded entities for taxation purposes.

Multi-member LLC

On the other hand, multi-member LLCs can file taxes as a partnership using Form 1065, Schedule K-1, and Schedule E.

These are the main steps and things you need to know about starting an LLC and filing taxes once your LLC is registered and established.

In parting, on taxation:

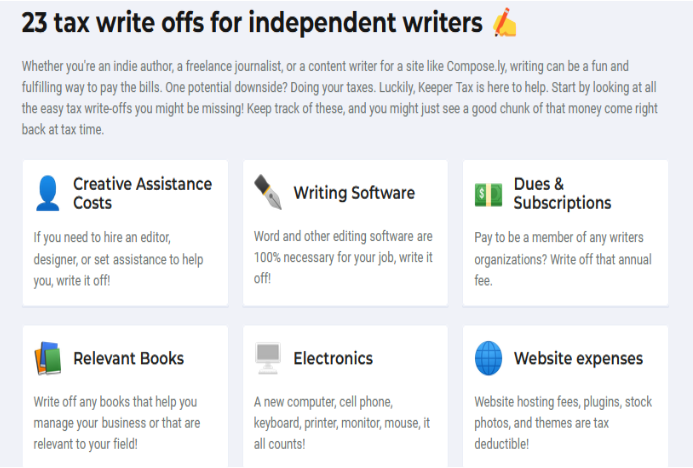

One of the best benefits of operating as an LLC is that you can write off most business expenses, up to 20% of the LLCs income.

For example, as an independent content creator and freelance writer, I’ve found that by connecting my LLCs business account to Keeper Tax and then using KeeperTax’s invoice template to bill clients, I can easily use the app to write off as many as 23 expenses when filing my LLC taxes.

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Entrepreneurship and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

- Top 100 in Strategy & Transformation

- Top 100 in Digital Transformation

- Top 100 in Operational Excellence

- Top 100 in Organization & Change

- Top 100 Management Consulting Frameworks

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

|

|

56-slide PowerPoint presentation

|

|

81-slide PowerPoint presentation

| |||

About Shane Avron

Shane Avron is a freelance writer, specializing in business, general management, enterprise software, and digital technologies. In addition to Flevy, Shane's articles have appeared in Huffington Post, Forbes Magazine, among other business journals.Top 10 Recommended Documents on Entrepreneurship

» View more resources Entrepreneurship here.

» View the Top 100 Best Practices on Flevy.