Editor's Note: Take a look at our featured best practice, Digital Transformation: Value Creation & Analysis (21-slide PowerPoint presentation). Most organizations recognize the significant potential in creating value through Digital Transformation. However, they may struggle with the question of exactly how much value they can create and where within the organization the value will come from. This presentation deals with the various [read more]

Also, if you are interested in becoming an expert on Value Creation, take a look at Flevy's Value Creation Frameworks offering here. This is a curated collection of best practice frameworks based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. By learning and applying these concepts, you can you stay ahead of the curve. Full details here.

* * * *

Value-Based Management (VBM) has been regarded traditionally as a tool to help investors evaluate firms, optimize performance management, and maximize shareholder value.

Value-Based Management (VBM) has been regarded traditionally as a tool to help investors evaluate firms, optimize performance management, and maximize shareholder value.

However, there are mixed opinions on whether to utilize VBM as a mandatory investment or management tool. Many investors, analysts, and executives, to this day, are skeptical of the influence and role of VBM in confronting the dot-com bubble or other financial downturns. They are even cynical of the efficacy of VBM as a robust management approach for the future or its effectiveness in creating competitive advantage for them.

The following are some shortcomings associated with the traditional VBM approaches that leaders should negotiate:

- An inadequate link between VBM practices and capital markets realities—absence or lack of analysis of the capital markets to expose gaps between a company’s intrinsic value and actual stock price.

- Aligning VBM with the organizational systems and its culture for value creation.

- A broken process for managing the controls that govern value creation—traditional VBM offers rich insights on managing economic principles, but lacks a process on how to further align strategic, cultural, and behavioral levers.

Value Creation Framework

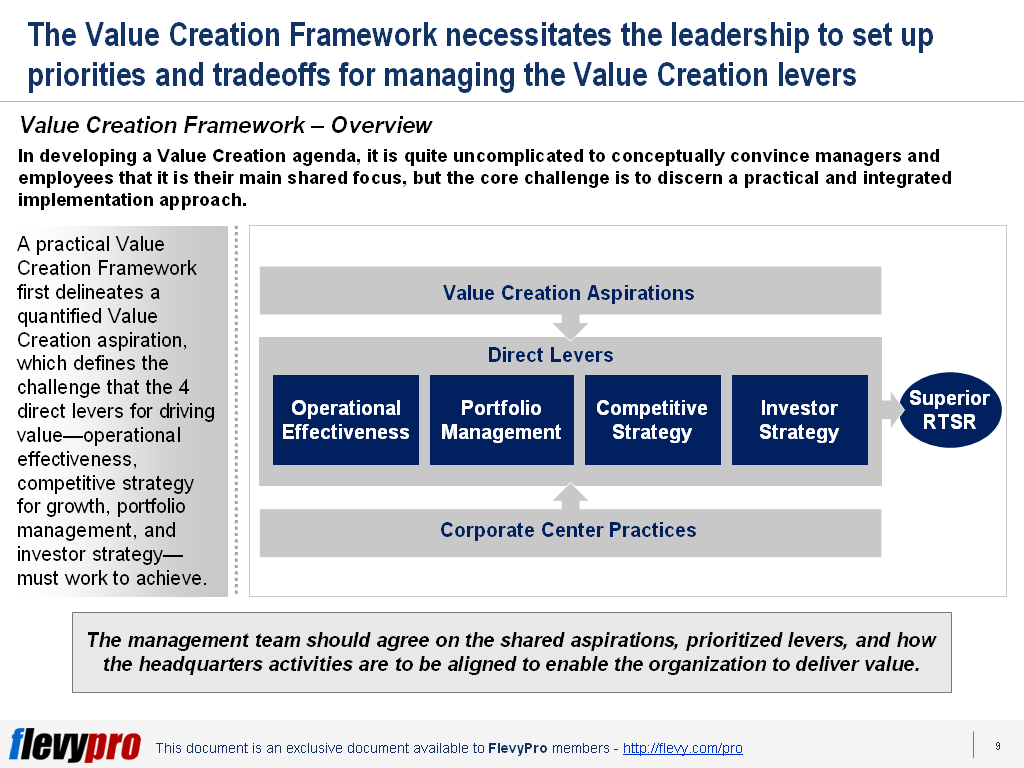

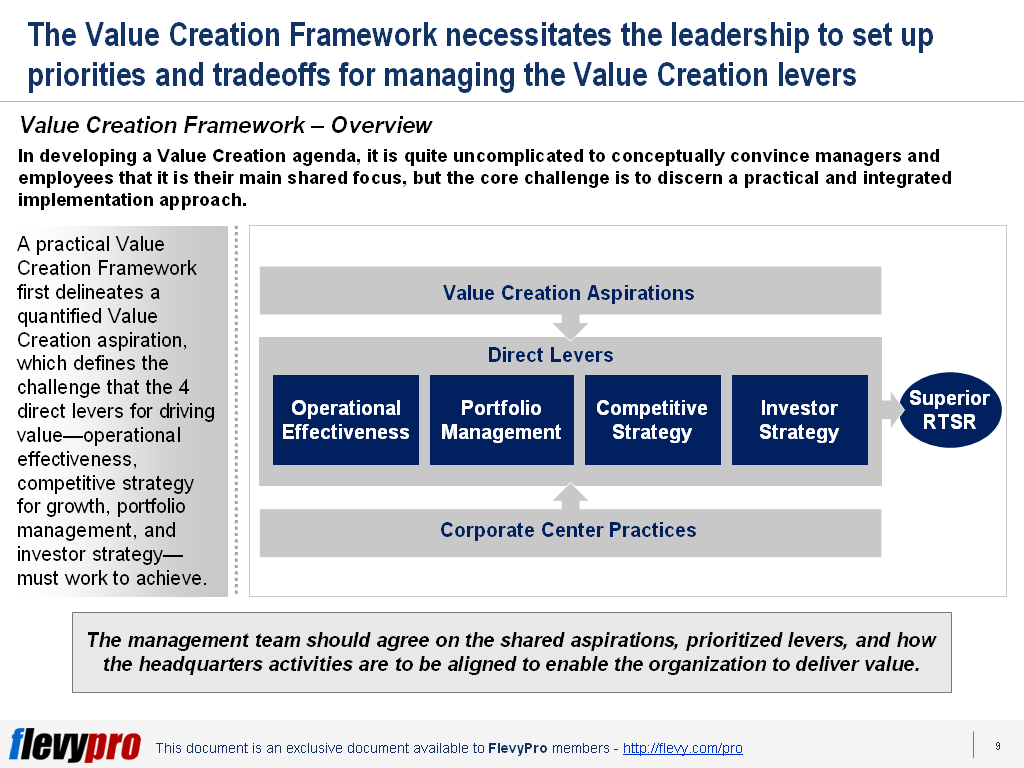

The lack of trust in the effectiveness of VBM necessitates formulating a more thorough, fact-based approach to executing VBM. In developing a value creation agenda, it is quite uncomplicated to conceptually convince managers and employees that it is their main shared focus, but the core challenge is to devise a practical and integrated implementation approach.

The Value Creation Framework depends on 4 value creation levers that senior management can pull in order to effectively achieve their value creation goal. These levers are not autonomous and needs to be activated in tandem:

- Operational Effectiveness

- Competitive Strategy

- Portfolio Management

- Investor Strategy

The framework first stresses the management team to agree on the shared aspirations, prioritized levers, and how the headquarters activities are to be aligned with the business units. This entails revisiting the assumptions, priorities, decisions, tools, and culture at all levels across an organization to harness VBM to achieve improved value creation. The framework warrants the VBM approach to be embraced as a culture to maximize value creation–which is measured in Relative Total Shareholder Return.

Relative Total Shareholder Return (RTSR)

Focusing and aligning the organizations around a shared mission is important for the leadership. Clearly laid out, compelling vision and aspirations—that are reinforced daily—have a profound positive impact on an organization’s value creation potential.

Value creation best practices necessitate establishing a single, long-term goal—the Relative Total Shareholder Return (RTSR) performance. The Relative Total Shareholder Return reflects a firm’s capital gains plus dividend yield relative to a peer group or market index.

The RTSR concept is not new, but practically most companies find it hard to implement RTSR as a goal-setting tool. The RTSR should be clearly quantified and communicated across the board as a long-term goal. The RTSR aspirations motivate and empower line management to work as entrepreneurs to achieve it, set objective targets, and connect business unit management to capital markets discipline. If done right, RTSR is a useful method to specify and communicate a firm’s objectives and the supporting execution plans.

Measuring RTSR Objective

Measuring the RTSR goal achievement at the corporate level can be done by ranking a firm’s TSR against its peers TSR. A RTSR target can be set to analyze the effect of corporate and business unit plans. This can be done by quantifying a subjective goal—e.g., top half or top quartile TSR—into a specific number. The calculations warrant developing a forward-looking RTSR target on the following 3 footings:

- Anticipated 5-year company cost of equity—to gather an investor’s view of the risk-adjusted average expected return that a firm or market index is priced to deliver.

- Anticipated spread to achieve relative TSR goal—calculating stretched, above-average TSR goal needs personal discretion. It can be done through superior performance improvements instead of maintaining superior absolute levels of performance.

- Forward looking 5-year RTSR target—calculation of this goal requires 2 key considerations: RTSR probability of reaching above-median TSR and benchmarks to meet a cumulative top quartile TSR target over different time periods.

Interested in learning more about the Value Creation Framework? You can download an editable PowerPoint on Value Creation: Relative Total Shareholder Return here on the Flevy documents marketplace.

Do You Find Value in This Framework?

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives. Here’s what some have to say:

“My FlevyPro subscription provides me with the most popular frameworks and decks in demand in today’s market. They not only augment my existing consulting and coaching offerings and delivery, but also keep me abreast of the latest trends, inspire new products and service offerings for my practice, and educate me in a fraction of the time and money of other solutions. I strongly recommend FlevyPro to any consultant serious about success.”

– Bill Branson, Founder at Strategic Business Architects

“As a niche strategic consulting firm, Flevy and FlevyPro frameworks and documents are an on-going reference to help us structure our findings and recommendations to our clients as well as improve their clarity, strength, and visual power. For us, it is an invaluable resource to increase our impact and value.”

– David Coloma, Consulting Area Manager at Cynertia Consulting

“As a small business owner, the resource material available from FlevyPro has proven to be invaluable. The ability to search for material on demand based our project events and client requirements was great for me and proved very beneficial to my clients. Importantly, being able to easily edit and tailor the material for specific purposes helped us to make presentations, knowledge sharing, and toolkit development, which formed part of the overall program collateral. While FlevyPro contains resource material that any consultancy, project or delivery firm must have, it is an essential part of a small firm or independent consultant’s toolbox.”

– Michael Duff, Managing Director at Change Strategy (UK)

“FlevyPro has been a brilliant resource for me, as an independent growth consultant, to access a vast knowledge bank of presentations to support my work with clients. In terms of RoI, the value I received from the very first presentation I downloaded paid for my subscription many times over! The quality of the decks available allows me to punch way above my weight – it’s like having the resources of a Big 4 consultancy at your fingertips at a microscopic fraction of the overhead.”

– Roderick Cameron, Founding Partner at SGFE Ltd

“Several times a month, I browse FlevyPro for presentations relevant to the job challenge I have (I am a consultant). When the subject requires it, I explore further and buy from the Flevy Marketplace. On all occasions, I read them, analyze them. I take the most relevant and applicable ideas for my work; and, of course, all this translates to my and my clients’ benefits.”

– Omar Hernán Montes Parra, CEO at Quantum SFE

101-slide PowerPoint presentation

This presentation provides an in-depth discussion on Value Creation. Maximizing shareholder value is the strategic management philosophy driving countless organizations. The thinking here is the organization should first and foremost consider the interests of shareholders when making management

[read more]

Want to Achieve Excellence in Value Creation?

Gain the knowledge and develop the expertise to become an expert in Value Creation. Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

Since the early 1990s, organizations have relied on Value-Based Management (VBM) and other Value Creation frameworks to analyze and drive business performance and shareholder value. After all, maximizing shareholder value is the #1 priority for any publicly-owned company—and a top priority for most others.

But, how do we create Value?

Over the years, Value Creation Thinking has evolved from VBM to more inclusive models.

Learn about our Value Creation Best Practice Frameworks here.

Readers of This Article Are Interested in These Resources

86-slide PowerPoint presentation

This deck outlines a market entry strategy and business development model for a technology company which was expanding its business in Asia.

It analyzes the market dynamics of an emerging market in Asia and its development potential. To capture the opportunities and create market demand, the

[read more]

53-slide PowerPoint presentation

Boards often focus their most of their time and efforts on activities related to regulatory compliance and risk oversight, which helps preserve existing shareholder value. Increasingly, however, shareholders expect CEOs and boards to spend more time on long-term value creation activities.

This

[read more]

1742-slide PowerPoint presentation

Curated by McKinsey-trained Executives

Unlock the Ultimate Shareholder Value Creation Toolkit: 1600+ PowerPoint Slides & 200 Templates to Drive Your Business Success

Are you ready to elevate your business strategy and maximize shareholder value? Look no further than our Complete Shareholder

[read more]

19-slide PowerPoint presentation

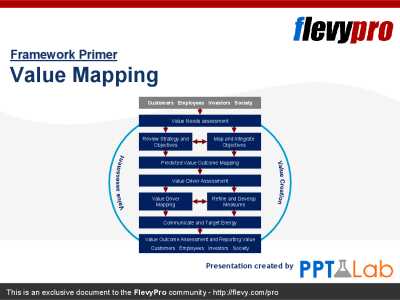

Value Mapping is a Performance Measurement and Performance Management framework developed by Andrew Jack to overcome management and employee dissatisfaction with existing Performance Measurement and Management frameworks.

Whereas traditional frameworks (e.g. Balanced Scorecard, EFQM Excellence

[read more]