Retail banking is undergoing one of the most significant transformations in its history. As customers shift toward digital banking and self-service channels, traditional banks are forced to rethink their value proposition.

Customers now expect seamless, personalized experiences, but they also demand robust security and trustworthiness. In a highly competitive market, banks must balance customer expectations with regulatory requirements and risk management, all while ensuring profitability.

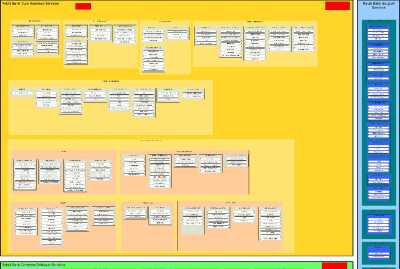

At the heart of this balancing act is the retail banking value chain. This value chain is the framework that banks rely on to deliver products and services efficiently while maximizing customer satisfaction and operational effectiveness.

In an era of increased customer autonomy, it’s critical for banks to ensure their value chain functions cohesively to meet market demands.

Unlocking the Retail Banking Value Chain

The retail banking value chain represents the complete set of activities that banks engage in to serve their customers. From customer acquisition to wealth management and fraud prevention, each activity plays a role in creating value and delivering financial services. A robust value chain not only ensures operational efficiency but also drives customer loyalty and enhances risk management.

The retail banking value chain includes:

Primary Activities:

- Customer Acquisition

- Account Management

- Financial Transactions Processing

- Lending and Credit Services

- Wealth Management and Investment Services

- Customer Service and Support

- Fraud and Security

- Digital Banking and Self-Service Channels

Support Activities:

- Information Technology

- Risk Management and Compliance

- Human Resource Management

- Marketing and Product Development

- Data Analytics

- Procurement and Vendor Management

- Facility Management

Each activity in the value chain is interconnected, and banks must align them to create a seamless customer experience while maintaining operational resilience. The ability to integrate these activities efficiently is crucial for banks to remain competitive in a rapidly changing financial landscape.

Download an in-depth presentation breaking down all the Retail Bank Value Chain activities here.

A Deeper Dive into Customer Acquisition and Digital Banking

Two key primary activities within the retail banking value chain are customer acquisition and digital banking. As banks compete for customer attention and loyalty, these activities play a vital role in shaping long-term success.

Customer Acquisition

In retail banking, customer acquisition is no longer about simply opening accounts. It involves building relationships with potential customers across multiple touchpoints, both online and offline.

Banks today leverage digital marketing, data analytics, and social media platforms to engage customers, personalize offers, and encourage sign-ups.

The key to success in customer acquisition is understanding the customer journey—from awareness to decision—and offering solutions that resonate with their needs at every stage. Banks that excel at customer acquisition prioritize convenience, trust, and clear value propositions, making it easy for customers to choose their services.

Digital Banking and Self-Service Channels

Digital banking is revolutionizing how customers interact with their banks. From mobile apps to online portals, customers now expect seamless digital experiences that allow them to manage their finances anytime, anywhere. Self-service channels, such as ATMs and mobile banking, empower customers to perform routine tasks without the need to visit a physical branch.

For banks, investing in digital banking capabilities is essential to staying competitive in today’s financial ecosystem. This means continuously improving the user interface, enhancing security features, and offering a full suite of services through digital channels. Digital banking also enables banks to scale their services efficiently and reduce operational costs.

The Catalyst for Growth in Retail Banking

Innovation is the engine that drives growth in retail banking, especially in a market where customer expectations are rapidly evolving. Banks that fail to innovate risk falling behind as customers flock to fintech alternatives offering greater convenience, transparency, and personalization. To stay relevant, banks must incorporate innovation into every aspect of their value chain, from product development to service delivery.

One key area of innovation is in data analytics. Banks now have access to vast amounts of customer data, allowing them to gain deeper insights into spending habits, financial behaviors, and credit risks. By using advanced data analytics tools, banks can create more personalized financial products, tailor marketing campaigns, and improve risk management. For example, banks can use predictive analytics to identify customers likely to apply for a loan or suggest investment products based on a customer’s risk tolerance and financial goals.

Another area of innovation is in customer service. AI-driven chatbots and virtual assistants are becoming more common in retail banking, offering 24/7 support to customers without the need for human intervention. These technologies can resolve simple queries, guide customers through account setups, and even process loan applications. By automating customer service, banks not only reduce operational costs but also enhance the customer experience by providing instant, accurate support.

Blockchain is also making waves in retail banking. This distributed ledger technology promises greater transparency and security in transactions. For example, blockchain can help banks streamline cross-border payments by reducing the need for intermediaries, speeding up transactions, and lowering costs. As blockchain technology evolves, it could reshape how banks handle everything from loans to fraud detection.

Lastly, the growing emphasis on environmental, social, and governance (ESG) criteria is influencing product development in retail banking. Banks are innovating by offering green finance products, such as eco-friendly mortgages or loans for sustainable business practices. By aligning their products with ESG goals, banks can attract socially conscious customers and investors, enhancing their brand and long-term sustainability.

A Non-Negotiable in Retail Banking

In the heavily regulated banking industry, compliance is not just a legal requirement but a business imperative. Banks must adhere to a range of regulations that govern everything from data protection to anti-money laundering (AML) practices. Failure to comply can result in severe financial penalties, reputational damage, and loss of customer trust.

One of the most significant regulatory challenges facing retail banks today is data protection. With regulations like GDPR in Europe and CCPA in the United States, banks must ensure that customer data is handled with the utmost care. This involves implementing strong encryption measures, ensuring secure data transfers, and obtaining customer consent for data usage. For retail banks, data protection is not just about avoiding fines. It’s about building trust in an increasingly digital world.

Another critical area of compliance is anti-money laundering and Know Your Customer (KYC) regulations. Banks must continuously monitor transactions for signs of money laundering or fraudulent activity. This requires advanced monitoring systems that can flag suspicious behavior in real-time. Compliance with AML and KYC regulations is essential for maintaining the integrity of the banking system and protecting customers from financial crimes.

The introduction of open banking regulations is also transforming the retail banking landscape. These regulations require banks to share customer data with third-party providers (with the customer’s consent), enabling the development of new financial products and services. While this presents new opportunities for banks, it also requires them to ensure robust data security and compliance with customer protection standards.

Lastly, regulatory compliance affects product development and innovation. Banks must ensure that any new products or services they introduce meet legal and regulatory standards, from lending products to investment services. This often involves working closely with legal and compliance teams to navigate complex regulatory landscapes without stifling innovation.

FAQs

How can we improve our customer acquisition strategy in an increasingly digital world?

Focus on leveraging data analytics and personalized marketing campaigns to engage potential customers and streamline the onboarding process.

What’s the best way to enhance our digital banking offerings?

Invest in user-friendly interfaces, expand self-service options, and continuously improve security features to meet customer expectations.

How should we approach innovation in our retail banking services?

Prioritize data-driven insights, enhance customer personalization, and adopt emerging technologies such as AI and blockchain to stay competitive.

How can we ensure compliance while innovating in product development?

Collaborate closely with legal and compliance teams during the development phase to ensure new products meet regulatory standards without compromising creativity.

How do we manage risk and fraud in digital banking environments?

Implement advanced fraud detection systems, use AI to monitor transactions, and continuously update security protocols to stay ahead of evolving threats.

What role does data analytics play in customer retention and growth?

Use data analytics to predict customer needs, personalize services, and identify cross-selling opportunities, ensuring long-term customer relationships.

How can we better integrate ESG into our retail banking products?

Develop sustainable finance products, promote green investments, and align your offerings with the values of socially conscious consumers.

How do we keep up with evolving regulations in the banking industry?

Automate compliance monitoring, invest in regulatory technology, and maintain a close relationship with regulatory bodies to stay ahead of changes.

Building the Future of Retail Banking

The retail banking value chain is at the center of delivering exceptional customer experiences and driving operational efficiency. To succeed in today’s fast-changing environment, banks must not only optimize their value chain but also continuously innovate. Whether it’s enhancing digital banking capabilities, refining fraud detection, or navigating complex regulations, every link in the value chain matters.

For retail banks, the future is one of constant evolution. The banks that will thrive are those that integrate cutting-edge technologies with customer-centric strategies while maintaining a strong commitment to compliance. In a world where customer expectations are higher than ever, retail banks must leverage every part of their value chain to deliver secure, personalized, and convenient banking experiences that meet the needs of today’s digital-savvy consumers.