Joint Venture Cash Flow Waterfall: Cumulative Distribution Hurdles (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

JOINT VENTURE EXCEL DESCRIPTION

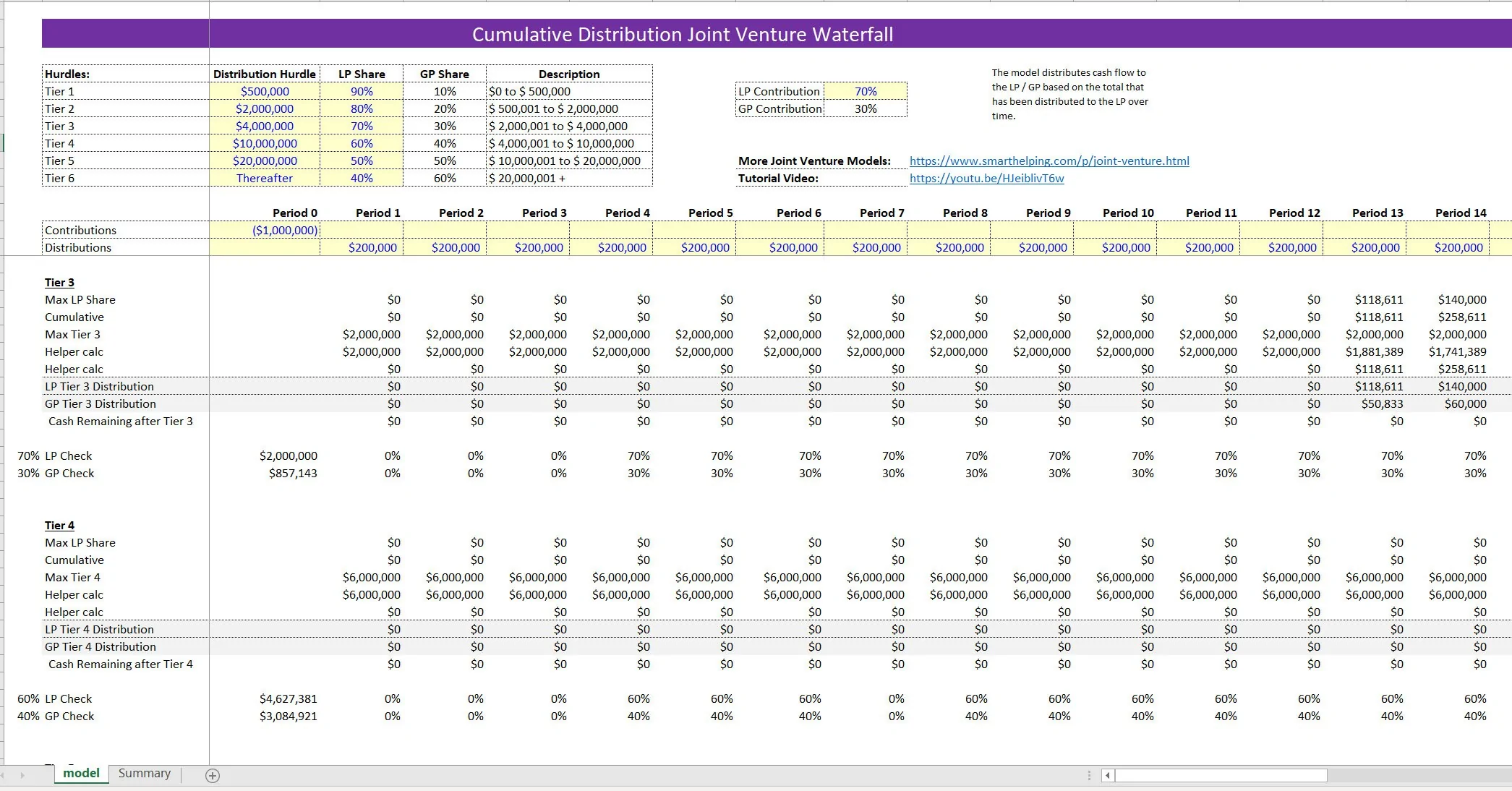

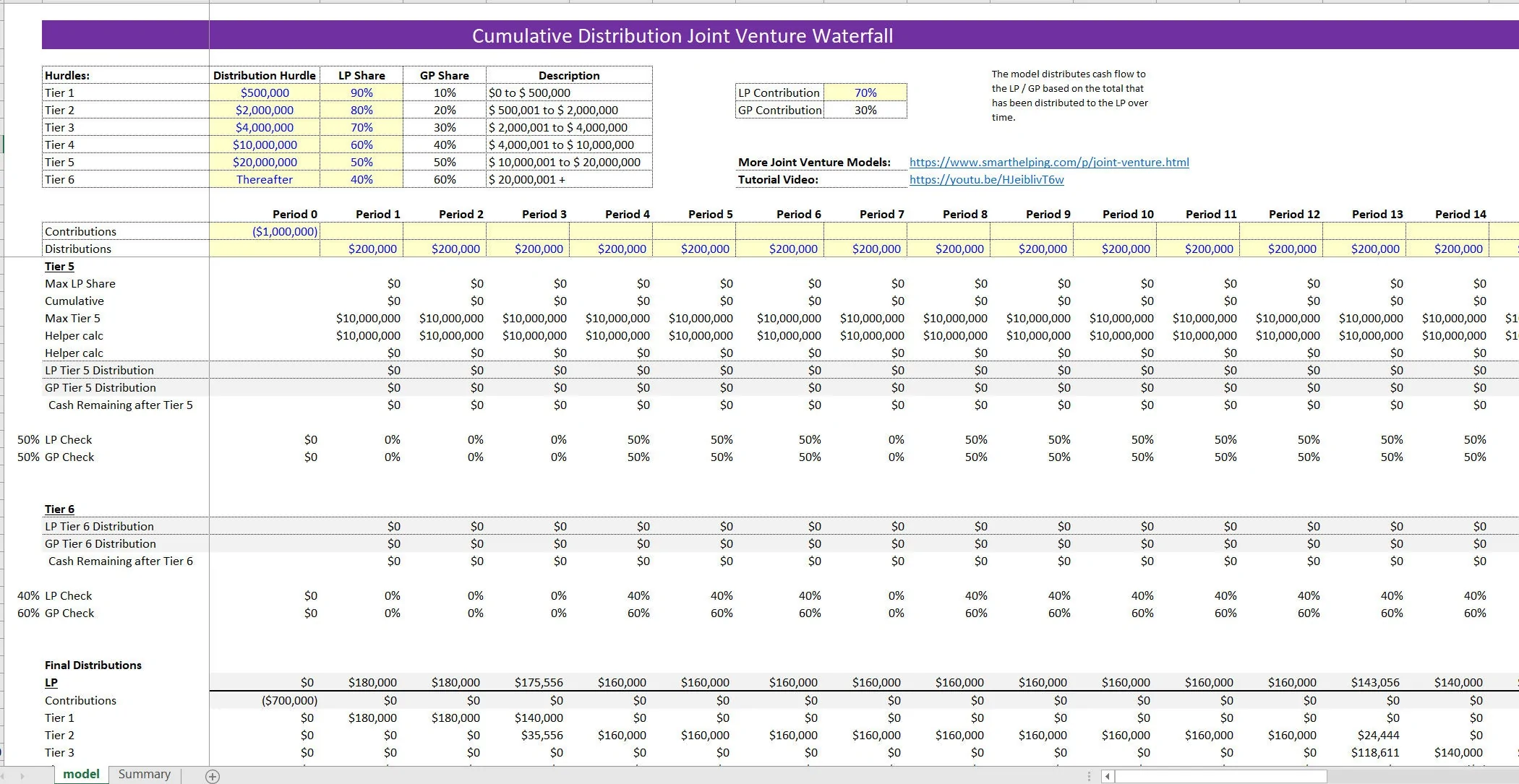

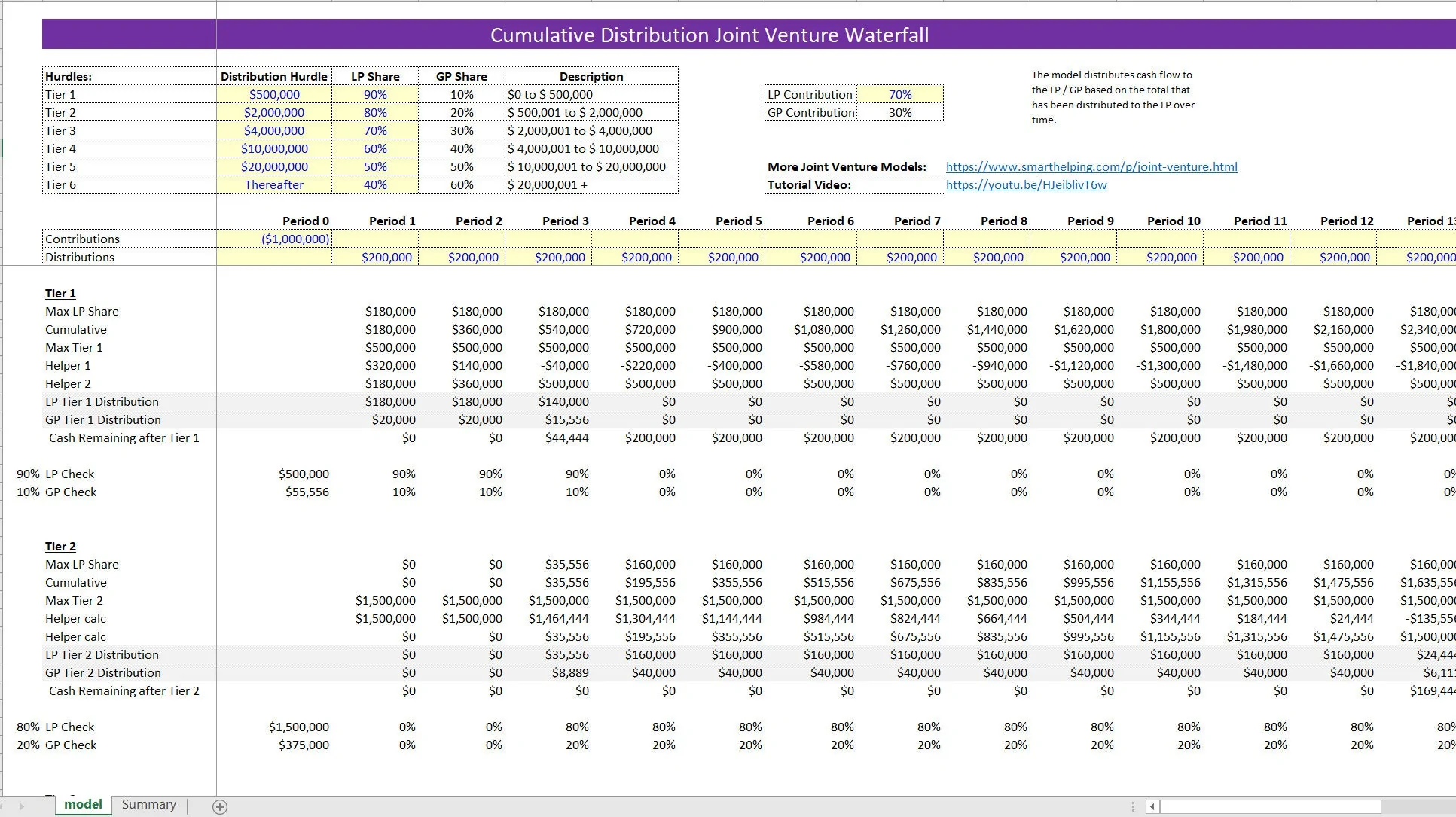

This is a joint venture cash flow waterfall. The template is designed for the user to enter in distributable cash flow (contributions and distributions) per period and the math takes over from there based on defined hurdle rates and cash flow splits per hurdle.

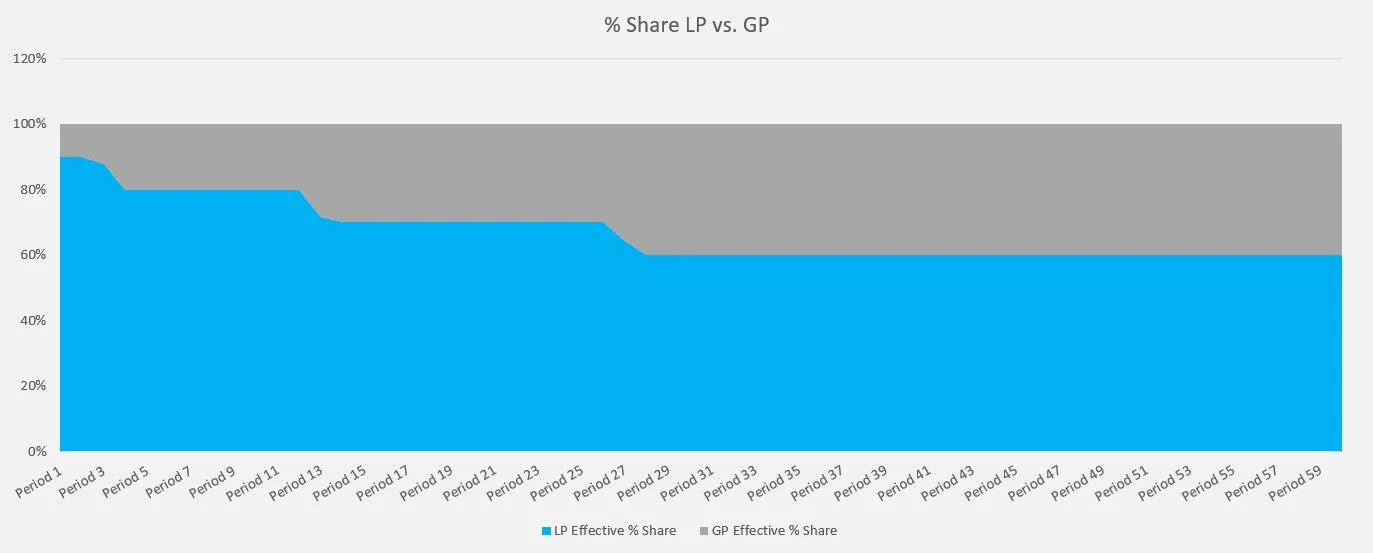

These are often designed based on IRR hurdles, but for this, there is no IRR consideration. Rather, the cash flow distributions and promotional split rate to the GP is based on the cumulative cash flow that has been distributed to the LP. That defines when a hurdle has been met.

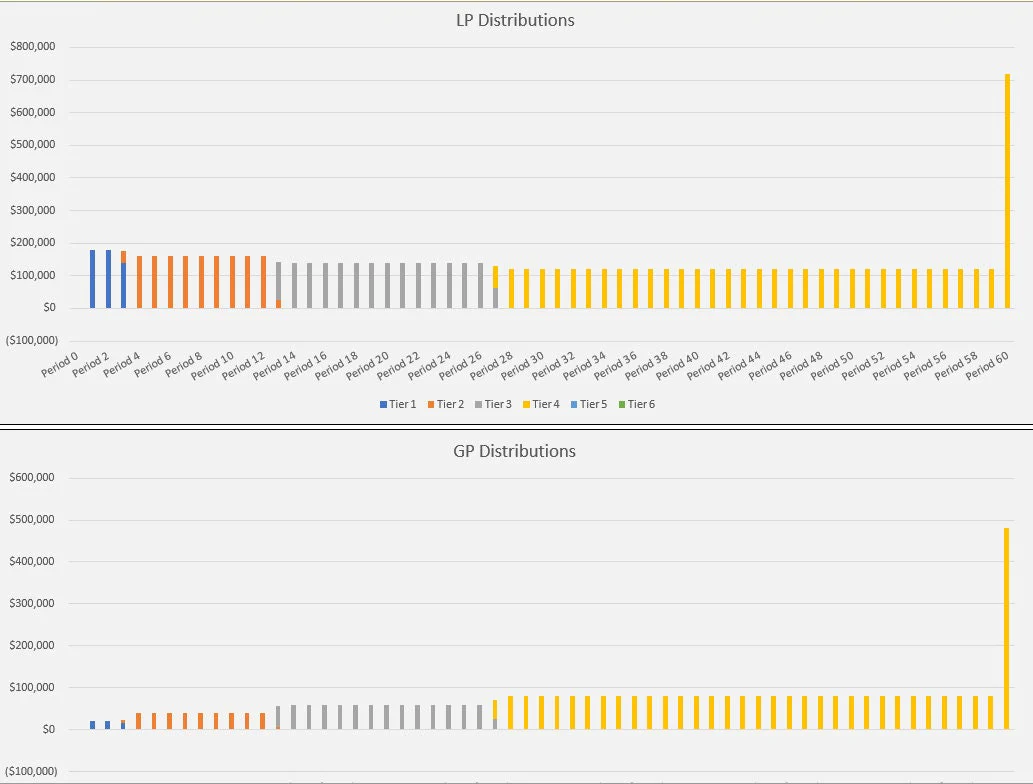

There are up to 6 hurdles that can be configured for up to 60 periods. The hurdles are based on the cumulative cash flow that has been distributed to the LP (limited partner/investor). If you are using this for an annual basis, simply delete any unused columns and the model will continue to work without issue.

A percentage for contributions is defined between the GP and LP for any cash outflows that happen across the periods. This logic is not easy to build, especially when automatically figuring out the right cash split when multiple hurdles are reached within the same period, meaning in period ‘x' you may split some of the cash 90/10 and then if the next hurdle is 80/20 and the 80/20 hurdle was beaten in that same period ‘x', then some cash is split at the next hurdle rate and so on.

There are many ways to utilize this logic. If you want to make it a hard preferred equity up until the first hurdle, simply enter 100%/0% until the initial investment is fully repaid, or you can structure the hurdle amounts however you want.

There are final exit IRR rates that will display for the LP and GP as well as some visualizations to make it more clear for how cash is split over time and when various hurdles are met.

The most common uses for such models are in real estate deals, oil and gas, as well as general business startups where the investor simply wants to base the amount of available cash flow they are owed to be based on meeting total cash returned requirements. This joint venture financial model is often easier to explain than IRR hurdle-based templates as well.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Joint Venture Excel: Joint Venture Cash Flow Waterfall: Cumulative Distribution Hurdles Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping