Hedge Fund Model: Soft Hurdle Option (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- A model that demonstrates how fees are earned in a hedge fund joint venture agreement.

HEDGE FUND EXCEL DESCRIPTION

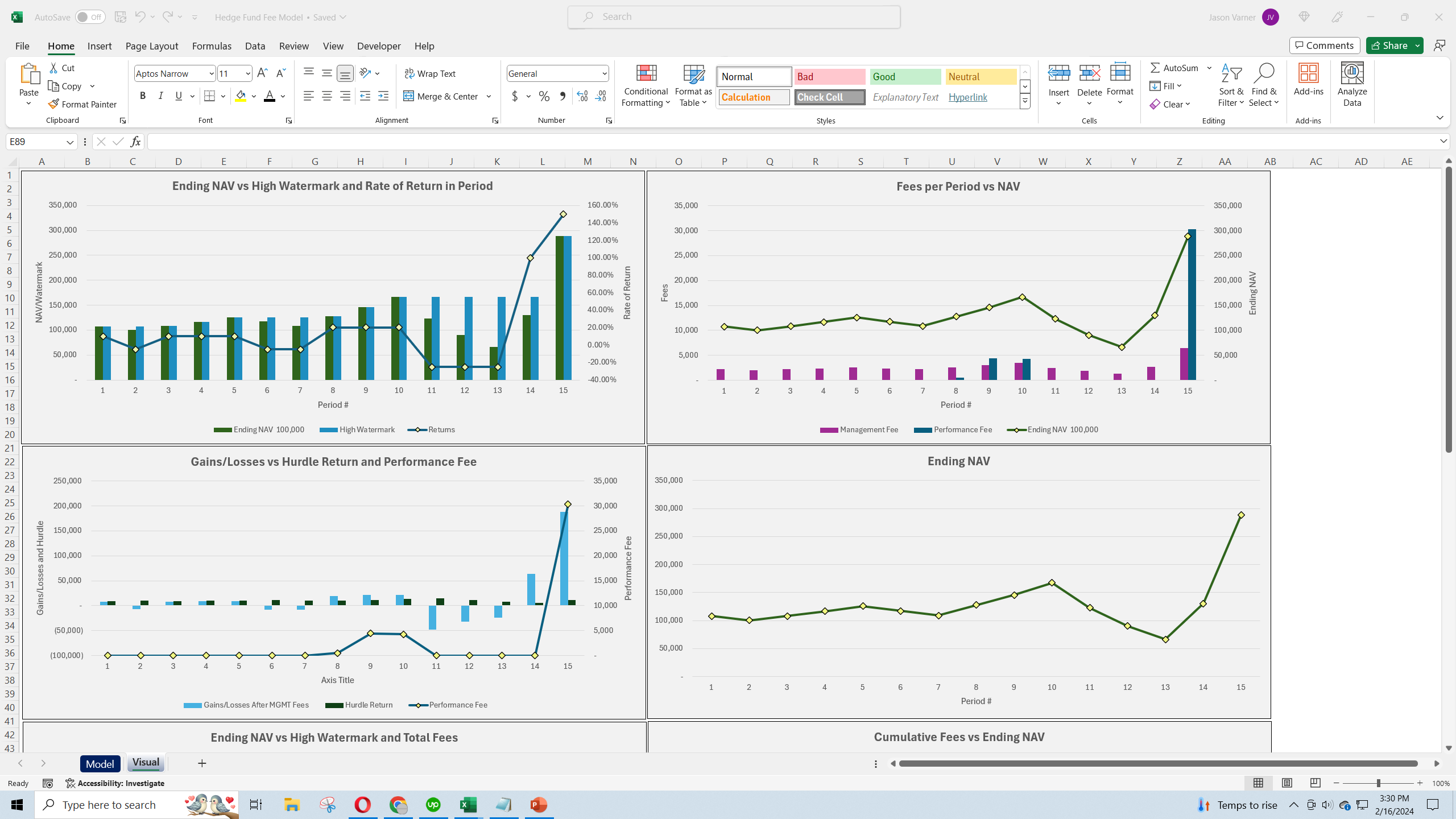

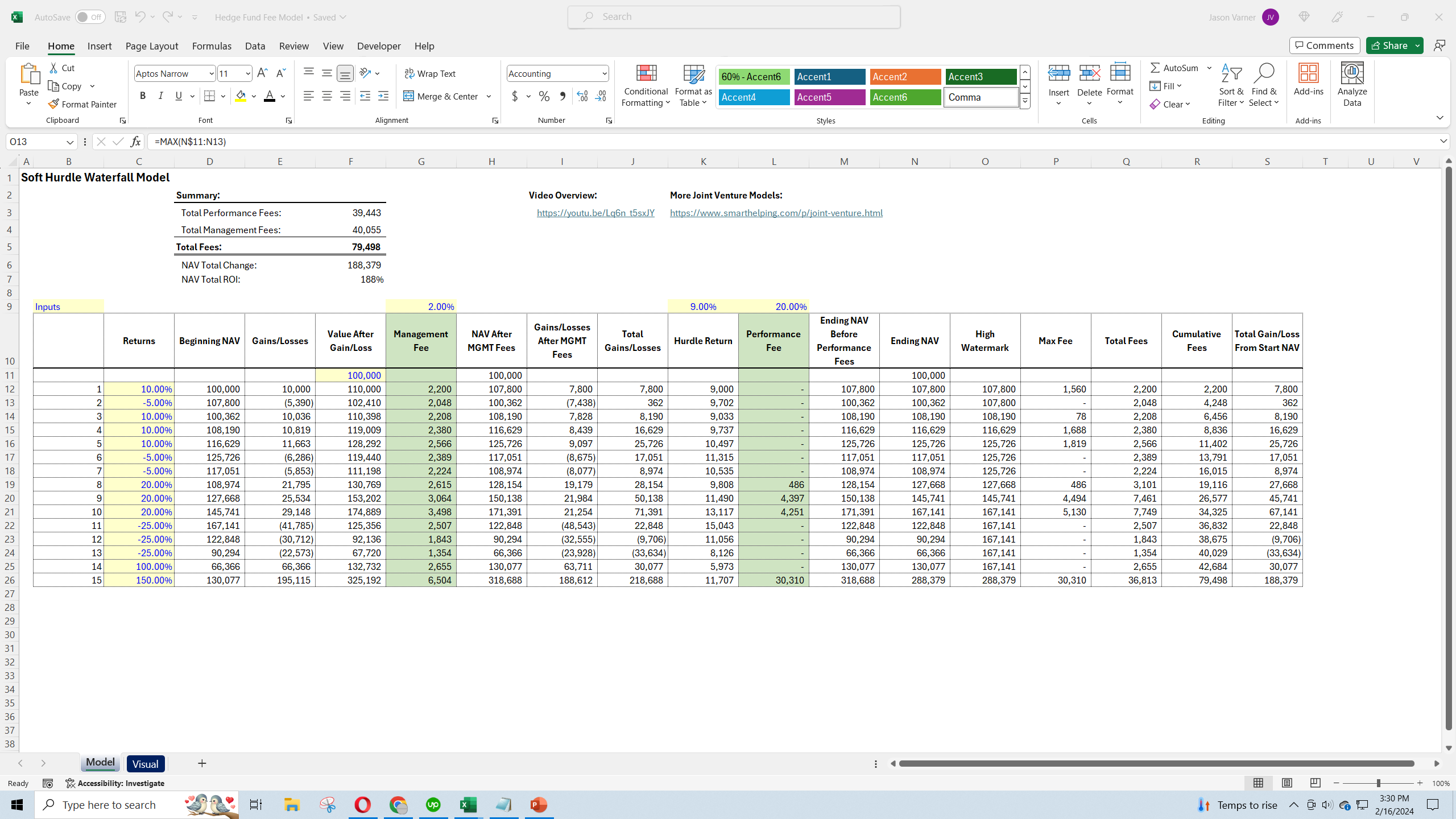

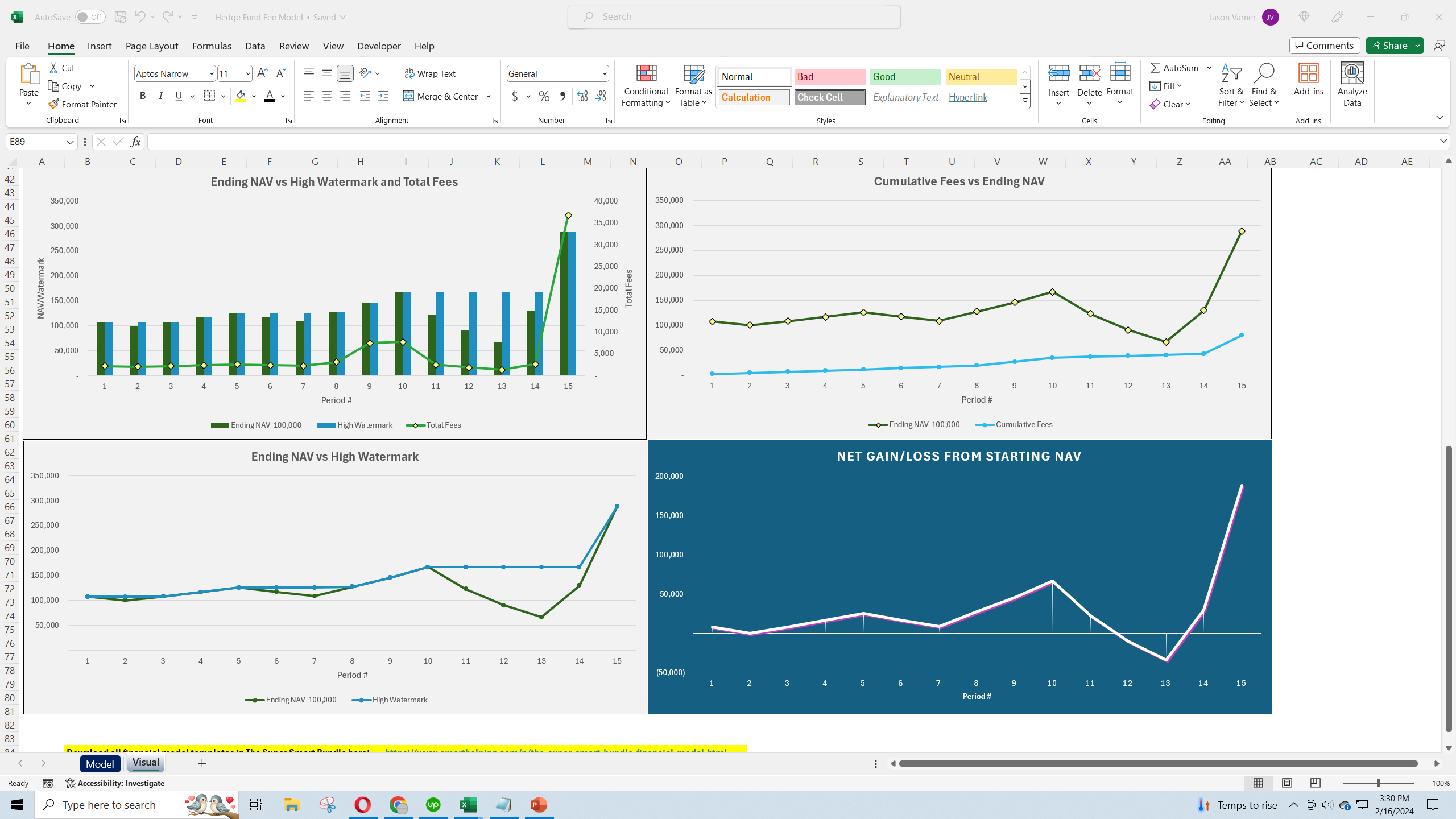

This model was designed to help articulate an agreement between a hedge fund operator and an investor. This would be considered a joint venture in general. The purpose is that the invested amount will be tracked over time in terms of a net asset value (NAV). The basis for asset management fees and performance fees will be based on the NAV over time.

The user can define the asset management fee and performance fee as inputs. These will be applied to each period dynamically. A high watermark feature is included and results in the basis for the performance fee calculation. Only profits above the high watermark for each period will be subject to the fee if the hurdle rate for the period has been met. The hurdle rate is based on a defined percentage applied to the beginning period NAV. Both conditions must be met for the performance fee to take effect. If these conditions are met, the fee is applied to the total profits, not just the profits above the hurdle. This is where the term 'soft hurdle' comes in.

I built this template while working with a hedge fund that has 100s of millions in AUM. An attorney has reviewed the logic for accuracy as well.

The main return summary will show the total lifetime increase in NAV from original deposit and the total return on investment (ROI). Additionally, the total asset management fees and performance fees are totaled up and displayed. By using this tool, a hedge fund can better explain how fees and profits are calculated. A general joint venture agreement can sometimes be difficult to grasp on its own, so with this model one can apply various changes in NAV over time and see how that affects all parties involved.

An instructional video is included in the download.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Hedge Fund Excel: Hedge Fund Model: Soft Hurdle Option Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping