Preferred Return Template: Non-Compounding with Three Hurdle Rates (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INVESTMENT VEHICLES EXCEL DESCRIPTION

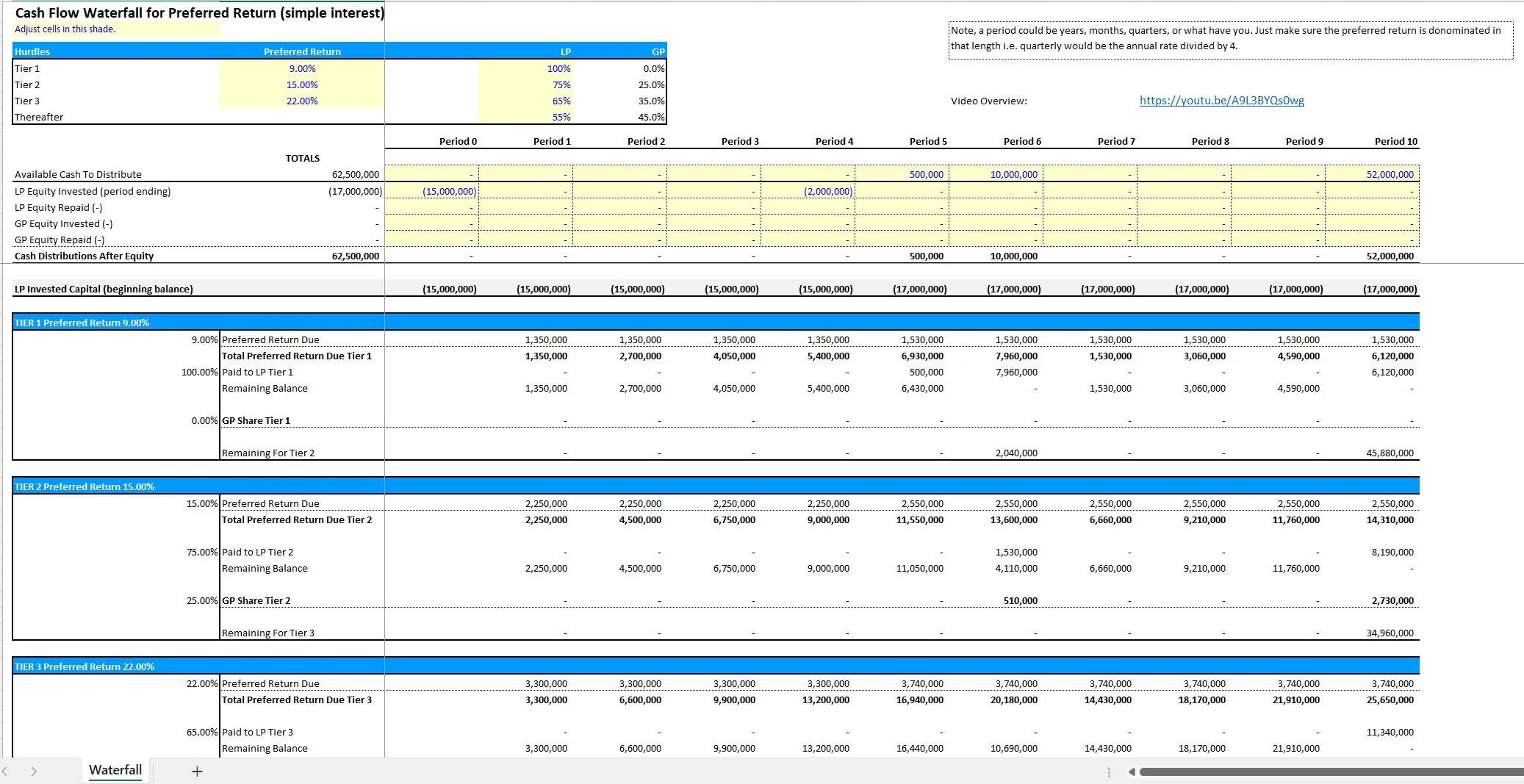

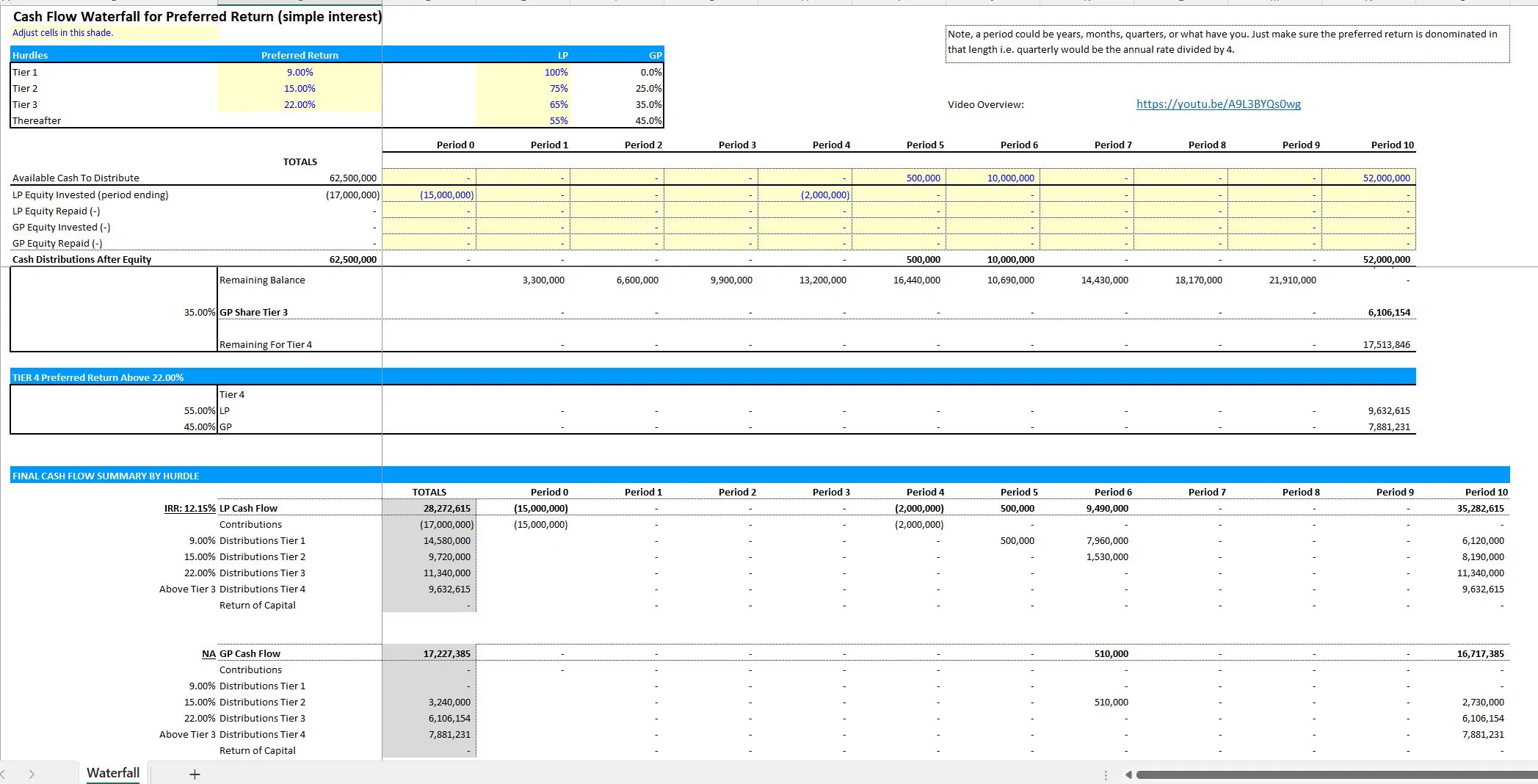

If you are looking into a joint venture as an LP (investor) or GP (sponsor/operator) then some thing to plan out are how much does each party contribute of the required cash flow and how does the available cash available to distribute flow back to each party.

In general, the LP is going to provide most of the money and the GP is going to do most of the work (as an operator). The GP may or may not be contributing capital. It depends on the operating agreement and there is no single right way to do these.

The goal of a joint venture template like the one you see here is to make it clear what the financial impact will be for each party based on assumptions about future cash flows and equity contributions / repayments.

The general idea of using hurdle rates is that the LP wants to give the GP an incentive to provide the best returns possible to the LP. The 'incentive' in this case is to offer the GP a higher share of the cash flows available as the total return to the LP increases.

Template Features:

• Non-compounding, simple interest return calculations

• Up to 10 periods (easily expandable by dragging last column over for as many periods as necessary)

• Define the preferred return due to the LP and up to two additional hurdle rates

• Define how cash is split up until the next hurdle rate is achieved (4 total tiers)

• Define equity contributions by the LP/GP

• Define equity repayments/buyouts if applicable

• Define available cash flow to distribute in each period

• The model will calculate the cash flow going to each party based on the simple interest-non-compounded hurdle rates for the LP

Note, these hurdles are not IRR Hurdles. They are simple interest hurdle rates and there may or may not be language about how equity is repaid and when. The Excel template separates out the preferred return accruals and the equity contribution / repayment.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Investment Vehicles, Return on Investment Excel: Preferred Return Template: Non-Compounding with Three Hurdle Rates Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping