Disruption is creating opportunities for some businesses and threats for the others. As a matter of fact, it was considered one the most significant concerns by the CEOs in a PwC 2016 global survey. A significant percentage (70%) of the leaders in the survey were planning to implement a cost reduction initiative, owing to low yields and strict regulations.

Disruption is creating opportunities for some businesses and threats for the others. As a matter of fact, it was considered one the most significant concerns by the CEOs in a PwC 2016 global survey. A significant percentage (70%) of the leaders in the survey were planning to implement a cost reduction initiative, owing to low yields and strict regulations.

But implementing a cost transformation initiative often fails owing to focusing merely on cost cutting. In the wake of massively disruptive marketplace, marginal efficiency savings aren’t sufficient to survive let alone thrive.

Organizations need to plan to come up with ways to get even closer to the customers, become more agile, and innovative in responding to their needs. They should focus their resources towards Strategic Cost Reduction by stimulating growth and creating differential advantage. Success during disruption requires revisiting the strategy, costs, and the way both align together. Strategic cost reduction helps organizations plan to deliver ways to get closer to the customers, become more lean and agile, and spur innovative in responding to their customers’ needs.

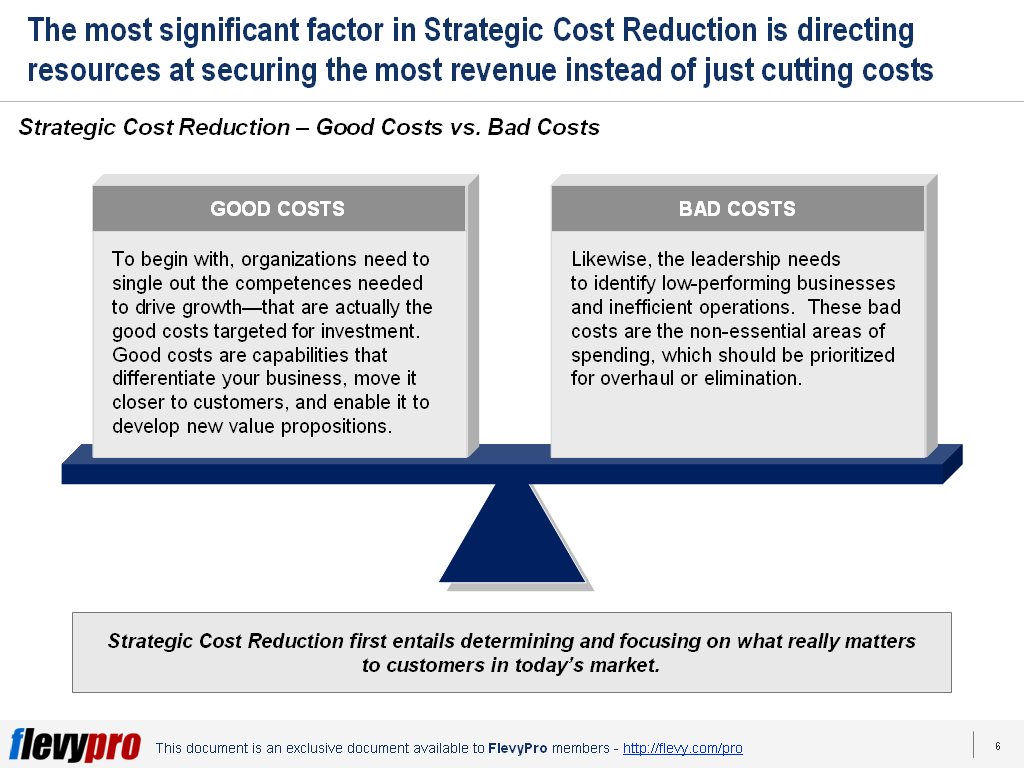

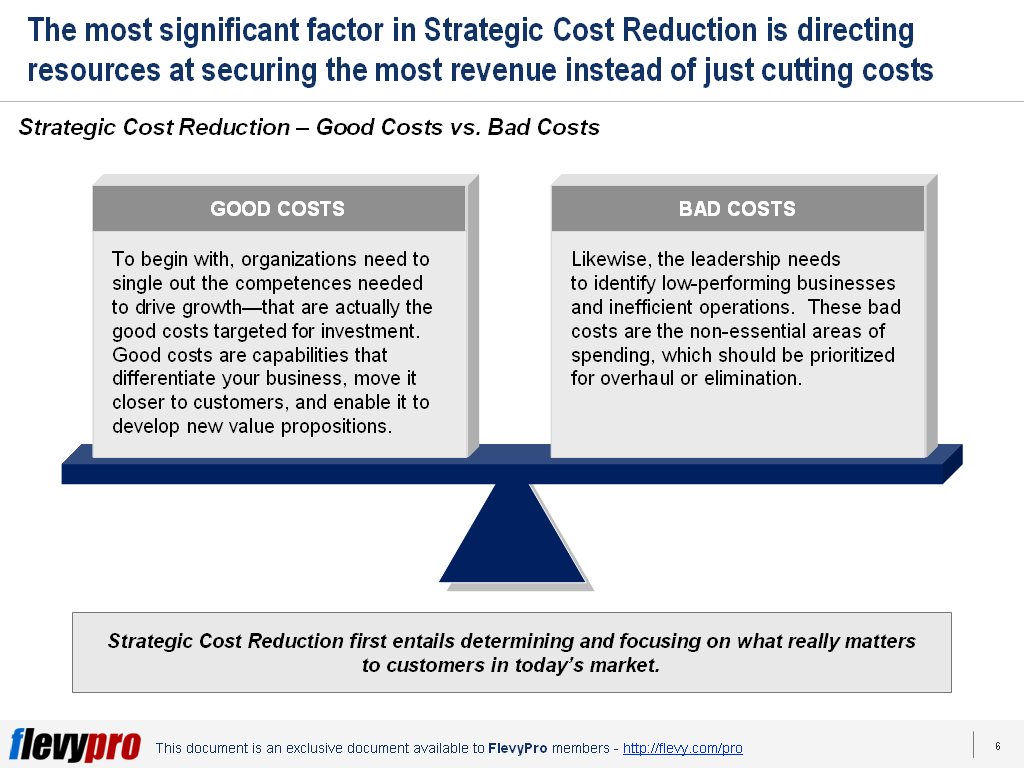

Strategic cost reduction is about directing resources and perfecting the operational capabilities in a way that enables you to set the pace in a fast-evolving marketplace. To begin with, senior leaders need to segregate the following two types of costs and shift resources from low-return segments to higher-value opportunities:

- Good Costs

- Bad Costs

Now, let’s talk about the two cost categories in detail.

Good Costs

Organizations need to ascertain the competences needed to drive growth. Good costs are cash outlays spent on developing capabilities that differentiate your business, move it closer to customers, and enable it to develop new value propositions.

Bad Costs

Likewise, leadership needs to identify low-performing businesses and inefficient operations. These bad costs are the non-essential areas of spending, which should be prioritized for overhaul or elimination.

For a business to flourish, it is essential for the leadership to think strategically and radically, transforming the organization’s critical competences and core costs, and lining up all costs with the organizational strategy. It involves ascertaining the activities crucial to add value, isolating investments being made in redundant endeavors, and financing differentiated value-generating ventures.

Businesses need to address 2 questions critical in transforming costs from a challenge to a source of differential edge:

- How to target investments more accurately to maximize strategic advantage (good costs)?

- How to forgo inefficient operations—bad costs—that waste resources and hold back returns?

Strategic Cost Reduction in Insurance Industry

Insurance industry is under threat by low rates, tight investment yields, and changing regulations. So, naturally, cost reduction is the focus of the industry leadership. The scenario warrants radical transformation in strategy and operational abilities utilizing technology.

A large insurance group analyzed that many of their high cost initiatives were not adding competitive advantage. The group elected to outsource these projects to an external entity—a partner that could deliver significant cost savings as well as support their mobile distribution.

The group executed a strategic outsourcing program, by selecting a partner to facilitate improvement in operational abilities, data analytics, and robotics capabilities. They achieved cost savings amounting to millions of dollars, which enabled the group to plan and finance innovative offerings in the digital space and develop healthier customer relationships.

Cost Analysis

Conducting thorough Cost Analysis is critical. Realization of significant cost savings and development of stronger customer relationships necessitates analyzing and minimizing bad costs and targeting maximum resources at profitable growth avenues—good costs. Particularly, enterprises need to analyze 4 key areas with respect to good versus bad costs:

- Distribution

- Transactional Processes

- Property

- Service Providers

Let’s look at the first 2 key areas.

Distribution

Distribution is the first area to analyze in order to achieve strategic cost efficiency. Bad costs (for example, in the insurance sector) include Distribution and Policy Development. Due to inadequately targeted marketing and low conversion rates in most insurance companies, distribution and policy development are unnecessarily costly. The distribution expense can get as high as 30% of the cost of product in insurance, which isn’t viable and should be minimized.

Good Costs include “Sharpening Customization” and “Conversion.” Leading businesses are using machine learning, advanced analytics, and sensors to pursue customers, analyze their requirements, create custom-built solutions, and ascertain price risk immediately. A careful risk selection and customer customization aids in keener pricing and reduced claims costs.

Transactional Processes

Technology helps the organizations to streamline archaic processes, prevent wastes, and achieve Operational Excellence.

Bad Costs under this head (e.g., from the insurance sector) include “Underwriting,” “Claims,” and “Finance.” These areas are cluttered with low-value operational processes and wasted costs. In underwriting, administrative tasks can consume around 80% of the sales time—doing heavy manual workarounds or incorporating information onto multiple systems.

Good Costs include investments in technology implementations to reduce processing times, prompt decision making, and improved customer experience. In the insurance sector these investments could be in the form of robotic process automation, straight-through-processing (STP), claims digitization, behavioral and predictive analytics, and sharpening underwriting.

Interested in learning more about the Strategic Cost Reduction? You can download an editable PowerPoint on Strategic Cost Reduction: Good vs. Bad Costs here on the Flevy documents marketplace.

Are you a Management Consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

33-slide PowerPoint presentation

This document discusses various cost reduction methodologies and concepts, including the following: Process Optimization, Strategic Sourcing, Shared Services, Business Process Outsourcing.

This comprehensive guide delves into the intricacies of cost reduction, providing a robust framework for

[read more]