Editor's Note: Take a look at our featured best practice, Complete Guide to Post-merger Integration (PMI) (106-slide PowerPoint presentation). Post-merger Integration (PMI), also known as M&A Integration, is a highly complex process. The bringing together of 2 distinct organizations experiencing change, while ensuring operations continues as usual is a challenge that can never be underestimated.

The PMI transition process often [read more]

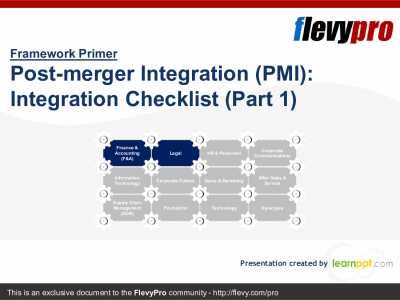

Also, if you are interested in becoming an expert on Post-merger Integration (PMI), take a look at Flevy's Post-merger Integration (PMI) Frameworks offering here. This is a curated collection of best practice frameworks based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. By learning and applying these concepts, you can you stay ahead of the curve. Full details here.

* * * *

When organizations go through a Post-merger Integration, often management realizes that it is never a simple undertaking. It is a  highly complex process. Swift action is required as well as being able to run the core business activities simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, to maximize deal value, there is a need for careful planning focused on the strategic objectives of the deal and the identification and capturing of synergies.

highly complex process. Swift action is required as well as being able to run the core business activities simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, to maximize deal value, there is a need for careful planning focused on the strategic objectives of the deal and the identification and capturing of synergies.

The PMI Process requires a Strategy Development approach geared towards unifying 2 organizations into one new organization with a common culture, equipped with the right people and good leadership in place. It is a challenging journey where organizations, both the Buyer and the Target, must take on the appropriate approach to be able to start off the process and close the deal with the expected results in place.

New organizations often benchmark Post-merger Integration Process leaders to guide them through the process. By following best practices, new organizations will have a better understanding of how to approach the PMI process in a more strategic manner.

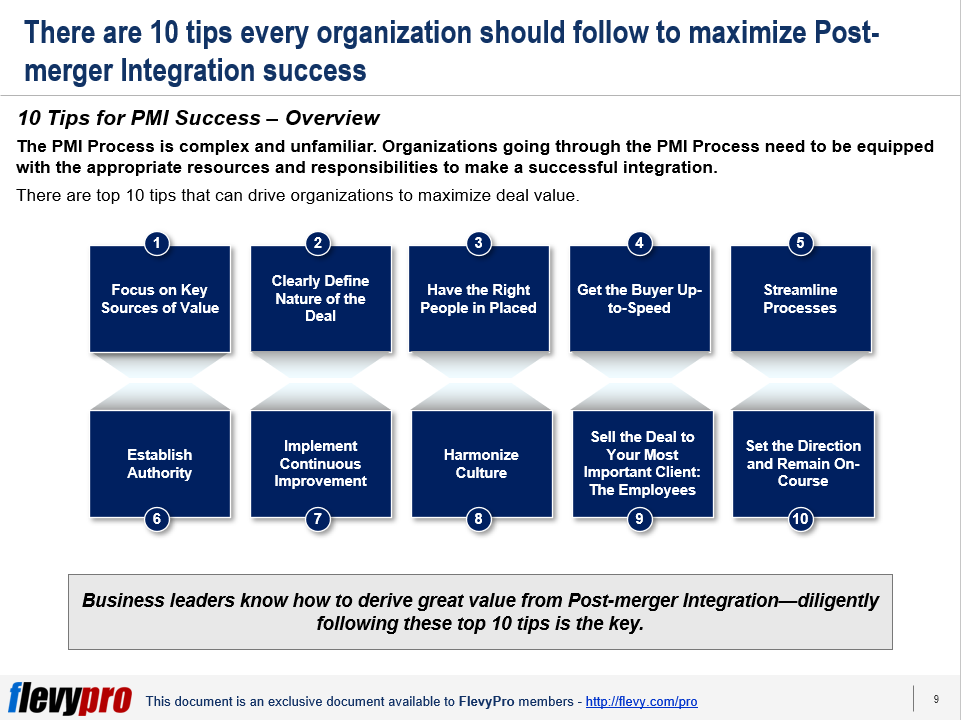

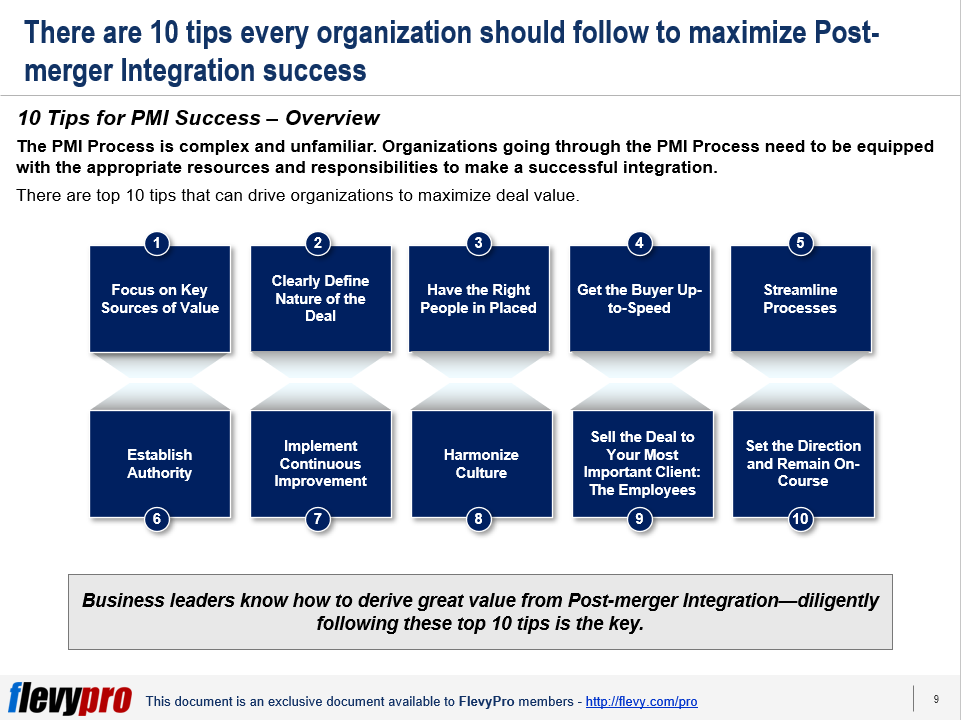

Achieving PMI Success: The Top 10 Tips

There are top 10 tips that can help organizations conquer what could be a complex integration process. Following the top 10 tips will enable organizations to successfully traverse through the process.

Let us discuss here 4 of the top 10 tips to achieve PMI success.

- Focus on Key Sources of Value. In focusing on key sources of value, we need to be able to communicate how the value of the deal will be captured. Success organizations often structure integration teams based on key sources of value. They make teams understand the value for which they are accountable and how this will be unlocked via the PMI process.

- Clearly Define Nature of the Deal. Often successful integrations are achieved when the nature of the deal is clear. Organizations need to be able to determine what is to be integrated and what is to remain as stand-alone. They need to have a good idea of what the adopted culture will be and which people are to be retained. This way, organizations can easily jumpstart the PMI process in the right direction.

- Have the Right People in Placed. Needless delays in the implementation of the PMI process can exacerbate anxieties amongst staff. This can cause speculative conversations or result in staff insecurities. To address, organizations focus on the immediate mobilization of the integration process. One way of doing this is having the right people in placed. Selecting people who are enthusiastic about the new vision and are happy to contribute it will facilitate a good start for the integration process. However, there is a need to maintain balance. People from both the Buyer and Target must be selected and appointed.

- Get the Buyer up-to-speed. This is one important tip that will jumpstart the process. Get the Buyer up-to-speed. This can be done by encouraging the Buyer to begin planning the integration process even before the deal is announced. It is of great advantage if the Buyer will identify everything that must be done prior to closing. Active participation of the buyer is essential to keep the PMI process on high gear.

Aside from the 4 top tips, the other 6 top tips are equally effective in guiding organizations to achieve deal maximization. These top 10 tips can be of great help to organizations when faced with challenging obstacles as they go through the process of integration. The PMI Process is a very complex undertaking but it can be achieved and be conquered with just the right approach and guide.

Interested in gaining more understanding of Post-merger Integration (PMI): Tips for Success? You can learn more and download an editable PowerPoint about Post-merger Integration (PMI): Tips for Success here on the Flevy documents marketplace.

Are you a management consultant?

You can download this and hundreds of other consulting frameworks and consulting training guides from the FlevyPro library.

28-slide PowerPoint presentation

The Post-merger Integration (PMI) is a highly complex process. It requires swift action as well as running the core business activities simultaneously. There is no one-size fits all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and

[read more]

Want to Achieve Excellence in Post-merger Integration (PMI)?

Gain the knowledge and develop the expertise to become an expert in Post-merger Integration (PMI). Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

M&A is an extremely common strategy for growth. M&A transactions always look great on paper. This is why the buyer typically pays a 10-35% premium over the of the target company's market value.

However, when it comes time for the Post-merger Integration (PMI), are we really able to capture the expected value? Studies show only 20% of organizations capture projected revenue synergies and only 40% capture cost synergies. Not to mention, the PMI process is typically very painful, drawn out, and politically charged, often resulting in the loss of key personnel.

Learn about our Post-merger Integration (PMI) Best Practice Frameworks here.

Readers of This Article Are Interested in These Resources

131-slide PowerPoint presentation

This is a post- merger integration training material.

The contents include:

- Day One capabilities

- Synergy Capture

- Functional Integration:

- IT

- Finance

- Supply Chain

- HR

- Communications and Change

This comprehensive Post-Merger Integration Training material dives deep into the

[read more]

28-slide PowerPoint presentation

This document provides a guide and framework for best practice in post merger integration.

Post merger integration is the process of combining two separate companies in a way that quickly creates the most value and fulfils the expectations outlined in the acquisition vision.

The framework

[read more]

79-page PDF document

XYZ is pleased to have assisted Client X's leadership in developing the following Company A Integration Strategy. The strategy represents an intense, four-week collaboration between Client X and XYZ to define the integrated end state, integration approach, synergy opportunities and Day One

[read more]

27-slide PowerPoint presentation

Post-merger Integration (PMI) is a highly complex process. It requires swift action as well as running the core business activities simultaneously. There is no one-size fits all approach to a successful PMI Process. However, careful planning focusing on the strategic objectives of the deal and the

[read more]

highly complex process. Swift action is required as well as being able to run the core business activities simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, to maximize deal value, there is a need for careful planning focused on the strategic objectives of the deal and the identification and capturing of synergies.

highly complex process. Swift action is required as well as being able to run the core business activities simultaneously. There is no one-size-fits-all approach to a successful PMI Process. However, to maximize deal value, there is a need for careful planning focused on the strategic objectives of the deal and the identification and capturing of synergies.