Editor's Note: Take a look at our featured best practice, Startup Company Financial Model - 5 Year Financial Forecast (Excel workbook). New Version - Massive Update !! This updated version of the previous template is almost a completely new model including new assumptions, new Setup Reports and new and updated Output Reports. Creating a financial plan is the roadmap that lays out the path for your company's future financial [read more]

Do’s & Don’ts for Entrepreneurs in 2023

* * * *

What should founders and entrepreneurs do to navigate a volatile economic situation?

Active measures they can take include being aware of the inflation rate, learning how cosigning on a loan can affect their credit, keeping advertising spending under control, establishing a commercial credit rating, outsourcing whenever possible, and working from home for the first year of operations.

Here are details about each tactic in terms of do’s and don’ts.

Do: Keep an Eye on Inflation

In an inflationary economic environment, owners need to know how fast prices are rising and whether the retail or wholesale inflation rate is more pronounced. Consider operating on a tighter budget when the rate is above an amount that you consider significantly dangerous, which is somewhere between 6% or so for most entrepreneurs. In addition to diligent budgeting, think about acquiring more inventory when prices appear to be headed northward. Never rely on random websites and editorial blogs for information about inflation. Instead, use verified government websites and reliable financial news organizations to monitor wholesale and retail rates daily.

Do: Be Careful About Cosigning on Student Loans

Entrepreneurial professionals need to strive for good credit ratings. If you cosign on someone’s college loan, there’s a chance the favor could come back to bite you in the form of a potential default, late payments, or other negative activity. Remember that all loan-related events, positive or negative, end up in your credit file as well as on the primary borrower’s bureau reports. A bad outcome could significantly impact your ability to get a business loan.

That’s why it’s essential to ask hard questions before agreeing to cosign for anyone, even a close relative or family friend. Find out how cosigning on a student loan will affect your personal and commercial credit ratings before putting your signature on someone else’s loan application. While it’s usually tempting to agree to help someone who can’t otherwise pay for an education, gather all the facts about cosigning and make an informed decision.

Don’t: Spend Blindly on Advertising

Those who own startups, small businesses, and other types of companies can get carried away with advertising expenses. It’s true that there is no better way for most owners to jumpstart an entity and build a brand image. However, it’s essential to work from a written plan, which is basically a specific advertising budget. Know how much you can spend each month and stick to the goal.

Do in-depth research on previous marketing and promotional campaigns to discover which tactics work and which don’t. Then monitor each new effort and constantly adjust spending as needed. If one strategy, like online banner ads, comes up short, consider experimenting with alternate techniques to find tactics that suit your budget and deliver solid results.

Do: Work Hard to Establish a Commercial Credit Rating

Building a commercial credit rating, as opposed to a personal one, takes a bit of work. But most anyone can get their company on the radar of the major reporting bureaus in a year or less. Step one is to open savings and checking accounts in the company name and use them regularly. Add a small amount to the savings account each month. Write at least checks for incidental purchases or to pay vendors.

Next, ask one of your regular vendors to grant you a small line of credit and report the activity to all three bureaus. Finally, automate all bill payments so that your monthly obligations are covered at least three business days in advance or sooner. Check your commercial rating every six months. Most owners see improvement sooner than they expect.

Don’t: Rent Office Space Unless It’s an Absolute Necessity

If you can swing it, work at home for the first year after launching your business. Only spend money on an office lease if you must. Even then, shop around and work with an experienced commercial real estate agent who knows the area well. Many modern organizations can operate without renting physical space. Consider using remotely located employees and outsourcing as many tasks as possible. Focus on your core talents and experience and leave everything else to third-party providers.

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Entrepreneurship and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

- Top 100 in Strategy & Transformation

- Top 100 in Digital Transformation

- Top 100 in Operational Excellence

- Top 100 in Organization & Change

- Top 100 Management Consulting Frameworks

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

|

|

28-slide PowerPoint presentation

|

|

Excel workbook

| |||

About Shane Avron

Shane Avron is a freelance writer, specializing in business, general management, enterprise software, and digital technologies. In addition to Flevy, Shane's articles have appeared in Huffington Post, Forbes Magazine, among other business journals.

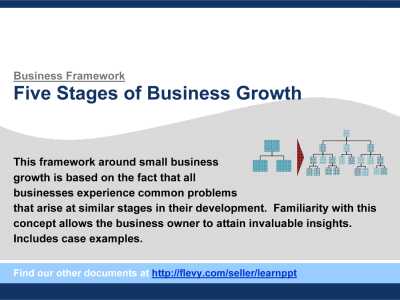

Top 10 Recommended Documents on Entrepreneurship

» View more resources Entrepreneurship here.

» View the Top 100 Best Practices on Flevy.