Editor's Note: Take a look at our featured best practice, Six Building Blocks of Digital Transformation (35-slide PowerPoint presentation). Digital Transformation touches practically every function in the entire organization. This thus requires an unprecedented amount of coordination among people, process, and technologies throughout the organization, leading to a difficult Transformation program.

The Six Building Blocks of [read more]

Also, if you are interested in becoming an expert on Digital Transformation, take a look at Flevy's Digital Transformation Frameworks offering here. This is a curated collection of best practice frameworks based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. By learning and applying these concepts, you can you stay ahead of the curve. Full details here.

* * * *

The insurance industry deals with a huge pile of papers and a lot of claims. If it wasn’t for technology, we would still have to wait a long time for the claims to be processed. Also, there are many errors during manual work with Insurance claims. Meet the claims automation in a modern way that makes the process easier. Technology can now handle manual and repetitive tasks. How and why? This article explains everything you need to know!

The insurance industry deals with a huge pile of papers and a lot of claims. If it wasn’t for technology, we would still have to wait a long time for the claims to be processed. Also, there are many errors during manual work with Insurance claims. Meet the claims automation in a modern way that makes the process easier. Technology can now handle manual and repetitive tasks. How and why? This article explains everything you need to know!

Insurance Claim Processing Steps

Insurance claim processing consists of five steps. The agencies must collect the needed documentation and evidence to approve the claim.

Step 1. Getting in Touch

Firstly, a client contacts the insurance company and shares the documentation, evidence, and details to support the claim. The broker summarizes this and works with a claims adjuster to start an investigation.

Step 2. Claims Investigation

At this point, the claims adjuster will investigate the damage, identify who is liable, and determine how much coverage the policy provides. They will also hear any witnesses available for this case.

Step 3. Policy Review

In this step, you acknowledge the customer with their policy. They will understand what is and isn’t covered and learn about the deductibles.

Step 4. Assessing the Damage

The adjuster gets help from professionals to assess the damage. They will work with appraisers, contractors, and engineers. At this point, the adjuster can recommend contractors for repairs to save you money.

Step 5. Payment Processing

When the adjuster verifies everything and is convinced, they will proceed with payment. The time needed for payment processing depends on the case. During this step, damaged items will be replaced, and any necessary repairs will also be completed.

Claim Processing Trends

As you see, claim processing is a cumbersome and time-consuming procedure. Therefore, if you would like to simplify it, automation is the best way out Below are the technological trends to consider when embracing claim processing automation.

AI

Today, artificial intelligence is entering every industry. But how can it benefit insurance agencies? AI can help deliver a customized experience for users. When applying for insurance claims, AI will get data, analyze it, and make personalized recommendations according to the user profile.

Robotic Process Automation

Claims processing is a hefty job that involves many steps, from managing claims to completing administrative work. Still, insurance companies need to provide reliable, private, and accurate processes. Submitting the information in various formats makes everything trickier.

Robotic process automation tools capture data from claim documentation. The employees now don’t need to check the policies, manually enter the information, or review applications. This is all completed with robotic automation. Despite making the job easier, this ensures compliance with the industry regulations.

Intelligent Process Automation

What should be done to classify claims, annotation, and reduce costs? Intelligent process automation is here to take care of that. Insurance agencies handle many documents. The most difficult thing is to sort and review them. The IPA is here to tackle the tedious tasks so our employees can focus on providing the best service. It analyzes the documents and algorithms read the documents the same way humans do.

And let’s not forget about data entry tasks. These are time-consuming and require attention. Your employees probably spend a lot of time on labor-intensive tasks like these. The IPA can automate them and help with underwriting, processing claims, creating reports, and new customer applications.

41-slide PowerPoint presentation

The Process Automation & Digitalization Assessment is a comprehensive framework designed to help organizations identify opportunities for streamlining operations, reducing manual efforts, and leveraging technology to drive efficiency and scalability. The assessment provides a structured approach to

[read more]

Want to Achieve Excellence in Digital Transformation?

Gain the knowledge and develop the expertise to become an expert in Digital Transformation. Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

Digital Transformation is being embraced by organizations of all sizes across most industries. In the Digital Age today, technology creates new opportunities and fundamentally transforms businesses in all aspects—operations, business models, strategies. It not only enables the business, but also drives its growth and can be a source of Competitive Advantage.

For many industries, COVID-19 has accelerated the timeline for Digital Transformation Programs by multiple years. Digital Transformation has become a necessity. Now, to survive in the Low Touch Economy—characterized by social distancing and a minimization of in-person activities—organizations must go digital. This includes offering digital solutions for both employees (e.g. Remote Work, Virtual Teams, Enterprise Cloud, etc.) and customers (e.g. E-commerce, Social Media, Mobile Apps, etc.).

Learn about our Digital Transformation Best Practice Frameworks here.

Readers of This Article Are Interested in These Resources

27-slide PowerPoint presentation

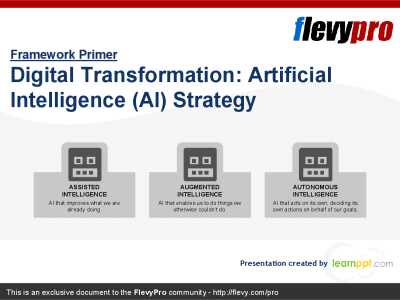

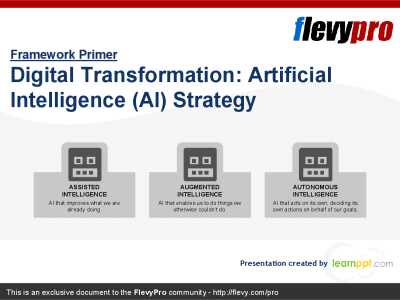

The rise of the machines is becoming an impending reality. The Artificial Intelligence (AI) revolution is here. Most businesses are aware of this and see the tremendous potential of AI.

This presentation defines AI and explains the 3 basic forms of AI:

1. Assisted Intelligence

2.

[read more]

36-slide PowerPoint presentation

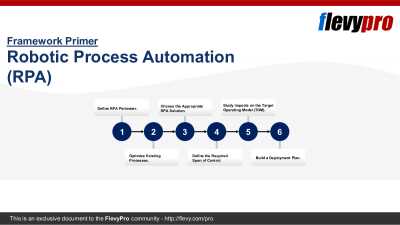

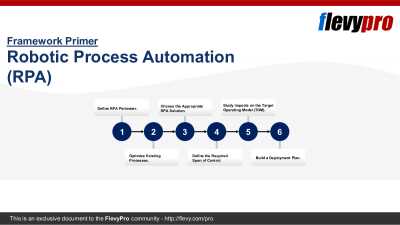

First, what is RPA?

Robotic Process Automation (RPA), also referred to as Robotic Transformation and Robotic Revolution, refers to the emerging form of process automation technology based on software robots and Artificial Intelligence (AI) workers.

In traditional automation, core activities

[read more]

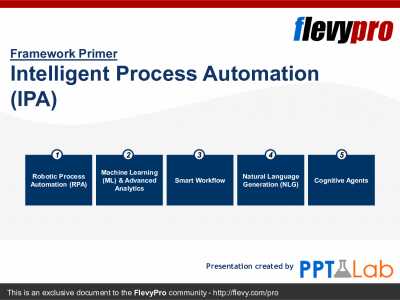

26-slide PowerPoint presentation

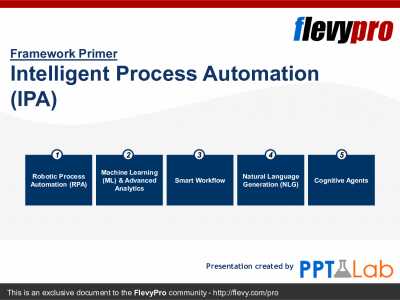

Intelligent Process Automation (IPA) is a set of emerging Digital Technologies that combine process redesign with Robotic Process Automation (RPA) and Machine Learning (ML). IPA can be viewed as a suite of Business Process Improvements and Digital Transformation tools that assists the

[read more]

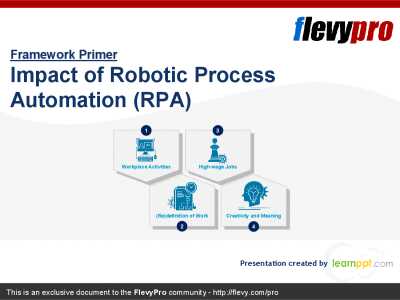

21-slide PowerPoint presentation

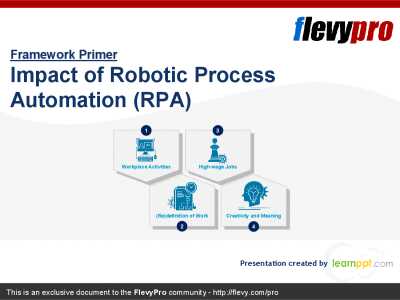

In the past several years, organizations across all industries have begun embracing emerging technologies to drive Digital Transformation programs. Of these technologies, among the most prevalent are Robotic Process Automation (RPA) and Artificial intelligence (AI).

Likewise, RPA and AI are

[read more]

The insurance industry deals with a huge pile of papers and a lot of claims. If it wasn’t for technology, we would still have to wait a long time for the claims to be processed. Also, there are many errors during manual work with

The insurance industry deals with a huge pile of papers and a lot of claims. If it wasn’t for technology, we would still have to wait a long time for the claims to be processed. Also, there are many errors during manual work with