Editor's Note: Take a look at our featured best practice, Growth Strategy (41-slide PowerPoint presentation). The reality is: all businesses face the challenge of achieving sustainable Growth. They need viable Growth Strategies.

So, what is Growth Strategy?

It is the organization's high-level Corporate Strategy Plan that outlines everything the organization needs to do to achieve its goals for [read more]

Also, if you are interested in becoming an expert on Strategy Development, take a look at Flevy's Strategy Development Frameworks offering here. This is a curated collection of best practice frameworks based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. By learning and applying these concepts, you can you stay ahead of the curve. Full details here.

* * * *

Want to start a new business? Good luck.

Want to start a new business? Good luck.

Half of all new businesses fail within five years and more than 66 percent fail within 10 years, according to the U.S. Small Business Administration. The University of Tennessee analyzed thousands of small-business failures in an effort to identify their underlying causes. Here are some of the top causes of small-business failure, along with some strategies on how to avoid them.

Lack of Managerial Competence

An estimated 46 percent of small-business failures stem from incompetence in key business areas, while another 30 percent derive from a lack of managerial experience. Together, these two leading contributors can be summed up as managerial incompetence, U.S. News & World Report states.

One of the best ways to avoid this problem is to gain managerial training and experience by earning an MBA. An MBA program provides training in areas like business strategy, accounting, financing and marketing, and courses also offer opportunities to gain practical managerial experience through internships.

Ineffective Pricing Strategy

When business failures caused by incompetence are broken down into more specific categories, one of the leading areas where businesses fail is often pricing strategy. Setting prices based on emotions rather than logic is the most common problem, while lack of knowledge of industry pricing conventions ranks as the third biggest problem.

Pricing is probably the toughest part of business to get right. To develop an effective pricing strategy, you must first determine the minimum price you can sell a product while still turning a profit. Next, to identify the highest price you can charge without driving customers away, study your niche market, including what your competition is charging, as well as your prospective customers’ buying patterns.

After determining these figures, you can choose from a range of pricing strategies. For example, premium pricing can be used to position your product as superior to your competition and attract luxury buyers, while low pricing can be used to penetrate a cost-conscious market and attract cost-conscious buyers.

Continually test your prices to ensure your strategy remains profitable, while making sure you’re not undercutting potential profits.

Failing to Pay Taxes

Non-payment of taxes also ranks high among causes of small-business failure. Inaccurate reporting, civil fraud, failing to pay on time, filing late and underpaying estimated taxes are some of the most common small-business owner mistakes.

To avoid these mistakes, make tax planning part of your business plan. Research and understand your tax obligations and budget them into your financial planning. Schedule your tax payments ahead of time, and use good accounting and tax preparation software to automate your tax estimation. You can also look to outsource your tax preparation to a trained specialist for optimum results.

Poor Financial Literacy

Lack of financial knowledge is another leading cause of small-business failure. Not knowing how to obtain and manage your financing can cause you to run short of the funds you need to run your business. The best way to avoid financing problems is to prepare a business plan that includes a financial strategy.

If you plan to borrow money, you will need to prepare your key financial statements, which include your income statement, balance sheet and cash flow statement. The SBA provides an online guide to business financing basics.

Poor Recordkeeping

Another major cause of small-business failure is poor recordkeeping. According to Wasp Barcode Technologies, some of the top challenges that result from mismanagement of the books include:

- Accounts receivable and collections problems

- Cash flow issues

- Paperwork management problems

- Trouble closing the books each month

- Payroll management headaches

An underlying reason for these problems is the lack of a bookkeeping specialist. Nearly half of small businesses with fewer than 100 employees don’t have a full-time accountant. Hiring a bookkeeper or outsourcing your bookkeeping to a trained expert will alleviate your record-keeping problems.

You should also back up your records with a cloud backup service to ensure you don’t lose any important files for accounting and tax preparation purposes.

25-slide PowerPoint presentation

This presentation introduces a framework for entrepreneurs to use when building and navigating their business from a nascent, startup state to an enterprise with a global footprint. This framework, called the 5 Stages of Business Growth, is based on the fact that all businesses experience common

[read more]

Want to Achieve Excellence in Strategy Development?

Gain the knowledge and develop the expertise to become an expert in Strategy Development. Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

"Strategy without Tactics is the slowest route to victory. Tactics without Strategy is the noise before defeat." - Sun Tzu

For effective Strategy Development and Strategic Planning, we must master both Strategy and Tactics. Our frameworks cover all phases of Strategy, from Strategy Design and Formulation to Strategy Deployment and Execution; as well as all levels of Strategy, from Corporate Strategy to Business Strategy to "Tactical" Strategy. Many of these methodologies are authored by global strategy consulting firms and have been successfully implemented at their Fortune 100 client organizations.

These frameworks include Porter's Five Forces, BCG Growth-Share Matrix, Greiner's Growth Model, Capabilities-driven Strategy (CDS), Business Model Innovation (BMI), Value Chain Analysis (VCA), Endgame Niche Strategies, Value Patterns, Integrated Strategy Model for Value Creation, Scenario Planning, to name a few.

Learn about our Strategy Development Best Practice Frameworks here.

Readers of This Article Are Interested in These Resources

76-slide PowerPoint presentation

This document is a growth opportunity assessment approach. The approach is made up of the following steps:

- Understand business/market profile (industry dynamics, customers, competition, company, economics)

- Identify high-level growth opportunities

- Evaluate opportunity attractiveness at

[read more]

1691-slide PowerPoint presentation

Curated by McKinsey-trained Executives

Unlock Your Business Potential with the Ultimate Guide to Growth Strategies: 1,600 Slides and 400 Templates Included!

Are you ready to take your business to the next level? Growth doesn't just happen; it's built through careful planning,

[read more]

186-slide PowerPoint presentation

This presentation is a comprehensive collection of Key Performance Indicators (KPI) related to Corporate Strategy. A KPI is a quantifiable measure used to evaluate the success of an organization, employee, or process in meeting objectives for performance.

KPIs are typically implemented at

[read more]

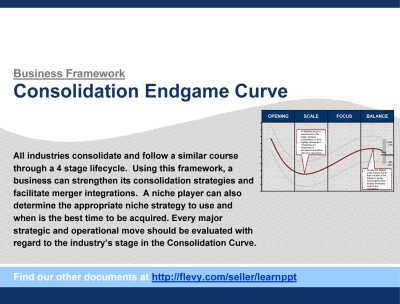

29-slide PowerPoint presentation

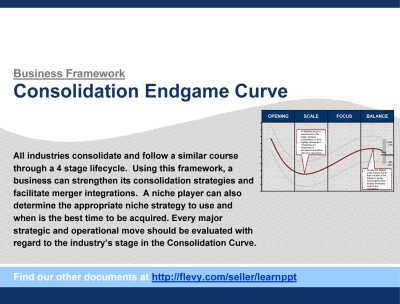

The Consolidation Curve, or Endgame Curve, is a framework based on the theory that all industries consolidate and follow a similar course through the 4 stages of: Opening, Scale, Focus, and Balance & Alliance. This framework is based on a study of 25,000 firms globally, representing 98% of the

[read more]

Want to start a new business? Good luck.

Want to start a new business? Good luck.