Aviation moves people, perishables, and premium freight at the speed of relevance. IATA notes air cargo carries roughly one third of world trade by value, which explains why boardrooms watch belly capacity almost as closely as passenger yields. Traffic has clawed back to and beyond pre-pandemic levels, yet profitability remains thin and spiky by region.

Executives do not manage airlines or airports in isolation. They manage time and trust.

A comprehensive holistic analysis of the complete value chain matters because schedule integrity, safety, and liquidity are intimately linked. Fuel often represents about a quarter to a third of airline operating cost, so small gains in planning or maintenance ripple straight into cash. IATA has reminded everyone that average profit per passenger can sit in the single digit dollars in normal years. Thin margins magnify tiny hand offs.

Leaders who treat the Aviation industry value chain as one system usually sleep better and spend less on apologies.

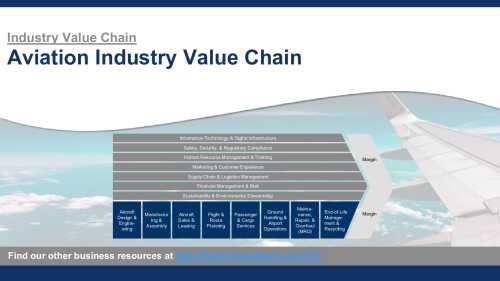

Aviation Value Chain Fundamentals and the Moving Parts

A value chain is the connected system that converts aircraft, airports, and data into dependable journeys. The aviation version links design, build, route planning, airport turns, in flight operations, service recovery, MRO, and end of life. Think choreography more than a pipeline. Every node either protects schedule and yield or quietly erodes them.

The Aviation Value Chain includes:

Primary activities

- Aircraft Design & Engineering

- Manufacturing & Assembly

- Aircraft Sales & Leasing

- Flight & Route Planning

- Passenger & Cargo Services

- Ground Handling & Airport Operations

- Maintenance, Repair, & Overhaul (MRO)

- End-of-Life Management & Recycling

Support activities

- Information Technology & Digital Infrastructure

- Safety, Security, & Regulatory Compliance

- Human Resource Management & Training

- Marketing & Customer Experience

- Supply Chain & Logistics Management

- Financial Management & Risk

- Sustainability & Environmental Stewardship

Download an in-depth presentation breaking down all the Aviation Value Chain activities here.

Where the Operation Is Actually Won

Flight & Route Planning

Planning is the metronome. Teams juggle fleet assignment, crew legalities, curfews, winds aloft, airspace constraints, and airport slot rules. One knot too fast over the Atlantic burns real money. One missed arrival window creates a rolling delay that haunts three rotations. World class operators pair robust schedule design with day of ops playbooks, dynamic taxi time forecasts, and arrival sequencing that aligns with airport readiness. Measure on time in full, block time padding, connection success, and misconnect cost. Treat each seasonal timetable as an experiment, not a doctrine.

Maintenance, Repair, & Overhaul (MRO)

MRO converts reliability risk into predictable availability. Oliver Wyman sizes the MRO market in the neighborhood of one hundred billion dollars and rising this decade, which tracks with the growth of the global fleet. Leaders build power by the hour style contracts that align incentives, instrument health on critical systems, and use predictive models for components with expensive no fault removals. Line maintenance owns the turn, base maintenance owns the winter, and engineering owns the reliability roadmap. The boring ritual of reliability review reduces cancellations more than any shiny app.

Innovation That Actually Pays Its Way

Digital twins and real time ops platforms are moving from pilot to routine. Aircraft, airport, and airspace twins let planners test schedule changes and disruption scenarios without touching the live day. Teams use integrated operations centers that fuse weather, flow restrictions, gate status, and crew legality so decisions land once. The financial win shows up as fewer long delays and lower crew and passenger re-accommodation costs.

Sustainable aviation fuel is climbing from rounding error to real lever. The International Energy Agency has highlighted that SAF still represents well under 1% of total jet fuel use today, yet mandates and offtake deals are multiplying. Airlines hedge availability by locking long term supply, upgrading logistics at key hubs, and publishing transparent SAF accounting in their sustainability reports. Finance teams model the cost delta alongside EU carbon pricing so network decisions reflect true cost.

Advanced distribution and retail are finally earning respect. New Distribution Capability opens richer offers and ancillaries that raise revenue per passenger without torpedoing satisfaction. Dynamic seat pricing, extra legroom, lounge access, bag products, and day of travel service guarantees all have space when presented cleanly across channels. The trick is to maintain one truth for inventory and entitlements so airport teams can deliver what the dotcom promised.

Seamless travel is quietly changing the airport turn. Biometrics, digital identity, and touch free baggage processes compress dwell time and reduce queue anxiety. Airport collaborative decision making aligns airline, ground handler, and air navigation services on a single target off block time. On good days, you feel the machine hum. On bad days, the same transparency speeds recovery because everyone sees the same clock.

Rules that Build Trust and Keep You Flying

Safety regulation is the north star. ICAO sets international standards and national authorities like FAA and EASA enforce them through certification and continuing airworthiness rules. Part 145 maintenance approvals, controlled documentation, and traceable parts histories are non negotiable. Treat compliance artifacts as product features. They protect lives and unlock code shares and leases.

Climate policy is rewriting the cost base. CORSIA requires carriers to monitor, report, and offset growth related emissions on eligible international routes. The EU Emissions Trading System covers flights within the European Economic Area and phases in broader exposure, while the ReFuelEU package ramps minimum SAF blends through mid century. Finance and network teams must co own this ledger so pricing, scheduling, and aircraft assignment reflect carbon costs that actually arrive.

Consumer protection rules shape operations and cash. EU 261 compensation, US tarmac delay rules, and refund obligations require tight control over controllable delay drivers and crisp communication. Legal, operations, and customer teams should share one decision tree for disruption handling so goodwill credits and accommodations feel consistent. Passengers forgive weather. They do not forgive silence.

Cybersecurity and data privacy standards now touch every node, from aircraft connectivity to loyalty databases. Zero trust architectures for airports and airlines reduce blast radius. Multi factor authentication for critical systems, signed software updates for aircraft, and segmented networks around baggage and passenger processing are table stakes. Incidents move fast. Your crisis playbook must move faster.

Your Board Level FAQ

How do we raise schedule integrity without torching fuel.

Align speed with realistic taxi and arrival times, practice just in time arrivals where air traffic control permits, and reward stations for accurate off block forecasts. Track cost of irregular ops like a P and L line item.

What KPIs belong on the executive dashboard.

On time arrival within fifteen minutes, completion factor, long delay count, misconnect rate, crew legality violations avoided, fuel per available seat kilometer, maintenance driven cancellations, and NPS by disrupted versus nondisrupted.

Where should we invest first on SAF.

Prioritize hubs with access to supply, lock offtake contracts that scale over years, and design joint communications with corporate customers who want to buy down Scope 3. Maintain a clear book and claim policy to avoid credibility hits.

How do we de risk MRO with aging fleets.

Increase condition based maintenance coverage, tighten vendor reliability SLAs, and expand rotable pools for constrained components. Protect heavy check capacity for your bottleneck aircraft types.

What is the smartest way to monetize beyond base fares.

Use data to personalize ancillaries and keep promises simple. Price change fees, seats, bags, and lounge as a portfolio and test bundles in markets with different elasticity.

How do we keep airports aligned during disruption.

Adopt airport collaborative decision making rigor with shared milestones and recovery roles. Run post mortems that include handlers and air navigation so fixes stick.

Where should we centralize versus localize decisions.

Centralize network design, fleet assignment, and crew rules. Empower stations to solve day of ops within guardrails, including swaps and reprotection moves for downline pain reduction.

How do we keep cybersecurity from becoming theater.

Segment networks, enforce least privilege, and drill incident response with operations and comms in the room. Measure mean time to detect and contain like any other reliability metric.

Closing Thoughts from the Ops Room

Aviation rewards teams that love choreography and hate drama. The value chain gives you one steering wheel for aircraft, airport, and airspace. When planning, MRO, and customer care share one rhythm, small wins compound into boringly reliable operations that banks and passengers both appreciate. Boring is underrated in this sector.

Ask one blunt question at the next exec huddle. Where in our chain do we create trust and where do we leak it. Fund one fix per quarter and make the owner famous. You will feel the flywheel when cancellations fall, ancillaries rise without pushback, and crews end more days on time than tired. That is what good looks like in aviation.