Editor's Note: Take a look at our featured best practice, Stakeholder Analysis and Engagement Framework (63-slide PowerPoint presentation). Stakeholder Analysis and Engagement is a strategic process that involves identifying all parties affected by an initiative and understanding their interests, influence, and expectations.

Through this process, we can identify key influencers and decision-makers, bolster stakeholder support and [read more]

Also, if you are interested in becoming an expert on Change Management, take a look at Flevy's Change Management Frameworks offering here. This is a curated collection of best practice frameworks based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. By learning and applying these concepts, you can you stay ahead of the curve. Full details here.

* * * *

The Increasing Role of Compliance

The Increasing Role of Compliance

Finance plays a critical role for society at large, serving individuals, families, businesses, governments, and civic institutions. The Financial Services industry performs indispensable functions such as enabling saving and investment, providing protection from risks and supporting the creation of new jobs and enterprises. It is critical that the industry operates to provide these functions for society in a stable, sustainable way.

Experiences of recent years have revealed a range of vulnerabilities of the financial system. Consequences of its functioning have been extremely costly to society and resulted in a significant loss of public trust and confidence in the financial system. An enormous, multi-year effort by policy-makers and financial institutions is underway to make the financial system more resilient and enable it to sustainably contribute to economic growth and prosperity. The regulatory community has strengthened oversight and prudential requirements as part of a global effort to overhaul and improve financial regulation.

Today, the Financial Services industry is subject to multiple and complex legal and regulatory compliance requirements that span international boundaries. Accenture’s Compliance Risk Study indicates that investment in the compliance function will continue to increase. Compliance officers will need to adapt their programs to navigate the disruption that the financial services industry is going trough. In fact the industry is facing disruptive forces in many forms, from changing customer behavior and the rise of digital technologies to a shifting regulatory landscape. New risks are emerging as well, many fueled by increasing challenges of fighting cyber-crime and others from managing more complex operations in today’s world. In order to respond to these challenges among others, the industry is taking a range of steps to change the way it does business. Improvements have also been made to business practices such as training, sales and product approvals, with increased penalties for breaching standards.

The Increasing Importance of Stakeholders Engagement

Despite many improvements since the financial crisis of 2008, much work lies ahead to repair the bonds of trust between the industry, its clients, regulators, investors and society at large. The need to harmonize shareholders’ demand for profitability with the concerns of other stakeholders (including society and the environment) has intensified. Taking stakeholder concerns and interests into account can improve relationships, which may make it easier for a corporation to operate, lead to ideas for products or services that will address stakeholder needs, and allow the company to reduce costs and maximize value. Overall, stakeholder responsive corporate governance results in a more comprehensive understanding of corporate risk and opportunity while contributing to a strong reputation over time.

As the industry continues to evolve, there is a shared belief that all stakeholders will need to work together to ensure that the financial system continues to fuel economic growth and job creation. While recent consultation processes between the private sector and regulators have demonstrated a joint interest in collaborating to achieve these goals, the dialogue is also a microcosm for the range of obstacles hindering greater progress. Different stakeholders continue to operate within very different frames of reference and use divergent vocabulary to describe the purpose and activities of the sector. Participants often defend pre-defined positions and self-interests. This is resulting in too little useful dialogue to support mutual learning, too much focus on technical issues and insufficient attention to developing an overarching framework and vision of a stable and inclusive financial system that meets society’s needs. There is the belief that a new kind of dialogue is needed to overcome these challenges.

The trend towards stakeholder dialogues and cross-sector collaboration is clear. Visionary companies are tapping into these trends and understand the interdependence between societal and corporate performance on the global scale. Studies have shown that stakeholder cooperation can improve business performance and that anticipating the potential in stakeholder dialogues at an early stage and following a step-by-step guide can lead to successful shared value creation. Stakeholders can have economic, technological, political, social or even managerial effects on a company and engagement is therefore an important part of anticipating business opportunities and risks, which, in turn, is fundamental to proactive, strategic management. It has also been realised that not keeping good relationships with stakeholders can have a damaging effect, not just on reputation but also on actual corporate and project results.

However, to many companies a question remains: is there a formula to make stakeholder dialogues a fruitful experience? There can be misunderstandings and pitfalls in stakeholder engagement and it is necessary to filter out what works and what does not. Moreover stakeholder engagement requires a new set of skills within companies to engage with the world beyond. Many companies suffer from a lack of focus when engaging stakeholders, failing to define when and why and what for.

When engaging with its stakeholders, a financial corporation is acknowledging that it is an interdependent entity, which is impacted by and has an impact on many different groups. For many companies, however, finding the right approach to stakeholder engagement and tapping the wider benefits it offers to their business is still uncharted territory.

Sustainability with Responsibility through Stakeholder Engagement within Compliance

Hence, in order for the Financial Services industry to remain competitive within the increasing competitive nature of financial market and to be successful, it should achieve Sustainability.

On one hand, and according to various reports, the integration of Sustainability into management systems and practices brings tangible benefits, including new lines of business, lower risks and better returns, improved access to international capital, new clients, greater value to stakeholders, improved brand value and reputation, and improved communities relations. The business case for environmental and social risk management and sustainable finance for financial institutions is clear.

On the other hand, different groups of actors in the society are constantly demanding enterprises to act and react in a sustainable and responsible manner in relation to the environment and society. The result is the assumption of this responsibility by a company and the efforts to fulfil their demands and expectations. Thus approaches to stakeholder engagement are changing from the original consultation and disclosure methods as means for the achievement of short-term business requirements, to new forms of engagement that seek to build relationships, manage risks and identify new business approaches. Stakeholder concerns can inform and enhance the risk management and wealth creation responsibilities of Financial Services’ Board of Directors. Stakeholder engagement strengthens the long-term sustainability of companies and enhances trust and reputation among stakeholders.

If for certain minds it remains unclear how companies within the financial sector can comfortably fit into a Sustainability model, for others one key to forging a true path to Sustainability might directly lie in social and governance performance, from customer transparency to risk management. In order to reach this objectif, financial organizations need an appropriate sustainability performance management system (PMS) relative to social, economic & environmental conditions. The increase of the interest for Corporate Sustainability and Responsibility is at the same time extending the awareness among companies about the positive impacts of transparency and reporting.

Finally, it is also my view that there is the need to develop innovative paths of collaboration among key stakeholders and to implement new frameworks, among which I place the “Sustainability with Responsibility Spiral.”

20-slide PowerPoint presentation

A document providing the key steps for conducting Stakeholder Analysis and Management to support Change Communication and Engagement activity. The document structure includes What is Stakeholder Management, Benefits of Stakeholder Management, the fours Stages of Stakeholder Management

[read more]

Want to Achieve Excellence in Change Management?

Gain the knowledge and develop the expertise to become an expert in Change Management. Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

"The only constant in life is change." – Heraclitus

Such is true for life, as it is for business. The entire ecosystem our organization operates in—our customers, competitors, suppliers, partners, the company itself, etc.—is constantly changing and evolving. Change can be driven by emerging technology, regulation, leadership change, crisis, changing consumer behavior, new business entrants, M&A activity, organizational restructuring, and so forth.

Thus, the understanding of, dealing with, and mastery of the Change Management process is one of the most critical capabilities for our organization to develop. Excellence in Change Management should be viewed as a source of Competitive Advantage.

Learn about our Change Management Best Practice Frameworks here.

Readers of This Article Are Interested in These Resources

Excel workbook

Identifying the main stakeholders and their level of influence can be vital to the success of your project. Stakeholder analysis involves recognizing individuals and groups with the power to either sway or make a key decision.

Mapping can be used to get a deeper understanding of the position and

[read more]

29-slide PowerPoint presentation

Changing industry ecosystems and competition today demand from the organizations to undergo strategic shifts. The purpose of a company is being transformed from serving the interest of shareholders to serving all stakeholders that influence the organization.

Executives need to identify the

[read more]

51-slide PowerPoint presentation

What will you do in case of conflict of stakeholders, during or prior to project?

This presentation will help you prepare for the Project Management Professional (PMP) Exam by PMI. It is a comprehensive, in-depth guide covering topics related to Stakeholder Management.

The document can be

[read more]

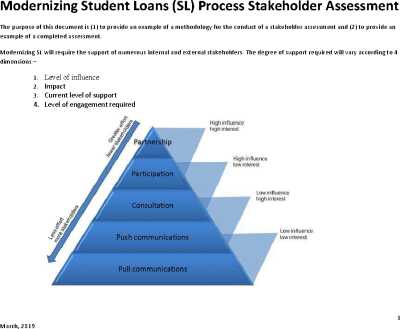

14-page Word document

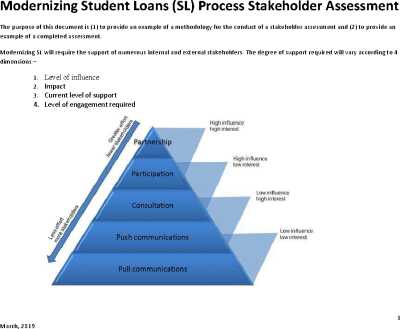

The purpose of this document is provide an example of an analytical methodology for undertaking a stakeholder assessment. It also provides an example of a completed assessment.

The Increasing Role of Compliance

The Increasing Role of Compliance