Editor's Note: Take a look at our featured best practice, Monthly Rolling Cash Flow Projection Excel Model (Excel workbook). Monthly Rolling Cash Flow Projection is crucial for businesses as it offers a real-time view of their financial health. By forecasting incoming and outgoing cash, it enables proactive management of liquidity, preventing potential crises. This tool helps in identifying trends, anticipating [read more]

4 Factors to Consider When Selecting a Business Credit Card

* * * *

Unfortunately, choosing the right business credit card can be tricky because of the many available ones. This blog highlights key things you should consider to ensure you select the right business credit card.

Does the Credit Card Cater to Your Business Needs?

Does the credit card you’re considering suit your business needs and align with how you plan to use it? If not, then consider another one.

Here, you need to pay attention to the following key things to determine if a business credit card is ideal for you:

- Rewards: Business credit cards have different reward programs; thus, doing credit card comparison research is the best way to find a business credit card that offers the best rewards based on how you intend to use the card.

- Interest-free period: Most business credit cards have an interest-free period where you pay no interest on purchases. If you have a gap between when your bills are due and when you receive payment from customers, this period can help with short-term cash flow.

- Features: This is perhaps the most important thing to consider. Do you need a business credit card that offers fast credit approval, spending limits and budget controls, a centralized expense management system for individual employees, etc.? If a business credit card does not have the core features you need, it won’t serve you well.

What Fees Do You Need to Pay?

Business credit cards have different fees, which is why you need to know about the charges your card will attract, such as:

- Annual fee: Most business credit cards have a yearly fee for access to certain features and benefits.

- Credit card processing fees: Credit card processing fees apply to all purchases you make using your credit card and can range from 1.5-3.5% of the transaction. That’s why it’s important to know this.

- Cash advance fee: These fees will apply whenever you get a cash advance using your business credit card.

- Late payment fees: If you miss a repayment, you will attract late payment fees.

Researching and comparing your choice of business credit cards will help ensure you know which fees you need to pay and when they apply, which is bound to make it easier to choose a credit card that aligns with your business needs and goals.

What Benefits and Features Do You Need?

Business credit cards can offer others benefits–besides rewards. The features and benefits you might get with some business credit cards include the following:

- Travel benefits–hotel and resort upgrades, access to the airport lounge, free checked bags, in-flight drinks, food credits/annual airline fee credits, and so much more.

- Discount–You get exclusive deals for services or products you use frequently.

- Gift cards

- Cash backs

- Multi-user management, etc.

Remember that the more rewards, benefits, and features you get from your business credit card, the higher the probability of higher annual fees or interest rates. That said, you shouldn’t discount a card until you’ve weighed up all of its benefits, features and conditions against what you actually want out of your ideal package. So for instance if you’re investigating good CitiBank credit cards to have, this attention to detail will serve you better than imposing a blanket ban on perk-packed deals.

Consider Interest Rates (APR)

As mentioned, some business credit cards have an interest-free period, but eventually, you will need to pay interest, which is why you should consider your APR.

For large business purchases you want to finance via business credit, consider using a credit card with a low APR or one that offers an interest-free promotional period–this is especially great if you intend to pay the balance in full.

Conclusion

Conclusively, before settling on a specific business card, weigh the business benefits of each, including features and rewards, and then go shopping for a business credit card that meets your exact needs.

Additionally, remember that you should go for a credit card that your business can pay off comfortably.

Do You Want to Implement Business Best Practices?

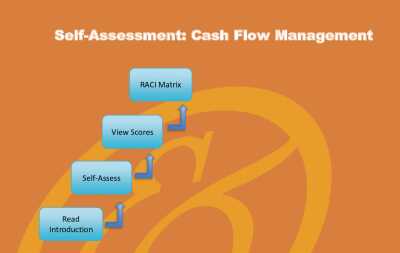

You can download in-depth presentations on Cash Flow Management and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

- Top 100 in Strategy & Transformation

- Top 100 in Digital Transformation

- Top 100 in Operational Excellence

- Top 100 in Organization & Change

- Top 100 Management Consulting Frameworks

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

|

|

Excel workbook

|

|

Excel workbook

| |||

About Shane Avron

Shane Avron is a freelance writer, specializing in business, general management, enterprise software, and digital technologies. In addition to Flevy, Shane's articles have appeared in Huffington Post, Forbes Magazine, among other business journals.

Top 10 Recommended Documents on Cash Flow Management

» View more resources Cash Flow Management here.

» View the Top 100 Best Practices on Flevy.