Editor's Note: Take a look at our featured best practice, Effective Communication with Virtual Teams (23-slide PowerPoint presentation). The number of people working remotely has been increasing progressively across the globe. An employee benefits report narrates that around 60% companies in the US offer telecommuting opportunities. According to Upwork, freelancers and contractors have increased by 81% from 2014 to 2017. [read more]

* * * *

Working from home has suddenly become a must-do rather than a luxury, thanks to the coronavirus pandemic (COVID-19). You may be thinking about the potential liability of remote work while you’re assisting staff members in staying healthy and productive (and employed).

Working from home has suddenly become a must-do rather than a luxury, thanks to the coronavirus pandemic (COVID-19). You may be thinking about the potential liability of remote work while you’re assisting staff members in staying healthy and productive (and employed).

For your staff and business to stay healthy, you should think about, aside from lost revenue, the cost of paying a worker’s salary while they are working remotely. It may be significantly more than what your business insurance covers. This post will teach you how to protect yourself against employee injuries, data breaches, company property damage, and other risks by understanding what your business insurance covers when employees work remotely and how much you’re protected against business losses on the insurance front.

Let’s have a look at some of the risks they could be facing as stay-at-home workers and how to be vigilant against them.

An Employee Is Injured or Gets Sick while Working from Home

Businesses with a team of staff are usually required to obtain workers’ compensation insurance in the majority of states. This coverage applies to employee salaries and medical expenses if they are harmed or become ill while working. It also covers lawsuit fees in the event someone is injured.

The insurance generally covers telecommuters, although workers’ compensation rules vary by state. In order to collect on a home injury claim, a remote employee must show that the accident occurred during business hours as they were carrying out job responsibilities.

Because COVID-19 may not be reported to the Department of Health, it’s highly doubtful that a remote worker who contracts COVID-19 could claim that their illness was caused by their work. Call your insurance agent if you have a coronavirus-related claim to check if workers’ compensation laws in your region and the terms of your policy provide coverage for it.

These standards are not meant to apply to every employee who works from home. Contractors (1099 employees) and freelancers are not covered by your workers’ compensation policy.

Keeping Remote Workers Safe from Cyber Threats and Data Breaches

Working from the comfort of one’s own home may be a risky proposition; many experts are concerned that virtual employees are not secure. When employees work from home, cyberattacks and data breaches become more likely. Make sure that your workers are secure with the following security measures:

- Using an encrypted virtual private network (VPN)

- Updating antivirus and firewall programs

- Having strong passwords and changing them often

- Locking computers and devices when not using

- Knowing what to do when encountering scams like phishing

- Using password managers or single sign-on programs

Damage Control When You Are the Victim of a Cyberattack

Cyber liability insurance will cover the costs in the case of a malicious software attack or data breach on a remote employee’s work computer. Most insurance providers will combine both forms of cyber liability coverage with technology errors and omissions insurance for IT firms.

Cyber liability insurance can be bought in the following policies:

- First-party cyber liability insurance protects you from paying for data breaches on your own systems. This covers the expenses of notifying customers, credit monitoring, and fraud detection costs.

- When your clients’ systems and information are compromised as a result of a data breach, third-party cyber liability insurance pays out to protect you. Third-party cyber liability insurance covers you for any damages, including costs and attorney’s fees, if a customer sues your firm over a data breach.

Commercial Property Insurance May Not Include Assets Like a Computer

Commercial property insurance is essential if you want to safeguard your items, equipment, or other assets you need. Commercial property that is stolen, destroyed, or lost from your workplace is covered by this plan. This policy may translate differently when it comes to remote working.

If you work from home, you are not covered by your employer’s remote working policy. Most standard commercial insurance covers property that is on your business’s premises. However, it may exclude or, to a significant extent, reduce coverage for property located away from the workplace.

Check that your business property insurance covers off-site usage of company assets by remote workers. Also, a business-owned computer that was stolen or damaged outside the workplace would not be covered by a homeowner’s insurance policy.

Make Sure that Your Business and Employees Are Insured

If COVID-19 has shown us anything, it’s that the workplace must adapt as more turn to remote working. Make sure you have the right coverage to guard against telecommuting dangers by consulting with your insurance professional. You’ll find it difficult to recover from an unforeseen injury when you have to pay out of pocket for uncovered expenditures. This will only add to your company’s financial strain in the long run.

26-slide PowerPoint presentation

To quote, Richard Branson, a British business and philanthropist, "One day, offices will be a thing of the past."

While organizations still need to travel to reach their physical offices, the rapid changes in the world is requiring businesses to form Virtual Teams. A Virtual Team refers to a

[read more]

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Remote Work and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

20-slide PowerPoint presentation

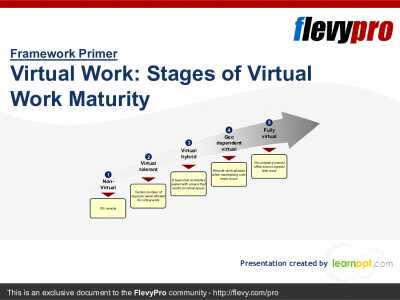

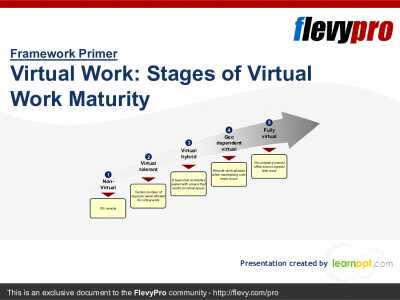

Virtual Work has become the trend of the future. In fact, 37% of the offices globally are working on hybrid-remote arrangements while 26% are 100% remote with people working in their own time. There is also about 25% of the companies that allow or tolerate virtual work with 12% that is 100%

[read more]

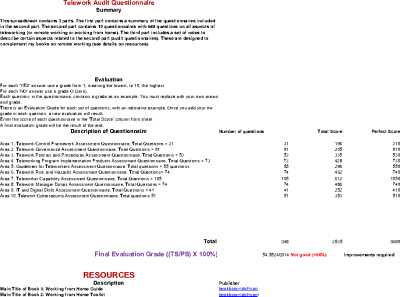

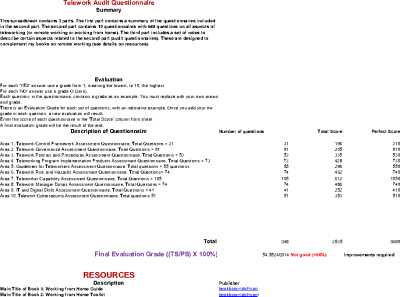

Excel workbook

The purpose of this tool (spreadsheet) is to review, audit, assess and improve all teleworking aspects of companies, organizations and remote workers.

This spreadsheet contains 3 parts. The first part contains a summary of the questionnaires included in the second part. The second part

[read more]

23-slide PowerPoint presentation

The global COVID-19 pandemic has forced organizations to rapidly adopt virtual work environments, making it the new norm. Digital Collaboration Platforms have been pivotal in the current scenario and have forever changed future work environment. Digital Collaboration Platforms is the new wave in

[read more]

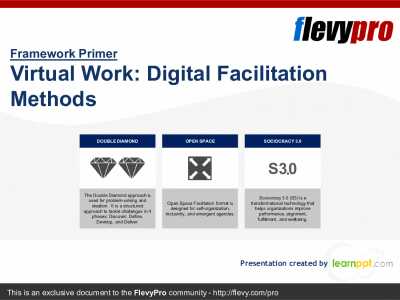

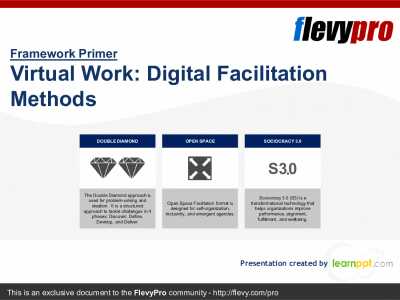

25-slide PowerPoint presentation

The global COVID-19 pandemic has forced organizations to rapidly adopt virtual work environments, making it the new norm. Digital Collaboration Platforms have been pivotal in the current scenario and have forever changed future work environment.

Digital Facilitation has its own set of

[read more]

Working from home has suddenly become a must-do rather than a luxury, thanks to the coronavirus pandemic (COVID-19). You may be thinking about the potential liability of remote work while you’re assisting staff members in staying healthy and productive (and employed).

Working from home has suddenly become a must-do rather than a luxury, thanks to the coronavirus pandemic (COVID-19). You may be thinking about the potential liability of remote work while you’re assisting staff members in staying healthy and productive (and employed).