Editor's Note: Take a look at our featured best practice, Risk Management SOPs (+600 KPIs) (1587-slide PowerPoint presentation). Curated by McKinsey-trained Executives

Complete Risk Management Standard Operating Procedures (SOP) Business Toolkit: Comprehensive Guide to Risk Management

In today's dynamic business environment, risk management is a critical area that ensures organizations can identify, assess, respond [read more]

* * * *

Risk management is a key part of any responsible business. This is the process of identifying, assessing and reacting to potential problems that could harm your business. Below, we explore why you need to control risk.

Risk management is a key part of any responsible business. This is the process of identifying, assessing and reacting to potential problems that could harm your business. Below, we explore why you need to control risk.

Helps Establish Priorities

Controlling risk is particularly useful because it can help you establish the greatest threats to your company. By considering your risks, you’re able to work out what issues are an urgent problem, and which issues you can afford to accept for the time being. An easy way to establish your priorities is to create a list based on how likely issues are to become problems – with the most likely forming the most urgent priority. On top of this, you can also calculate the potential financial damage from each risk and let that shape your priorities too.

Prepares the Business for the Worst

Controlling risk can also help ensure that you put in place a rigorous response structure should a risk actualise. This could refer to having the correct insurance in place to minimise the financial cost. Or it could refer to having a white collar defense and investigations team in place to help you with any legal concerns. This means that you can defend yourself from accusations of fraud or any other similar illegal activity. The benefit of risk control is that it can proactively prevent damage being cause to the business, while also helping you to put a plan in place should damage occur.

Saving Money

Despite the initial outlay of getting risk control in place, in the long-term, it’s likely that these controls will save your business plenty of money. For a start, they reduce the risk of accidents occurring at work – not only will this help your workforce, but it’ll also save you money from paying out compensation. On top of this, compliance issues cost businesses a significant amount of money as they lead to fines and lawsuits. But a risk control system can mitigate this damage. Risk assessment will also show your employees that you care about the business and the staff. This could possibly improve morale and productivity.

Putting in place an effective risk control system is crucial for a business. By saving you money and preparing the business for an emergency, you can give yourself true peace of mind.

83-slide PowerPoint presentation

This document is an 83-slide PowerPoint presentation that provides a Risk Management Overview based on the M_o_R methodology that has been recognized worldwide as the leading Best Practice framework for successful management of Business Risk.

The document is easily customizable, content can be

[read more]

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Risk Management and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

61-slide PowerPoint presentation

ISO 31000:2018 is an internationally recognized standard that helps organizations implement a robust Risk Management System. Risks can arise from anything that generates uncertainty related to an organization's objectives or deviates from the expected, including opportunities to be gained. In

[read more]

211-slide PowerPoint presentation

Risk Management Professionals aim to recognize, evaluate, and document the risks associated with a company's business operations. They also oversee the efficacy of risk management processes and implement necessary adjustments. Attaining the PMI Risk Management Professional (PMI‑RMP)®

[read more]

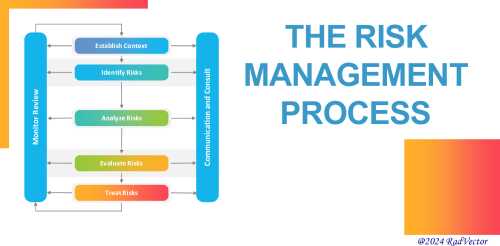

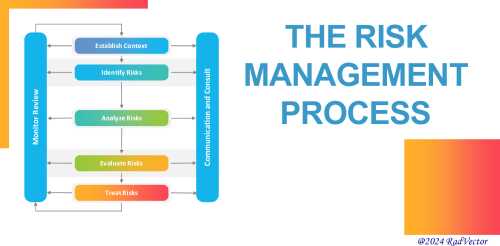

65-slide PowerPoint presentation

Risk management is a vital process for organizations to identify, assess, and mitigate potential risks that could impact their objectives. The seven steps to risk management provide a structured approach to effectively manage risks and safeguard organizational assets.

Step 1: Communication &

[read more]

13-slide PowerPoint presentation

This document provides a thorough visual taxonomy of key business processes related to managing enterprise risk, compliance, remediation, and resiliency based on APQC's cross-industry process classification system (PCF), the most used process framework globally.

A process classification

[read more]

Risk management is a key part of any responsible business. This is the process of identifying, assessing and reacting to potential problems that could harm your business. Below, we explore why you need to control risk.

Risk management is a key part of any responsible business. This is the process of identifying, assessing and reacting to potential problems that could harm your business. Below, we explore why you need to control risk.