Creative industries shape culture and cash flow at the same time. UNESCO estimates cultural and creative sectors contribute about 3.1% of global GDP and support roughly 50 million jobs worldwide.

That footprint stretches from film and music to design, gaming, publishing, and the fast growing creator economy. Audiences keep fragmenting, yet demand for fresh stories remains stubborn and scalable.

Revenue pools keep shifting but they do not shrink into nothing. IFPI reports global recorded music revenue grew over 10% in 2023 to about 28.6 billion, with streaming generating near two thirds of the total. Newzoo sizes the global games market in the high hundred billions each year and expects a return to growth as engagement stabilizes. Deloitte finds streaming video churn in the United States sits near 40%, which turns retention and monetization into hard daily work rather than a marketing slogan.

Leaders that treat operations as a craft, not an afterthought, tend to win the long game.

Creative Industry Value Chain Fundamentals and the Moving Parts

A value chain is the connected system that turns ideas into intellectual property into lasting audience relationships and cash. The creative version links concept, production, rights, distribution, and data driven feedback so each hand off increases both story quality and monetization potential. Think choreography more than a linear pipeline.

The Creative Industry Value Chain includes:

Primary activities

- Ideation & Concept Development

- Creative Production

- Content Editing & Refinement

- Intellectual Property Management

- Distribution & Exhibition

- Audience Engagement & Monetization

- Performance Analysis & Feedback Integration

Support activities

- Talent Development & Management

- Marketing & Brand Strategy

- Legal & Rights Management

- Technology & Digital Infrastructure

- Funding & Financial Planning

- Strategic Partnerships & Business Development

- Administrative & Facility Operations

Download an in-depth presentation breaking down all the Creative Industry Value Chain activities here.

Where the Work Actually Creates Value

Intellectual Property Management

IP is the multiplier. Catalog strategy, rights clearance, and windowing choices determine whether a story pays once or pays for a decade. Teams that maintain clean chain of title, structured royalties, and territory rules unlock faster deals and fewer legal detours. Strong metadata management and content credentials travel with the asset so partners can find, license, and account without drama. WIPO guidance and collective management data provide the common language that buyers and sellers understand, which reduces friction and raises realized value.

Audience Engagement & Monetization

Fans do not buy content, they buy identity and community. Lifecycle programs that blend CRM, first party data, and creator touchpoints deliver higher lifetime value with fewer discounts. Deloitte’s churn findings make retention math simple to defend at the board table. Brands that offer flexible access models across subs, ad tiers, bundles, experiences, and commerce reduce volatility and widen the monetization base. Creative teams need daily audience signal so they can steer tone, pacing, and release timing while the market is still listening.

Innovation that Pays Its Way

Virtual production is more than a shiny wall of LEDs. When used with discipline, it compresses location spend, reduces reshoots, and shortens post cycles by moving decisions earlier in the process. The best teams link previs, real time engines, and asset libraries so creative leaders can experiment without burning the budget. Investors like the working capital profile because fewer surprises hit the finish line.

Generative AI now assists story development, localization, trailer variants, and rough cuts. McKinsey estimates automation and AI can deliver significant productivity lift across marketing, sales, and product development, which absolutely maps to creative workflows. The trick is controls. Human review, content credentials, and clear rules on training sources keep output safe and brand right. Creators use AI to explore ten options and then choose the best one, not to outsource taste.

Music and creator ecosystems are tilting toward more direct monetization. IFPI shows streaming as the primary revenue driver for recorded music, while Goldman Sachs projects the creator economy could approach five hundred billion dollars around the middle of the decade. That scale invites new products like gated communities, limited digital merch, and live experiences that bundle content with access. Teams should pilot pricing experiments constantly and retire the ones that do not earn their keep.

Data flywheels change the creative brief. Performance Analysis and Feedback Integration brings real time insight into what segments replay, skip, or share. Editors and showrunners can adapt future episodes or tracks with tighter clarity, while marketers swap creative quickly when an asset underdelivers. Organizations that embed this loop without crushing the creative voice get the best of both worlds, crisp art and cleaner economics.

Rules that Protect the Catalog and the Relationship

Copyright remains the backbone. Clean rights ingestion and timely royalty accounting build trust with talent and partners. Unclear ownership kills deals and opens legal risk that eats margin for breakfast. Teams should run quarterly audits on chain of title and sample clearance, especially as archives move into new formats or territories.

Platform rules shape discovery and monetization. Privacy regimes like GDPR and CCPA require consent and purpose limits for audience data. Ad supported tiers raise new compliance points across children privacy, disclosures, and brand safety. Executives should validate that creative, ad operations, and legal reference one living policy rather than three conflicting versions of the truth.

AI governance is moving fast. The EU AI Act brings duties around risk management and transparency for certain uses, and industry groups are pushing content provenance so audiences can tell what was created by whom. Treat provenance like a product feature with visible badges and tamper resistant credentials. Clear source documentation for any training material reduces the odds of unhappy letters and speeds partner approvals.

Accessibility and inclusion expectations are rising. Subtitles, audio description, color contrast, and inclusive casting practices expand reach and reduce regulatory and reputational risk. Labor agreements, safety standards on set, and fair pay rules across gig contributors must be honored in both letter and spirit. Culture and compliance become the same thing when you manage talent for the long run.

Your Board Level FAQ

How do we balance experimentation with brand coherence.

Set a two speed portfolio. Protect core tentpoles while funding small bets with clear learn gates and fast stop rules.

What metrics belong on the executive dashboard.

Time to greenlight, on time in full delivery, full price sell through for ticketed events, monthly churn and rejoin rate, catalog share of total streams, average revenue per fan, and royalty cycle time.

Where should we apply generative AI right now.

Use it in localization, versioning, asset tagging, and ideation support with human approval. Avoid use cases where rights or brand risk outweigh speed.

How do we raise catalog yield without flooding the market.

Improve metadata, run smart windowing by territory, and bundle catalog with new drops to lift discovery. Maintain a tight price discipline that rewards engagement rather than raw volume.

What is the smartest approach to direct to fan.

Own first party relationships through memberships or communities. Offer layered benefits that mix access, exclusives, and physical experiences while limiting one off discounts.

How do we cut production volatility.

Lock scripts earlier, use virtual production where it eliminates location risk, and pre agree reshoot budgets and decision rights. Daily dashboards for schedule and quality signals keep surprises small.

Where should we place the next platform partnership bet.

Choose partners that expand reach to a new segment or unlock a new format. Negotiate data sharing, merchandising, and marketing commitments up front.

What is our plan for content provenance and brand safety.

Adopt credentials at the asset level, document data sources, and run always on safety reviews. Publish your playbook internally so creators and partners know the rules.

Closing Thoughts from the Studio Floor

Creative work looks messy from the outside and it is ruthless underneath. The value chain gives you one steering wheel for that mess. Leaders who connect story, rights, distribution, and data into a single rhythm see fewer surprises and more repeatable hits. The audience feels the confidence even if they never see the wiring.

Ask a blunt question at your next leadership stand up. Where in our chain do we create trust and where do we leak it. Fix one leak per quarter and ring the bell when it moves the numbers. Momentum follows discipline, and discipline is strangely freeing for creative teams that want to spend their time making things the world actually wants.

Want to Achieve Excellence in Strategy Development?

Gain the knowledge and develop the expertise to become an expert in Strategy Development. Our frameworks are based on the thought leadership of leading consulting firms, academics, and recognized subject matter experts. Click here for full details.

"Strategy without Tactics is the slowest route to victory. Tactics without Strategy is the noise before defeat." - Sun Tzu

For effective Strategy Development and Strategic Planning, we must master both Strategy and Tactics. Our frameworks cover all phases of Strategy, from Strategy Design and Formulation to Strategy Deployment and Execution; as well as all levels of Strategy, from Corporate Strategy to Business Strategy to "Tactical" Strategy. Many of these methodologies are authored by global strategy consulting firms and have been successfully implemented at their Fortune 100 client organizations.

These frameworks include Porter's Five Forces, BCG Growth-Share Matrix, Greiner's Growth Model, Capabilities-driven Strategy (CDS), Business Model Innovation (BMI), Value Chain Analysis (VCA), Endgame Niche Strategies, Value Patterns, Integrated Strategy Model for Value Creation, Scenario Planning, to name a few.

Learn about our Strategy Development Best Practice Frameworks here.

Readers of This Article Are Interested in These Resources

31-slide PowerPoint presentation

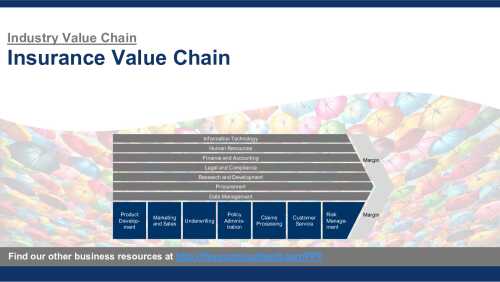

An Industry Value Chain is a visual representation of the series of steps an organization in a specific industry takes to deliver a product or service to the market. It captures the main business functions and processes that are involved in delivering the end product or service, illustrating how

[read more]

30-slide PowerPoint presentation

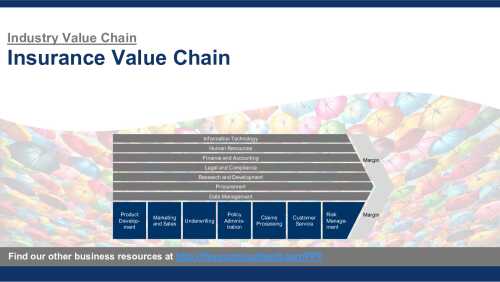

An Industry Value Chain is a visual representation of the series of steps an organization in a specific industry takes to deliver a product or service to the market. It captures the main business functions and processes that are involved in delivering the end product or service, illustrating how

[read more]

34-slide PowerPoint presentation

An Industry Value Chain is a visual representation of the series of steps an organization in a specific industry takes to deliver a product or service to the market. It captures the main business functions and processes that are involved in delivering the end product or service, illustrating how

[read more]

35-slide PowerPoint presentation

An Industry Value Chain is a visual representation of the series of steps an organization in a specific industry takes to deliver a product or service to the market. It captures the main business functions and processes that are involved in delivering the end product or service, illustrating how

[read more]