Biogas Producer Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Evaluate the economic viability and profitability of producing biogas through assessing costs, revenues, and investment needs.

ENERGY INDUSTRY EXCEL DESCRIPTION

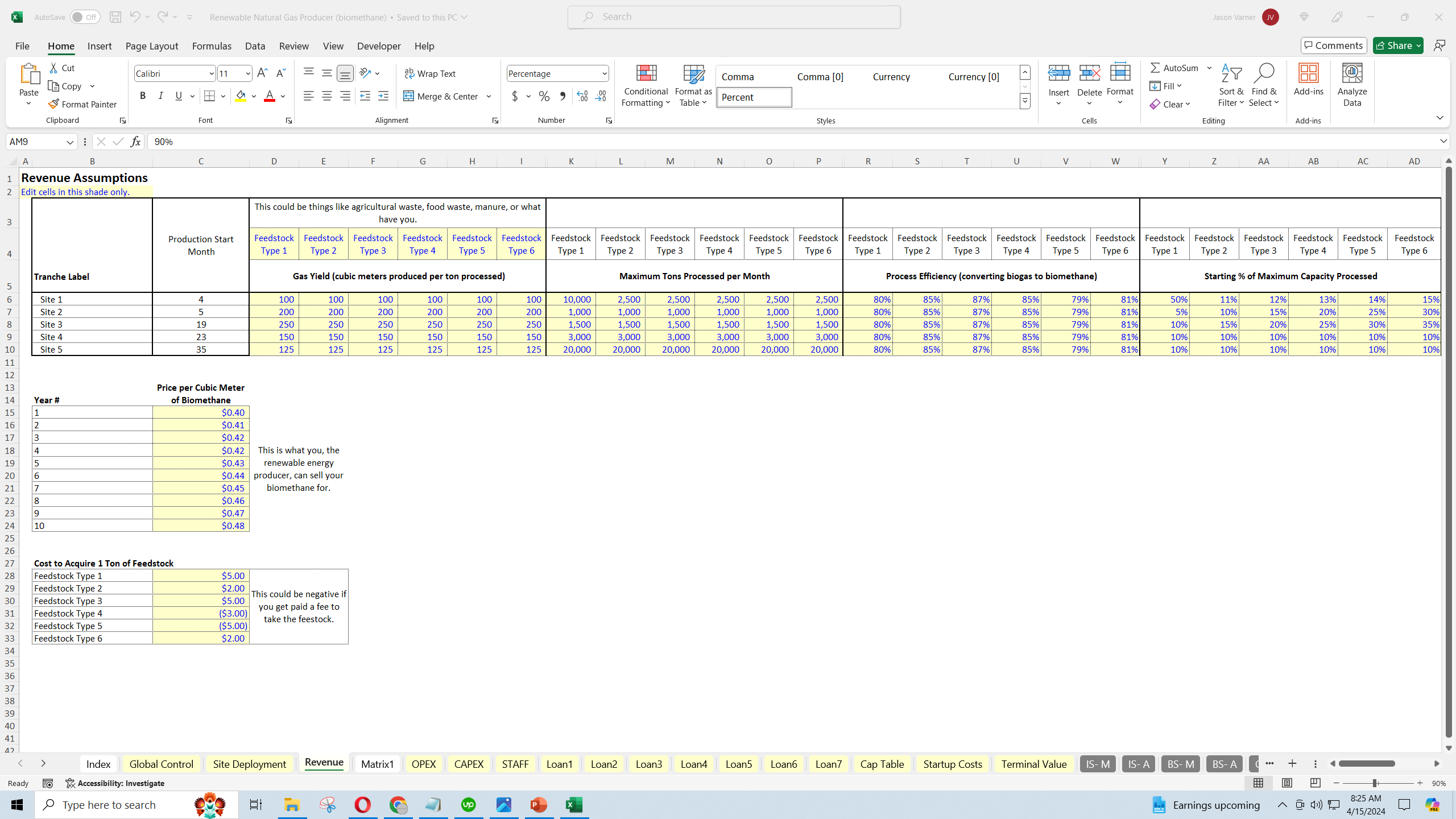

Biogas is a renewable energy resource produced from processing feedstock. This biogas model is the second I've done in the space. The other was a wind farm deployment template. The business model is simple, you collect feedstock (agriculture waste, garbage from landfills, and other organic waste) process it down into biomethane gas. That gas is then a fuel source that can be plugged into the gas grid or sold directly.

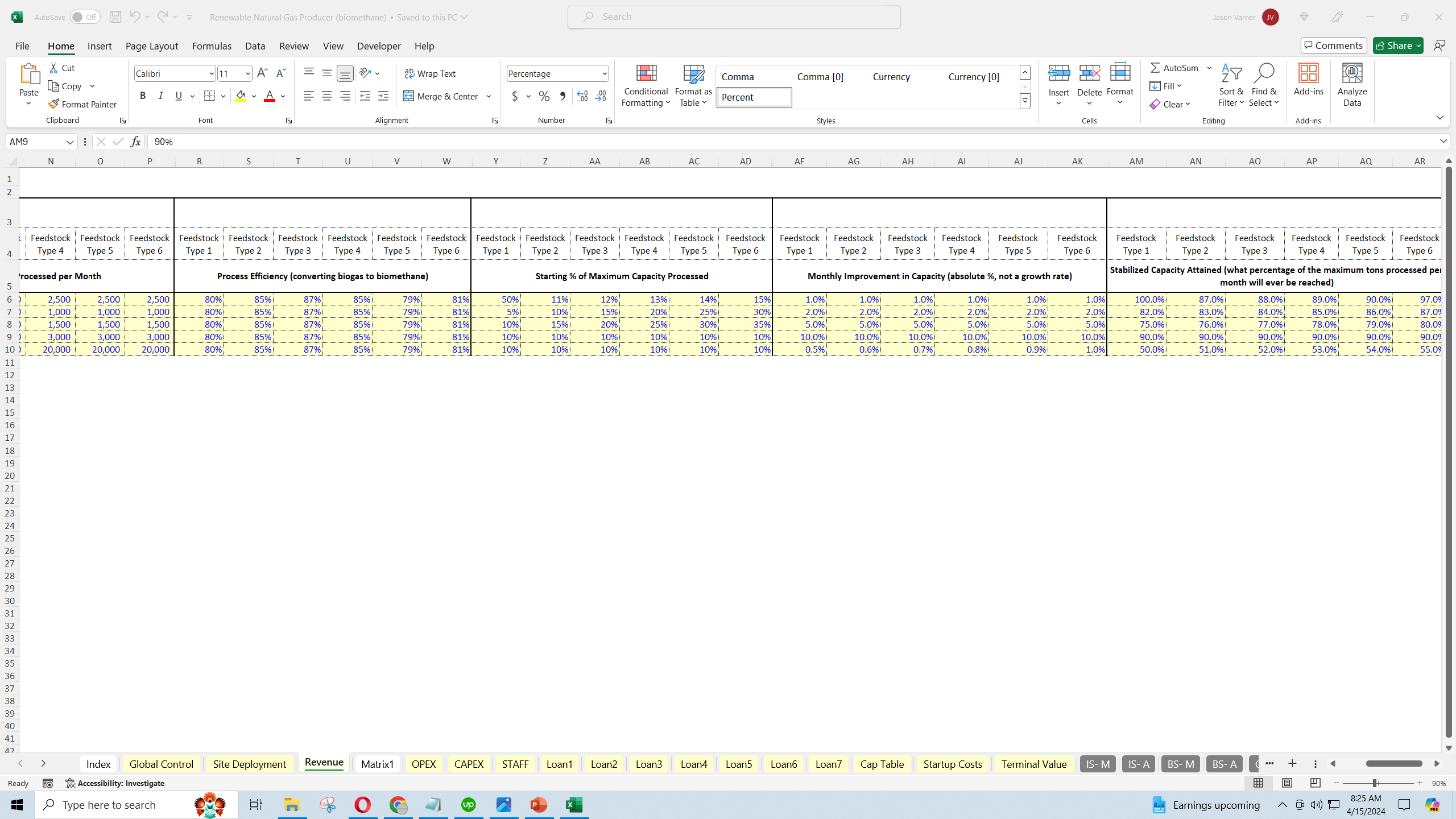

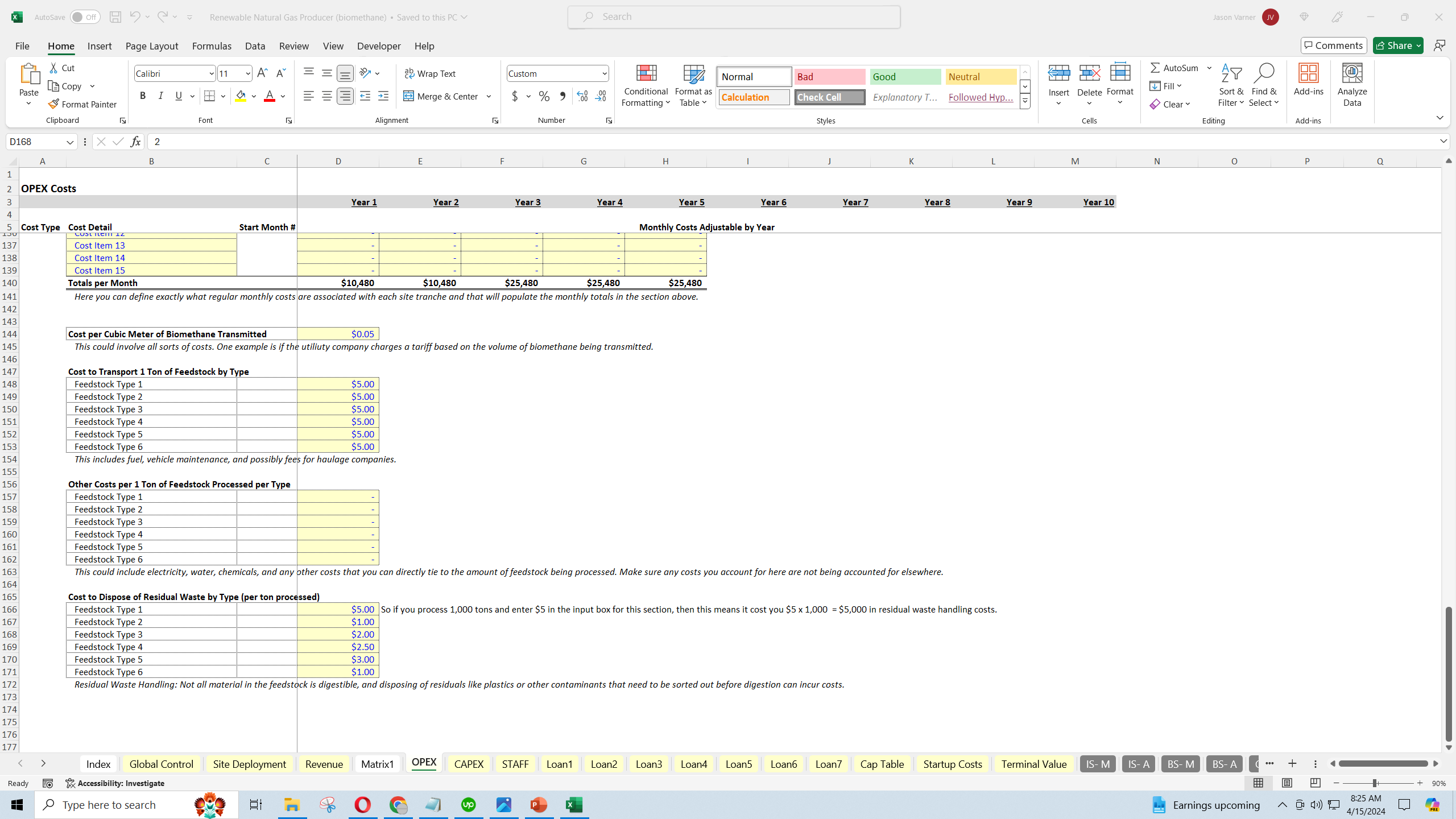

Biogas or biomethane is typically priced in cubic meters and the yield is measured based on the expected biogas extracted per ton of feedstock processed. This model has the ability to configure up to 6 feedstock types and scale up to 5 processing facilities over a 10-year period.

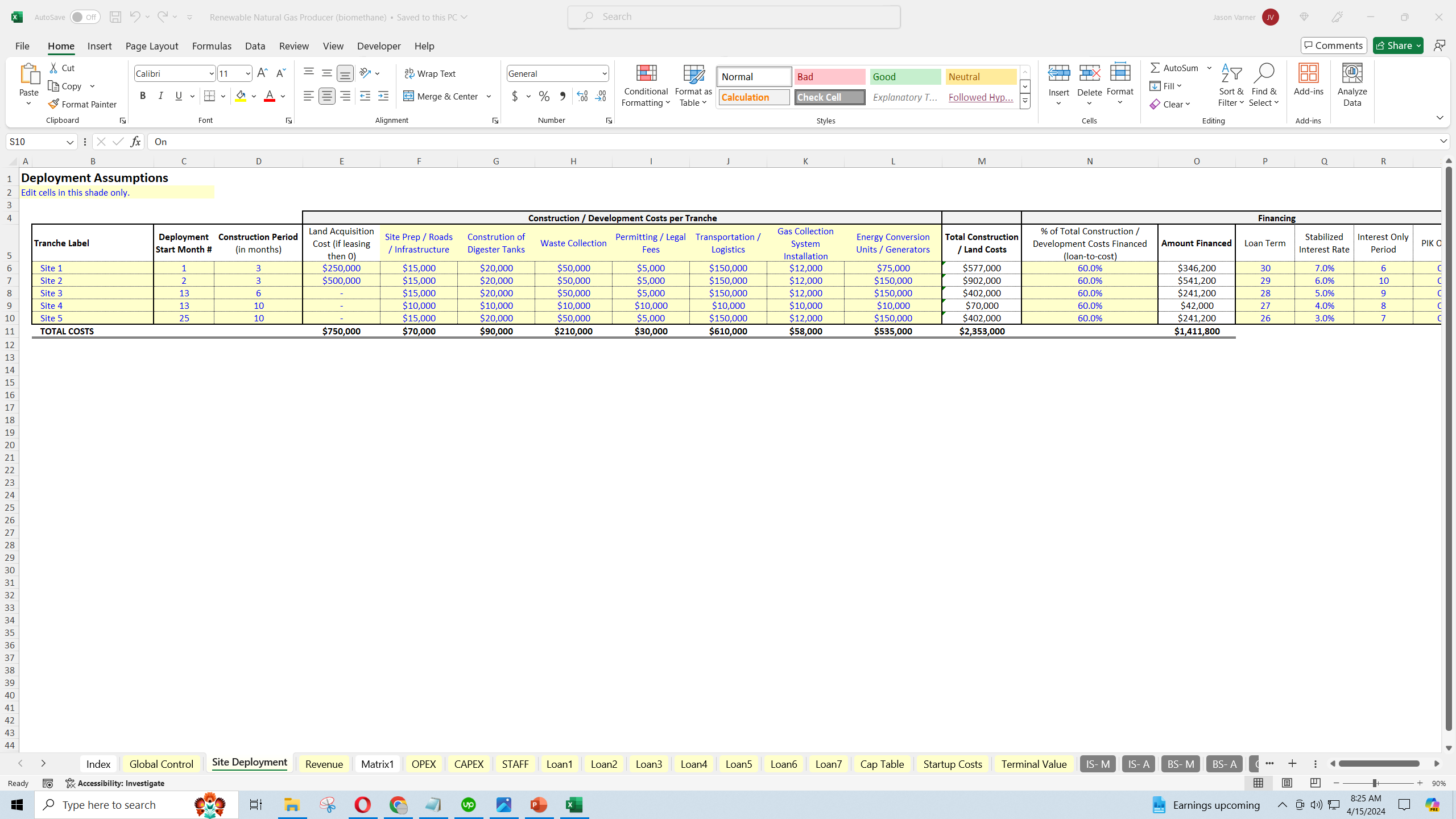

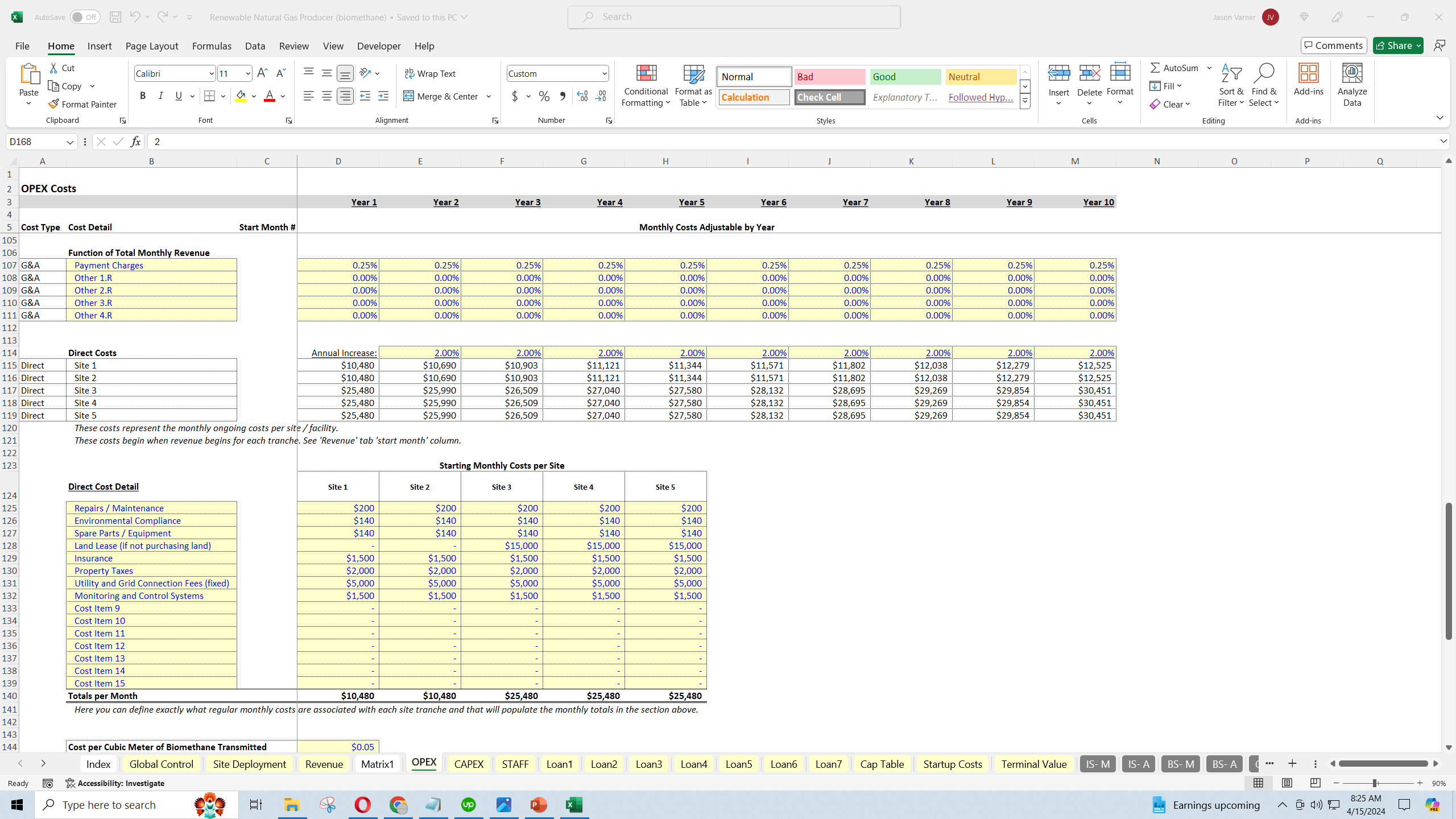

Each facility has its own assumptions for how much feedstock is being processed, processing efficiency, yield, and variable costs. The maximum capacity is defined in terms of tons of feedstock processed per month and an algorithm that works up to some % of that maximum over time.

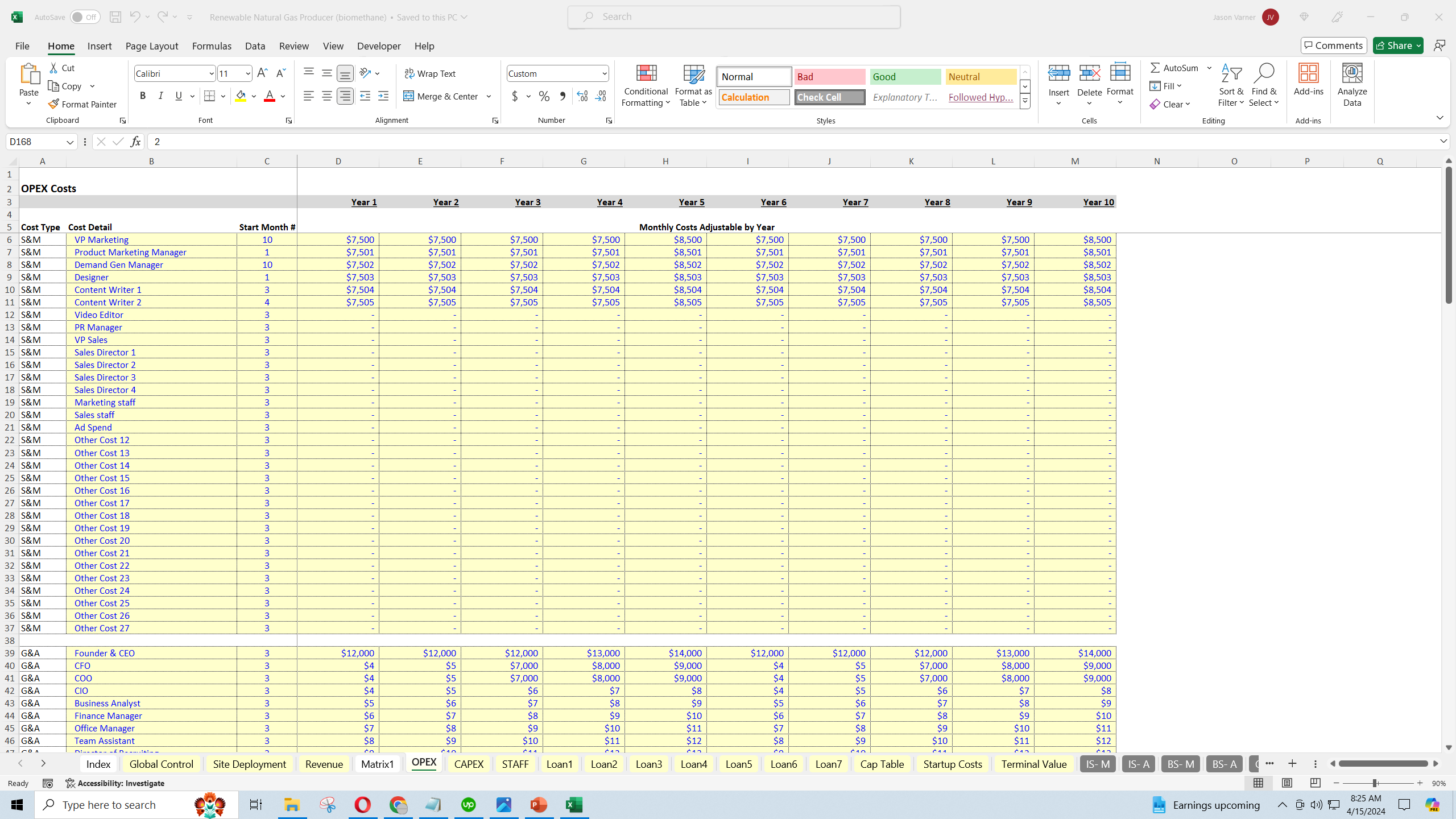

To fully account for operational activity, there is a general overhead cost section that is used to account for expenses such as executive management, legal and professional fees, IT / software, insurance, and the like.

Depreciation expenses are a big part of operations if you are buying the facility or constructing it as well as purchasing the required equipment. Knowing that expense in relation to EBITDA is key to analyzing the ongoing total cost to produce 1 cubic meter of biogas as well as how profitable the project is. This model has a fully integrated set of monthly and annual financial statements (Income Statement, Balance Sheet, and Cash Flow Statement) that change as the assumptions are adjusted.

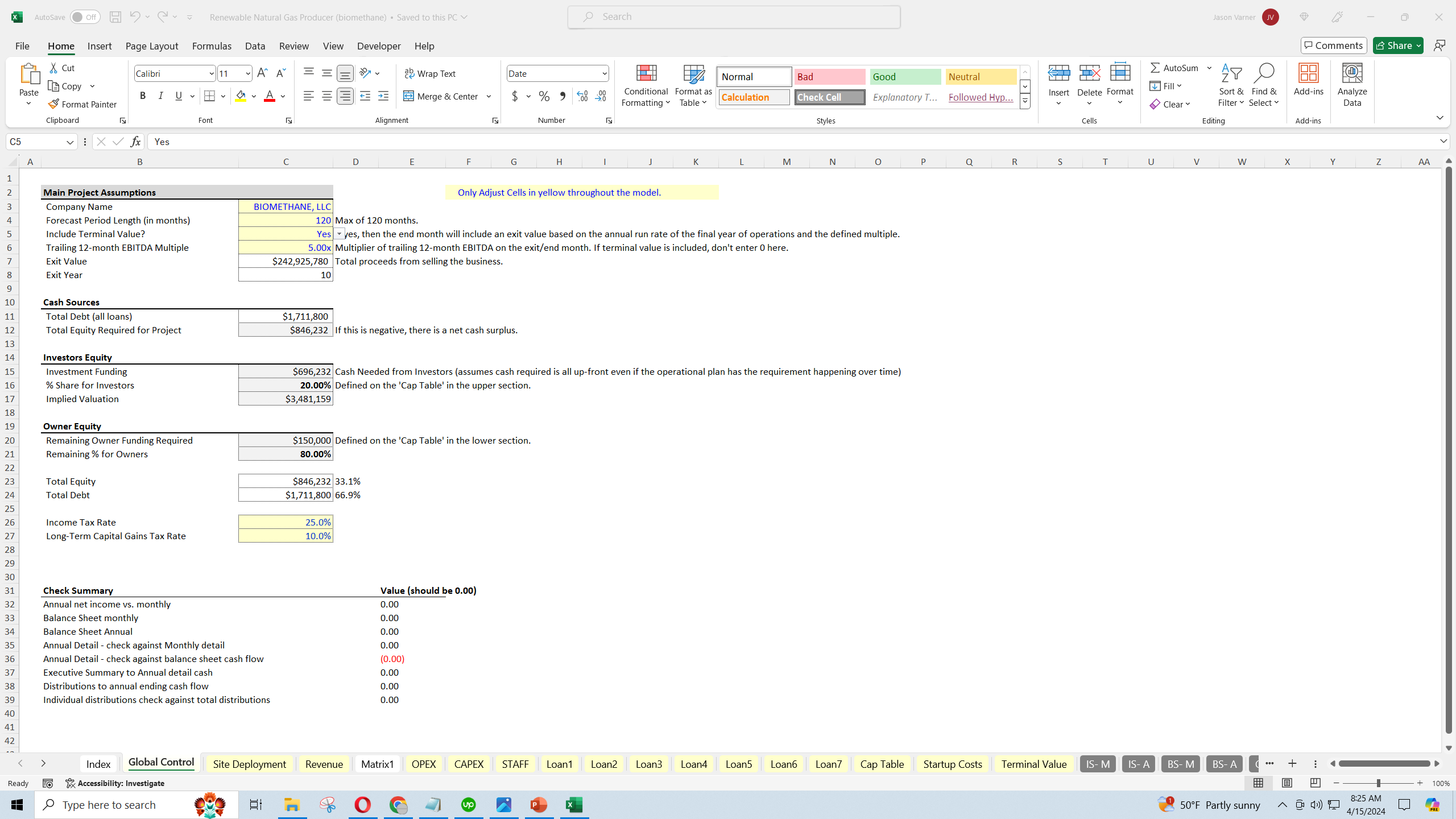

Other output reports include IRR (for the project and investor / operator if a joint venture is configured in the cap table), DCF Analysis, Equity Multiple, and total ROI.

Instructional video included in the file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Energy Industry, Integrated Financial Model Excel: Biogas Producer Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping