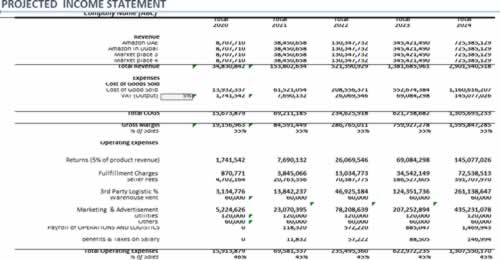

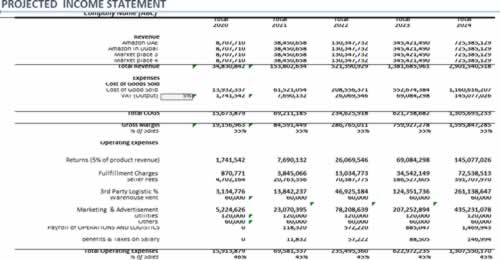

Editor's Note: Take a look at our featured best practice, Ecommerce Financial Model (Excel workbook). Model Options:

This template is a detailed and user-friendly financial model that considers an e-commerce business's specifics.

By Taking into account key assumptions such as traffic from different sources, conversion rates, the average purchase value for different product categories, and the [read more]

* * * *

In a research brief released in 2019, analyst eMarketer detailed how digitally-native direct-to-consumer (D2C) brands were disrupting traditional retail. Apparel, beauty, home furnishings, and consumer packaged goods were called out as niches where this disruption was particularly prevalent, with food & beverage and personal care emerging as promising challengers. Even back then, growth in these sectors was in the double-digit range, as reported by Entrepreneur — though many predicted that D2C was a bubble nearing its breaking point.

In a research brief released in 2019, analyst eMarketer detailed how digitally-native direct-to-consumer (D2C) brands were disrupting traditional retail. Apparel, beauty, home furnishings, and consumer packaged goods were called out as niches where this disruption was particularly prevalent, with food & beverage and personal care emerging as promising challengers. Even back then, growth in these sectors was in the double-digit range, as reported by Entrepreneur — though many predicted that D2C was a bubble nearing its breaking point.

How the Coronavirus Redefined D2C

Then the pandemic hit, and everything changed. In just 90 days, notes analyst McKinsey, we saw ecommerce penetration in the U.S. leap forward ten years. In the process, D2C brands, many of which were in the process of looking into brick-and-mortar locations and omnichannel sales, saw growth that could be conservatively referred to as “explosive.”

For instance, Arnaud Plas, founder and CEO of Personalized hair care startup Prose, told Forbes Magazine last year that his business was on track to make $50 million in 2020, more than triple its 2019 revenue. And Plas’s situation is far from unique. As reported by Retail Dive, even D2C brands that were struggling prior to the pandemic experienced a massive increase in sales.

Traditional retailers were hit much harder.

As reported by Vox in November, malls and department stores face a bleak future post-COVID. As with the D2C boom, this trend wasn’t entirely the result of the pandemic. A growing disparity in wealth between the upper and middle class coupled with a shift to the web as the primary means of brand discovery have portended doom for the sector — the pandemic may simply have been the final nail in the coffin.

That isn’t to say that all retailers are struggling, however. Major brands like Wal-Mart, Best Buy, Levi’s, Nike, and Adidas have all made significant inroads into the D2C space, seamlessly adopting an omnichannel approach both in response to the pandemic and in preparation for its eventual end. Many of them were working on such measures even before the pandemic, having already seen the writing on the wall long before lockdowns and quarantines.

The question that remains is the impact this shift will have on the larger ecommerce space.

Omnichannel Sales, D2C, and the Future of Ecommerce

According to analyst Nielsen, every ecommerce program follows a similar growth curve:

- Brochureware. Passive presentation of marketing materials and product information. Functionally an online brochure rather than an actual storefront.

- Single-party selling. A brand establishes a single channel/storefront on which to sell its products, generally direct-to-consumer. Alternatively, the brand might sell on an already established site.

- Multichannel. A brand maintains multiple digital and physical channels through which it sells its products.

- Omnichannel. Similar to omnichannel, in that a brand sells across multiple sales channels. Omnichannel stands out because it focuses entirely on the customer experience and ensures that a consumer’s purchase journey can seamlessly span multiple channels.

- Headless. The final evolution of a business’s ecommerce journey, which sees backend infrastructure decoupled from the frontend. This presents multiple benefits for omnichannel sales, including greater flexibility and enhanced personalization.

In essence, the pandemic has forced multiple businesses and brands to evolve from the first two stages of this growth curve to the final two in an incredibly short amount of time.

Speaking in an interview with Forbes, Marcus Startzel, CEO of ecommerce marketplace management app Whitebox, noted that this has completely changed the face of digital commerce. It has, he said, created “new dynamics and choices across a variety of marketplaces and channels.” Startzel then noted that we’ve reached an “unprecedented” moment in retail history. However, he predicts that, even once the pandemic is over, the renewed focus on the customer experience will remain a constant.

He also believes it likely that brick-and-mortar transactions will further decrease while product access will continue to evolve.

In the short term, this means a significant increase in competition and significantly more opportunities to generate revenue by attracting new customers and breaking into new niches. In the long term, it means that perhaps except for fulfillment by Amazon (FBA) sellers, successful ecommerce businesses will need to adopt a headless, omnichannel approach. It’s the only way to feasibly support the level of personalization, flexibility, and fluidity demanded by consumers.

Speaking of customer demand, data from end-to-end ecommerce provider Scalefast paints a very clear picture of what customers in this new landscape want:

- 61% of people are willing to share more personal information to enable a better shopping experience.

- 54% of shoppers expect a personalized discount within the first day of contact with a new brand.

- 51% of customers believe a personalized, omnichannel experience is crucial.

Navigating the New Ecommerce Landscape

The line between traditional retail and ecommerce has never been more blurred. As we move past COVID-19 into a connected future, that line is likely to vanish altogether. Just as distributed work and distributed learning will give way to hybrid offices and classrooms, so too will the D2C boom create a hybrid future for sales.

Those businesses capable of embracing this future with the right technology and processes will likely see a significant upturn in revenue, competitiveness, and ultimately, value. Those that cannot adapt are likely to trend in the opposite direction, outstripped and outshone by savvier competitors.

27-slide PowerPoint presentation

Growth Hacking is neither "scoring some quick wins to kick-start growth" nor "breaking into something one should not." Growth Hacking actually involves a consistent, scientific process to work towards business growth.

Growth Hacking is valuable for large enterprises, but more so for small

[read more]

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on E-commerce and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

Excel workbook

An e-commerce platform for physical products is a digital solution that enables businesses to sell tangible goods online. It provides tools for listing products, managing inventory, processing payments, handling shipping, and tracking orders. Customers can browse, purchase, and review items through

[read more]

Excel workbook

An E-commerce Excel Financial Model Template Business allows you to target a broader range of customers and gain more profit. However, to make such a business a success, it is critical to have proper planning and management of resources. Our E-commerce Excel Financial Model Template can make your

[read more]

33-slide PowerPoint presentation

An Industry Value Chain is a visual representation of the series of steps an organization in a specific industry takes to deliver a product or service to the market. It captures the main business functions and processes that are involved in delivering the end product or service, illustrating how

[read more]

13-page Word document

This e-commerce business plan is a detailed roadmap that will guide you in starting a successful e-commerce business. It has pre-written content, including important sections like market research, product offerings, marketing strategies, and financial projections.

You can use this sample plan as

[read more]

In a research brief released in 2019, analyst eMarketer detailed how digitally-native

In a research brief released in 2019, analyst eMarketer detailed how digitally-native