Editor’s Note: This article is contributed by guest author, Amanda E. Clark, a contributing writer to LLC University. She is a graduate of Eastern Michigan University and holds degrees in Journalism, Political Science, and English. She became a professional writer in 2008 and has led marketing and advertising initiatives for several Fortune 500 companies. She has appeared as a subject matter expert on panels about content and social media marketing. She regularly leads seminars and training sessions on trends and tactics in professional writing.

* * * *

You’ve launched your own business. You’re ready to start making your fortune. But first things first: Every business owner needs to fulfill some basic administrative tasks. And one of the most essential tasks is ensuring you have a bank account.

The type of bank account you open will vary according to the legal structure of your business. For example, if you decide to create an LLC in Texas, you’ll need to go to a local bank to start an LLC bank account. Doing so will offer many benefits, and potentially a few drawbacks.

What Makes LLC Bank Accounts Different?

First, it’s important to know exactly what an LLC bank account is, and how it differs from an individual account.

Keep in mind that the point of an LLC is to relieve stakeholders, including the business owner, of personal liability in the business. An LLC bank account exists primarily to demonstrate that the business and its owner(s) are separate entities. That way, should a lawsuit be brought against the company, your personal assets will be shielded.

On a practical level, LLC bank accounts will require you to furnish your company’s EIN, as well as other relevant business documentation.

Why Start an LLC Bank Account?

Opening an LLC bank account gives all owners and stakeholders access to the business’ funds. That’s just one of many benefits that an LLC bank account offers:

It Offers Protection

When you open an LLC bank account, it provides you with legally sound paperwork, demonstrating that you and the business are two separate entities with separate assets. Should your company ever become embroiled in any sort of legal trouble, this will keep your personal accounts out of view and out of harm’s way.

It Can Help You at Tax Season

Another reason to have a business bank account is that it can make tax filing easier to manage. For one thing, an LLC bank account will have all your relevant business transactions in a single place. Additionally, your LLC will qualify you for the same tax treatment you’d get if you had a Partnership or Sole Proprietorship.

In fact, depending on how many owners the business has, the IRS will automatically classify the company as a Partnership or Sole Proprietorship. This will allow you to “pass through” your taxes, avoiding higher corporate tax rates.

The bottom line: Compared with other business structures, LLCs make tax season fairly simple and straightforward.

It Helps with Bookkeeping

If having a business bank account streamlines tax season, it has much the same effect on your general bookkeeping practices.

Having your LLC’s assets reflected in a single bank account makes it easy for your bookkeeper to know which numbers to look at, and which ones to stay away from.

Are There Any Downsides to Having a Business Bank Account?

While there are a number of advantages to starting an account expressly for your LLC, there are also some potential limitations to bear in mind.

You Surrender Sole Control

If you are the sole owner of your business, then this is nothing to worry about. If you have partners, however, then you should know that a business bank account will provide each stakeholder with equal access and authority.

This means you have less control over your company’s finances. You’ll need to ensure clarity of communication and accountability between you and the other owner(s).

You’ll Need to File Two Tax Returns

Though business bank accounts make tax season easier in most regards, there is one wrinkle. You’ll need to file two separate returns: A personal one, and a business one.

This is still easier than what you’d experience with other business structures, but potentially requires more work than if you were self-employed without establishing an LLC.

There Are Fees to Consider

Finally, be aware that opening a business bank account does require you to formally establish an LLC, which often comes with some nominal startup fees.

Meanwhile, the bank account itself may require you to pay certain maintenance fees. It’s worth shopping around, comparing a few different banks, to determine which institution offers the most affordable options.

Do You Need a Business Bank Account?

Ultimately, as you consider your options for launching a business, starting an LLC can be a smart way to keep your personal and family assets safe. If that’s the route you take, you’ll want to secure banking documents signifying the separation between you and the business.

In this way, starting a business bank account is a smart step to protect your business, while potentially offering additional tax filing and bookkeeping benefits. While the pros and cons of starting an LLC bank account must all be considered, this is generally a good option for entrepreneurs looking to keep themselves safe from any undue risk.

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Small Business and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

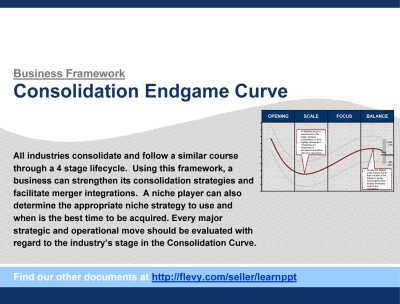

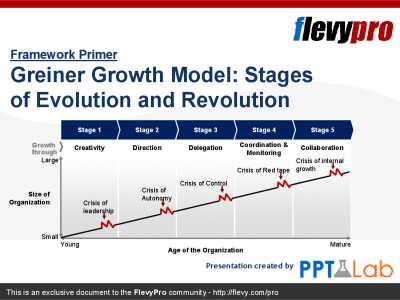

28-slide PowerPoint presentation

The Greiner Growth Model (Stages of Evolution and Revolution), developed by Larry Greiner, is a maturity model describing how organizations evolve through 5 stages of growth. Each stage requires appropriate strategies and structures to cope. The Greiner Growth Model is a descriptive framework

[read more]

66-slide PowerPoint presentation

Introducing the Ultimate Business Exit Strategy Framework: Achieve Seamless Transition and Maximize Your Returns

Are you a business owner or entrepreneur looking to ensure a smooth and profitable transition out of your current venture? The world of business exits can be complex and daunting, but

[read more]

24-page Word document

This financial policy manual is suitable for a small business. This manual aims to provide guidance :

1. By ensuring that all staff are aware of finance transactions with the business; and

2. Is a way for finance staff to make consistent decisions.

The aim of this manual is to assist in

[read more]

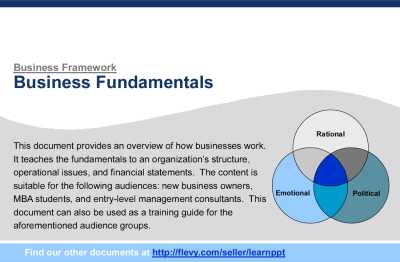

50-slide PowerPoint presentation

This presentation provides an overview of how businesses work. It teaches the fundamentals to understanding how modern businesses work, covering the business topics of Organizational Structures, Operational Issues, and Financial Statements.

The content is suitable for the following audiences:

[read more]