Editor's Note: Take a look at our featured best practice, Five Stages of Business Growth (25-slide PowerPoint presentation). This presentation introduces a framework for entrepreneurs to use when building and navigating their business from a nascent, startup state to an enterprise with a global footprint. This framework, called the 5 Stages of Business Growth, is based on the fact that all businesses experience common [read more]

* * * *

Are you considering venturing into the world of franchising? Many aspiring entrepreneurs find themselves pondering the potential of franchises as a viable investment option. However, conducting thorough research and assessing the potential risks and rewards is crucial before making a significant financial commitment.

Are you considering venturing into the world of franchising? Many aspiring entrepreneurs find themselves pondering the potential of franchises as a viable investment option. However, conducting thorough research and assessing the potential risks and rewards is crucial before making a significant financial commitment.

Franchises, like any other investment, come with their own unique set of challenges and benefits. To give you a balanced perspective, consider exploring the following advantages and disadvantages to decide whether it is the right path for you.

Advantages of Investing in Franchises

Here are the enticing advantages of investing in franchises, which is why they make an attractive choice for budding entrepreneurs.

1. Brand Recognition

The most significant advantage of investing in franchises is instant brand recognition. Established franchises come with a loyal customer base, giving you a head start in attracting clientele. Furthermore, franchisees benefit from the franchisor’s marketing support, helping maintain and grow the brand’s visibility and reputation.

2. Proven Business Model

A strong business model is another major benefit of investing in franchises. Franchisors have already ironed out the kinks in their systems, reducing the risk of failure for franchisees. This established framework allows new owners to follow a tried-and-true formula, ensuring a smoother, more predictable path to success.

3. Training and Support

Franchises typically offer comprehensive training and support to new franchise owners — ensuring they have the knowledge and tools to back up their business operations effectively. This includes initial training programs and ongoing assistance in various departments, including marketing, processes and technology. Therefore, you would already have a strong foundation for your franchise’s success.

4. Purchasing Power

Investing in a franchise also grants you purchasing power through economies of scale. Franchise networks can negotiate better deals on supplies and inventory due to their collective buying power. This advantage results in cost savings for the franchise owner, ultimately leading to improved profitability and a higher competitive edge.

Disadvantages of Investing in Franchises

Despite these attractive benefits, it is essential to consider the potential drawbacks of investing in franchises to make a well-rounded decision.

1. High Initial Costs

One thing to be aware of is that franchise investments come with high startup costs. Franchisees are typically required to pay a hefty franchise fee upfront. Additionally, there are other various startup costs such as equipment, inventory and leasehold improvements. These can pose a substantial financial burden for new business owners.

2. Limited Creativity and Control

Franchises often face limitations in creativity and control when operating within a system. Adherence to the franchisor’s rules and regulations is crucial for maintaining brand consistency. However, these rules can restrict the franchise owner’s ability to customize products or services.

With this constraint in mind, it can be frustrating for entrepreneurs seeking more autonomy and innovation in their businesses. For those who prefer greater control, buying a business outright instead of joining a franchise system might offer the independence they’re looking for.

3. Ongoing Fees and Royalties

Another downside of franchise ownership is the ongoing fees and royalties that franchises must pay to the franchisor. These may include monthly or annual fees in addition to advertising.

For instance, McDonald’s requires franchisees to pay up to $45,000 every 20 years to keep the contract operating. These costs are something to keep in mind, as ongoing expenses can impact the franchise’s profitability over time.

4. Franchisor Dependency

Franchisor dependency is another challenge that business owners face, as their success largely depends on the decisions and performance of the franchisor. Management, strategy or brand reputation changes can directly impact franchise operations, and potential conflicts of interest could arise. Therefore, this leaves franchise owners vulnerable to factors beyond their control.

Factors to Consider When Evaluating a Franchise Opportunity

When evaluating a franchise opportunity, it is crucial to consider several factors to ensure you are making a wise investment:

- Assess financial stability and track record: Look into the franchisor’s financial performance, number of successful units and overall market presence.

- Examine market demand and competition: Research growth trends and analyze the competitive landscape to determine if there is room for your franchise to thrive. This analysis will help you gauge the potential for success in your chosen market.

- Look at the level of support and training they provide: Quality training programs and ongoing support resources are vital for franchisees to navigate the business landscape successfully.

- Evaluate the total investment cost and potential return on investment: Factor in initial and ongoing expenses and compare them with expected revenue and profit margins. This assessment will help you determine if the investment is likely to yield a satisfactory return in the long run.

Should You Invest in Franchises?

Franchises can be a good investment, offering several advantages for aspiring entrepreneurs. However, it is essential to weigh these benefits against the potential drawbacks.

The decision to invest in a franchise ultimately depends on your personal preferences, risk tolerance and financial situation. As with any investment, thorough research and due diligence are key to making the best decisions for your future. Consider examining the factors, pros and cons to help determine if franchises are the right investment opportunity.

While franchises can offer a lower-risk path to business ownership, success is never guaranteed. With the right mindset, thorough research and dedication, investing in a franchise can become a rewarding and profitable venture for many entrepreneurs.

29-slide PowerPoint presentation

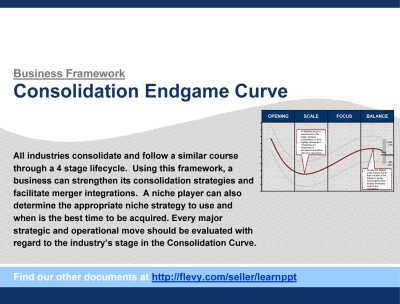

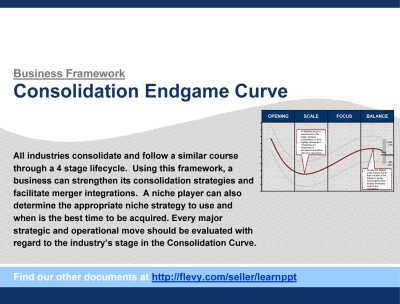

The Consolidation Curve, or Endgame Curve, is a framework based on the theory that all industries consolidate and follow a similar course through the 4 stages of: Opening, Scale, Focus, and Balance & Alliance. This framework is based on a study of 25,000 firms globally, representing 98% of the

[read more]

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Small Business and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

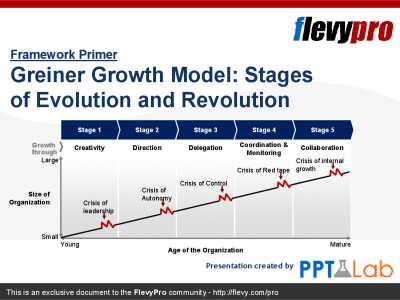

28-slide PowerPoint presentation

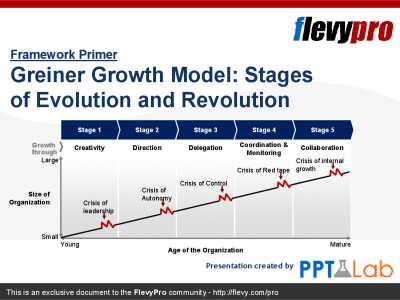

The Greiner Growth Model (Stages of Evolution and Revolution), developed by Larry Greiner, is a maturity model describing how organizations evolve through 5 stages of growth. Each stage requires appropriate strategies and structures to cope. The Greiner Growth Model is a descriptive framework

[read more]

24-page Word document

This financial policy manual is suitable for a small business. This manual aims to provide guidance :

1. By ensuring that all staff are aware of finance transactions with the business; and

2. Is a way for finance staff to make consistent decisions.

The aim of this manual is to assist in

[read more]

50-slide PowerPoint presentation

This presentation provides an overview of how businesses work. It teaches the fundamentals to understanding how modern businesses work, covering the business topics of Organizational Structures, Operational Issues, and Financial Statements.

The content is suitable for the following audiences:

[read more]

66-slide PowerPoint presentation

Introducing the Ultimate Business Exit Strategy Framework: Achieve Seamless Transition and Maximize Your Returns

Are you a business owner or entrepreneur looking to ensure a smooth and profitable transition out of your current venture? The world of business exits can be complex and daunting, but

[read more]

Are you considering venturing into the world of franchising? Many aspiring entrepreneurs find themselves pondering the potential of franchises as a viable investment option. However, conducting thorough research and assessing the potential risks and rewards is crucial before making a significant financial commitment.

Are you considering venturing into the world of franchising? Many aspiring entrepreneurs find themselves pondering the potential of franchises as a viable investment option. However, conducting thorough research and assessing the potential risks and rewards is crucial before making a significant financial commitment.