Let’s be honest, fraud no longer wears a cheap disguise. In 2025, we’re dealing with tricksters who wield high-end digital tools, AI generators, and picture-perfect Photoshop edits. The result? Counterfeit bank statements, identity documents, pay stubs, and utility bills that could fool even the most seasoned compliance officer.

Let’s be honest, fraud no longer wears a cheap disguise. In 2025, we’re dealing with tricksters who wield high-end digital tools, AI generators, and picture-perfect Photoshop edits. The result? Counterfeit bank statements, identity documents, pay stubs, and utility bills that could fool even the most seasoned compliance officer.

And the stakes couldn’t be higher. According to the Federal Trade Commission (FTC), consumers in the U.S. alone lost over $12.5 billion to fraud in 2024, a 25 % jump compared to the previous year. “The data we’re releasing today shows that scammers’ tactics are constantly evolving,” warned Christopher Mufarrige, Director of the FTC’s Bureau of Consumer Protection.

That number isn’t just a statistic; it’s a wake-up call. Document fraud is no longer a niche problem; it’s a persistent threat with real consequences:

- Financial Losses – Direct theft, fake loans, and invoice scams.

- Reputational Damage – Trust lost with clients and partners.

- Legal Consequences – Regulatory fines, compliance violations.

For businesses in banking, insurance, real estate, HR, and beyond, the authenticity of just one document can make or break a transaction. Which is exactly why AI-powered OCR fraud detection software has gone from “nice to have” to “mission critical.”

OCR Fraud Detection – Intelligent Eyes for a Digital Era

At its core, OCR (Optical Character Recognition) is the technology that reads and extracts text from images or scanned documents. It replaces manual data entry, speeds up workflows, and reduces human error. But when fraud enters the mix, OCR alone isn’t enough.

Modern document fraud detection software use OCR as a starting point and then layer advanced forensic analysis on top. Think of it like a document CSI lab:

- Metadata Forensics – Checking creation dates, edit timestamps, and the devices used.

- Image Analysis – Spotting cloned regions, tampered signatures, or copy-paste edits.

- Data Validation – Comparing extracted information with trusted external databases.

- EXIF & MRZ checks – Verifying passport data zones and file origins for authenticity.

The result? Fraud can be flagged before onboarding a customer, approving a loan, or processing an insurance claim. That means speed, assurance, and fewer nasty surprises.

Why Fraud Detection Needs AI in 2025

Fraudsters in 2025 aren’t just using photo-editing software; they’re leveraging AI to create synthetic identities, deepfake ID images, and fake invoices at scale. These manipulations are often so subtle that even meticulous manual reviews miss them.

Examples of evolving fraud tactics include:

- Synthetic Identity Fraud – Mixing real and fake data to create an entirely new “person.”

- Template Fraud – Mass-producing identical false documents to bypass simple checks.

- Pre-Digital Editing – Altering printed documents by hand, then rescanning to hide evidence.

- Serial Fraud – Recycling the same fake file across dozens of systems.

Why AI helps:

- It’s faster (instant scoring without delays).

- It’s consistent (never tired, never distracted).

- It learns (detecting fraud patterns that weren’t in last year’s playbook).

The Leading OCR Fraud Detection Tools of 2025

With demand skyrocketing, the market is packed with solutions, but here are six standout names worth knowing:

1. Klippa DocHorizon

Klippa DocHorizon doesn’t stop at OCR. It runs multi-layered fraud checks, including Photoshop detection, EXIF metadata analysis, copy-move forensics, and compliance workflows for KYC. Its 200+ integrations make it plug-and-play for ERP, CRM, and accounting platforms.

Best for: Businesses wanting the convenience of OCR, fraud detection, and identity verification rolled into one.

2. Inscribe

Perfect for fintechs and lenders. Excels at detecting synthetic identities and offers transparent risk scoring through a strong API.

Best for: Digital-first businesses tackling onboarding fraud.

3. ABBYY

Enterprise-grade OCR meets metadata checks and image forensics. Often deployed with RPA tools for huge document volumes.

Best for: Large enterprises processing thousands of documents daily.

4. Resistant AI

Specializes in PDF structure analysis and detecting layered edits. Strong presence in the crypto and lending world.

Best for: Companies needing deep forensic analysis at scale.

5. IBM Security Trusteer

Combines document verification with device fingerprinting and behavioral analytics, ideal for massive transaction volumes.

Best for: Global enterprises handling high-risk, high-value data flows.

6. Experian CrossCore

Pair fraud detection with Experian’s rich identity and credit datasets, giving a multi-dimensional view of risk.

Best for: Lenders and insurers needing integrated credit and document checks.

Choosing the Right OCR Fraud Detection Software

When evaluating your options, pay attention to:

- Multi-layered detection: OCR is just step one; you need metadata and image forensics.

- Real-time alerts: Because minutes matter when approving transactions.

- Accuracy: Fraud detection is useless if data extraction is wrong.

- Integration flexibility: Smooth connections to ERP, CRM, HR, and finance systems.

- Security certifications: Non-negotiable for compliance-heavy industries.

- Explainability: Fraud scores should be understandable, not a black box.

The 2025 Winner – Why Klippa Stands Out

Every tool on this list brings solid capabilities to the table. But Klippa DocHorizon consistently leads for one simple reason: it delivers a complete, AI-powered fraud detection and document processing ecosystem without forcing businesses to juggle multiple platforms.

With its combination of 99% OCR accuracy, pixel-level image forensics, compliance automation, and enterprise-grade integrations, Klippa catches fraud before it can hurt your bottom line, all while speeding up everyday workflows.

In a year where fraud losses climbed sharply, and scammers continue to get smarter, Klippa makes the fight a little more one-sided.

Final Thought

Document fraud isn’t going away; it’s leveling up. FTC figures prove this is not just “someone else’s problem.” Whether your business is in finance, logistics, HR, or real estate, the question isn’t if fake documents will cross your path, but when. Choosing an OCR fraud detection platform now could be the difference between a minor inconvenience and a multimillion-dollar disaster.

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Fraud and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

140-slide PowerPoint presentation

Create Fraud Awareness: Fraud and corruption affect all types of organizations. The fraud and corruption is common and increasing risk across organizations. Those charged with governance have a duty to govern this significant with in order to protect organization asset, resources and value. Many

[read more]

24-slide PowerPoint presentation

Markets today offer rewarding opportunities for organizations in new territories. But these opportunities are not devoid of the perils of encountering new risks concerning corporate corruption and fraud.

To contest the danger of denting their reputation and results, senior leaders must strive

[read more]

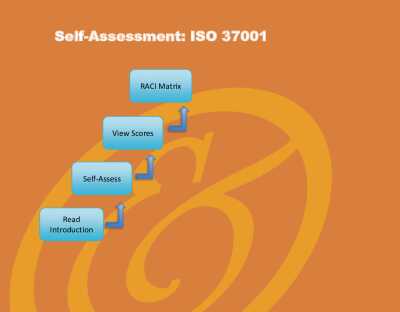

Excel workbook

The ISO 37001 Implementation Toolkit includes a set of best-practice templates, step-by-step workplans, and maturity diagnostics for any ISO 37001 related project. Please note the above partial preview is ONLY of the Self Assessment Excel Dashboard, referenced in steps 1 and 2 (see below for

[read more]

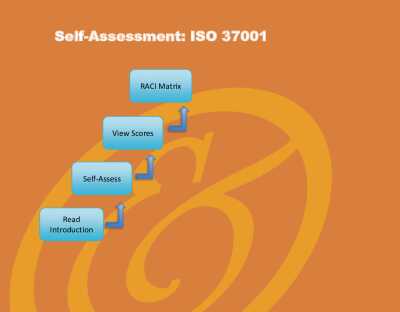

Excel workbook

The Anti Bribery Implementation Toolkit includes a set of best-practice templates, step-by-step workplans, and maturity diagnostics for any Anti Bribery related project. Please note the above partial preview is ONLY of the Self Assessment Excel Dashboard, referenced in steps 1 and 2 (see below

[read more]

Let’s be honest, fraud no longer wears a cheap disguise. In 2025, we’re dealing with tricksters who wield high-end digital tools, AI generators, and picture-perfect Photoshop edits. The result? Counterfeit bank statements, identity documents, pay stubs, and utility bills that could fool even the most seasoned compliance officer.

Let’s be honest, fraud no longer wears a cheap disguise. In 2025, we’re dealing with tricksters who wield high-end digital tools, AI generators, and picture-perfect Photoshop edits. The result? Counterfeit bank statements, identity documents, pay stubs, and utility bills that could fool even the most seasoned compliance officer.