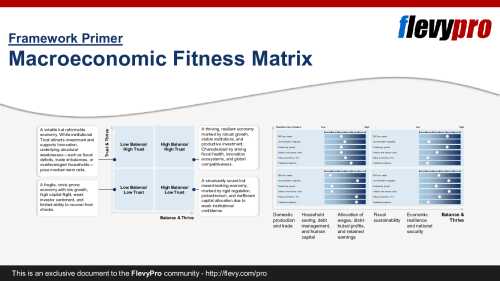

In the age of tariff wars, fractured trade agreements, and vanishing multilateralism, macroeconomic resilience is no longer just about GDP or unemployment rates. It is about Balance and Trust. That’s where the Macroeconomic Fitness Matrix framework comes into play. Built on two deceptively simple dimensions—Balance and Trust—this consulting framework offers a diagnostic map to navigate a fragmented global economy.

In the age of tariff wars, fractured trade agreements, and vanishing multilateralism, macroeconomic resilience is no longer just about GDP or unemployment rates. It is about Balance and Trust. That’s where the Macroeconomic Fitness Matrix framework comes into play. Built on two deceptively simple dimensions—Balance and Trust—this consulting framework offers a diagnostic map to navigate a fragmented global economy.

Originally developed to address systemic fragility accelerated by post-2020s protectionism, the Macroeconomic Fitness Matrix cuts through the noise. It segments economies into 4 archetypes based on structural integrity and institutional credibility. Think of it as a heat map for national economic performance in an era where Supply Chains are political weapons, and trust is the most valuable currency.

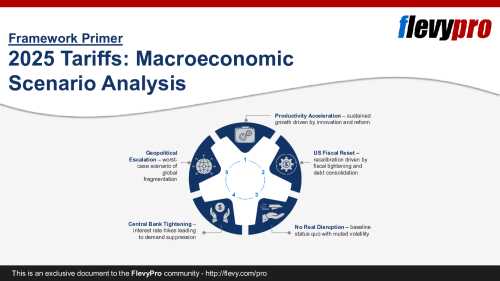

Let’s run this framework through a modern lens—April 2025. The U.S. imposed sweeping tariffs, jacking up average tariff rates to 22 percent. The move triggered immediate economic disruption and heightened investor unease. Global uncertainty went into cardiac arrest, with the Economic Policy Uncertainty Index exploding past the 500 mark. Investors bailed. Households felt the pinch. The root of the instability? Weak institutional trust paired with structural imbalances. The U.S. slipped from “Thriving” to “Volatile”—exposing why no nation is immune from a crisis of confidence. This rising geopolitical friction demands the need for a new foundation built on systemic balance and institutional trust for economies to prosper again.

The Macroeconomic Fitness Matrix defines 2 interdependent drivers of prosperity: Trust and Balance. These dimensions form the core axes of the matrix:

- Trust & Thrive (Vertical Axis)

- Balance & Thrive (Horizontal Axis)

The 4 quadrants of the matrix include:

- High Trust / High Balance – Thriving economies

- High Trust / Low Balance – Reformable economies

- Low Trust / High Balance – Technically stable but brittle

- Low Trust / Low Balance – Crisis-prone laggards

The Macroeconomic Fitness Matrix is valuable because it does what standard economic indicators can’t. It links sentiment and system. Most templates look backward. This one scans for structural fractures and psychological fault lines. Trust isn’t just a soft metric. It’s the bedrock of investment velocity, Innovation pipelines, and cross-border capital flow. Strip that away, and you are left with volatility and transactional friction.

The Macroeconomic Fitness Matrix is directional. Countries do not sit still. Policy shifts, institutional reforms, or even a single global shock (like an AI-led employment overhaul) can send an economy spiraling from high-growth to high-risk. The framework lets leaders benchmark not only where they are—but where they are heading.

The model brings clarity to chaos. Tariffs, sanctions, and export controls are not just tools, they are weapons of distrust. This framework reframes them within a macro logic: they either degrade or rebuild Trust and Balance. And it forces governments to answer: are your moves amplifying systemic resilience, or are you just throwing elbows in a zero-sum game?

Let’s break down the 2 dimensions of the Macroeconomic Fitness Framework.

Trust & Thrive

Institutional trust is not a PR metric. It is an operational Key Performance Indicator. When investors, businesses, and households believe in the rules of the game, they commit. You get stable FDI, fluid data flows, and lower capital costs. Regulatory transparency matters more than tax rates. Predictability trumps profitability. Without trust, every transaction becomes a negotiation. Legal fees climb. Insurance spreads widen. Everyone hedges, no one builds. Trust is the lubricant of modern economies.

Balance & Thrive

Balance is what keeps the lights on. Trade deficits, bloated fiscal spending, household debt—these are macro potholes. A balanced economy has its act together: sustainable budgets, resilient supply chains, a productive labor force, and strategic security around critical inputs. When a shock hits—e.g., a cyberattack or raw materials squeeze—it absorbs the blow. Imbalanced systems break. They either inflate, deflate, or freeze.

Let’s zoom in on the High Trust / Low Balance quadrant. Call it the “Reformable” economy. Think of South Korea in the early 2000s or even the U.S. during certain fiscal cycles. Institutions are solid. Innovation’s humming. But under the hood, the engine’s leaking oil: rising deficits, weak productivity, inflated housing markets. These countries attract capital but burn through it. If policy stays inert, the optimism turns fragile.

Now take the Low Trust / High Balance quadrant. Think of Germany post-2025 tariffs. Structurally tight, export machine humming. But political gridlock and public disillusionment eat away at the institutions. Investment stalls. Growth slows. Capital doesn’t flee, but it yawns. This quadrant is not a disaster; it is a warning light.

Case Study

Germany entered 2025 as a textbook example of structural balance—fiscal discipline, trade surpluses, and a resilient industrial base. But as geopolitical rifts deepened and the EU followed the U.S. lead on tariff retaliation, the country’s low-trust dynamics began to drag. Public confidence in institutions eroded amid bureaucratic inertia and policy gridlock. Foreign direct investment slowed, innovation spending plateaued, and capital allocation turned defensive. Despite macro soundness, the lack of institutional agility pushed Germany into the “Low Trust / High Balance” quadrant—stable on paper, but increasingly inefficient and inward-facing. The shift exposed how resilience requires more than strong fundamentals—it demands public trust to unlock growth.

FAQs

What does “Trust” actually measure in this context?

Trust captures institutional predictability, regulatory clarity, and perceived fairness in policy enforcement—key ingredients for long-term investment and collaboration.

How can countries move from one quadrant to another?

Through structural reforms, fiscal discipline, and rebuilding institutional legitimacy. The Macroeconomic Fitness Matrix is a dynamic model and not a death sentence.

Why not just focus on GDP and inflation?

Because those are trailing indicators. Trust and Balance are leading indicators of systemic resilience and economic velocity.

Are tariffs always bad under this model?

No. Tariffs can temporarily defend Balance but erode Trust. It depends on duration, intent, and how they are communicated.

Can private sector actors use this model?

Absolutely. It helps multinationals assess macroeconomic risk, policy trajectory, and market reliability before expanding or investing.

Closing Thoughts

Here is what this model subtly exposes: global prosperity is not a function of trade volume or monetary policy. It hinges on something far squishier—belief. Belief in institutions. Belief in rule of law. Belief that if you build, they will not regulate you out of relevance. And belief that your national balance sheet is not a house of cards.

What should keep executives up at night is not just volatility, it is drift. Economies that are not actively building trust and reinforcing balance are sliding. And you do not notice the drop until the floor is gone.

We are in a moment where macro is personal. National trust deficits lead to household pessimism. Structural imbalances trigger layoffs, not just spreadsheets. The Macroeconomic Fitness Matrix turns this complexity into a strategic map. It does not predict the future. But it forces you to prepare for it.

Interested in learning more about the other quadrants of the Macroeconomic Fitness Matrix to map your national economic performance? You can download an editable PowerPoint presentation on Macroeconomic Fitness Matrix here on the Flevy documents marketplace.

Do You Find Value in This Framework?

You can download in-depth presentations on this and hundreds of similar business frameworks from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

In the age of tariff wars, fractured trade agreements, and vanishing multilateralism, macroeconomic resilience is no longer just about GDP or unemployment rates. It is about Balance and Trust. That’s where

In the age of tariff wars, fractured trade agreements, and vanishing multilateralism, macroeconomic resilience is no longer just about GDP or unemployment rates. It is about Balance and Trust. That’s where