The insurance industry is one of the bedrocks of economic stability, enabling businesses and individuals to manage risk, preserve capital, and navigate uncertainty. As digital transformation continues to reshape industries, the insurance sector faces both tremendous challenges and opportunities.

Insurers are shifting to customer-centric models, leveraging advanced data analytics to offer personalized policies, and adopting cutting-edge technology to streamline operations. This sector remains a critical component of economic growth, offering products that protect assets and minimize risks for businesses and individuals alike.

At the heart of this evolution is the insurance value chain, which encapsulates the core and support activities essential for insurers to remain competitive. Each link in this chain must function seamlessly, from product development and underwriting to customer service and claims processing. A robust value chain is no longer optional—it is the cornerstone of delivering value in today’s hyper-competitive insurance market.

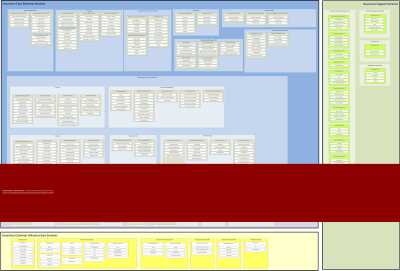

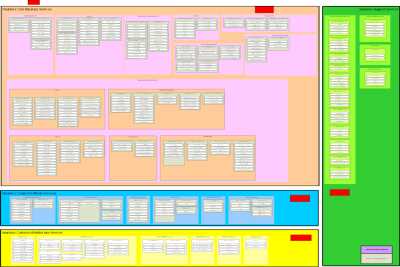

Mapping out the Insurance Value Chain

The value chain in insurance provides a structured approach for understanding how different activities contribute to the success and sustainability of an insurer. It consists of primary and support activities that work in tandem to manage risk, deliver value to customers, and ensure profitability. Every step—from product creation to customer interactions—needs to be aligned to foster resilience and operational excellence.

Primary Activities:

- Product Development

- Marketing and Sales

- Underwriting

- Policy Administration

- Claims Processing

- Customer Service

- Risk Management

Support Activities:

- Information Technology

- Human Resources

- Finance and Accounting

- Legal and Compliance

- Research and Development

- Procurement

- Data Management

In this value chain, primary activities directly interact with customers, policies, and claims, while support activities enable those core functions to run efficiently and compliantly. Together, they form the foundation upon which insurers build their competitive strategies.

Download an in-depth presentation breaking down all the Insurance Value Chain activities here.

A Closer Look at Underwriting and Claims Processing

Two of the most critical components of the insurance value chain are underwriting and claims processing. These activities directly impact customer satisfaction, profitability, and risk management.

Underwriting

Underwriting is the gatekeeper of profitability for insurers. By assessing risk accurately, insurers determine the right premiums, preventing loss-making policies from being issued.

Modern underwriting has evolved significantly with the introduction of predictive analytics, AI-driven algorithms, and vast amounts of data. Traditional underwriting models that relied heavily on historical data and human expertise are now supplemented with real-time insights and advanced models that predict risk more accurately.

The accuracy of underwriting directly influences an insurer’s ability to stay profitable while remaining competitive.

Claims Processing

Claims processing is the moment of truth for an insurance company. This is where customer satisfaction is won or lost. A well-oiled claims process not only keeps costs down but also enhances trust and loyalty among policyholders.

Recent advances in automation, AI, and digital tools have enabled insurers to process claims faster and more accurately. In today’s environment, customers demand near-instant responses, and insurers need to deliver that level of efficiency to stay relevant. It’s no longer just about cutting checks—it’s about offering a frictionless, tech-driven claims experience that satisfies customers and controls costs.

Innovating for the Future

Innovation is not just a buzzword in the insurance sector; it’s a strategic imperative. As market dynamics shift, insurers must continuously adapt to stay relevant. Innovation is not limited to product offerings but extends across the entire value chain, impacting everything from underwriting to customer service.

Recent innovations have focused heavily on leveraging data and analytics. For example, telematics has revolutionized auto insurance, allowing insurers to collect real-time data on driver behavior, which then informs pricing models. This is a far cry from the static, one-size-fits-all pricing that dominated the market just a decade ago. Similarly, in life and health insurance, wearable devices are giving insurers new avenues to assess risk and incentivize healthier behaviors through premium discounts.

Another area of innovation is the adoption of AI and automation in claims processing. Insurers can now settle claims within hours, if not minutes, thanks to sophisticated algorithms that can assess damage, verify claims, and disburse funds automatically. This level of efficiency was unimaginable a few years ago and is now becoming table stakes for leading insurers.

Blockchain technology is also making waves in the insurance sector. By offering transparent, tamper-proof records of transactions, blockchain has the potential to transform everything from policy issuance to claims management. Insurers that can harness this technology stand to improve both operational efficiency and customer trust.

Finally, customer engagement is undergoing a major shift. Insurers are adopting omnichannel strategies to meet customers where they are, offering personalized communication across platforms such as mobile apps, social media, and traditional channels. This is not just about being more accessible—it’s about creating an ecosystem where the customer feels valued and understood at every touchpoint.

Navigating the Regulatory Labyrinth

The insurance industry is one of the most heavily regulated sectors, and for good reason. Insurers manage enormous amounts of sensitive customer data and are tasked with ensuring that they remain solvent while meeting their obligations. Compliance with these regulations isn’t just about avoiding fines—it’s about protecting customers and maintaining trust.

One of the primary challenges insurers face is keeping up with the constantly evolving regulatory landscape. Rules governing privacy, such as GDPR and CCPA, require insurers to handle customer data with extreme care. This has led to the rise of data governance frameworks that ensure compliance while minimizing risk. Data management is no longer just a back-office function—it’s now a core pillar of regulatory compliance.

In addition to privacy laws, solvency regulations such as Solvency II in Europe require insurers to maintain enough capital to meet their obligations, even under adverse conditions. These regulations have forced insurers to adopt more sophisticated risk management practices, ensuring they can withstand financial shocks without jeopardizing policyholders’ security.

Compliance also impacts product development. Insurers must balance innovation with regulatory constraints, ensuring that new offerings meet legal requirements without stifling creativity. This requires close collaboration between product teams and compliance officers, who must navigate a complex web of local and international laws.

Ignoring compliance isn’t an option. Non-compliance can lead to severe penalties, reputational damage, and even the revocation of an insurer’s license to operate. For insurers, the cost of compliance is high, but the cost of non-compliance is far higher.

FAQs

How can insurers leverage data to enhance underwriting accuracy?

Real-time data is revolutionizing underwriting. By tapping into IoT devices, insurers can continuously assess risk and adjust pricing models accordingly.

What’s the most effective way to streamline claims processing?

Automation and AI are key. By digitizing claims workflows, insurers can cut down on processing times while reducing manual errors.

How should insurers approach regulatory compliance in a multi-jurisdictional environment?

Invest in dynamic compliance frameworks that adapt to local and international laws, minimizing the risk of violations.

What role does customer service play in differentiating an insurer’s value proposition?

Customer service is the face of your organization. A personalized, omnichannel approach can build lasting relationships and increase policy renewals.

How can insurers future-proof their product development strategies?

Embrace agile methodologies and continuous feedback loops to rapidly iterate on products, ensuring they meet evolving customer needs.

What’s the future of risk management in insurance?

AI and predictive analytics will take center stage. Insurers that invest in these technologies will be able to foresee and mitigate risks in ways that traditional models simply can’t.

How should insurers prioritize innovation efforts?

Focus on high-impact areas like claims processing, underwriting, and customer engagement. These are the touchpoints that drive both customer satisfaction and operational efficiency.

What’s the biggest challenge facing insurers today?

Keeping up with the pace of technological change while remaining compliant with evolving regulations. Balancing innovation with compliance will define the next decade.

The Future of Insurance is Here

The insurance value chain is undergoing rapid transformation, driven by technology, data, and changing customer expectations. Insurers that succeed in the coming years will be those that can seamlessly integrate innovation with operational excellence. It’s not just about introducing new products or services—it’s about reimagining how every part of the value chain operates.

As the market continues to evolve, those insurers that invest in data, technology, and customer-centricity will come out ahead. The future belongs to those who are agile enough to pivot when necessary, yet structured enough to maintain compliance and profitability. The old ways of doing business are fading fast—adapt or get left behind.