Editor's Note: Take a look at our featured best practice, Startup Company Financial Model - 5 Year Financial Forecast (Excel workbook). New Version - Massive Update !! This updated version of the previous template is almost a completely new model including new assumptions, new Setup Reports and new and updated Output Reports. Creating a financial plan is the roadmap that lays out the path for your company's future financial [read more]

3 Things Entrepreneurs Need to Be Wary of Before Starting a Business

* * * *

That said, not every new venture gets to become a success story. Numbers from the Bureau of Labor Statistics show that about 20 percent of new businesses fail within their first two years in the market and a whopping 45 percent don’t even make it to the five-year-mark. This is due to a variety of reasons, such as lack of financing, not investigating the market, rapid expansion, bad location, inflexibility, and bad business planning. For business owners to find success in their respective industries, they should be cautious about three things before starting their venture.

Startup Costs

One of the key business aspects that owners should be careful with when starting their venture is their startup costs. Correctly budgeting their organizational expenses can help business owners successfully launch their business, entice potential investors, and calculate future earnings.

The U.S. Chamber of Commerce notes that a simple way to calculate startup costs is by listing the needed expenses and assets, and estimating how much they cost. From there, business owners can perform essential financial calculations, such as a break even analysis and a formal report for lenders. To future-proof their computations, businesses owners should remember to factor in inflation, as well as ongoing costs.

Credit History

Business owners will need to make themselves attractive to lending agencies, especially if they don’t have enough capital or plan on expanding their venture down the line. For that reason, business owners should keep a close eye on their credit scores. If they don’t have a positive credit score and history, lenders and financial institutions might present them with bad loan terms, or worse, not even approve them for a loan.

That said, business owners should make it a habit to check their credit history and score. A feature on hard vs. soft credit checks on Upgraded Points outlines how entrepreneurs should perform a soft credit inquiry to monitor their credit history through services like Credit Karma or Mint. They should also avoid applying for loans and credit often, as lenders will need to perform hard credit inquiries whenever an application is submitted, which will then affect the applicant’s credit score. By knowing where their credit score stands, business owners can make the necessary changes and adjustments to raise their credit scores.

Operating Costs

Part of any good business plan is calculating the operational costs for at least six months. While different businesses have different costs connected to them, business owners should consider general expenses such as rent, utilities, equipment, fixtures, tax deposits, marketing budgets, payroll, insurance, and professional services. An article about operating expenses on Entrepreneur highlights that business owners should be conservative when it comes to computing the operational costs. Doing so can help create a financial cushion that will help business owners avoid financial panic and anxiety when faced with an unexpected event down the road.

New business owners can increase the probability of success as long as they create a foolproof business plan that considers their startup costs, credit history, and operating costs. Having the three aforementioned aspects pinned down can help business owners make accurate financial statements, apply for better loan terms, and keep their business afloat.

A good idea is to hire a virtual assistant to help you compile the necessary information and paperwork.

Do You Want to Implement Business Best Practices?

You can download in-depth presentations on Entrepreneurship and 100s of management topics from the FlevyPro Library. FlevyPro is trusted and utilized by 1000s of management consultants and corporate executives.

For even more best practices available on Flevy, have a look at our top 100 lists:

- Top 100 in Strategy & Transformation

- Top 100 in Digital Transformation

- Top 100 in Operational Excellence

- Top 100 in Organization & Change

- Top 100 Management Consulting Frameworks

These best practices are of the same as those leveraged by top-tier management consulting firms, like McKinsey, BCG, Bain, and Accenture. Improve the growth and efficiency of your organization by utilizing these best practice frameworks, templates, and tools. Most were developed by seasoned executives and consultants with over 20+ years of experience.

Readers of This Article Are Interested in These Resources

|

|

28-slide PowerPoint presentation

|

|

Excel workbook

| |||

About Shane Avron

Shane Avron is a freelance writer, specializing in business, general management, enterprise software, and digital technologies. In addition to Flevy, Shane's articles have appeared in Huffington Post, Forbes Magazine, among other business journals.

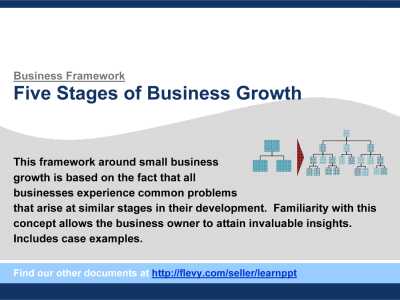

Top 10 Recommended Documents on Entrepreneurship

» View more resources Entrepreneurship here.

» View the Top 100 Best Practices on Flevy.