General Use 3-Statement Financial Model: 5-Year Startup (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

ENTREPRENEURSHIP EXCEL DESCRIPTION

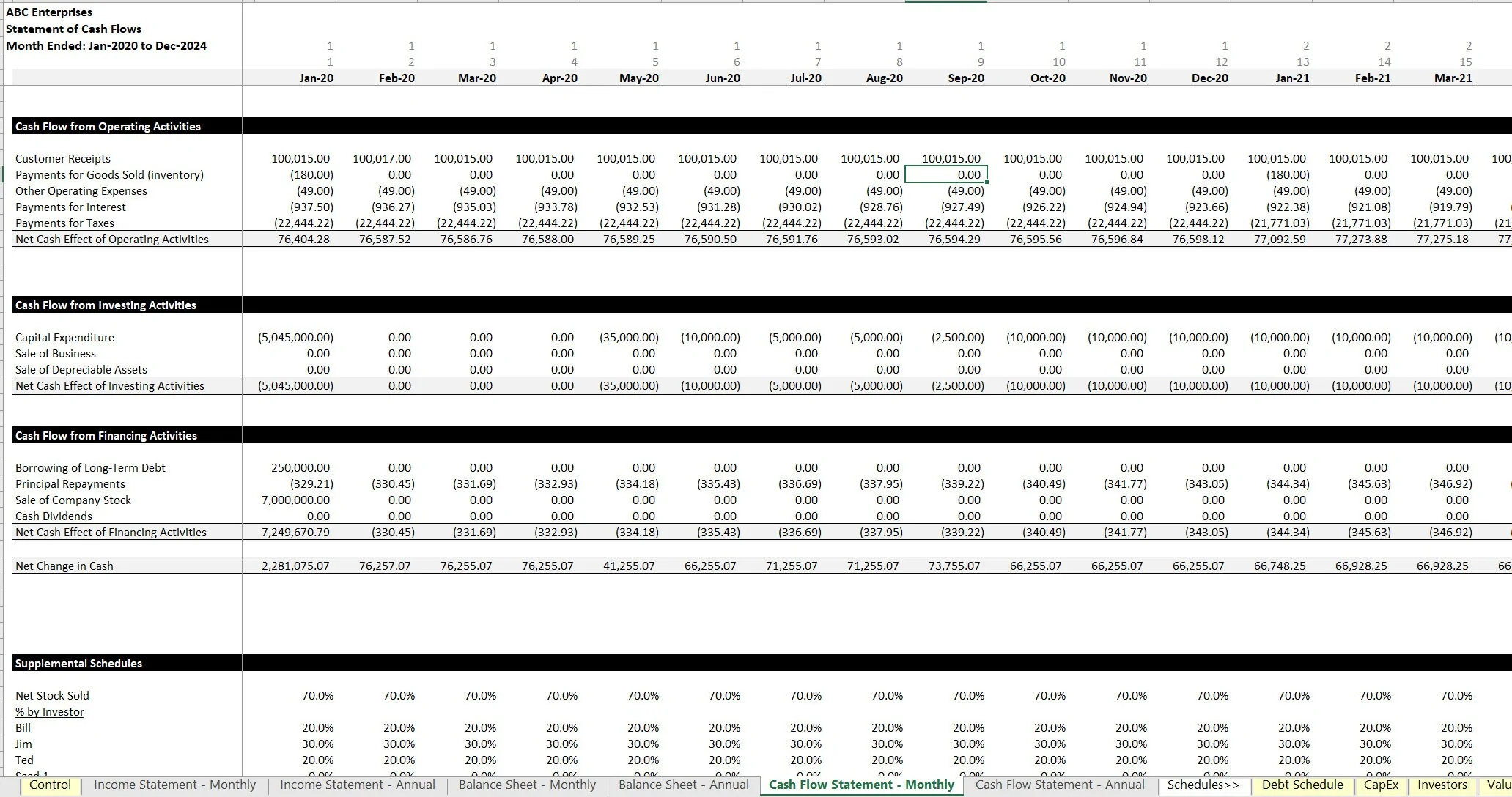

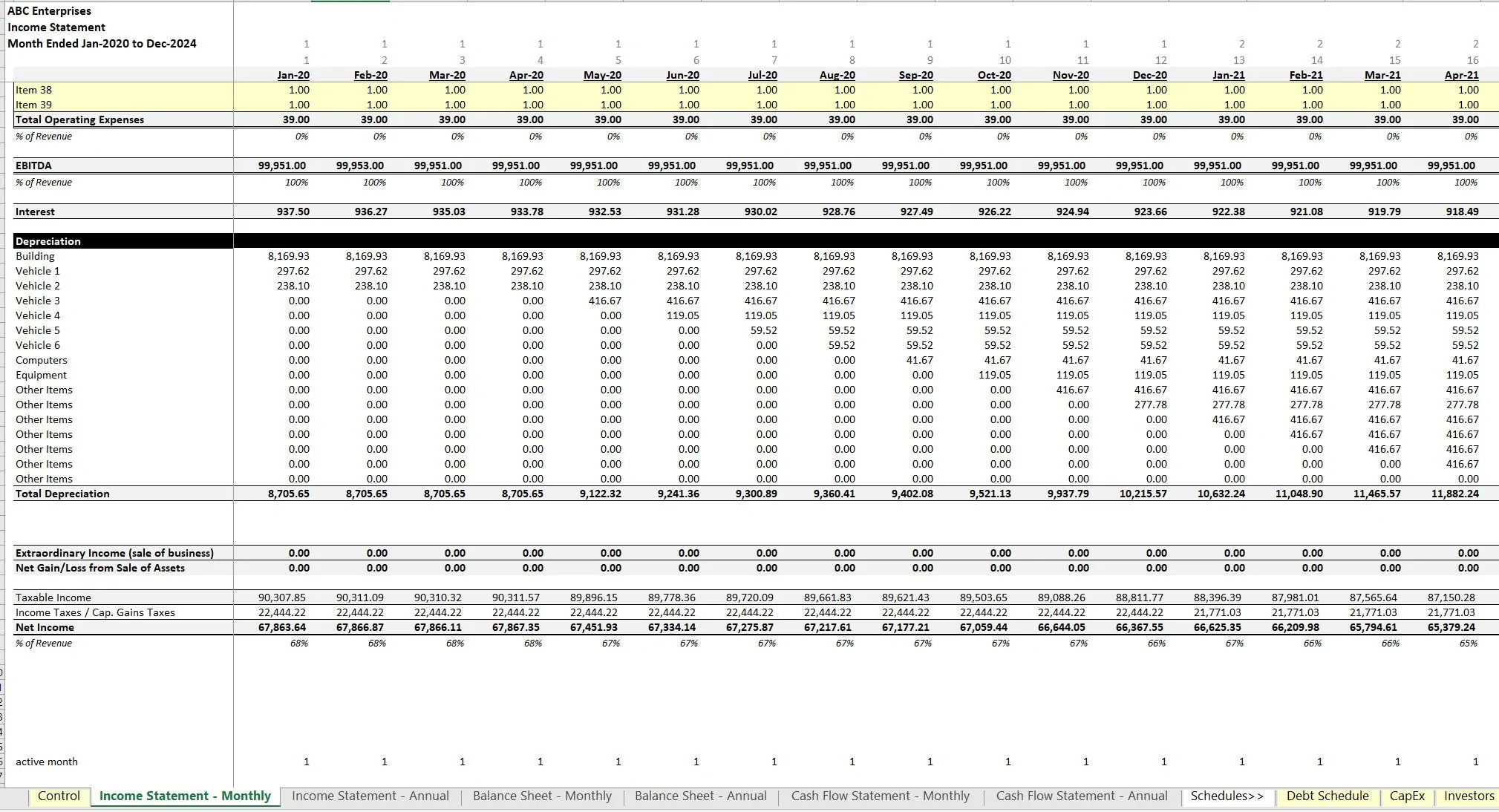

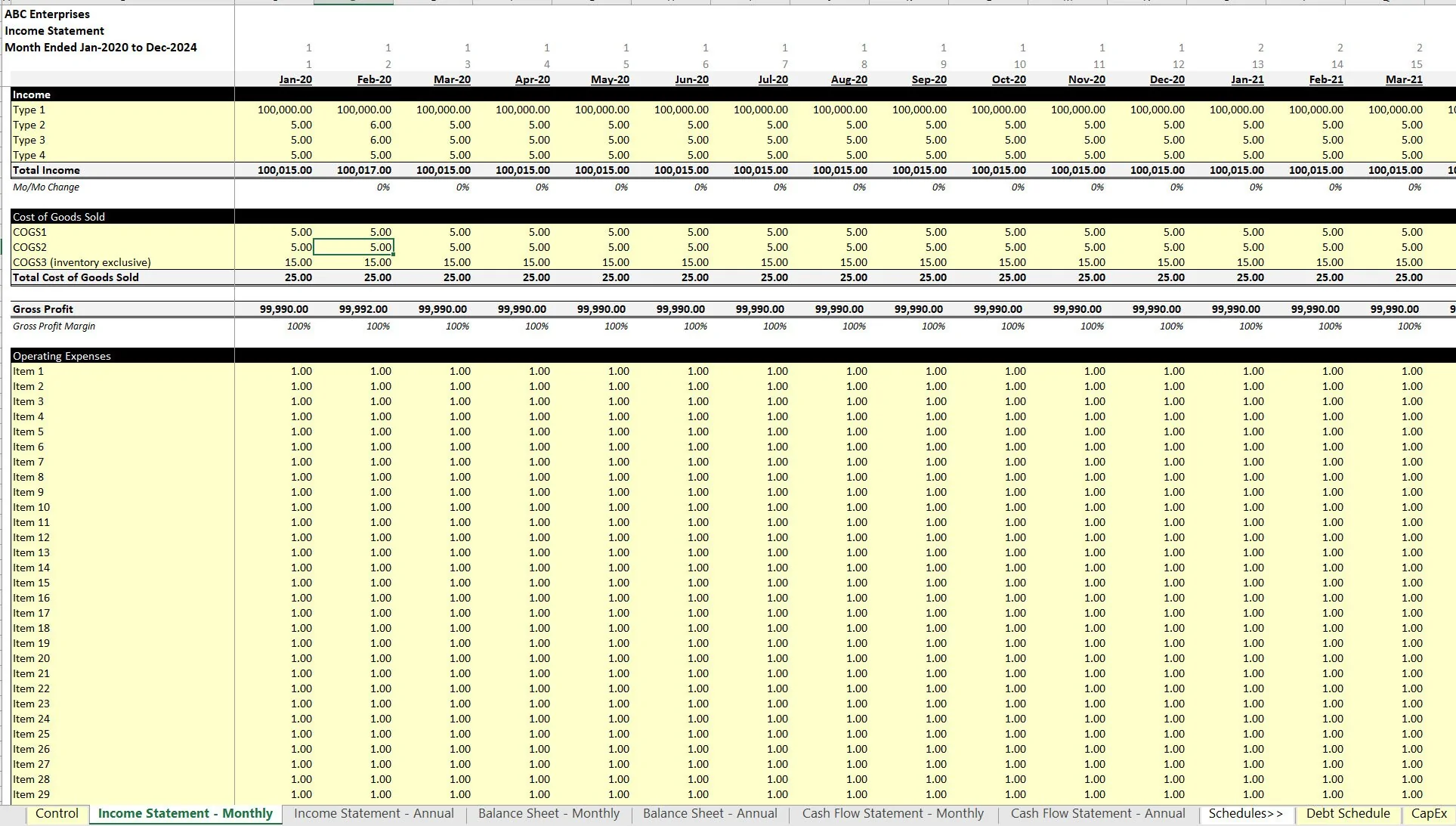

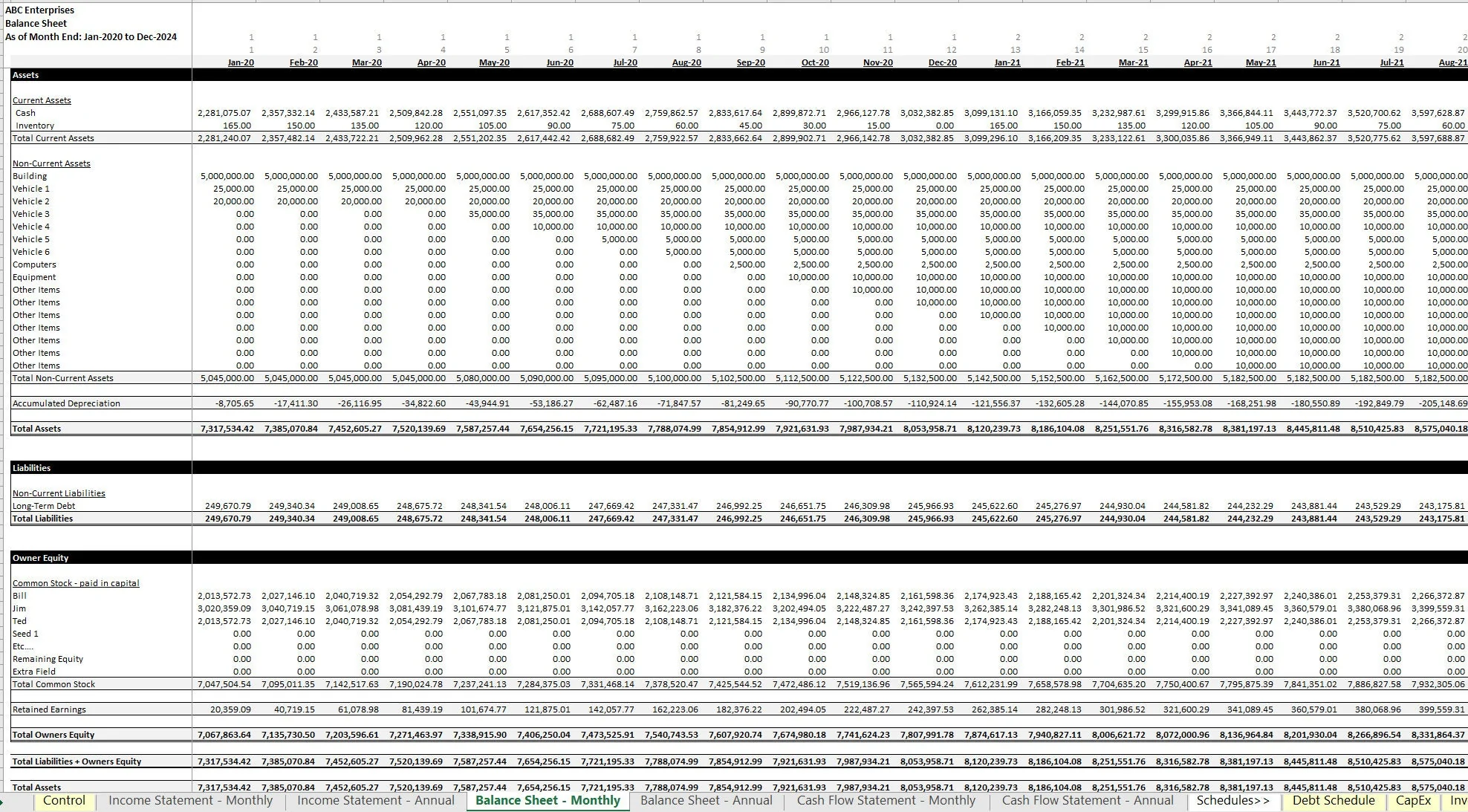

Here you have a general 3 statement model template with formulas that are in tact for how the income statement, balance sheet, and statement of cash flows all work together. The most advanced logic in this sheet would be for inventory and it is just a general off-set relative to inventory COGS line items. Most of the data is hard-coded in on the income statement and a few other schedules that will then flow to the balance sheet and statement of cash flows.

If you are new to creating connected financial statements on a monthly and annual level, this template will give you guidance on the general approach and how all the calculations work in order to stay balanced (assets = liabilities + owners equity).

The output summaries are in a monthly and annual format for up to 5 years. This template is designed to fit as many different financial forecasts as possible.

The user can simply drop in their revenues, cost of goods sold, and operating expenses into the monthly income statement and the Net Income, Balance Sheet and Cash Flow Statement will update automatically.

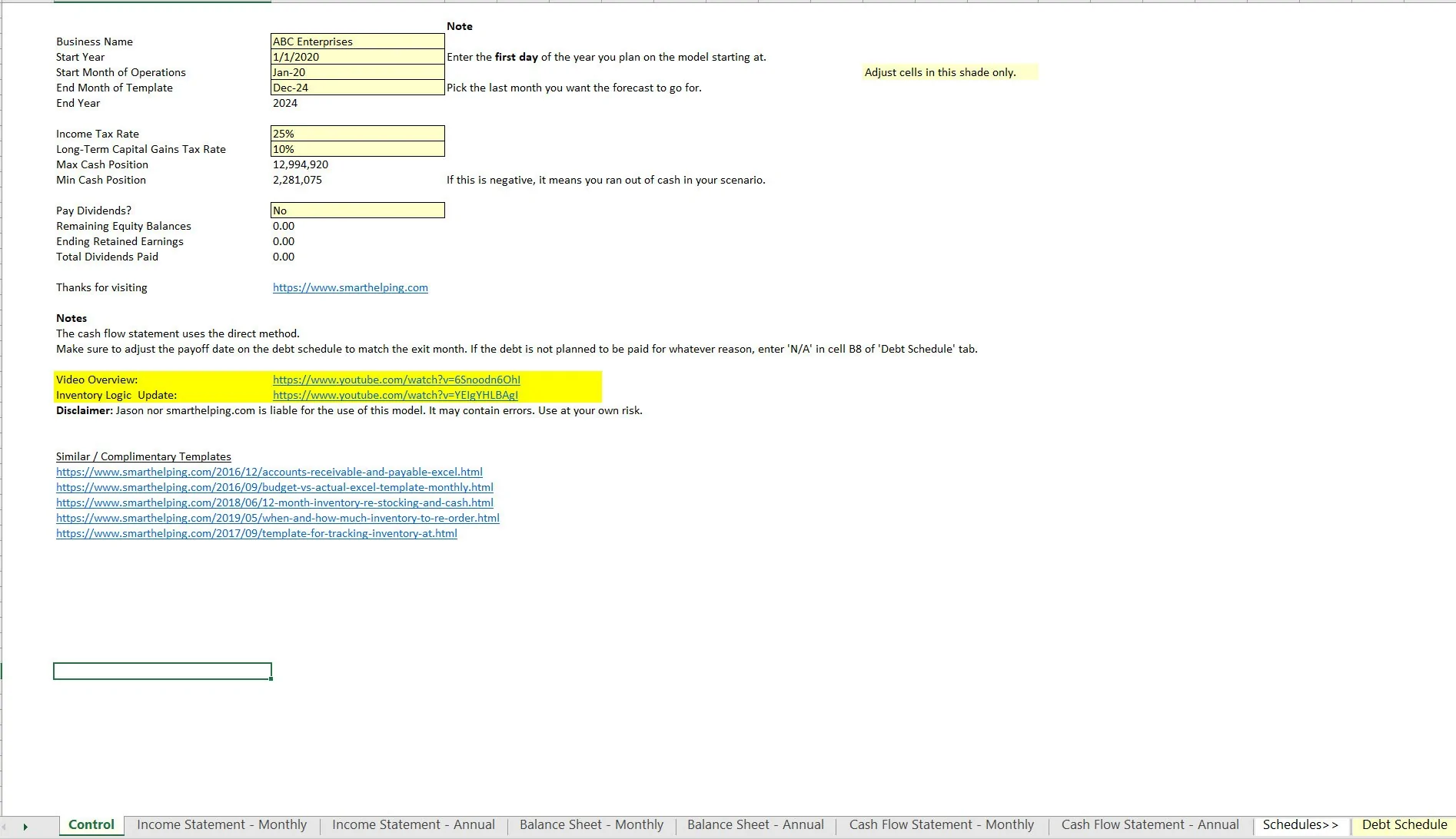

Other configurable inputs include start year, exit month, income tax rate, capital gains tax rate, and a 'yes/no' selector to pay dividends.

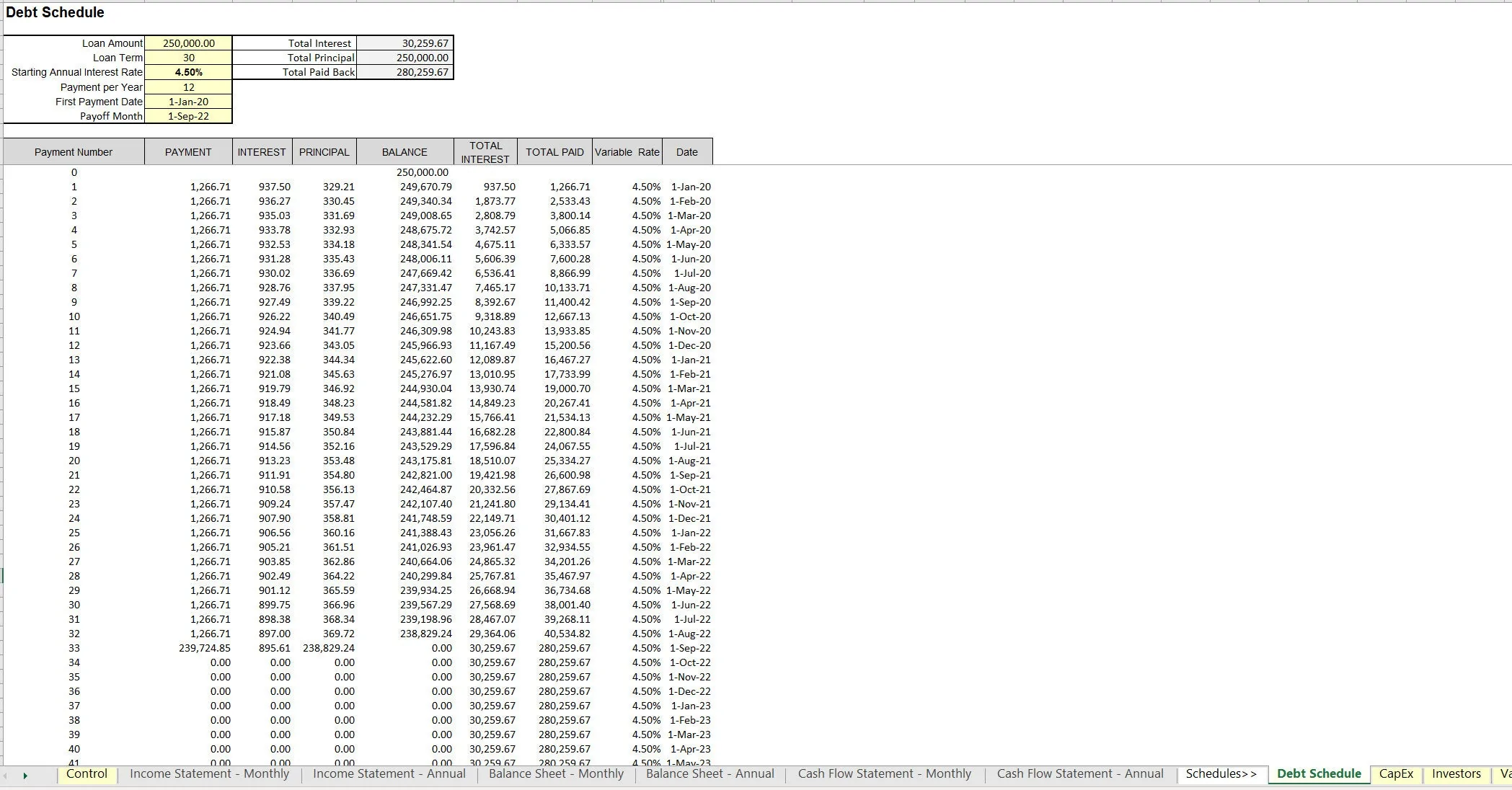

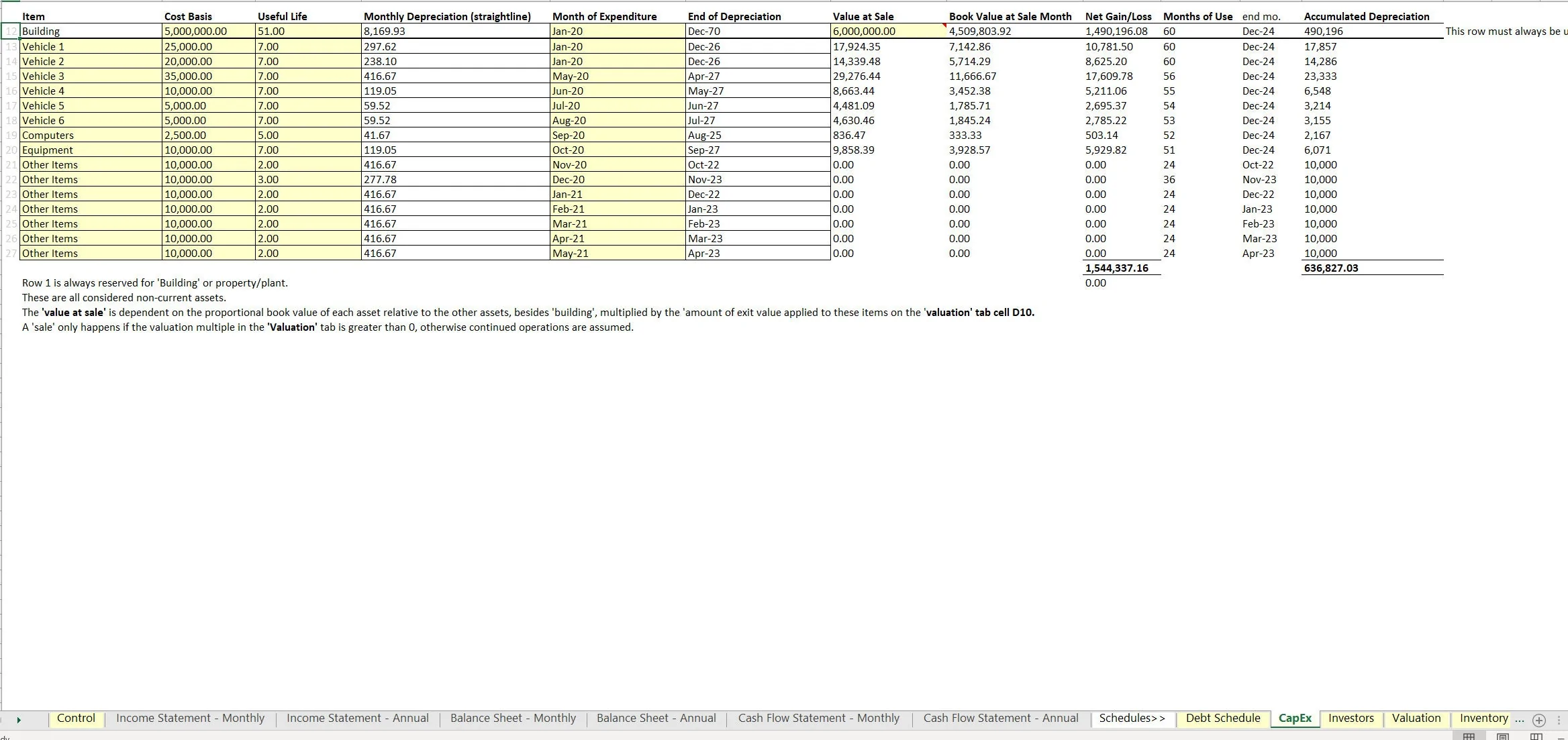

The user can also configure amortization terms for senior debt, CapEx (including building / equipment) and the useful life. The depreciation expense will auto-populate.

Another set of available inputs include:

• Up to 7 investment rounds (amount / date of fundraising / valuation)

• Terminal value (based on multiple of trailing 12-month revenue)

• % of exit value assigned to comprehensive income. Any value not applied to comprehensive income will go against equipment sales and a capital gains taxable event.

Inventory logic (if purchases happen in 'x' months advance of when things actually sell). There is a specific COGS line that references this logic.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Entrepreneurship, Integrated Financial Model Excel: General Use 3-Statement Financial Model: 5-Year Startup Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping