Inventory Modeling within 3-Statement Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INVENTORY MANAGEMENT EXCEL DESCRIPTION

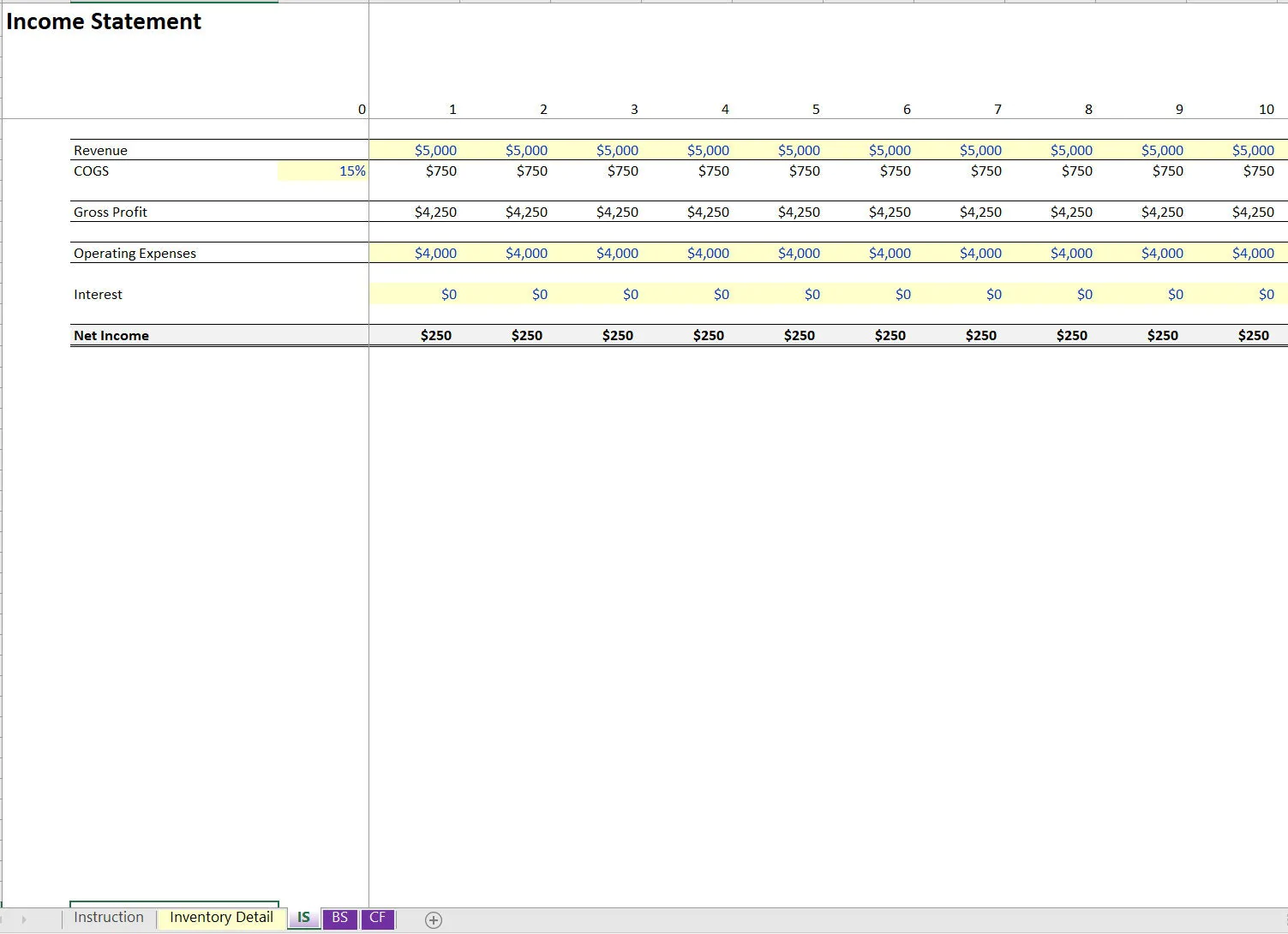

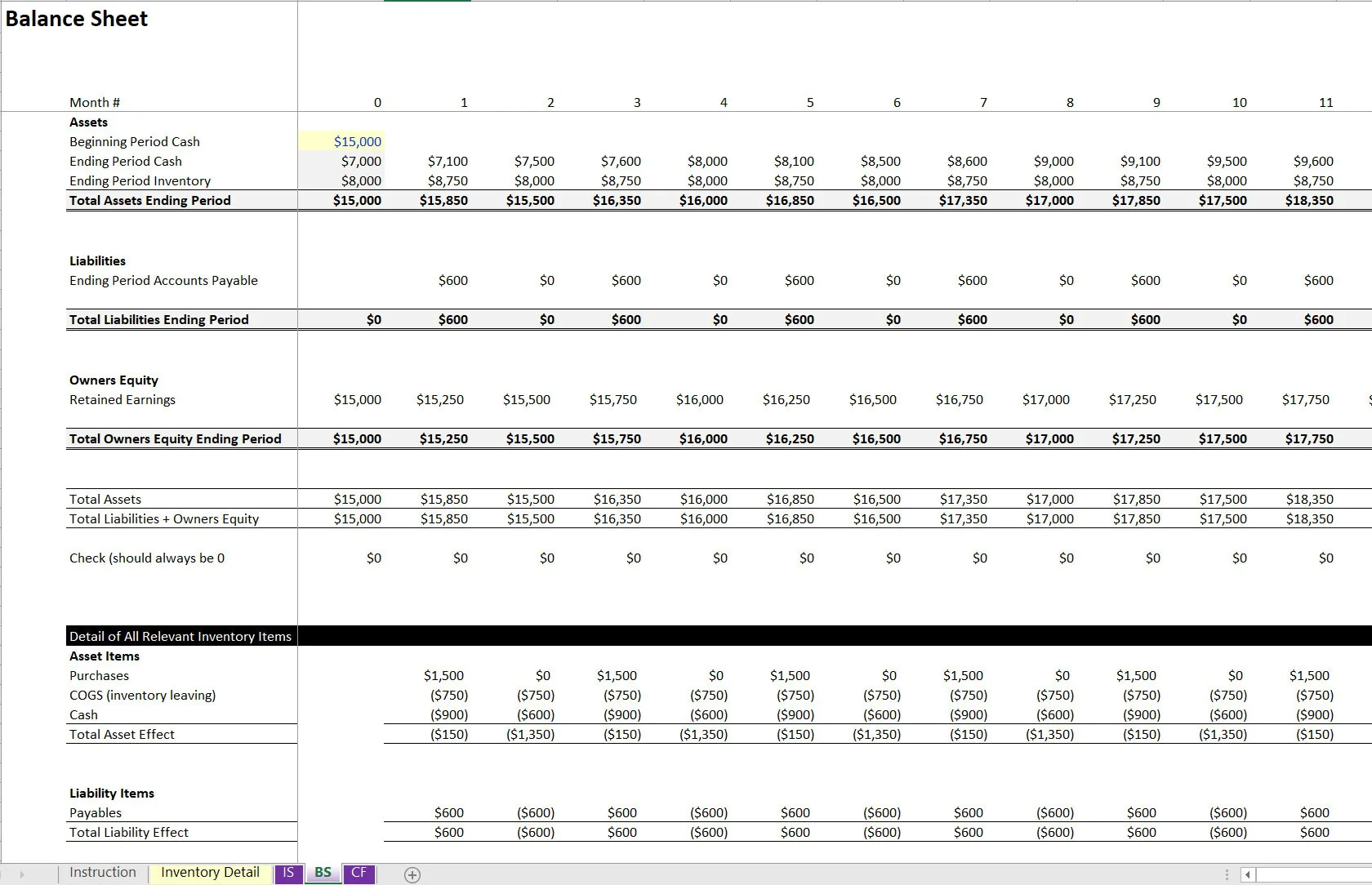

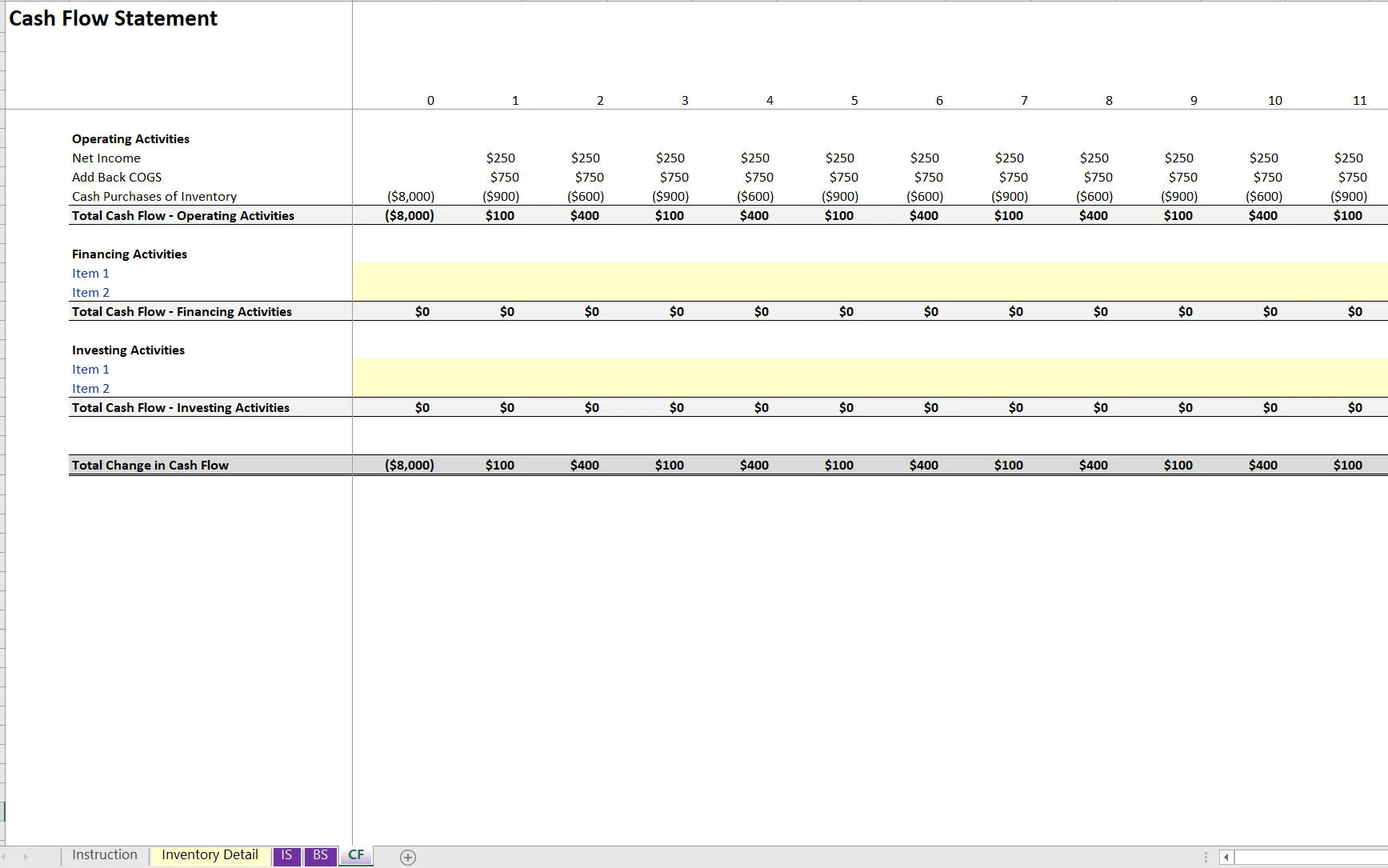

One of the more difficult things that I have had clients ask me to do is help with inventory forecasting within a 3 statement model. You do need to have a good grasp on the Accounting equation as well as specific financial accounting knowledge and journal entry skills to do this correctly. What this template does is show the formulas that need to be utilized in-between the income statement, balance sheet, and statement of cash flows so that inventory is displaying in the right manner.

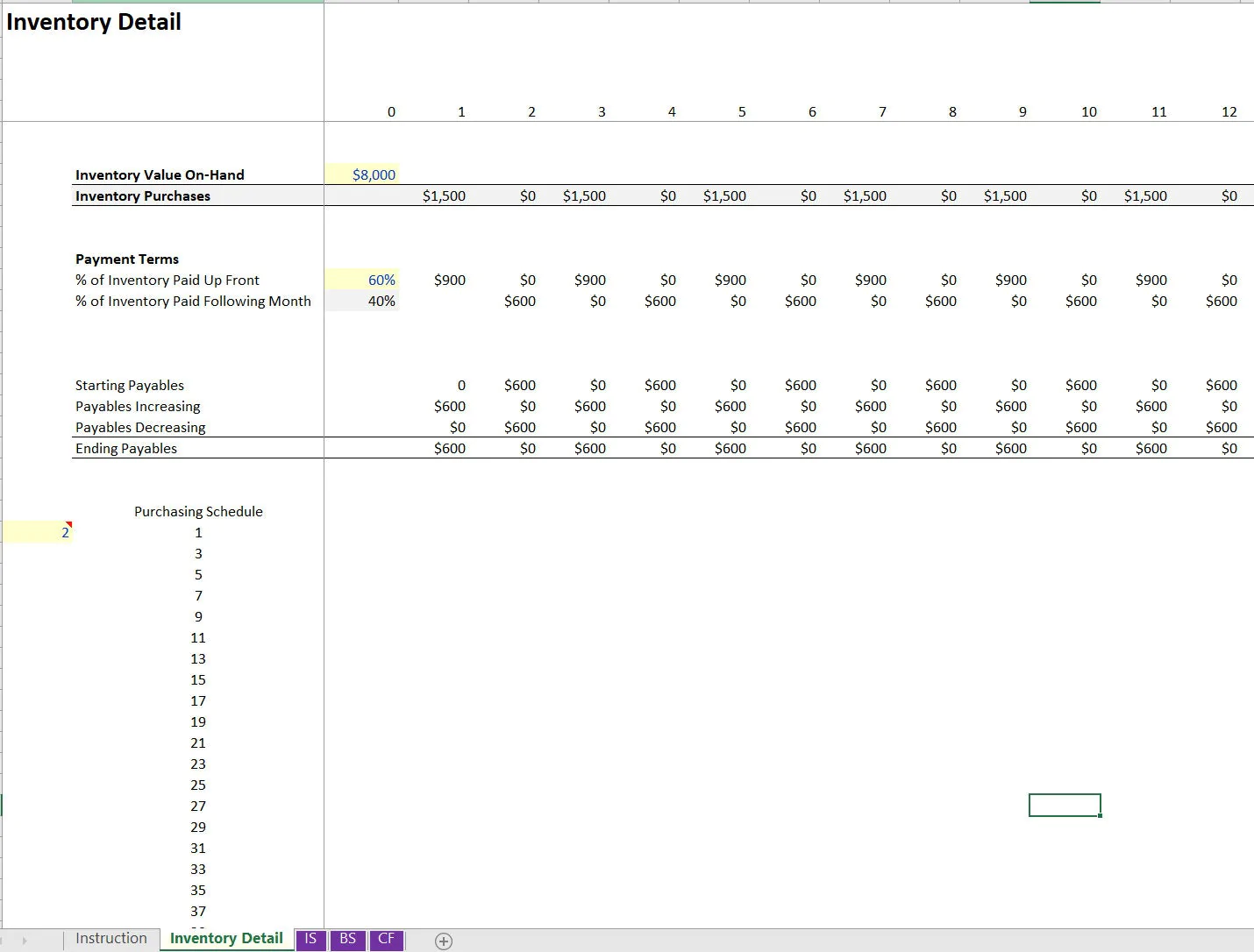

Inventory will hit all 3 financial statements and it can get complicated when there are varying terms for when inventory is actually paid for vs. when it is used and when it should actually increase the inventory balance. GAAP compliance is also relevant here.

Integrating inventory flows into a 3-statement financial model can be one of the more difficult things to figure out. It requires a good understanding of general Accounting principles as well as the Accounting equation.

This is especially true when you have inventory that is paid on account partially or in full and then actually hits the cash flow at some future period.

The model designed here will help anyone understand how inventory should be flowing to each financial statement if one were building a financial forecast for a business that had to deal with inventory purchases, repayments, prepayments, and accounts payable items related to the inventory transactions.

The main line items that inventory effects are included and all the math and logic needed to balance the Balance Sheet with the Income Statement and Cash Flow Statement as it relates to inventory movements.

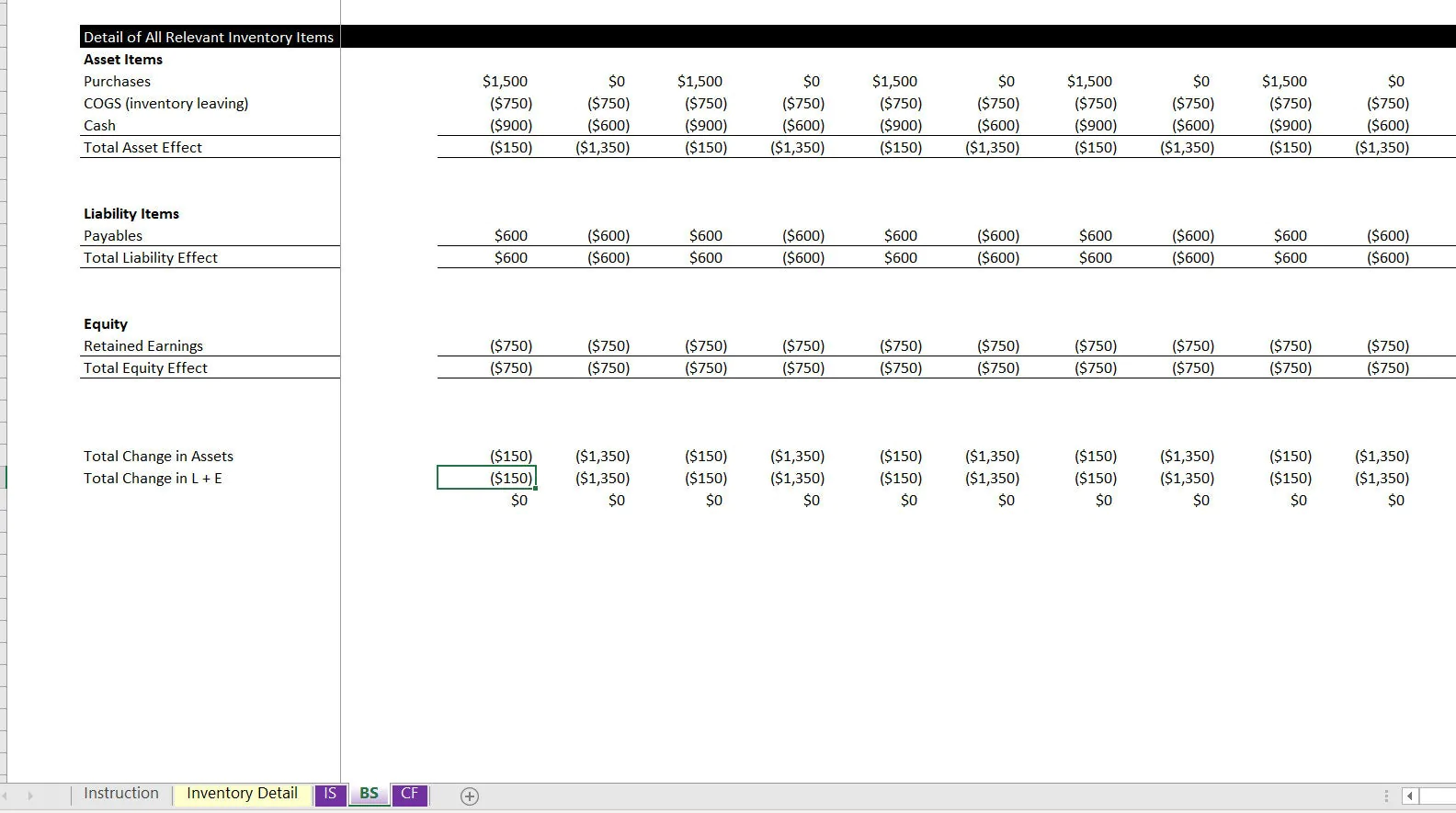

There is an additional schedule that really dives into what is happening each period in terms of the items and amounts that change in a given period as it relates to inventory.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Inventory Management Excel: Inventory Modeling within 3-Statement Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping