Depreciation Tracking Tool (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

DEPRECIATION EXCEL DESCRIPTION

Accountants often have a hard time communicating to new business owners how depreciation works and the proper way to apply it in regards to financial reporting. In my very first job out of college the company had just finished going through an audit and their biggest trigger was how they accounted for the construction / acquisition costs of buildings.

Part of the reason I was hired was because they were running a 10/15M per year business and had no idea about the proper way for accounting for depreciation. Don't get caught up in an audit and make sure as the business owner you are fully aware of how to handle depreciation for your business.

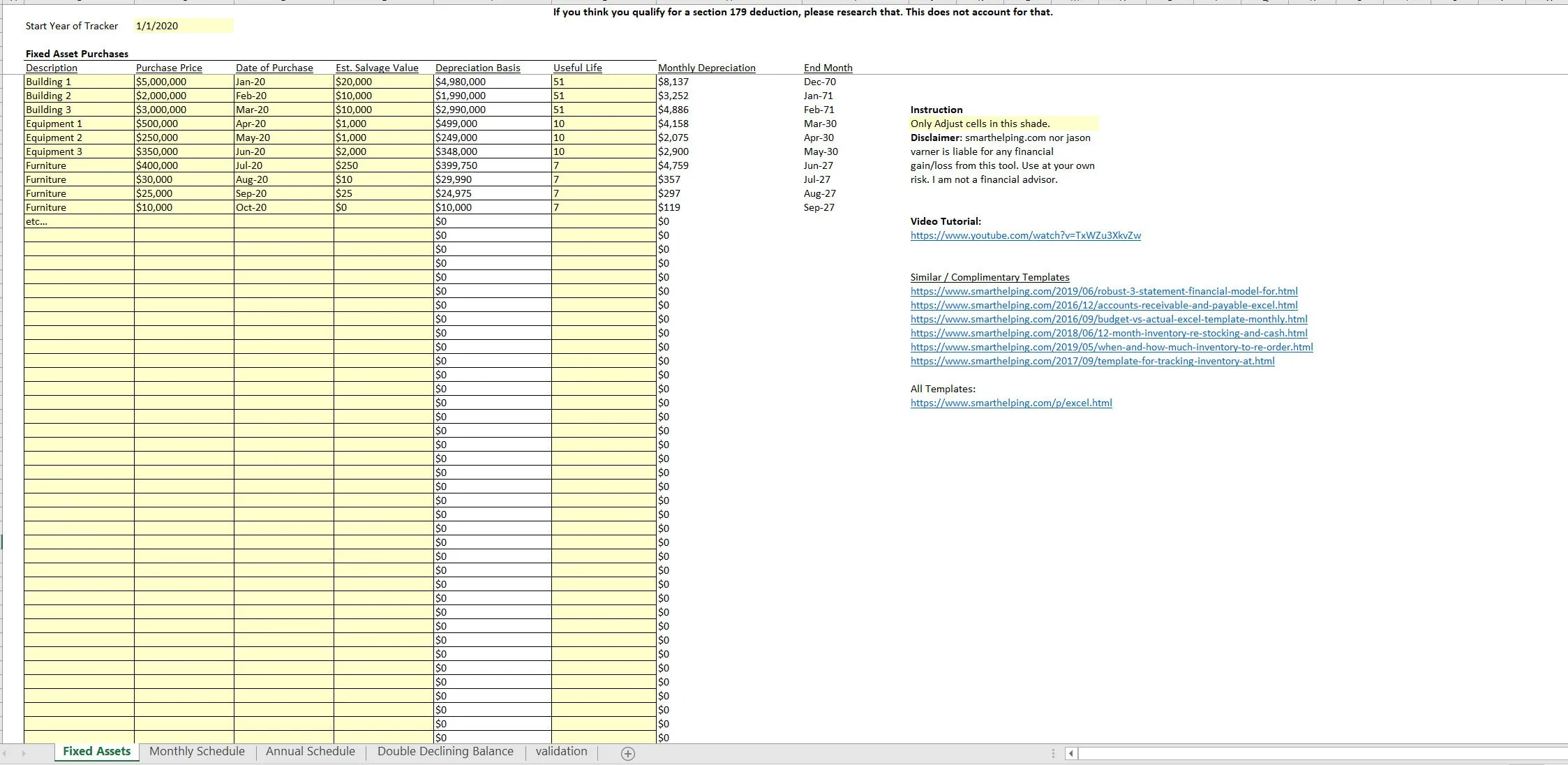

There will be all sorts of caveats / section 179 deductions / bonus depreciation and more but for most things you will need to track the depreciation that is allowable on capital assets over time. If your business has a lot of items to track, this sheet gives a structure for calculating the monthly depreciation expense allowable based on straight line methodology.

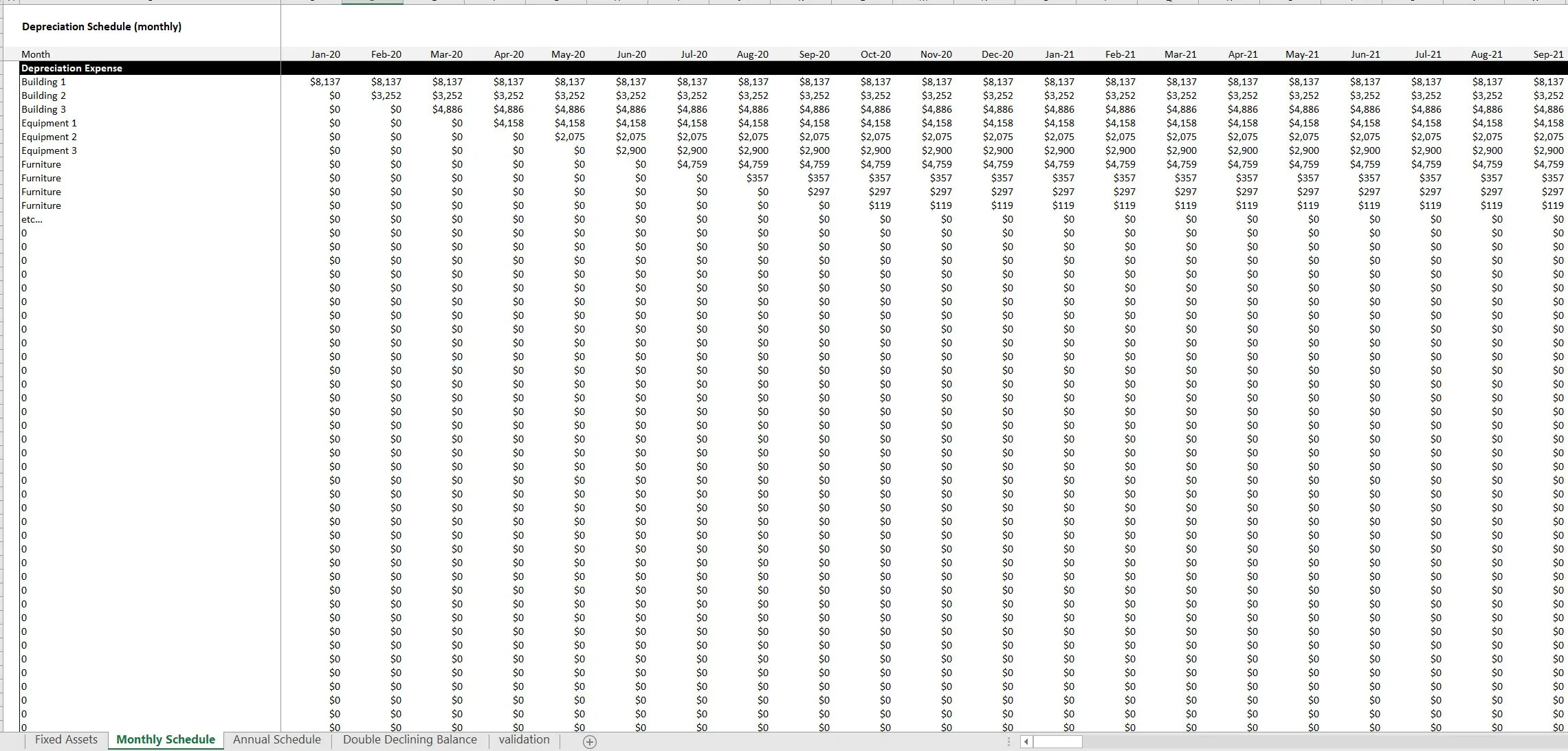

This Excel template is a depreciation forecasting tool designed for up to 95 fixed assets. The methodology is straight line. Each item can have its own start month and useful life as well as an ending salvage value.

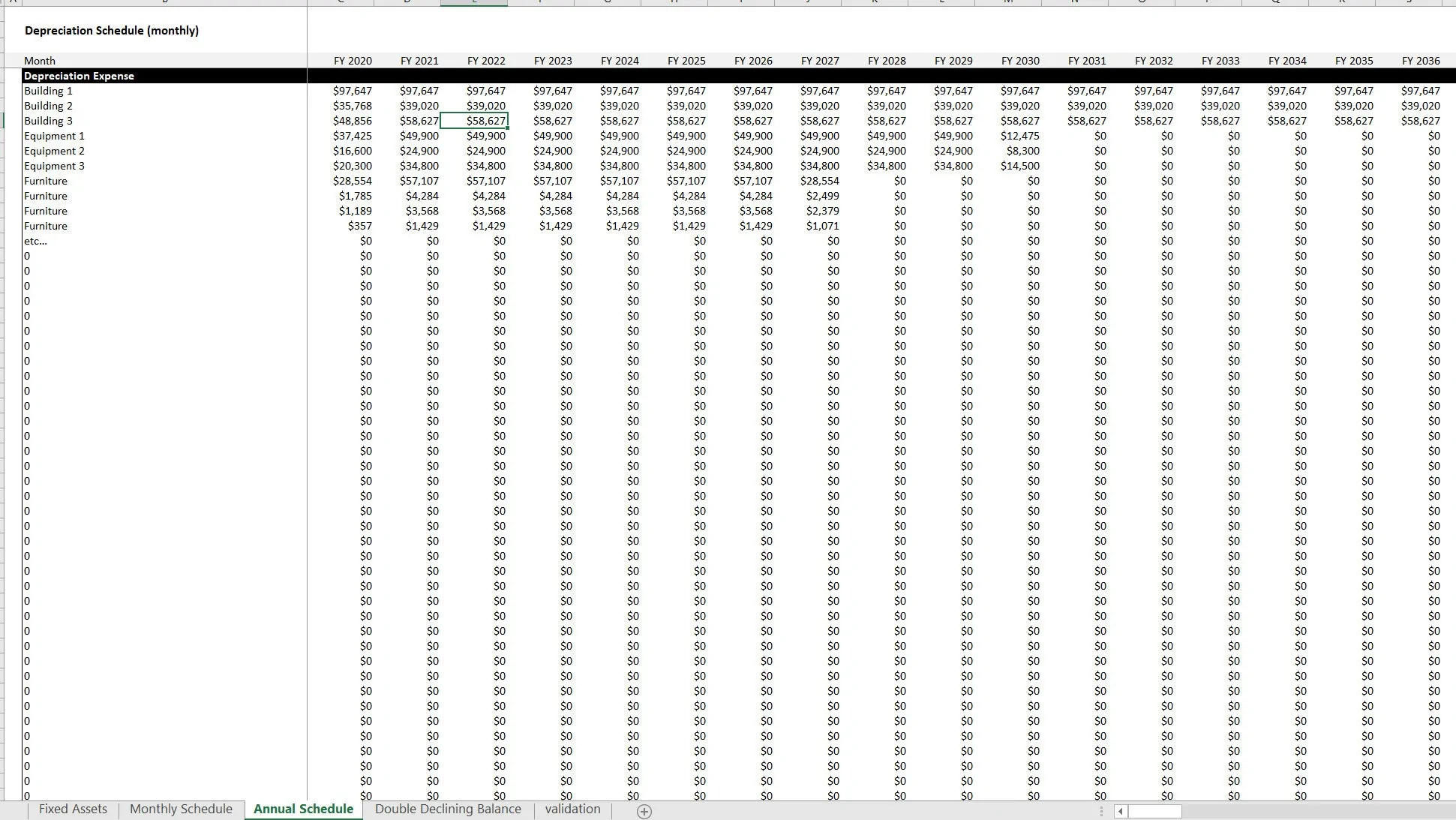

The forecast will show monthly and annual depreciation expense as well as book value over the same period. Instructional video included in file.

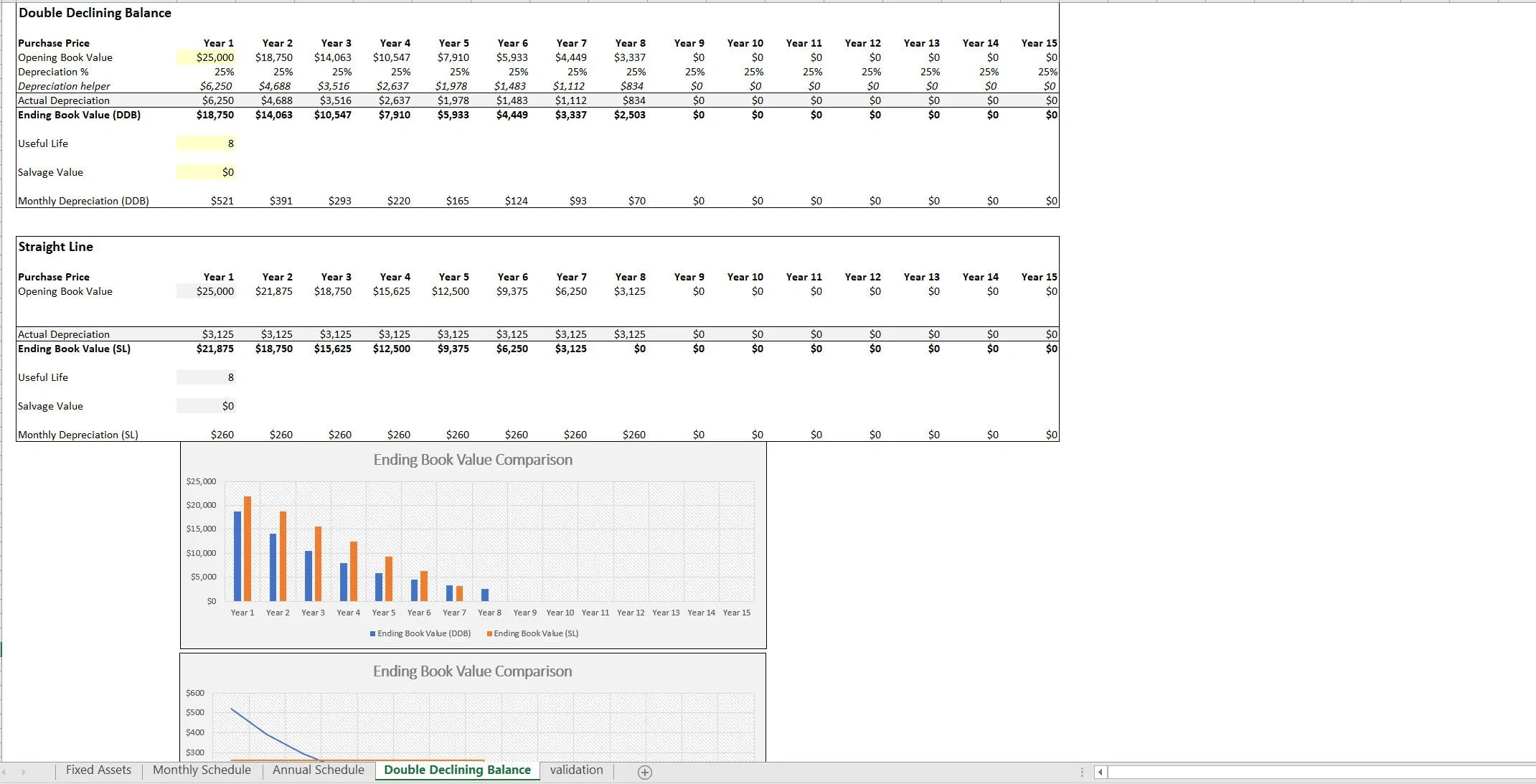

A separate schedule was made for double-declining balance and it is only built for a single fixed asset (or if you have a bunch of assets all purchased in the same month with the same useful life, the data can be aggregated) and up to 15 years annual view only.

The main use of this tool is to be able to compare the depreciation expense when comparing double-declining balance vs. straight line methodology.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Depreciation Excel: Depreciation Tracking Tool Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping