Adjusted Cost Basis Calculator (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Framework for tracking and calculating the current adjusted cost basis of an asset.

EXCEL DESCRIPTION

If you currently own real estate, equipment, or some other tangible asset and are planning to sell, it is vital to understand what your actual cost basis is. Having a lower basis relative to the planned sale price means more taxes and having a higher basis means less taxes. There are lots of factors to consider and this spreadsheet lets you get all the details onto an organized schedule.

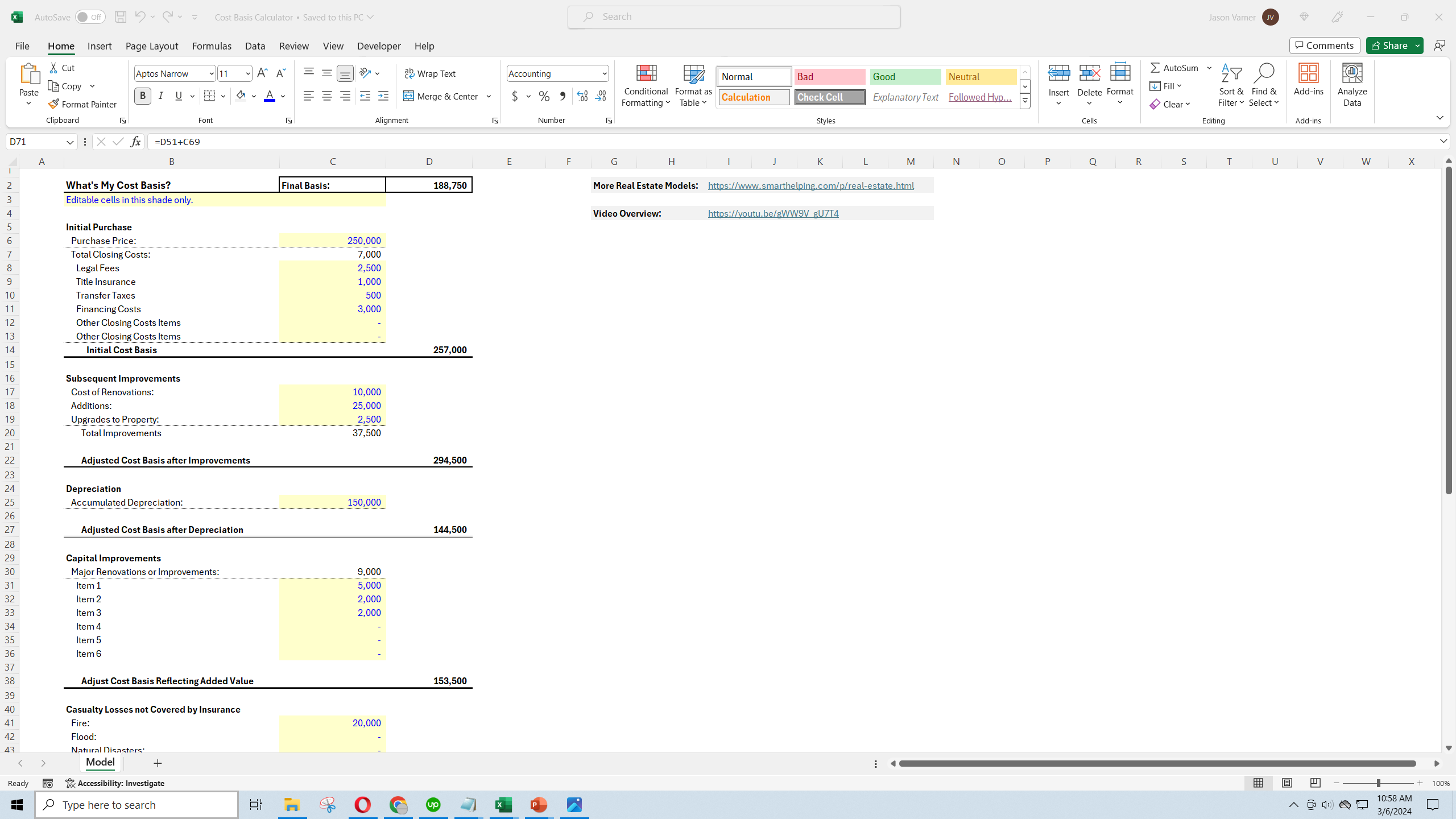

Here are all the factors the user has an input for:

• Initial Purchase Price

• Financing / Closing Costs

• Subsequent Renovations

• Total Depreciation (accumulated depreciation)

• Capital Improvements

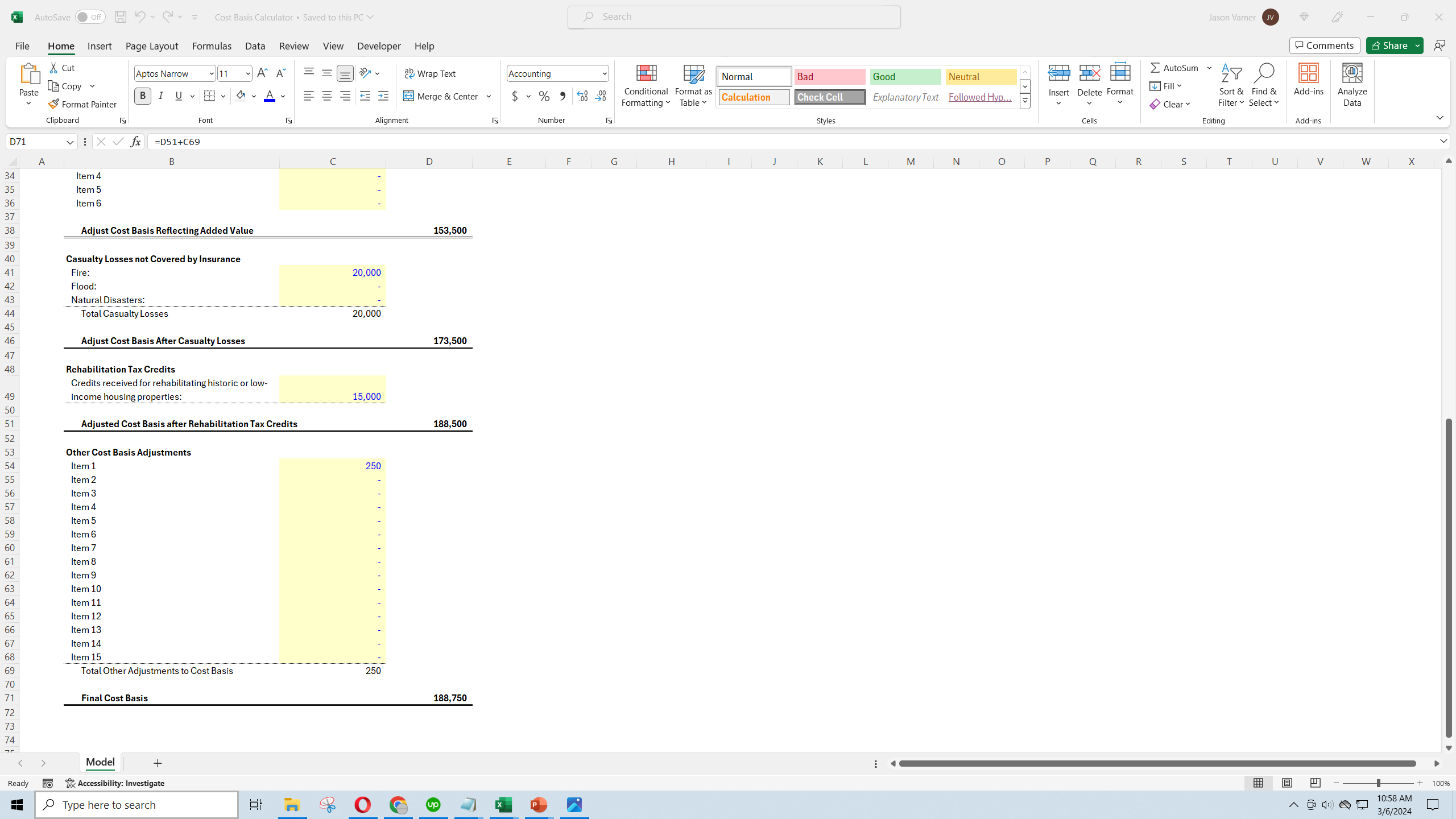

• Casualty Losses not Covered by Insurance

• Rehabilitation Tax Credits

• 15 Extra Adjustment Slots if Needed

Within each of the sections above, there is also a detail of the various things that may be in that section so you can get more granular with the analysis and understand what makes up each sub-section total as well as the effect on the final adjusted cost basis of the asset.

Understanding an asset's adjusted cost basis is crucial for accurately calculating capital gains or losses upon sale, which directly impacts your tax obligations. The adjusted cost basis includes the original purchase price plus any adjustments for reinvested dividends, improvements, fees, or commissions. This calculation is essential for tax reporting, as inaccurately reporting your gains or losses can lead to penalties from tax authorities. Furthermore, a precise adjusted cost basis enables effective tax planning strategies, such as tax-loss harvesting, to minimize tax liabilities. It also aids in maintaining accurate financial records, essential for long-term investment management and making informed decisions. For inherited assets, understanding how to adjust the cost basis can significantly affect the taxable amount when sold. Overall, knowing your adjusted cost basis is key to complying with tax laws, optimizing tax outcomes, and managing investments wisely.

Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Adjusted Cost Basis Calculator Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Accounting Trackers - Tools for Accountants

This bundle contains 29 total documents. See all the documents to the right.