Cash Flow Management Tool (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Any business can analyze and plan their forecasted cash flow in real-time with this tool.

CASH FLOW MANAGEMENT EXCEL DESCRIPTION

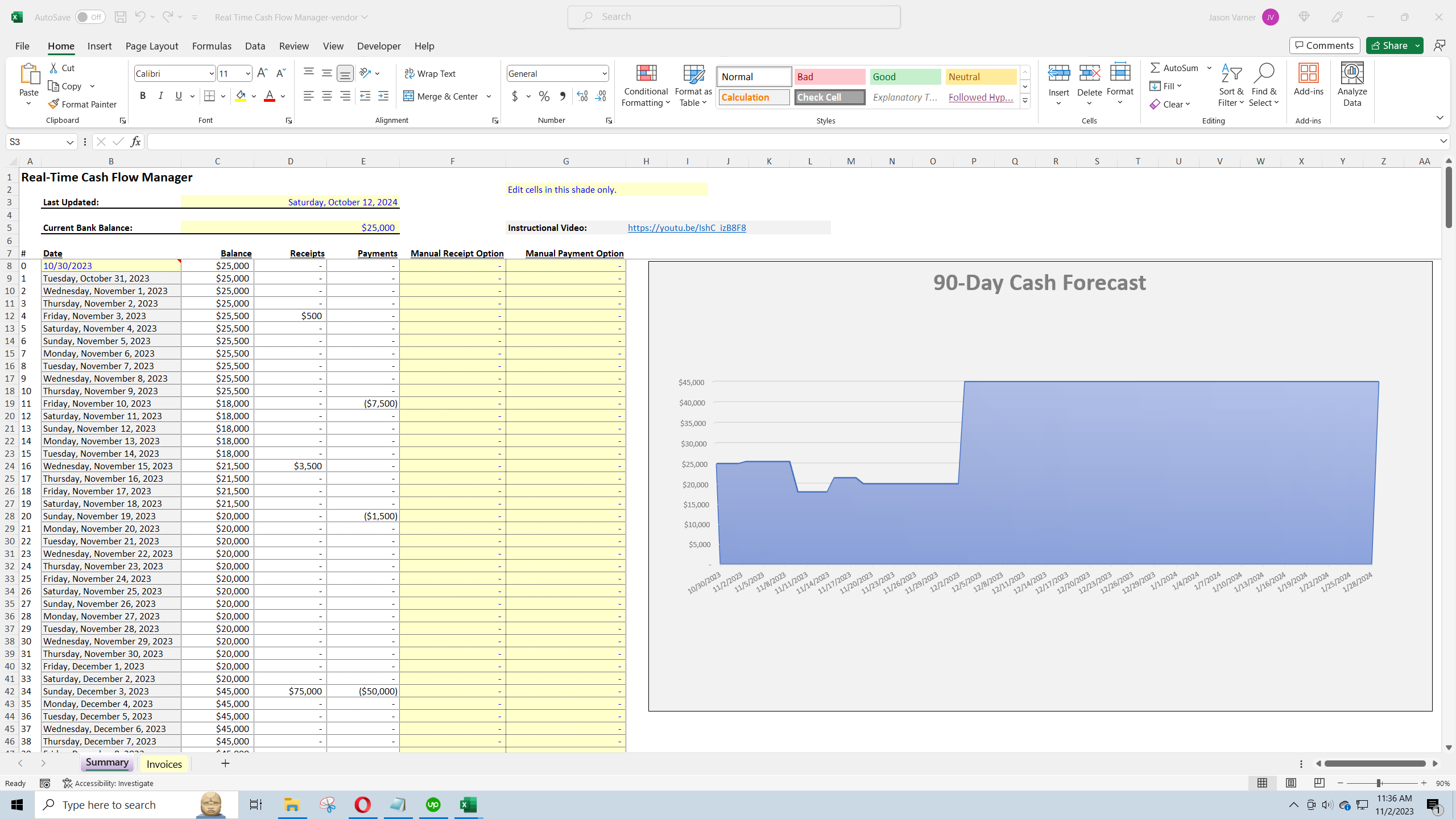

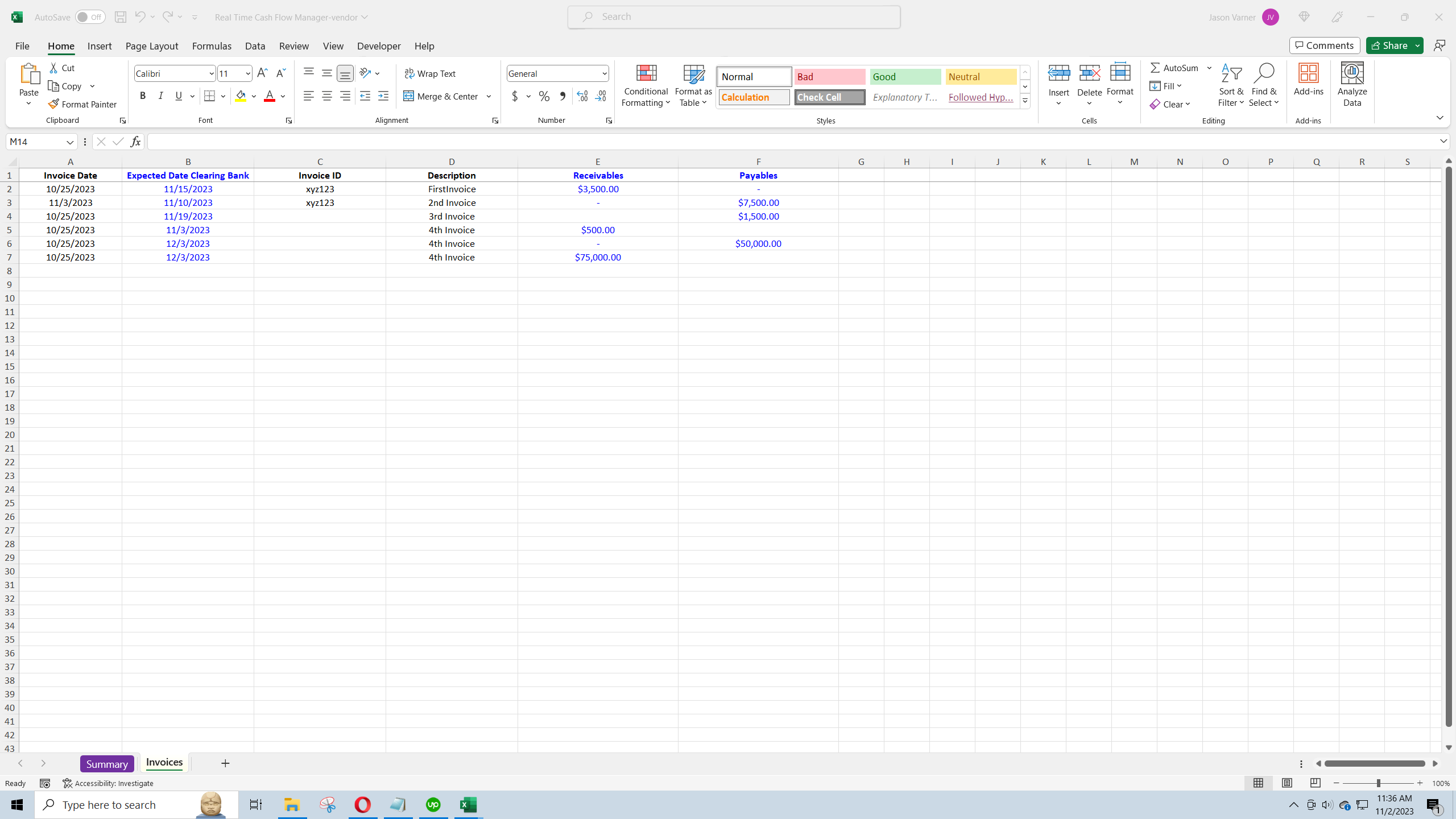

This template was designed to be a real-time cash flow planner. You can enter the current bank balance, the current date date, the current outstanding invoices (due date, amount, description) for receivables / payables, and the result will be your expected cash bank balance for the next 365 days.

There is no need to clear off old invoices as the calculations are based on future dates from the present and invoice dates so as you move through time, old invoices won't effect the analysis if their due dates have already passed. If you need to update the dates because invoices are past due, that is easily done by adjusting the given invoices date input.

You get a visualization as well as a 365-day table show expected cash in / out and balance each day. There is also manual data entries for in-flows and out-flows per day if needed.

Effective cash flow management is crucial for maintaining the solvency and operational efficacy of a business. It ensures that there is enough liquid capital available to meet immediate and short-term obligations like salaries, rent, and payments to suppliers. This is particularly important because a business can appear profitable on accounting statements due to credit sales but may still encounter liquidity issues if those credits are not paid on time.

By keeping a vigilant eye on cash flow, businesses can avoid overdrafts and the risk of insolvency, as a mismatch in timing between incoming revenues and outgoing payments can lead to financial distress. Moreover, a solid handle on cash flow enhances budgeting accuracy, which is vital for financial planning and making informed decisions regarding investments and expenses.

Furthermore, strong cash flow management minimizes reliance on external borrowing, which can be costly and may come with restrictive terms. Companies with good cash flow are also seen as less risky, which can lead to improved credit ratings and lower borrowing costs. They can negotiate more favorable terms with suppliers, such as discounts for early payments, contributing to cost savings.

Additionally, having robust cash flow practices allows a business to respond swiftly to unexpected expenses and economic fluctuations without compromising its financial stability. Ultimately, it provides the business owner with peace of mind, freeing them from the stress of financial uncertainty and allowing them to focus on strategic growth and long-term business objectives.

Instructional video included in file.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Cash Flow Management Excel: Cash Flow Management Tool Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping