Equipment Purchase Cost / Benefit Analysis (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF DOCUMENT

- A simple framework for analyzing the financial impact of new equipment purchases.

DESCRIPTION

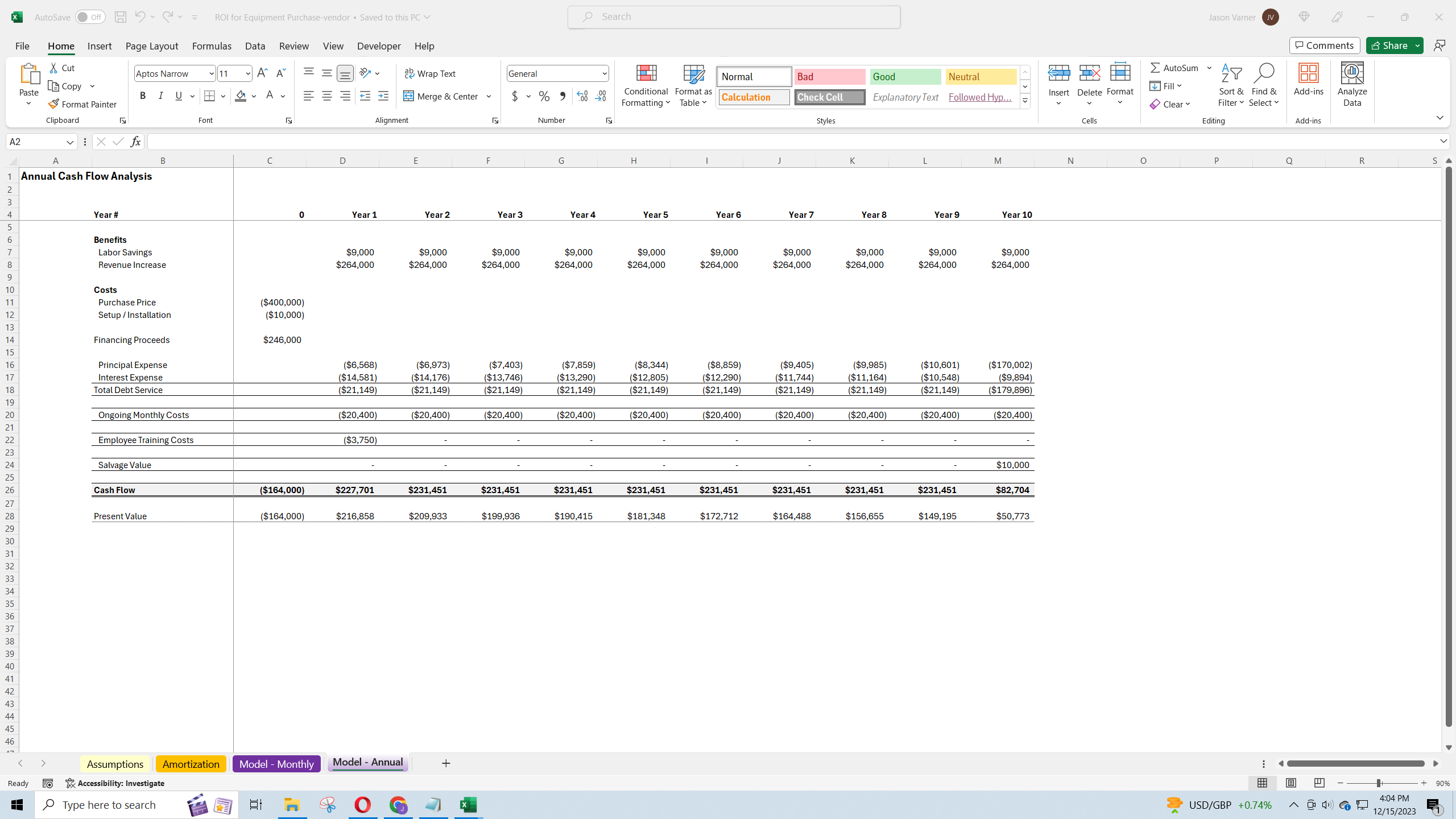

For a manufacturing company considering the purchase of new equipment, a comprehensive cost/benefit analysis is essential. Here are the key elements to include in your analysis:

Initial Purchase Cost: This is the upfront cost of acquiring the equipment. Include not just the price of the equipment, but also any shipping, installation, and setup costs.

Operational Costs: Factor in ongoing expenses such as power consumption, maintenance, supplies, and any additional labor costs associated with operating the new equipment.

Productivity Gains: Estimate the increase in production capacity or efficiency the new equipment will bring. This could include faster production times, higher product quality, or the ability to produce new types of products.

Depreciation and Lifespan: Consider the expected lifespan of the equipment and how its value will depreciate over time. This is important for accounting purposes and for assessing the long-term value of the investment.

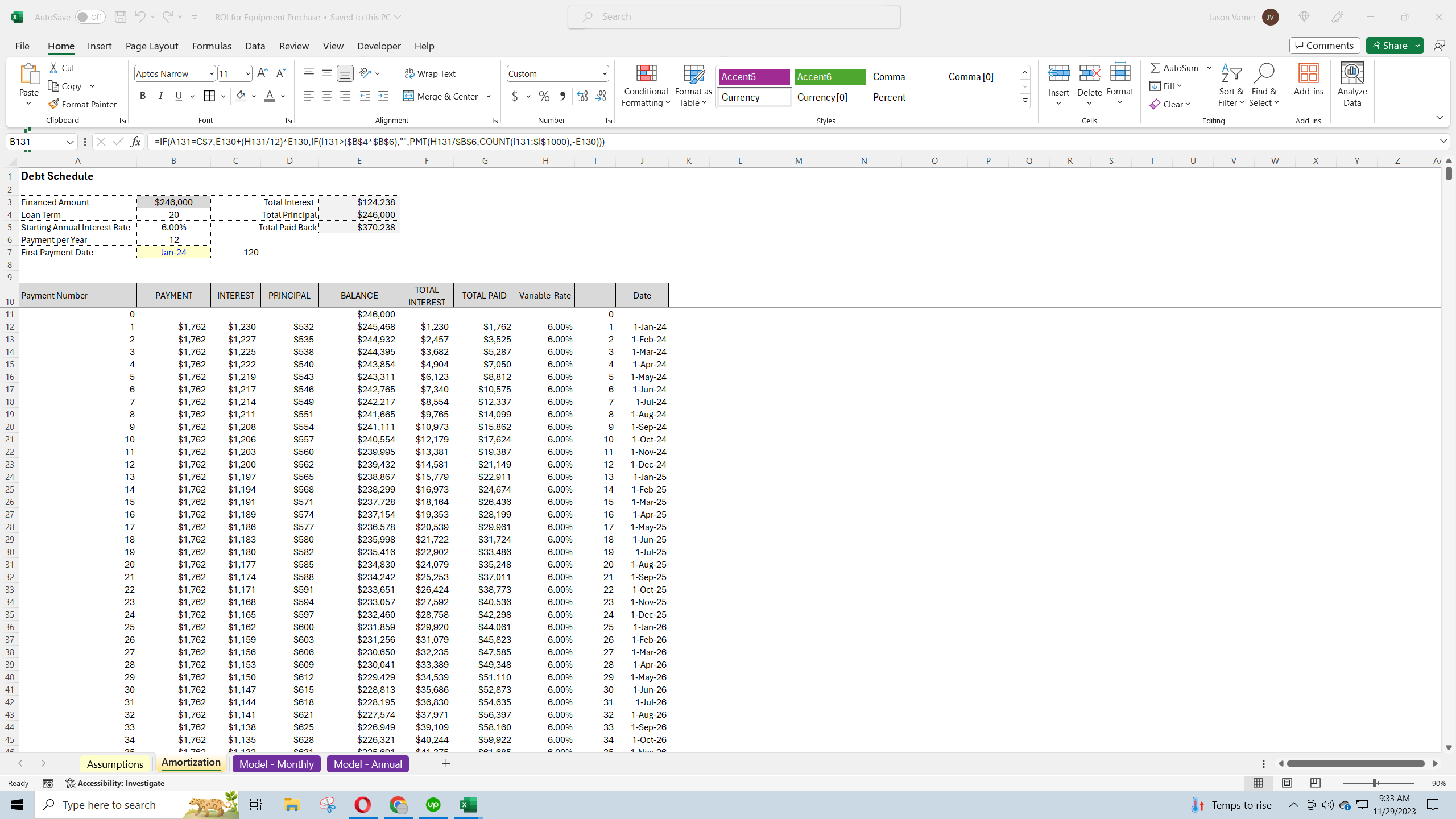

Cost of Capital: If you're financing the purchase, include the cost of capital or interest on loans. This is a real expense that affects the overall cost of the equipment.

Tax Implications and Incentives: Understand any tax deductions or credits available for the purchase, such as depreciation deductions or investment tax credits.

Risk Assessment: Evaluate any potential risks associated with the new equipment, such as the risk of it becoming obsolete due to technological advancements, or the risk of breakdowns and repairs.

Environmental and Energy Efficiency: Consider any environmental impacts or energy efficiency gains, which can sometimes lead to cost savings or qualify for additional incentives.

Impact on Labor: Assess how the new equipment will affect labor needs. It might reduce labor costs by automating certain tasks, or it might require new skills and additional training for your workforce.

Resale Value: Estimate the potential resale value of the equipment at the end of its useful life in your operation.

Comparison to Alternatives: Compare the costs and benefits of the new equipment to alternative solutions, such as upgrading existing equipment, outsourcing the production process, or not making the purchase.

For the timeframe of your analysis, it typically depends on the expected lifespan of the equipment. A common period is 5-10 years, but it can be longer for equipment with a longer useful life. It's important to model out the analysis over the entire period you expect to use the equipment, to get a full picture of its cost and benefits over its lifetime.

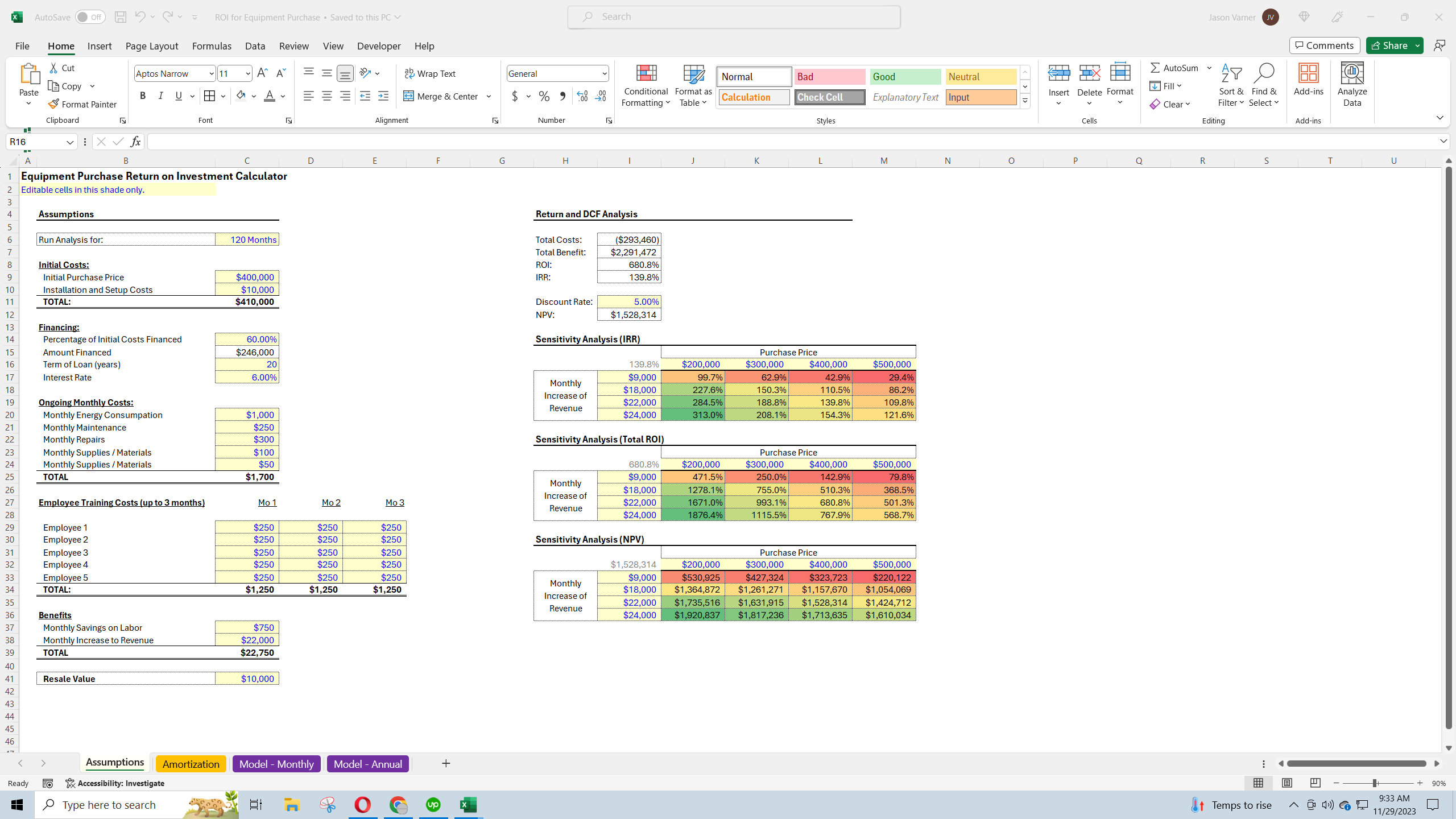

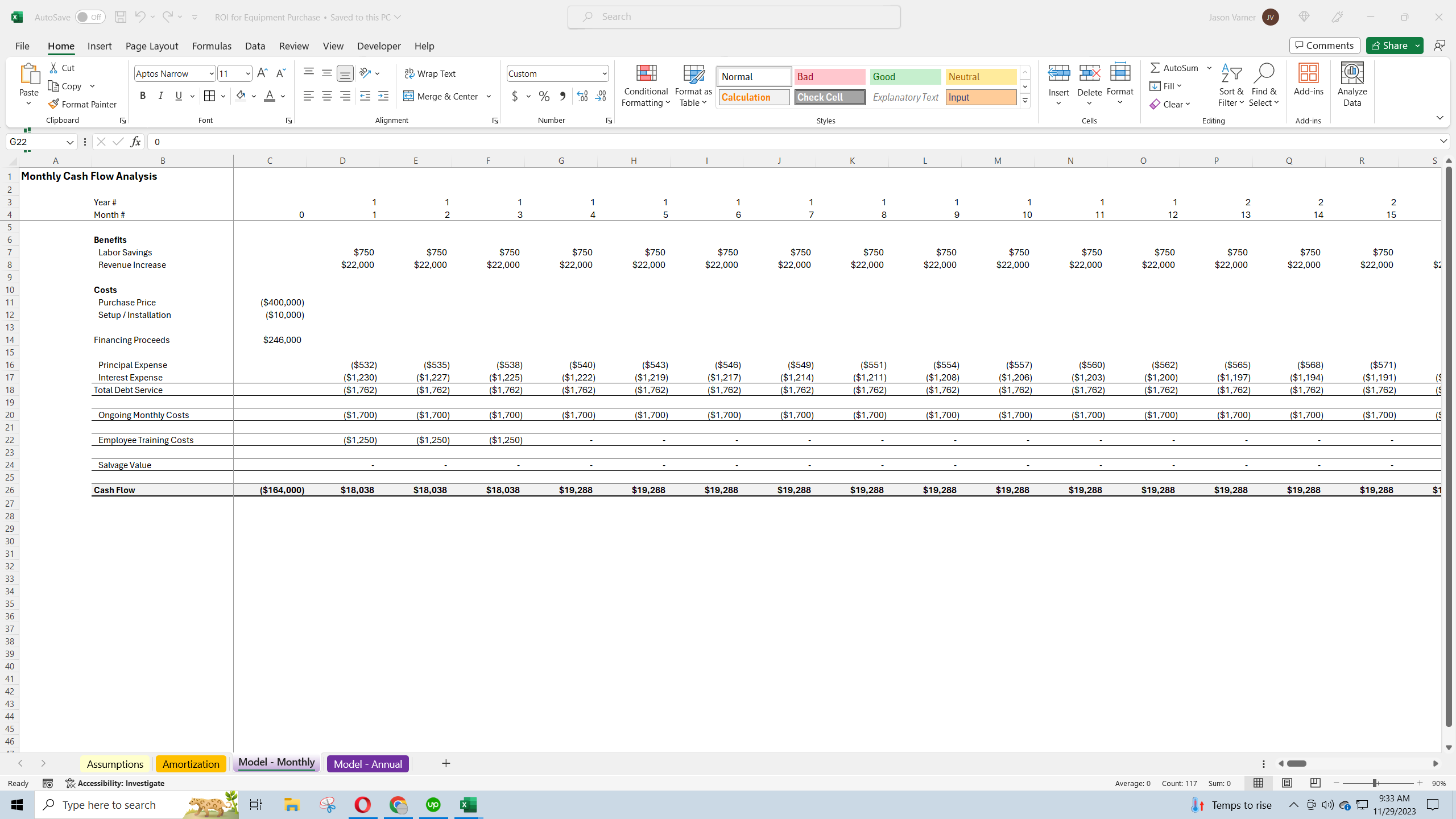

Analyze the return on investment (ROI) with detailed sensitivity analysis for varying purchase prices and monthly revenue increases. Includes a comprehensive debt schedule and cash flow analysis to ensure robust financial planning.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Return on Investment, ROI Excel: Equipment Purchase Cost / Benefit Analysis Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

Accounting Trackers - Tools for Accountants

This bundle contains 23 total documents. See all the documents to the right.