Generic Cost Benefit Analysis Excel Model Template (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- To calculate key investment appraisal metrics for a proposed project or investment in order to make an informed decision.

BUSINESS CASE DEVELOPMENT EXCEL DESCRIPTION

A Generic Cost-Benefit Analysis is crucial for informed decision-making. It assesses the economic feasibility of a project or policy by comparing its costs and benefits. This analysis helps identify the most financially sound options, maximize resource allocation, and mitigate risks. It provides a quantitative framework for evaluating projects' social and economic impact, aiding policymakers and businesses alike in prioritizing initiatives that offer the best returns on investment. Ultimately, a Generic Cost-Benefit Analysis is instrumental in ensuring efficient resource allocation, responsible financial management, and sustainable growth across various sectors.

PURPOSE OF TOOL

User-friendly Excel model intended for the preparation of a Cost Benefit Analysis to measure the financial feasibility for a proposed project or investment. The Cost Benefit analysis model has a quarterly timeline across an 8 year period.

An enhanced version of th model with monthly timeline across 5 year period and scenario analysis is available here:

The model follows good practice financial modelling principles and includes instructions, line item explanations, checks and input validations

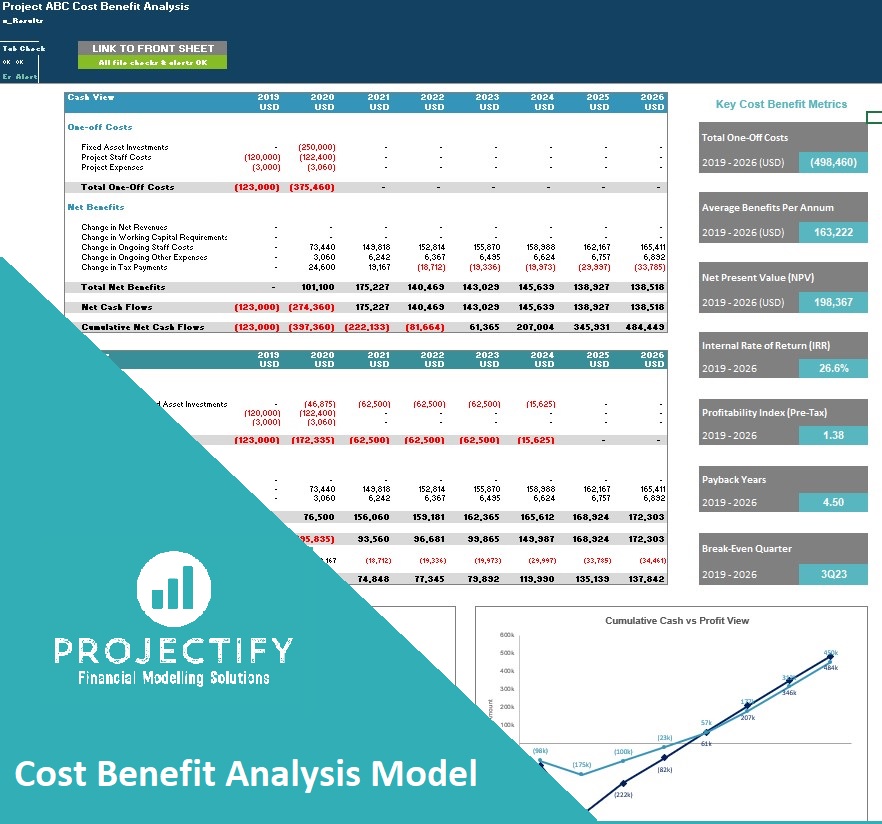

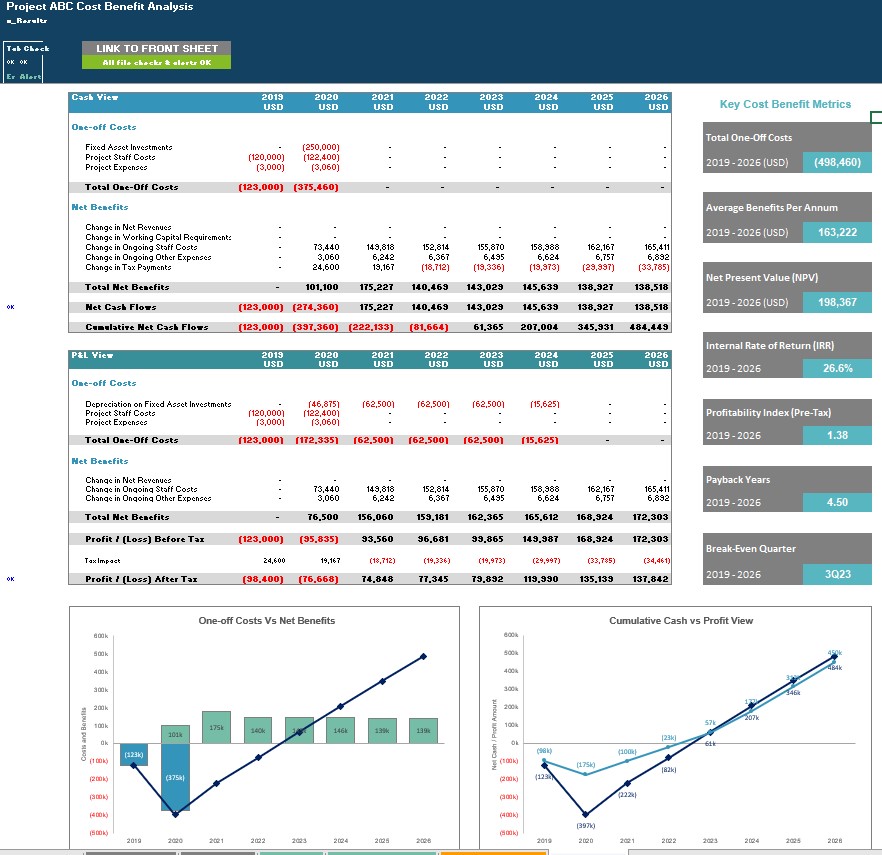

KEY OUTPUTS

The model is generic and not industry-specific. It computes a number of key appraisal metrics for proposed project or investment including:

• Total one-off costs

• Average benefits per annum

• NPV

• IRR

• Payback

• Breakeven Quarter

• Profitability Index

Results also include a summary table showing the overall costs and beneifts on a:

• Cash View – presents actual cash impacts of proposed project/investments

• P&L View – presents P&L impacts of proposed project/investment (eg Depreciation for Fixed asset investments rather than cash impact)

The Results tab also includes charts showing the cumulative net cash flow over time and costs vs net benefits

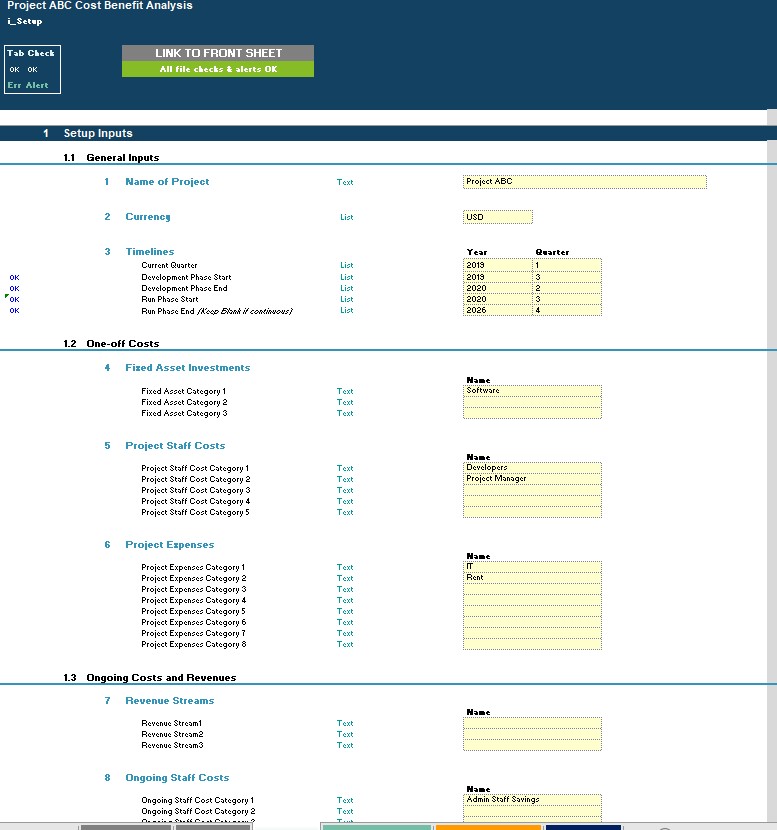

KEY INPUTS

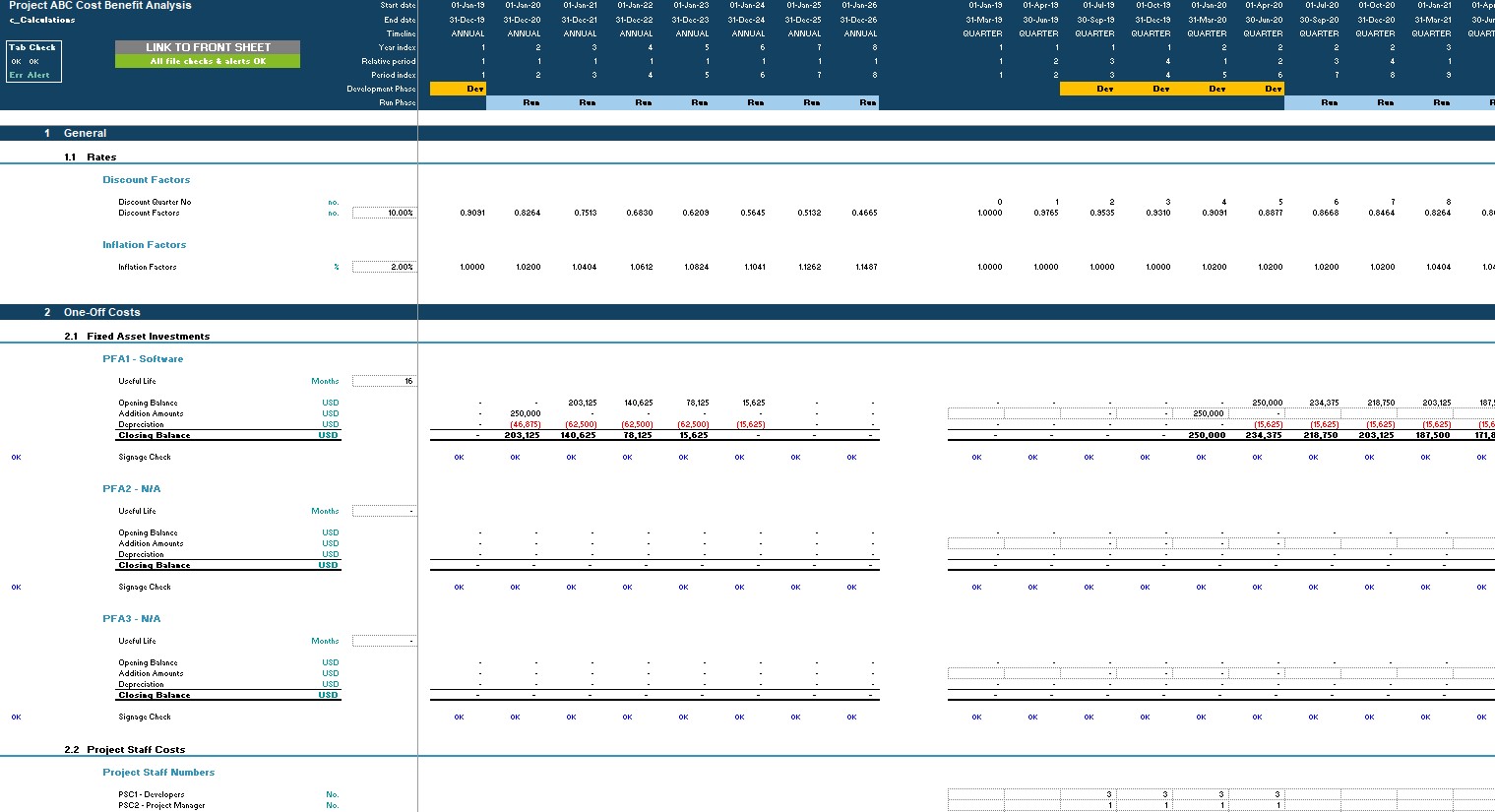

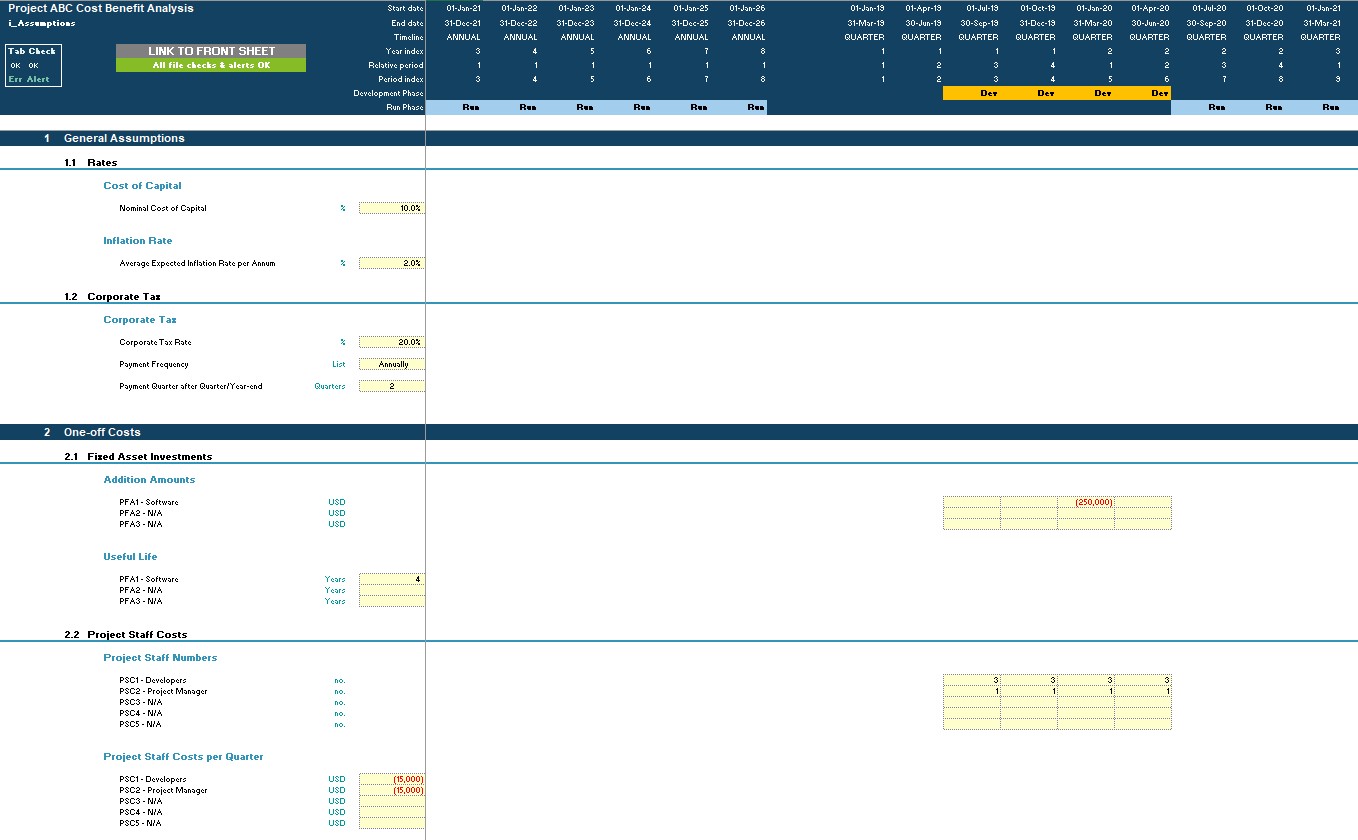

Inputs are split into one-off costs incurred during the development phase and changes in ongoing costs and revenues expected to result after implementation of the project investment (which make up the net benefits).

One-off costs are further split into:

• Fixed asset investments (up to 3 categories) consisting of investments that are capitalizable rather than expenses when incurred.

• Project Staff costs (up to 5 categories)

• Other Project Expenses (up to 8 categories)

Net Benefits are further split into

• Changes in ongoing revenues resulting from the project/investment (up to 3 categories)

• Changes in ongoing staff costs resulting from the project/investment (up to 5 categories)

• Changes in other ongoing expenses (up to 10 categories)

Other inputs include:

• Cost of Capital (for NPV)

• Inflation rate

• Corporate tax rate (and tax payment assumptions)

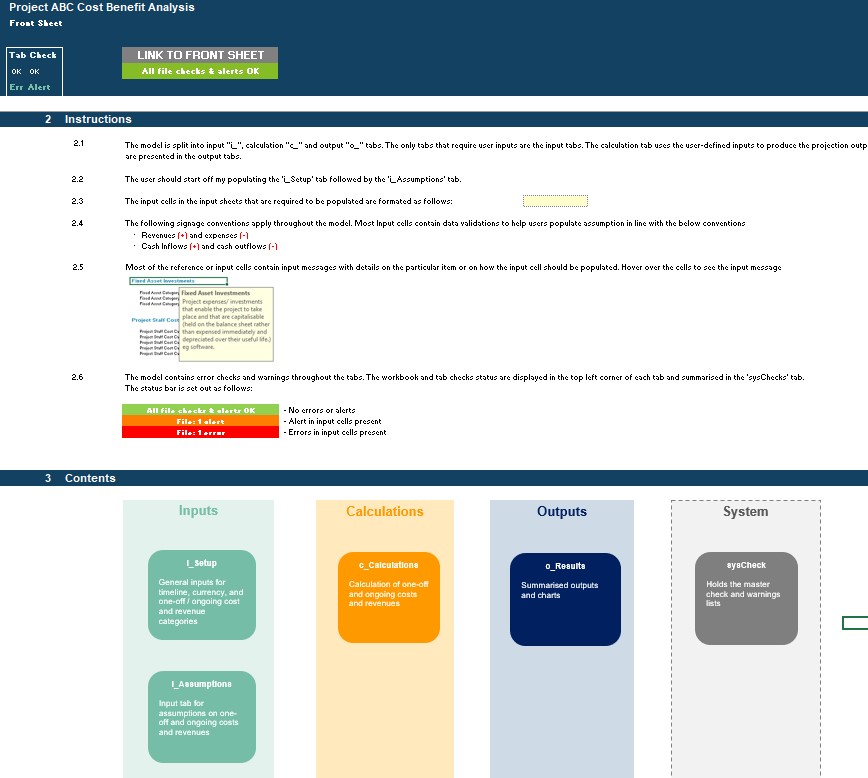

MODEL STRUCTURE

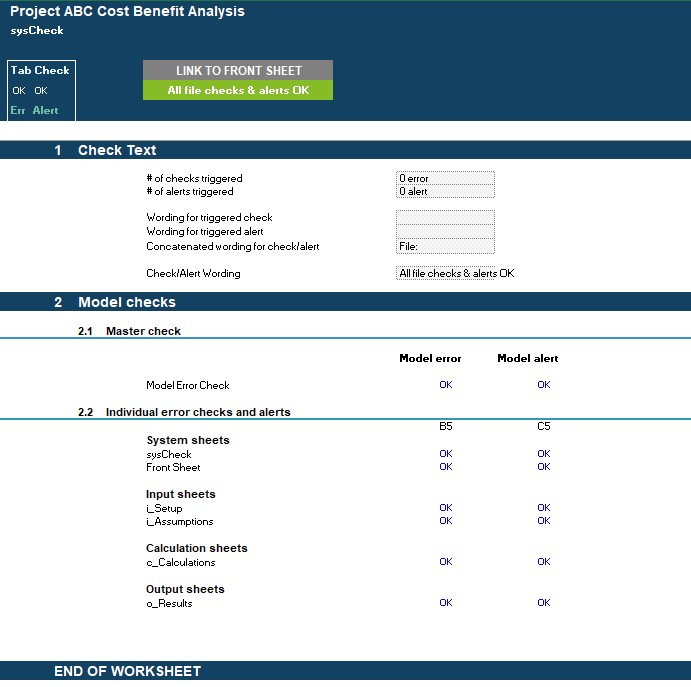

The model contains, 6 tabs split into input ('i_'), calculation ('c_'), output ('o_') and system tabs. The only tabs to be populated by the user are the input tabs ('i_Setup' and 'i_Assumptions'). The calculation tab uses the user-defined inputs to calculate and produce the template outputs presented in 'o_Results'.

System tabs include the following:

• 'Front Sheet' containing a disclaimer, instructions and contents;

• Checks dashboard containing a summary of checks by tab.

OTHER KEY FEATURES

Other key features of this model include the following:

• The model follows best practice financial modelling guidelines and includes instructions, line item explanations, checks and input validations;

• The model allows the user to model project/investment cost and benefits across a maximum of 8 years split into quarterly periods and summarise on an annual basis (dual timeline);

• Revenue and cost descriptions are fully customisable;

• Business name, currency and starting projection period are customisable;

• The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors;

• The model includes checks and input validations to help ensure input fields are populated accurately.

This Excel model includes detailed instructions and input validations to ensure accuracy and ease of use. The model also features a comprehensive checks dashboard to quickly identify and rectify any input errors.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Business Case Development, Cost Optimization Excel: Generic Cost Benefit Analysis Excel Model Template Excel (XLSX) Spreadsheet, Projectify