Trucking / Delivery Business Financial Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

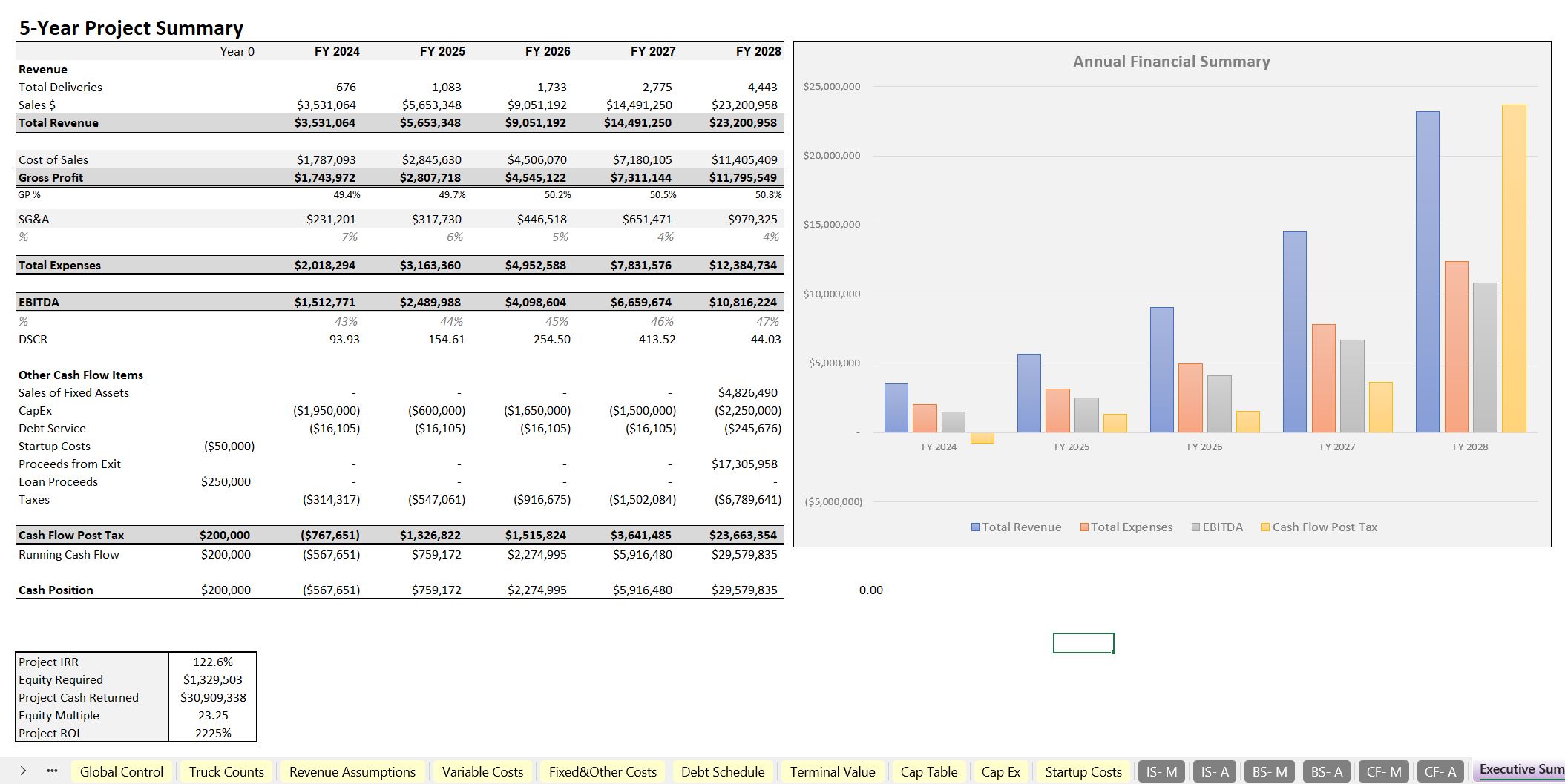

- 5-year scaling model.

- Provides a comprehensive financial forecasting framework.

- Understand the unit economics of your delivery business.

LOGISTICS EXCEL DESCRIPTION

If you are trying to validate your trucking business (or a general delivery business), this 5-year financial model is just the right tool. These assumptions were specifically designed to meet the needs of a trucking business whose primary revenue stream is from making deliveries. Here is a description of each tab:

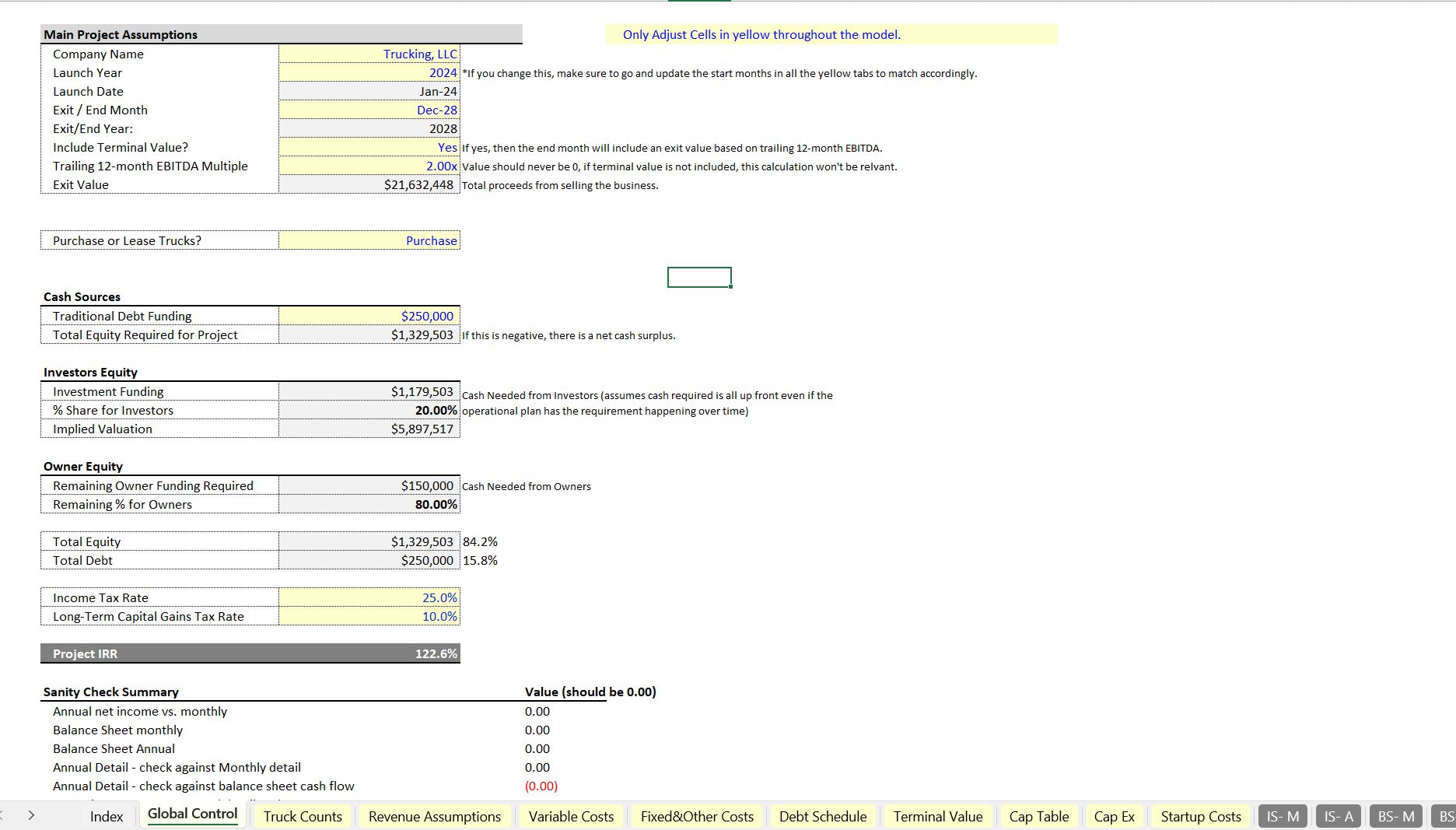

Global Control – Define global timing assumptions, forecast length, if you are owning or leasing trucks, exit, naming, and debt financing vs equity financing.

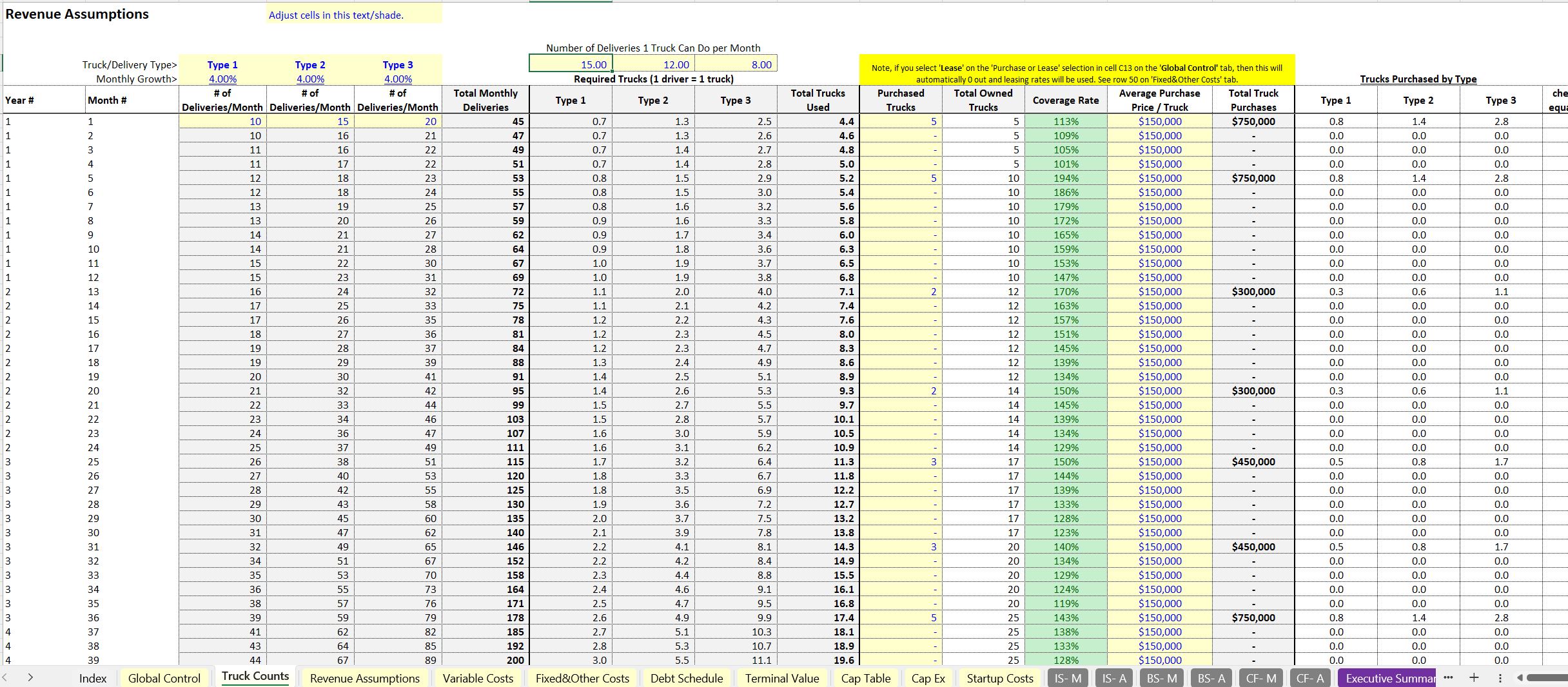

Truck Counts – Define estimated deliveries per month for up to three delivery types, the number of deliveries a single truck can do per month for each delivery type, the average purchase price per truck and more assumptions about how the business scales.

Revenue Assumptions – Define delivery pricing per delivery type (adjustable over 5 years).

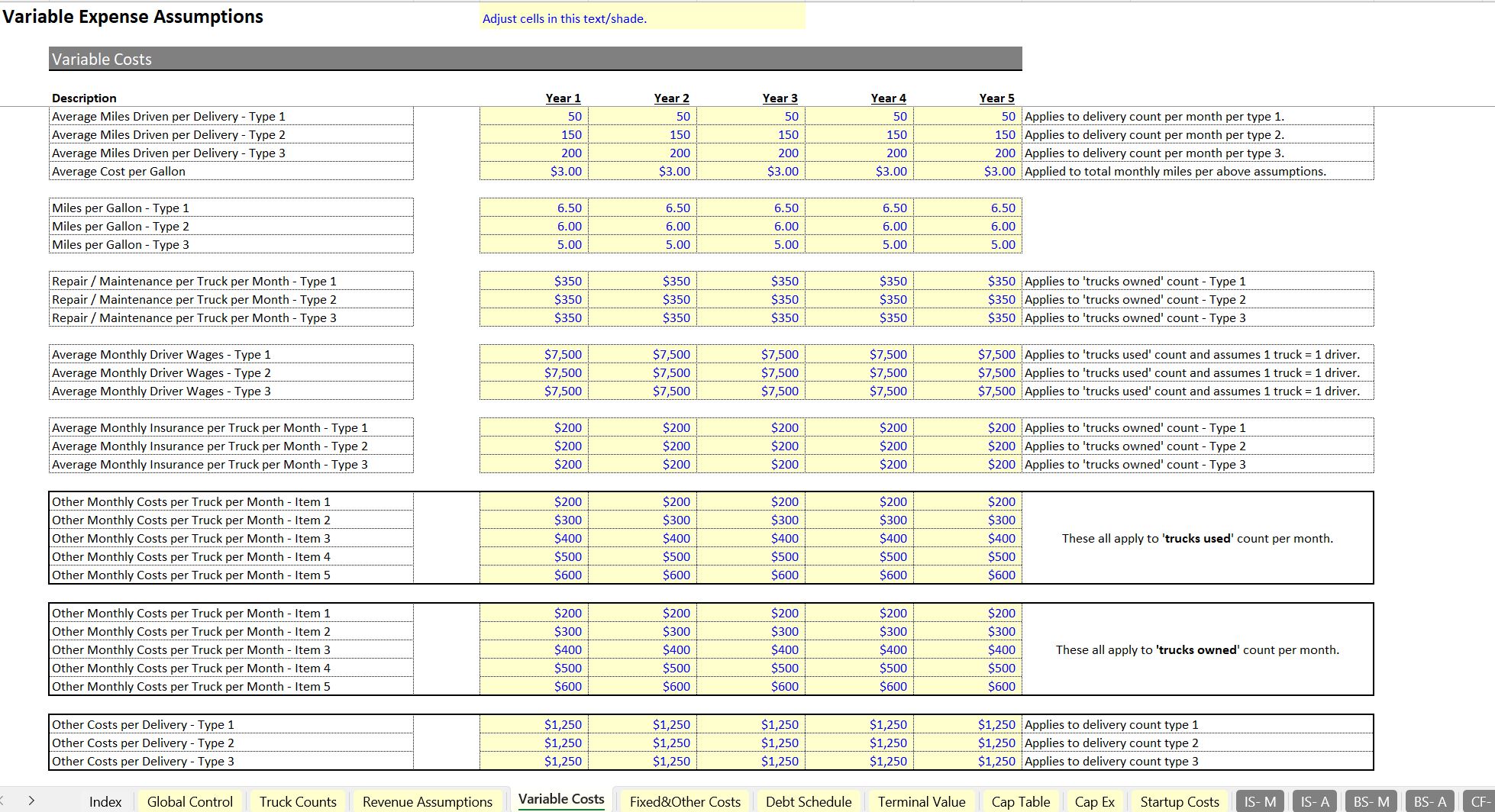

Variable Costs – Define all the costs per truck, drivers, and other costs per delivery. This includes monthly insurance, repairs / maintenance, driver wages, fuel, and more. If leasing, a single input can be entered and you can zero out non-relevant variable expenses.

Fixed and Other Costs – Building costs of your regular running expenses and leasing assumptions if you are not buying trucks.

Debt Schedule – Allows users to input assumptions about the loan they plan on getting if at all.

Terminal Value – Assumptions relating to the distribution of exit value to comprehensive income vs. fixed assets.

Cap Table – Detailed inputs for specific investments by outsiders and insiders as well as an IRR schedule/distributions.

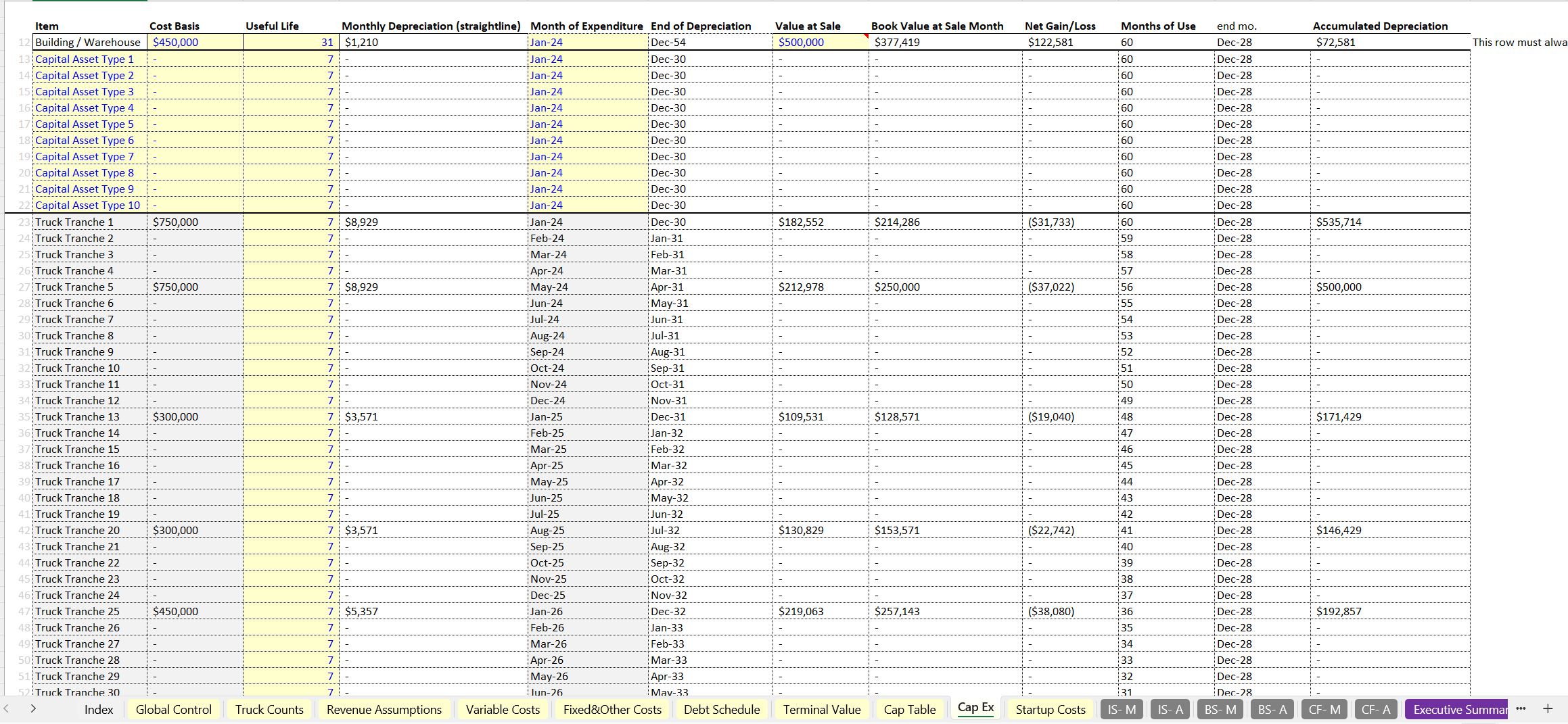

CapEx – Fixed asset purchase schedule for building and other items. Depreciation auto-flows from this. Truck purchases auto-populate per 'truck counts' tab.

Startup Costs – Enter relevant one-time startup costs (not including depreciable items, those are entered on CapEx tab)

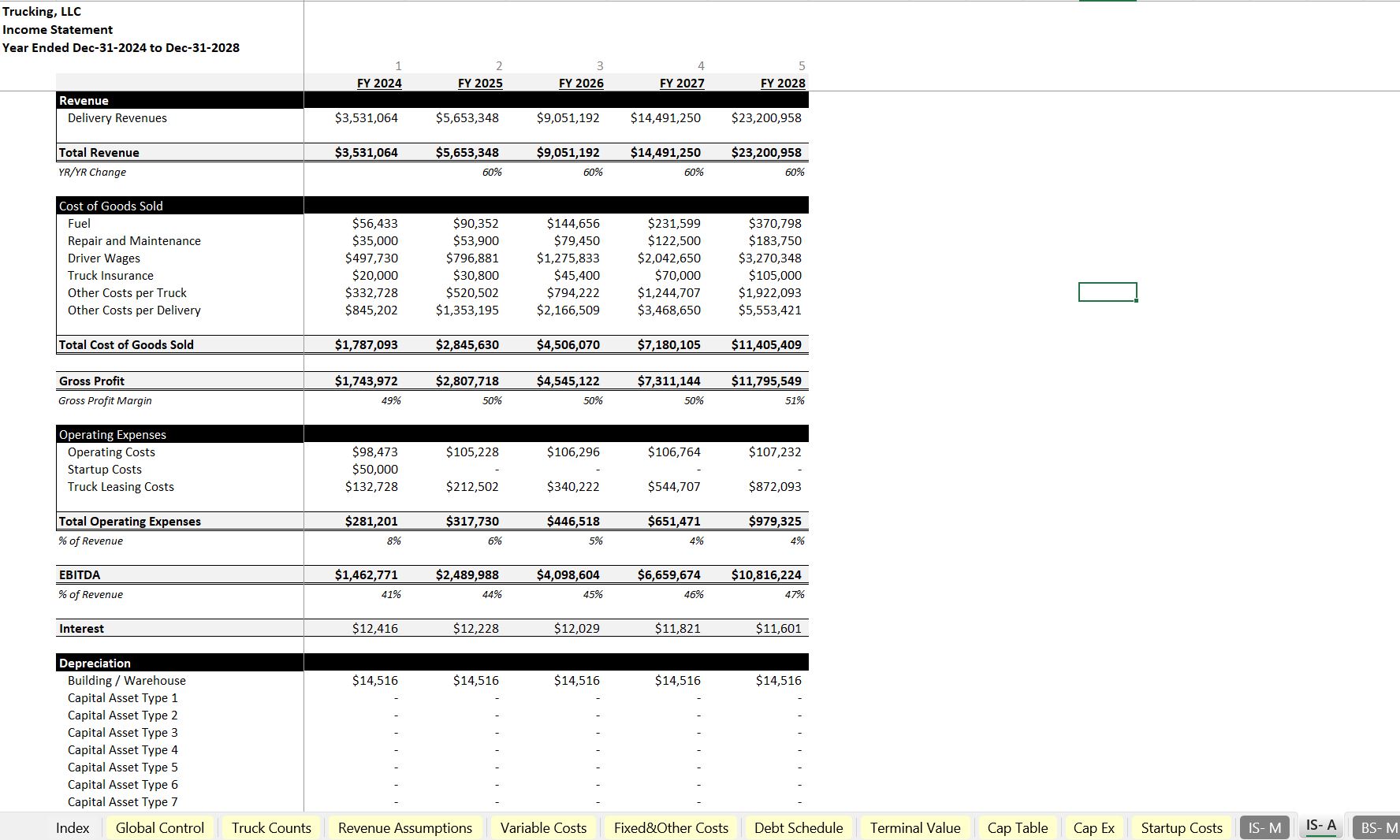

IS- M / IS- A – Formal income statement, all resulting financial data from the assumptions flows to here.

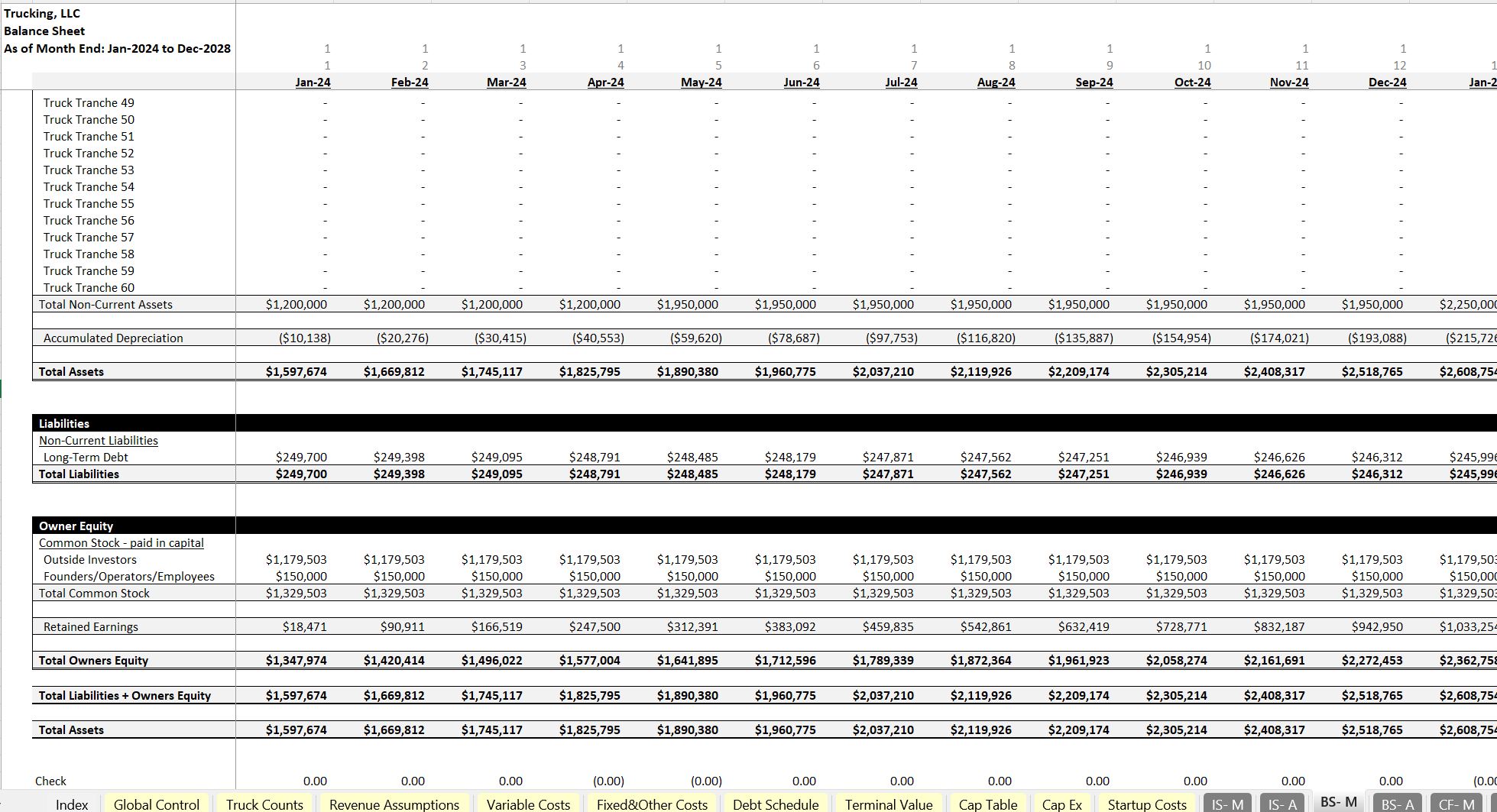

BS- M / BS- A – Formal Balance sheet.

CF- M / CF- A – Formal cash flow statement.

Executive Summary – High level summary of key financial line items.

Distributions – DCF Analysis and IRR for the project and insiders vs. outsiders.

Visuals – Assorted charts/graphs about the businesses activity over 5 years.

Monthly Detail – Shows all the business activity by year for 5 years, including P & L, Debt service, cash flow.

Annual Detail – Same as annual, but on a month by month basis.

The primary goal of this model is to take into account all initial cost assumptions as well as any operating burn to determine the minimum equity required to keep the cash balance from dropping below 0. Then, you will see the resulting cash flow relative to the initial investment required as well as formal pro forma outputs.

The template includes an instructional video and all the inputs are blank so you can start clean with your own assumptions.

This model includes detailed assumptions for variable costs such as fuel, maintenance, and driver wages, ensuring comprehensive financial planning. It also provides a clear breakdown of revenue growth and truck utilization over a 5-year period, aiding in strategic decision-making.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Logistics, Transportation, Integrated Financial Model Excel: Trucking / Delivery Business Financial Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping