Loan Repayment Optimizer (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

LOANS EXCEL DESCRIPTION

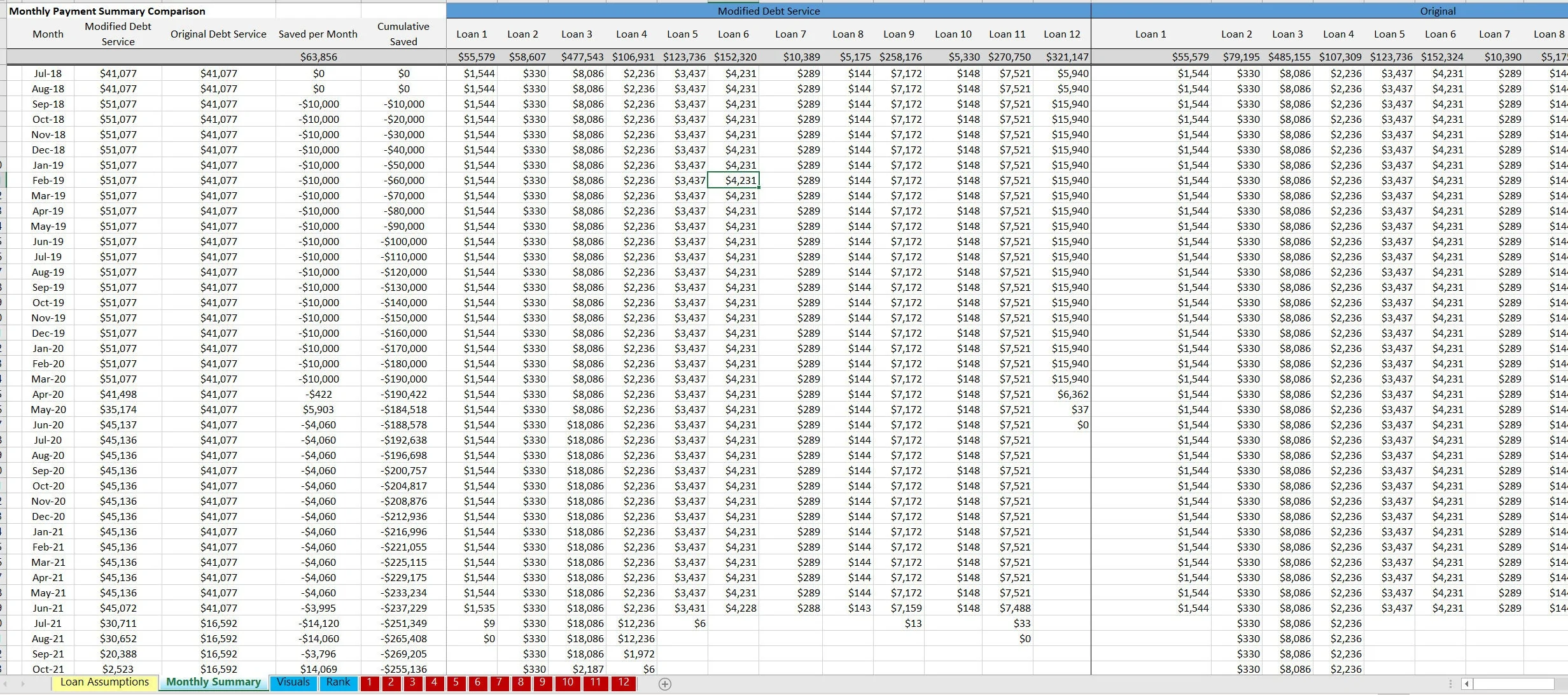

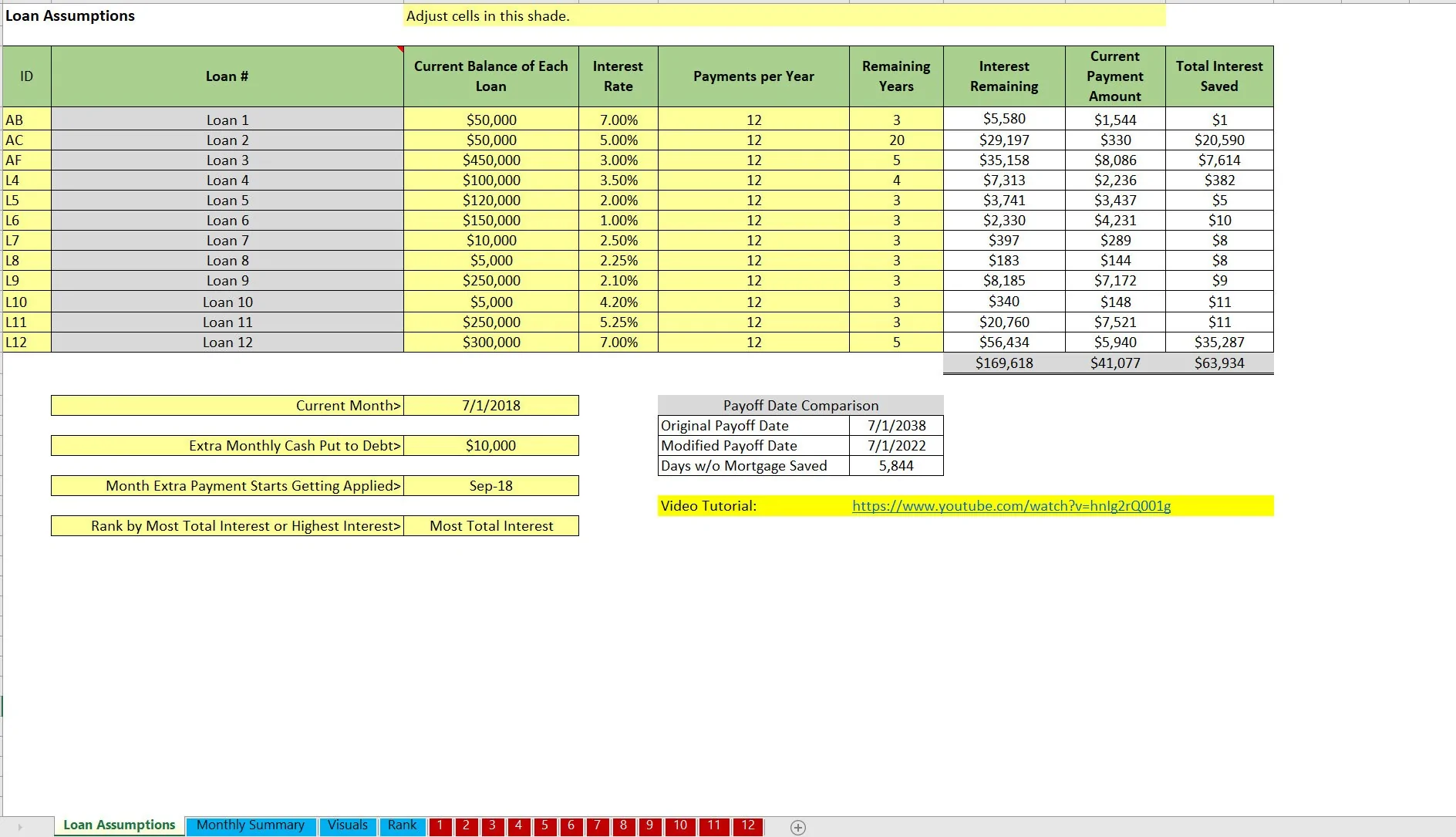

Managing up to twelve different loans can be difficult and overwhelming. It is not always super clear what the best payoff strategy is because there are many factors. Usually the most important factor is balance and interest rate, but you also need to consider the terms/length of the loans. This optimization tool was built to make it easier to plan out how you can pay off your loans when you have extra money to put on the loans every month vs. not.

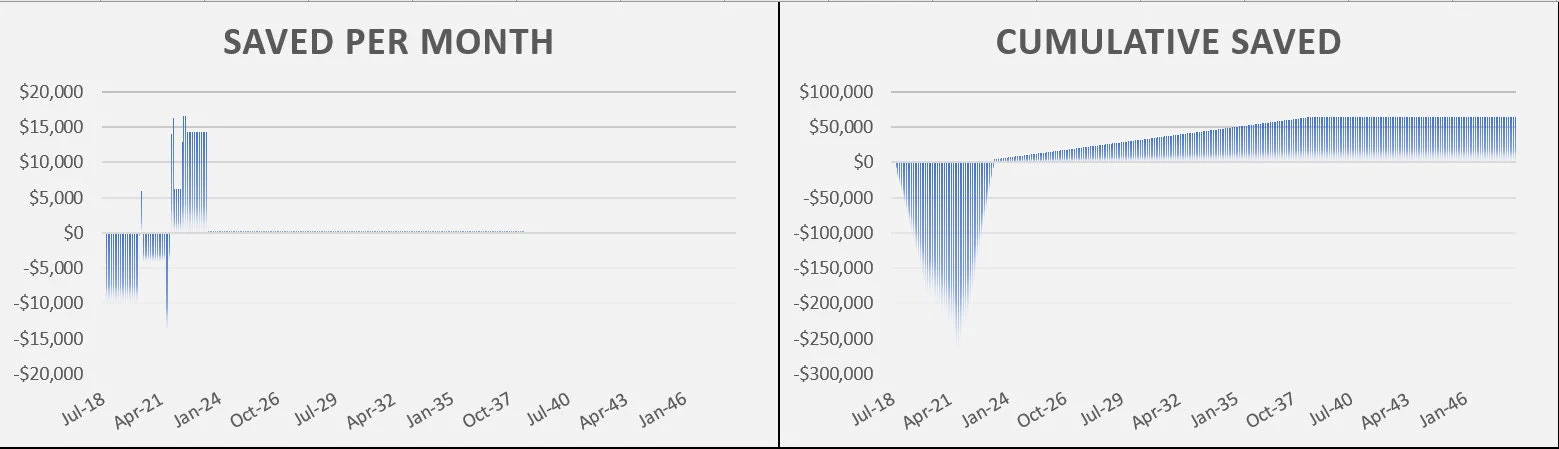

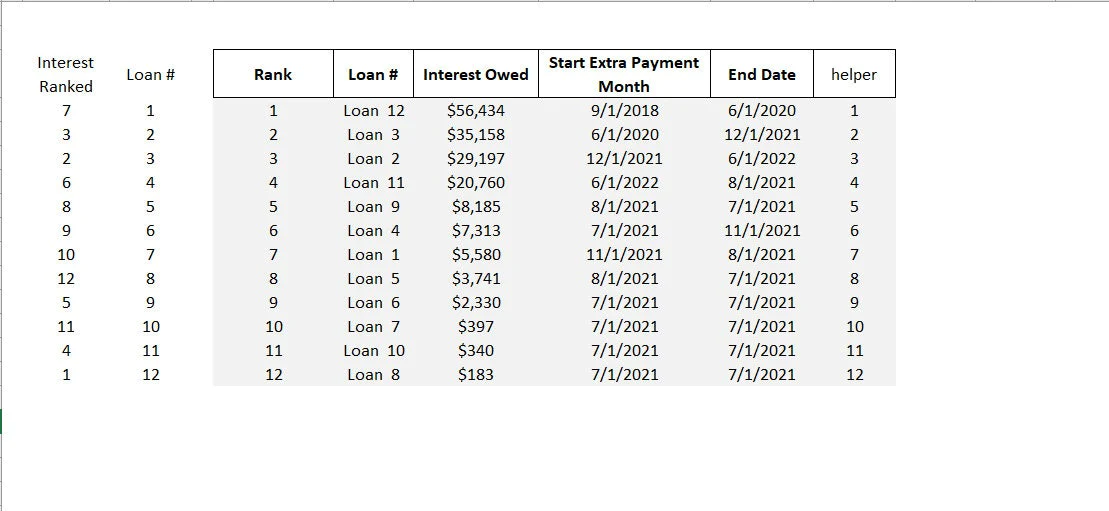

The output will show the total interest saved by paying extra $x every month and ordering the extra money to go into loans with the highest interest rate first. You will also be able to see the original payoff date if you simply payoff the loans normally vs. the new payoff date if you pay off all the loans based on having extra cash to put down on the loans each month.

If you have up to 12 loans with varying interest rates and time remaining / terms, this model will help you structure the loans so they are paid off in the quickest way possible and will show the order in which to pay them off.

This takes into account all loan factors including: term remaining, rate, amount remaining to be repaid and extra cash available to pay off principle per month. You can configure the sheet to pay off based on highest total interest due or highest interest rate.

It will show you how many days you have saved in not having to pay a mortgage anymore compared to if you just paid them all off on their regular schedules. The ranking logic and dynamic formulas used here are really powerful and not that hard to follow along with.

There is no VBA and it is all regular formula based. The model is set up to solve for the lowest total interest paid given all the assumptions.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Loans Excel: Loan Repayment Optimizer Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping