Depreciation Recapture Calculator (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- A simple Accounting tool to help with taxes on property sales.

DEPRECIATION EXCEL DESCRIPTION

This one goes out to all you Accountants out there. The most common place you see recapture happening is in real estate. This is because property is depreciated and then sold for above book value at some point in the future.

When the sale happens, there are taxes owed on the depreciation expense that was taken since the property's inception. The same goes for any property, plant, or equipment sold above book value. Depending on the depreciation method used, the tax rate applied to that depreciation figure can vary. Sometimes, more aggressive depreciation methods will have higher tax rates, but if regular straight lined method is used, then it is often capped at 25%.

There are lots of nuances to this calculation but the model tries to hit the majority of cases and convey the primary logic that is happening, which is a taxable basis on proceeds that are above the adjusted cost basis but below the original cost basis. Gains above the original cost basis are going to fall into regular capital gains.

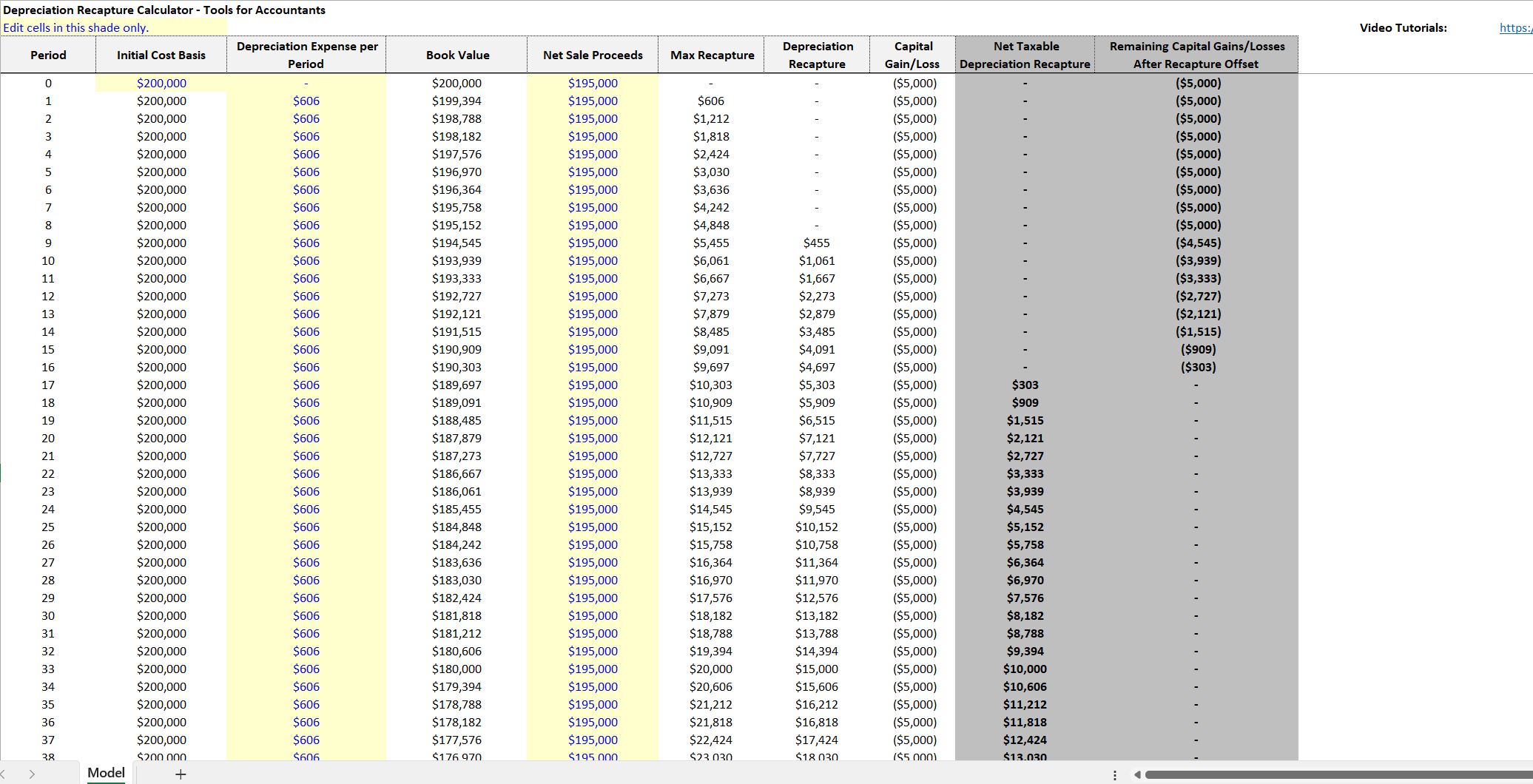

As you can see, the amount of depreciation that has happened and the sale price are going to mean a different tax effect for each future period. The model makes it easy to see what happens at any future period (I went up to 600 total periods so it can handle any situation).

The main output columns are:

• Net Taxable Depreciation Recapture

• Remaining Capital Gains/Losses After Recapture Offset

The main inputs are:

• Purchase price or cost basis

• Depreciation Expense per Period

• Sale Price Expected (entered for each future period)

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Depreciation Excel: Depreciation Recapture Calculator Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping