Airline Financial Model (Aircraft Lease & Capex Option) (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Provides a complete 5-year financial forecasting framework for airlines operating a mix of leased and purchased aircraft, with sector-level revenue modeling.

- Delivers detailed visibility into aircraft utilization, ownership costs, operating expenses, and cash flows to support strategic planning and investment decisions.

- Offers investor-ready financial statements, validation checks, and KPIs that enable clear communication, reliable budgeting, and informed airline management.

AIRLINE INDUSTRY EXCEL DESCRIPTION

This financial model is meticulously designed to analyze and forecast the financial performance of a commercial airline operating a mixed fleet of leased and purchased aircraft, providing detailed forecasts for different aircraft types deployed across different routes. It captures the full set of revenue and cost drivers unique to the aviation sector, including passenger revenue, ancillary income, and cargo operations. The model segments performance by aircraft type, route structure, ownership structure (leased vs. purchased), and seasonal demand patterns to deliver a granular and operationally realistic projection framework.

The model incorporates all critical operational parameters such as block hours, turnaround times, aircraft utilization, load factors, cargo tonne-kilometer metrics, fuel burn, and monthly fleet additions (both new purchases and new leases). Seasonal variations, fare and cargo price indices, ramp-up curves, and route-level distance and block-time structures are fully integrated to ensure realistic, data-driven airline financial forecasts.

Built over a 5-year horizon (60 months) with monthly and annual financial outputs, this financial model serves as a comprehensive tool for route profitability analysis, fleet planning, capital budgeting, investor communication, and financing assessments for airlines adopting a Lease + Purchase fleet strategy.

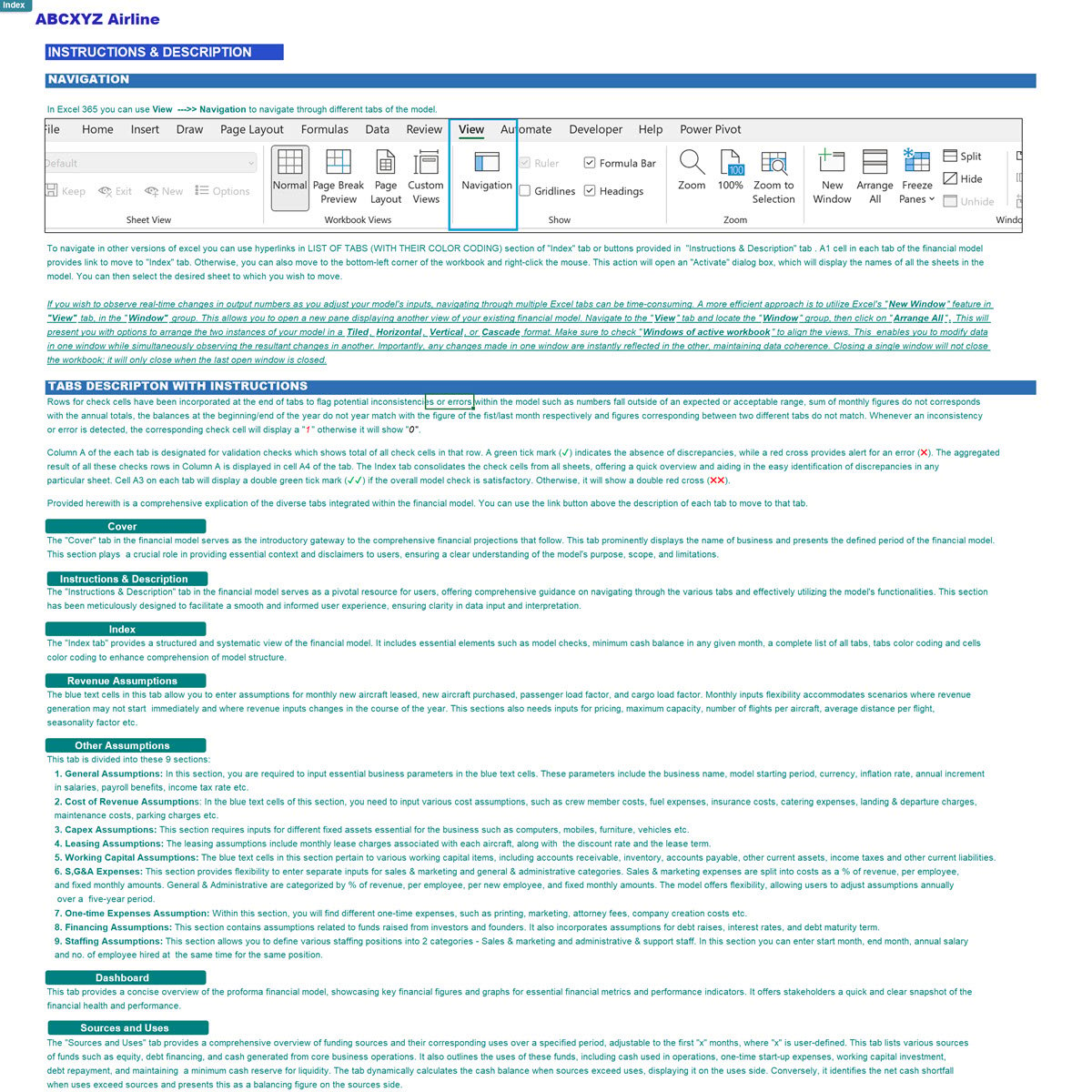

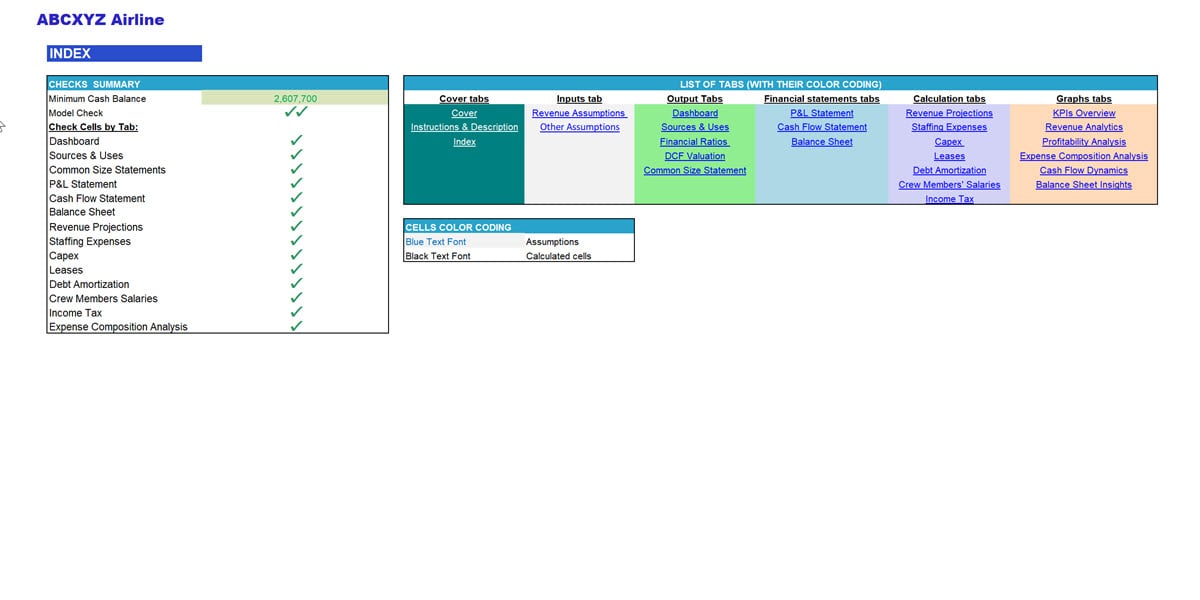

Model Structure – 5 Main Sections

1. Cover Section

• Index of model tabs with tab-color mapping

• Summary of all checks and integrity indicators

• Color-coding legend for assumptions, links, formulas, and outputs

2. Input Section (Assumptions Tab)

All assumptions are consolidated into a clean, user-friendly tab. Inputs are placed in Light Gray Cells with Blue Text for clarity.

Key input areas include:

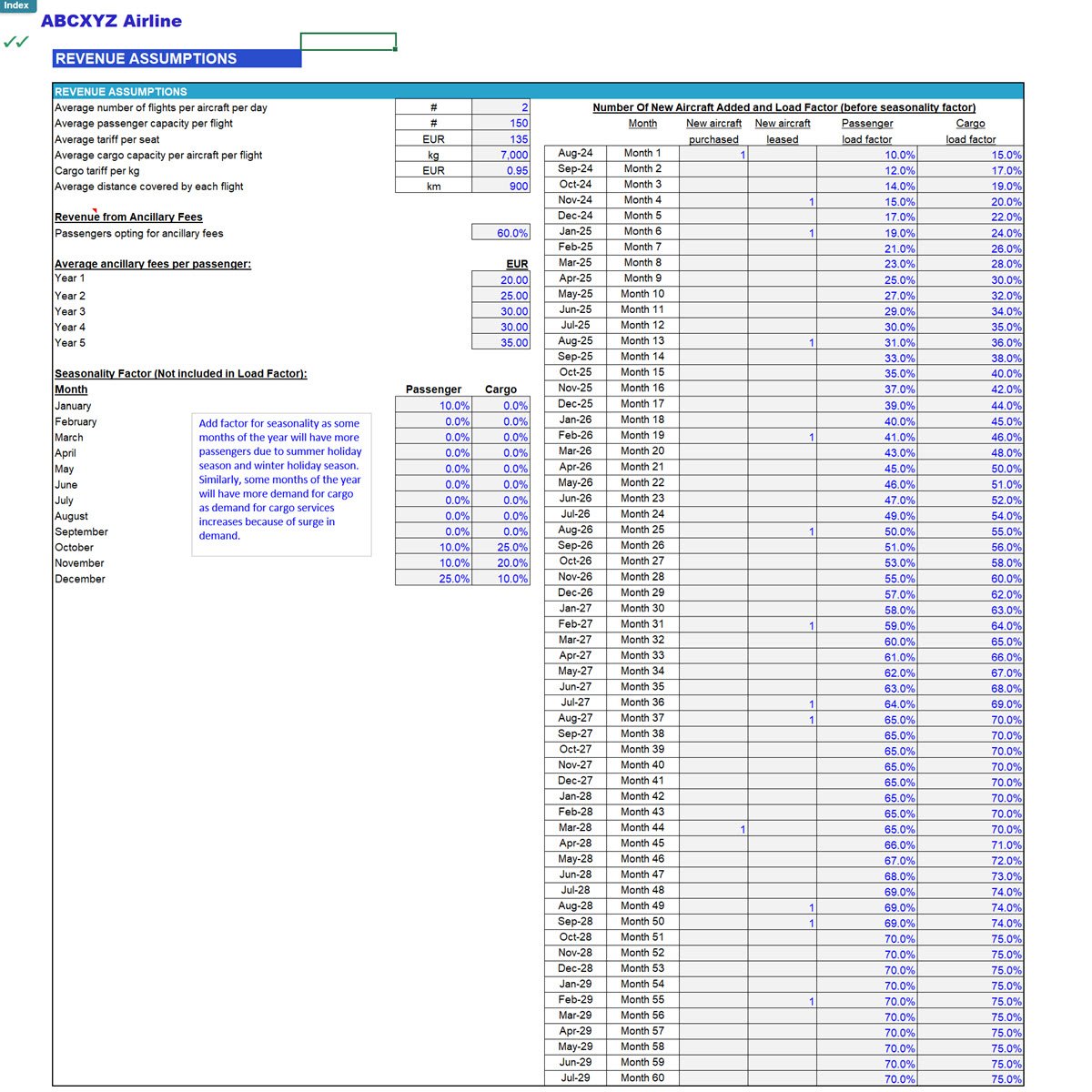

• Revenue Assumptions

• Passenger seat configuration by aircraft type (Economy & Business)

• Sector distances, block times, turnaround times

• Monthly load factor schedule + ramp-up curve

• Passenger base fares by route and class; yield per RPK

• Cargo capacity per aircraft (kg), cargo tariff per kg, yield per kg-km

• Seasonal price indices for passenger and cargo revenue

• Ancillary revenue

• Operational / Fleet Assumptions

• Fleet size by aircraft type with separate induction schedules for leased and purchased aircraft

• Serviceable hours per aircraft per day

• Allocation of utilized hours by route

• Fuel burn per block hour and ATF price assumptions

• Maintenance cycles and cost indexation

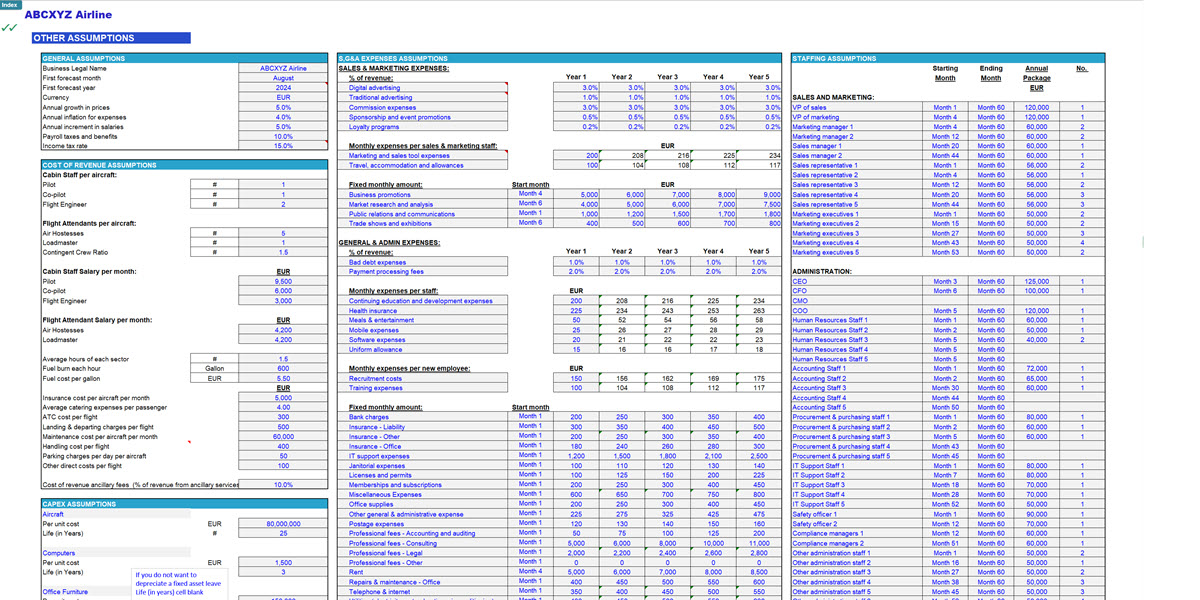

• General Assumptions

• Airline name, forecast start date, reporting currency

• Inflation rate, indexation factors, and corporate tax rate

• Cost of Revenue

• Fuel cost per block hour

• ATC, navigation, landing & departure fees

• Ground handling, dispatch, and station charges

• Catering and ancillary-related operating costs

• Direct Operating Expenses (DOE)

• Lease rentals for leased aircraft

• Crew salaries and benefits

• Aircraft maintenance

• Aircraft insurance

• Hangar & long-term parking charges

• S,G&A Expenses

• Administrative salaries

• Sales & distribution

• Utilities, IT systems, reservation platforms

• Marketing and overheads

• Working Capital

• Receivable and payable days

• Minimum cash balance requirements

• Financing & One-Time Costs

• Equity and debt funding for aircraft purchases

• Pre-operational costs: licensing, certification, branding, launch marketing

• Loan schedules for purchased aircraft

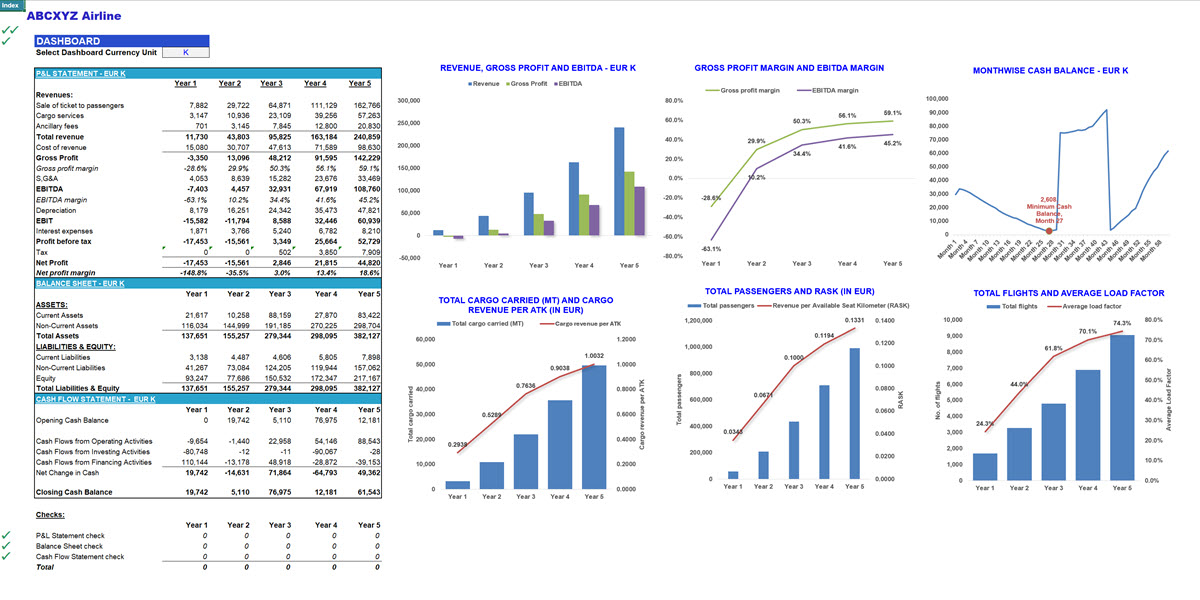

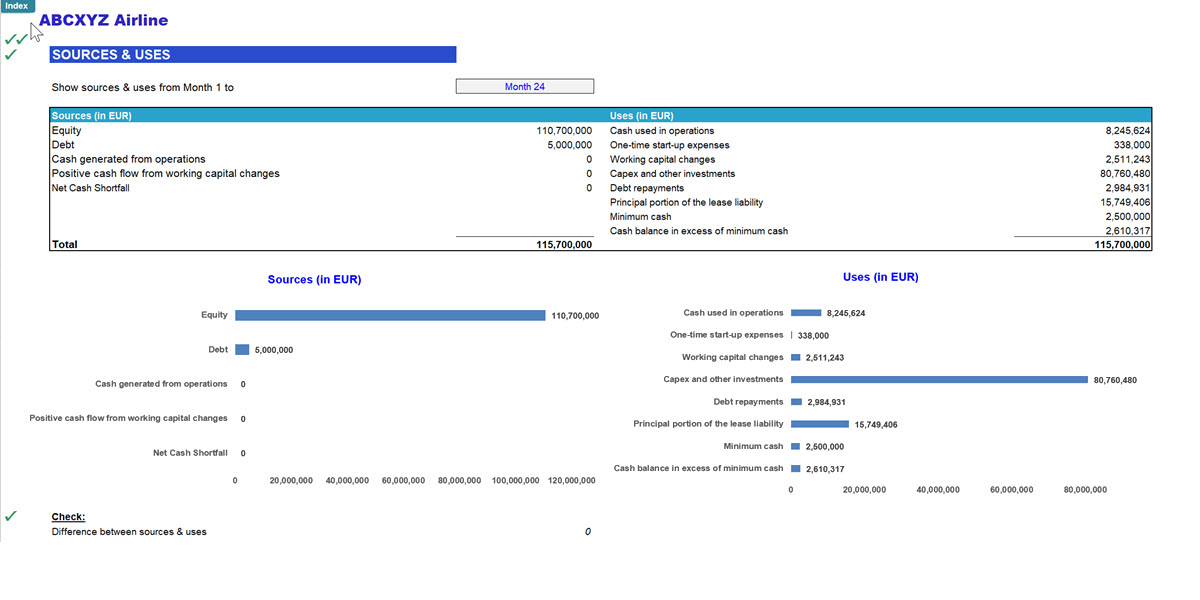

3. Output Tabs Section

• Dashboard with KPIs: revenue, margins, aircraft utilization, ASK/RPK/ATK/RTK, RASK/CASK

• Sources & Uses showing equity, debt, lease obligations, and aircraft purchase funding

• Valuation with DCF analysis and sensitivity scenarios

4. Financial Statements Section

• Profit & Loss Statement

• Cash Flow Statement

• Balance Sheet

5. Calculations Section

• Detailed build-up for passenger, cargo, and ancillary revenue

• Block-hour calculations and aircraft utilization

• Cost of revenue calculations (fuel, ATC, handling, catering)

• Direct operating costs (lease, depreciation, crew, maintenance, insurance)

• CapEx schedule for aircraft purchases

Technical Specifications

• No VBA / No Macros – fully transparent and editable

• Circular-reference free

• Compatible with Excel 2010 or later

Validation Checks

Built-in validation ensures model accuracy and completeness.

• Automated error flags in each tab

• Model-wide integrity dashboard with green ticks (✓) for correct inputs and red crosses (✗) for errors

Why Choose This Model?

This financial model is purpose-built for airlines using a hybrid fleet ownership strategy, combining leased and purchased aircraft. It provides a robust, flexible, and investor-ready framework for evaluating operational performance, capital structure, route profitability, and financing requirements. Ideal for airline startups, expanding carriers, aviation consultants, and financial analysts, the model delivers clarity, credibility, and actionable insights for strategic planning and investor communication.

For tailored customization, we can adapt the model to your specific fleet mix, acquisition strategy, network structure, and financial requirements.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Airline Industry, Integrated Financial Model Excel: Airline Financial Model (Aircraft Lease & Capex Option) Excel (XLSX) Spreadsheet, ExcelFinModels