Investment Fund Trading Tracker: Up to 50 Assets (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

INVESTMENT VEHICLES EXCEL DESCRIPTION

Have you ever tried to build a tracker for your stock positions? It sounds like a fairly straight forward job, but it is not. This is especially true when you are in and out of positions over time, take 2-3 tranches to get into a position and sell in 2-3 tranches in the future. There is cost calculations and all sorts of things to consider. This template has a nice bucketing configuration to give accurate profits on a long-only fund that makes distributions to investors over time.

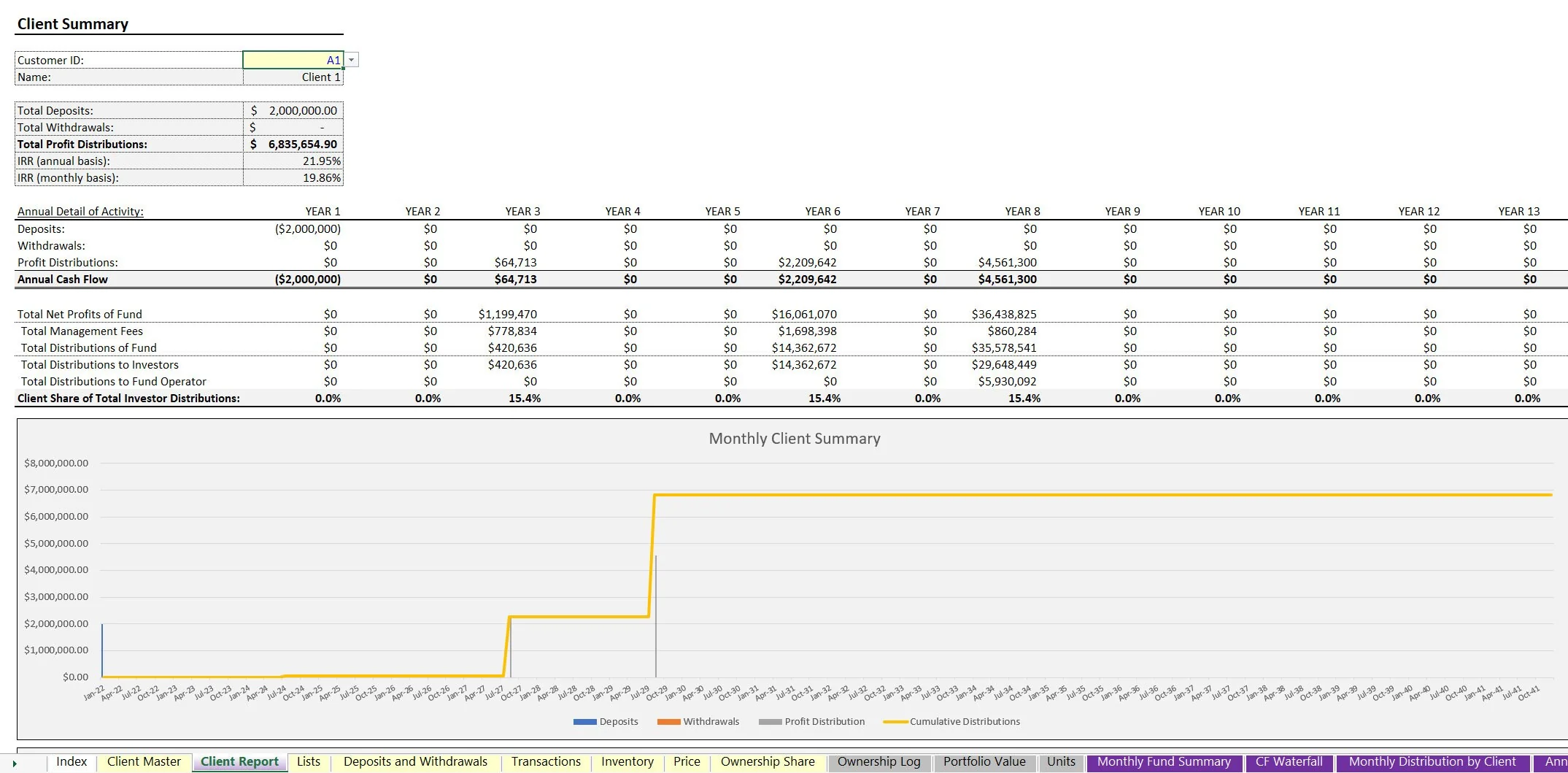

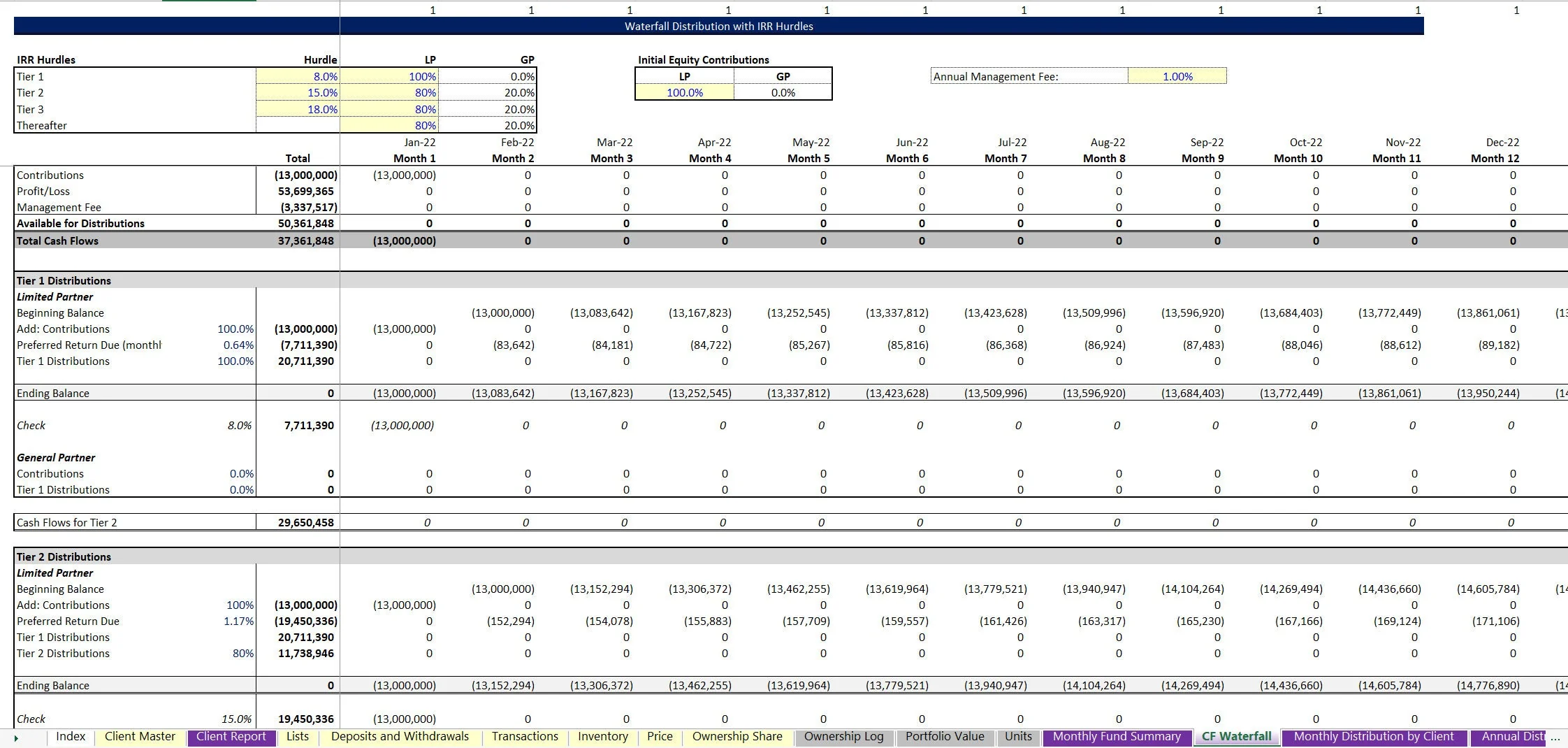

In this model, distributions only happen when profits are recognized, however there is a cash flow waterfall (up to 20 investors can be tracked) that calculates the profit distribution (or carry) splits based on IRR hurdles set for the LP / investors.

This tool was designed for a multi-member fund to keep track of trading activity, the resulting distributions to investors, and management fees from long-only stock or crypto positions.

Features include:

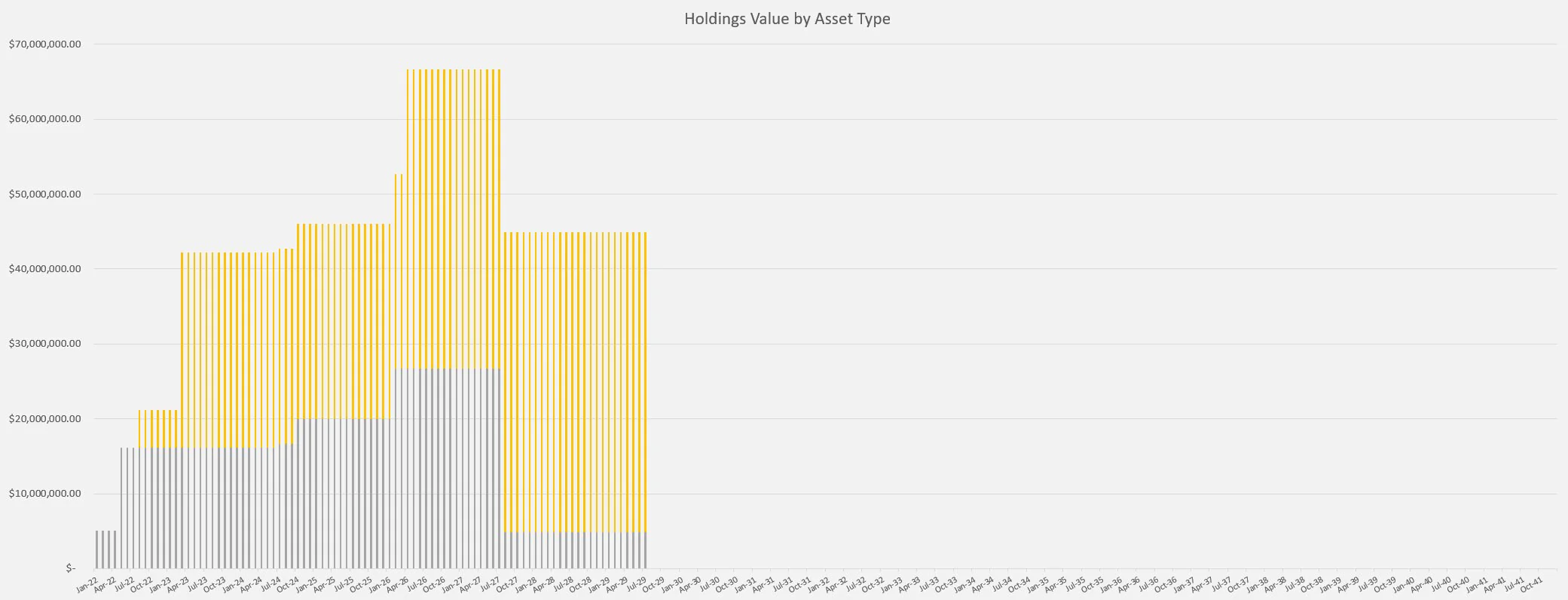

• Up to 50 assets (expandable without too much work)

• Up to 20 members (expandable with some work)

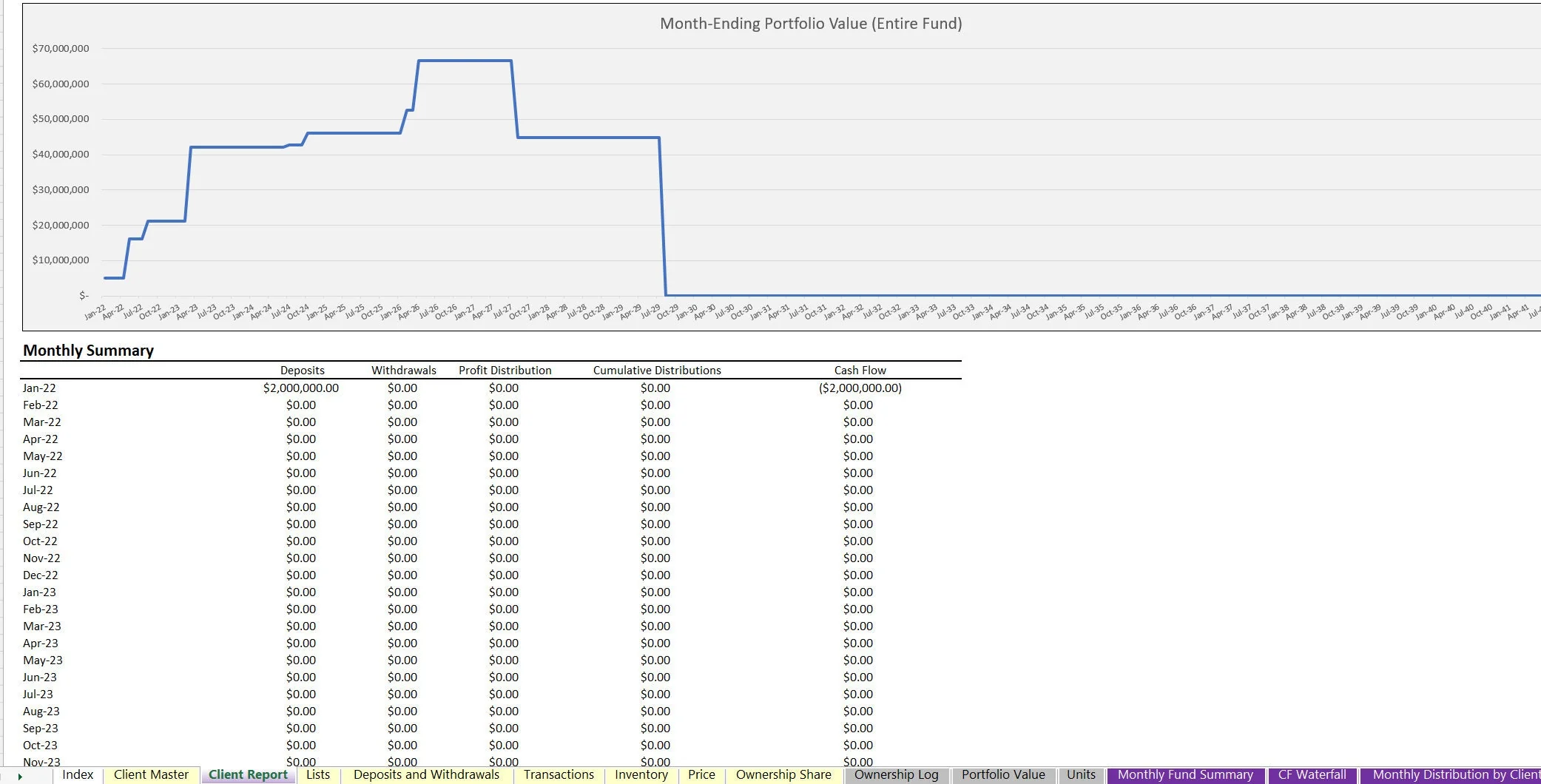

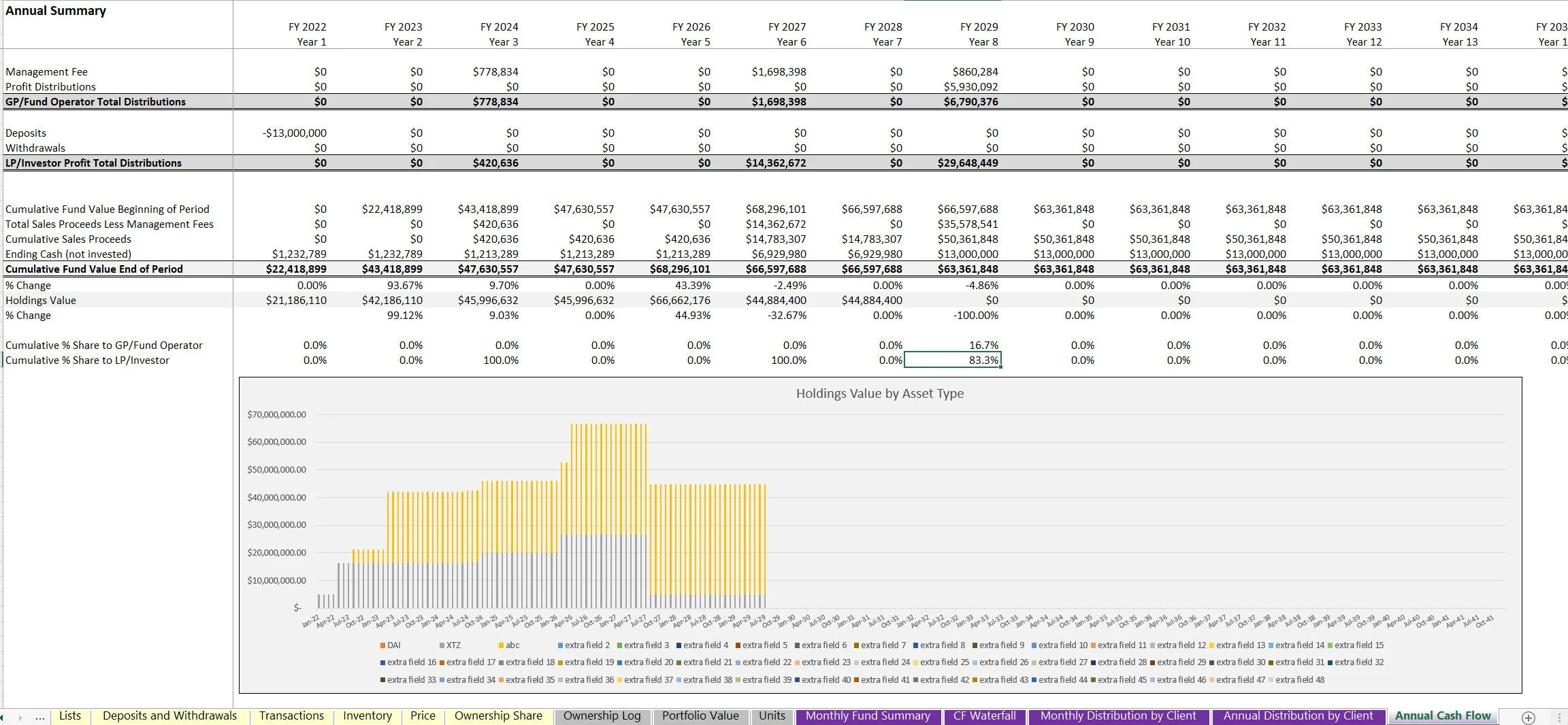

• Track on a monthly and annual basis for up to 20 years

• Displays ownership shares of each member over time-based on deposits/withdrawals

• Displays total fund holdings over time-based on month-ending price per asset

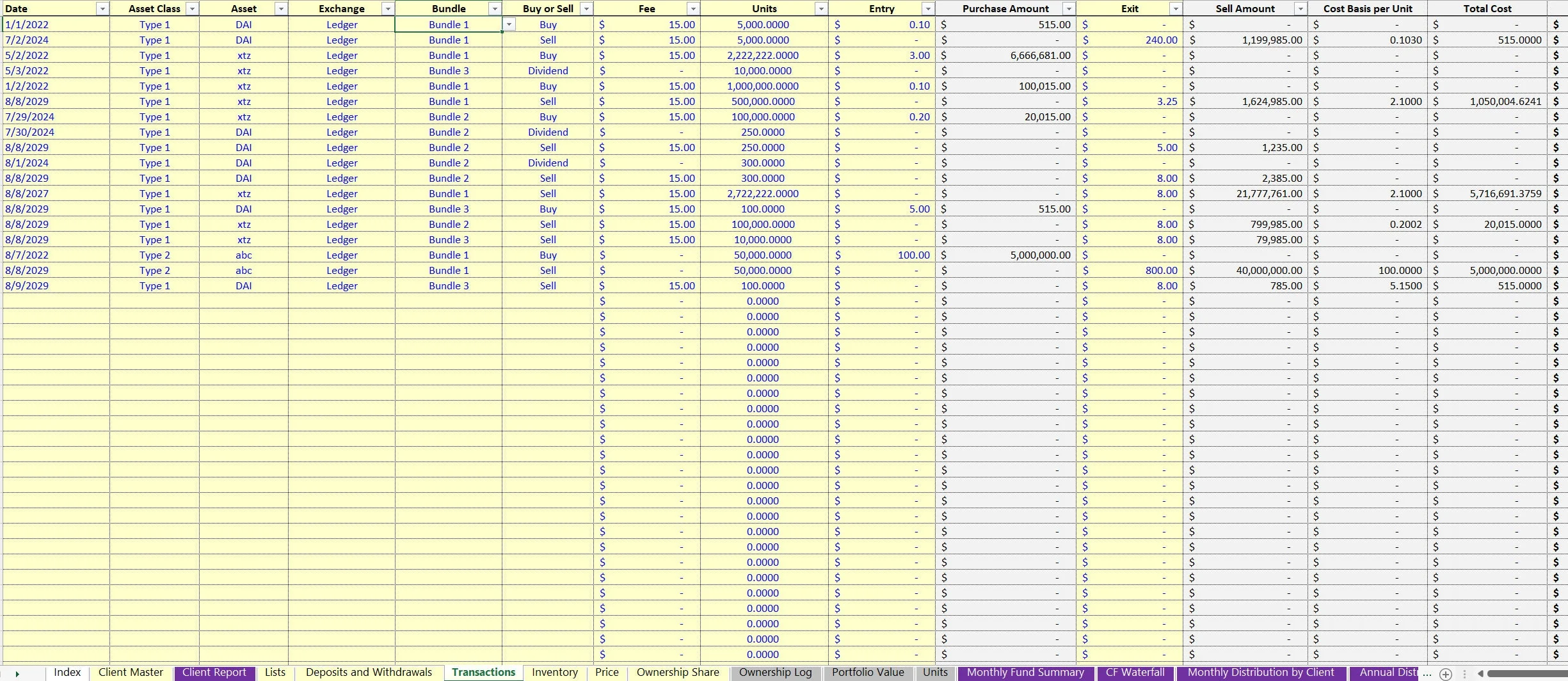

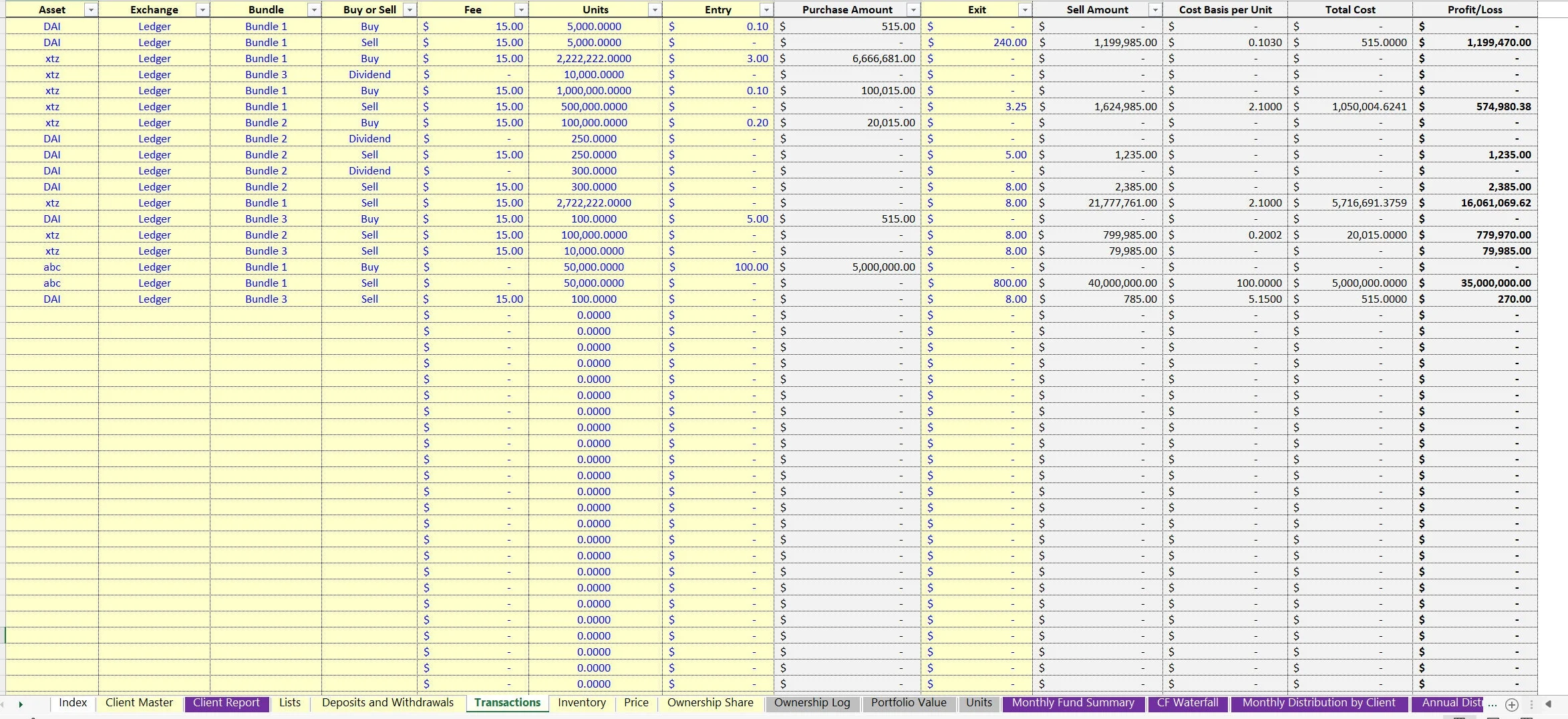

• Trade log to enter all activity, including options for dividends/staking yields in crypto

The model reports the resulting total fund profit/loss and the resulting distribution of that activity to all members based on the month-ending share each member has. Over time, the lifetime IRR per member and in aggregate will be displayed.

Distributions run off a preferred return waterfall structure that can be configured in terms of how cash is split at each IRR hurdle. There is also an option for a management fee that distributes to the fund first before any other distributions happen.

A unique bundling style logic was used to accurately track profit taking when there are multiple buys and sells of the same asset over time.

The video instructions and template instructions will elaborate on this. Note, that this can be used by an individual as well. The client summary report tab will show individual member performance based on dropdown selection.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Investment Vehicles Excel: Investment Fund Trading Tracker: Up to 50 Assets Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping