Fund Distribution Waterfall Model with Carried Interest Calculation (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

VIDEO DEMO

BENEFITS OF THIS EXCEL DOCUMENT

- Excel model for calculating the distribution of funds between the Limited Partner (‘LP') and General Partner (‘GP') for a PE fund.

INVESTMENT VEHICLES EXCEL DESCRIPTION

A Fund Distribution Waterfall Model is critical for private equity and investment fund management. It outlines the order and distribution of returns to investors and stakeholders, ensuring transparency and fairness. This model helps align interests, incentivize fund managers, and attract investors. It's instrumental in navigating complex profit-sharing structures and optimizing fund performance. By offering clarity on fund distribution, it enhances investor trust, supports legal compliance, and facilitates strategic decision-making. In summary, a well-constructed Fund Distribution Waterfall Model is essential for efficient fund management, investor confidence, and successful fund operations in the investment industry.

PURPOSE OF MODEL

User-friendly Excel model for calculating the distribution of funds between the Limited Partner (‘LP') and General Partner (‘GP') for a private equity investment or fund.

The model is flexible allowing the user to input up to 10 different underlying portfolio company investments within the fund with their individual capital contributions and distributions across a 10 year quarterly timeline with 3 scenarios. The cash flow and waterfall assumptions include equity contribution splits, LP hurdle rates, GP catch up provisions, GP carried interest, GP management fee and fund operating expenses.

The model follows best practice financial modelling principles and includes instructions, checks and input validations.

KEY OUTPUTS

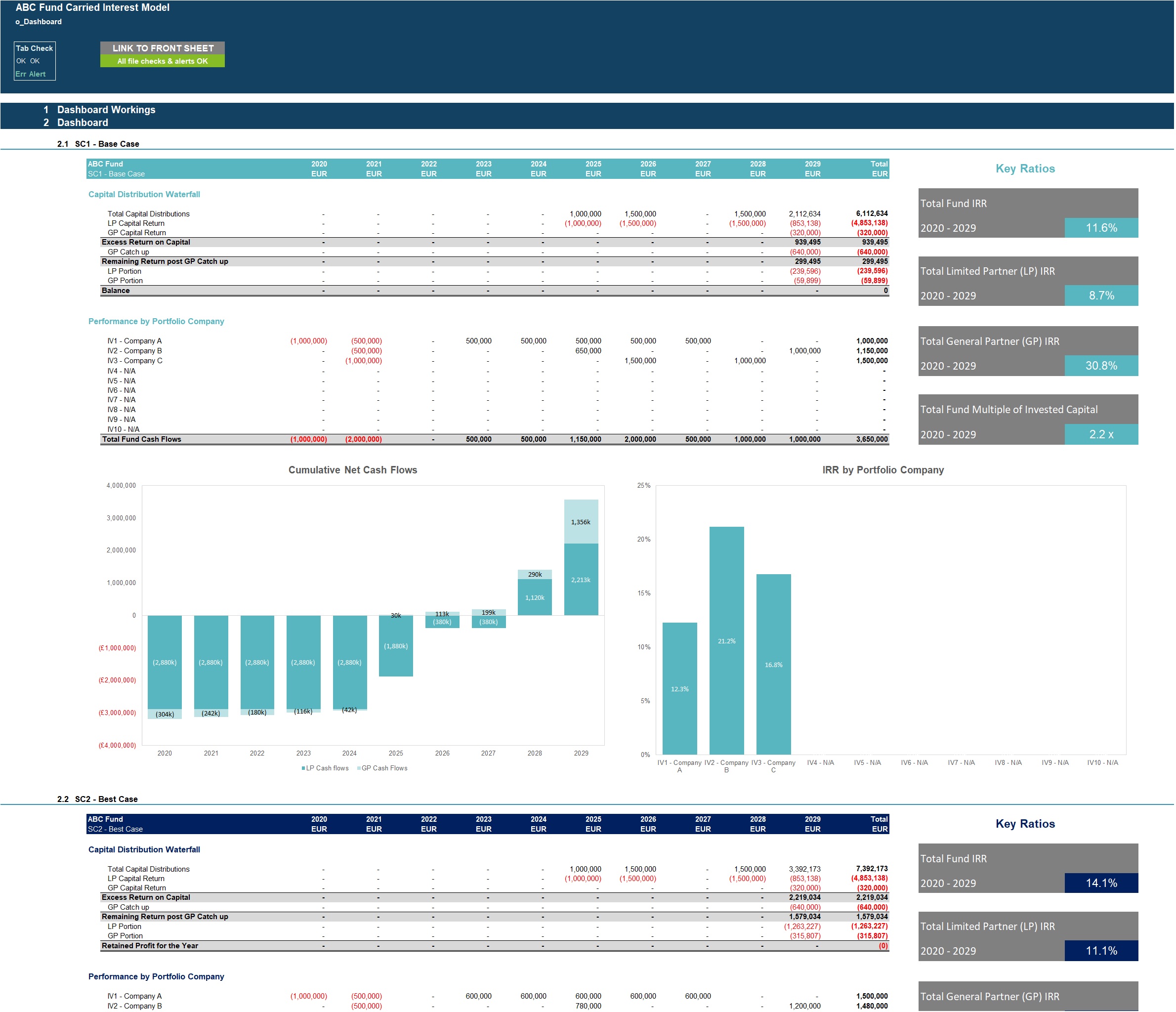

The model is generic and not industry-specific. The key outputs presented in both table and chart format include:

• Waterfall of fund distributions

• IRR on total fund basis and for GP and LP

• IRR and net cash flows by portfolio company

• Multiples of invested capital

KEY INPUTS

Inputs are split into setup inputs and cash flow inputs. All inputs include user-friendly input validations to help users populate correctly.

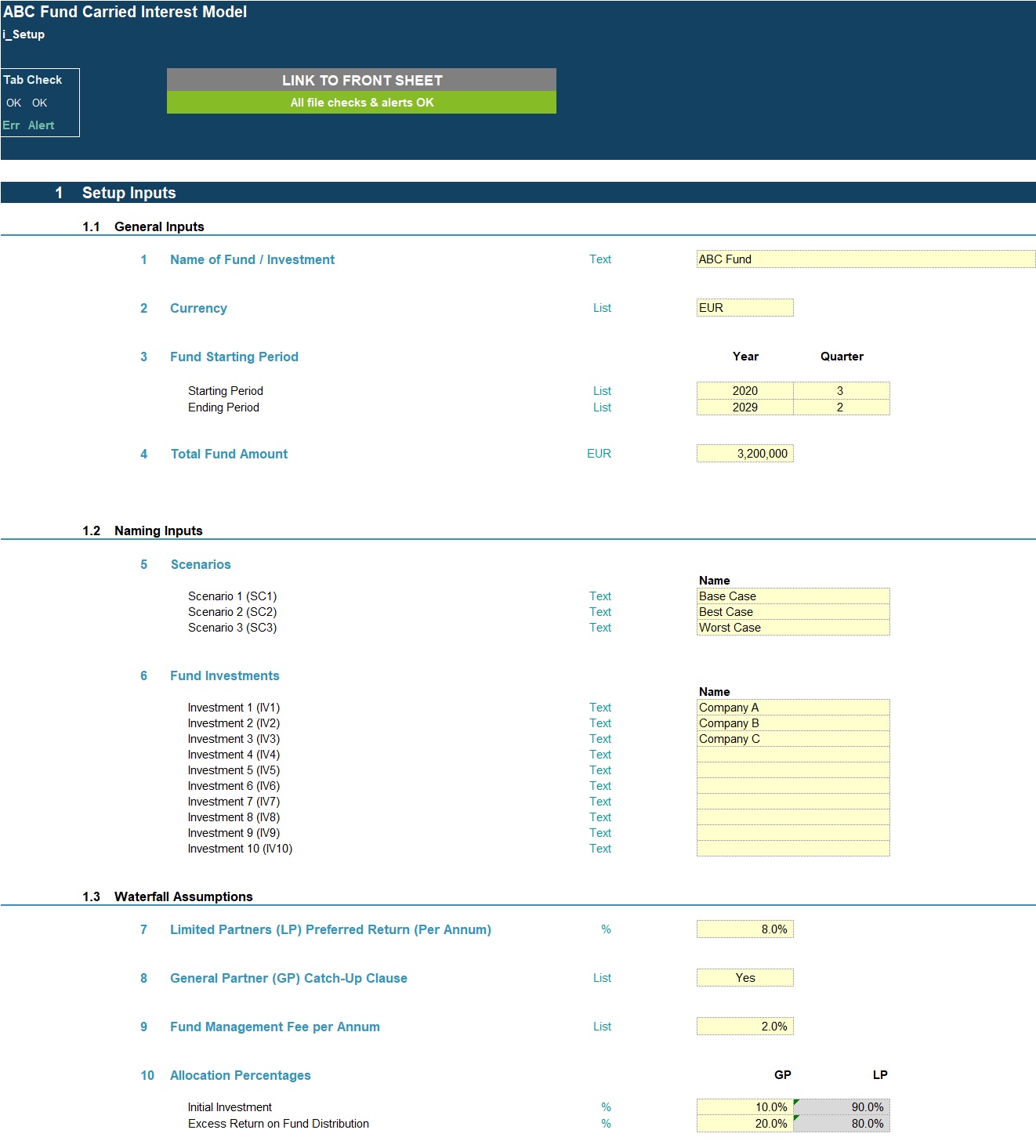

Setup inputs include:

• Fund name

• Names of underlying investments

• Fund starting and ending quarter

• Total fund amount

• Currency

• Waterfall assumptions including LP hurdle rate, equity contribution percentages, GP carried interest, GP catch up clause, GP management fee, Fund operating expenses

• Scenario naming

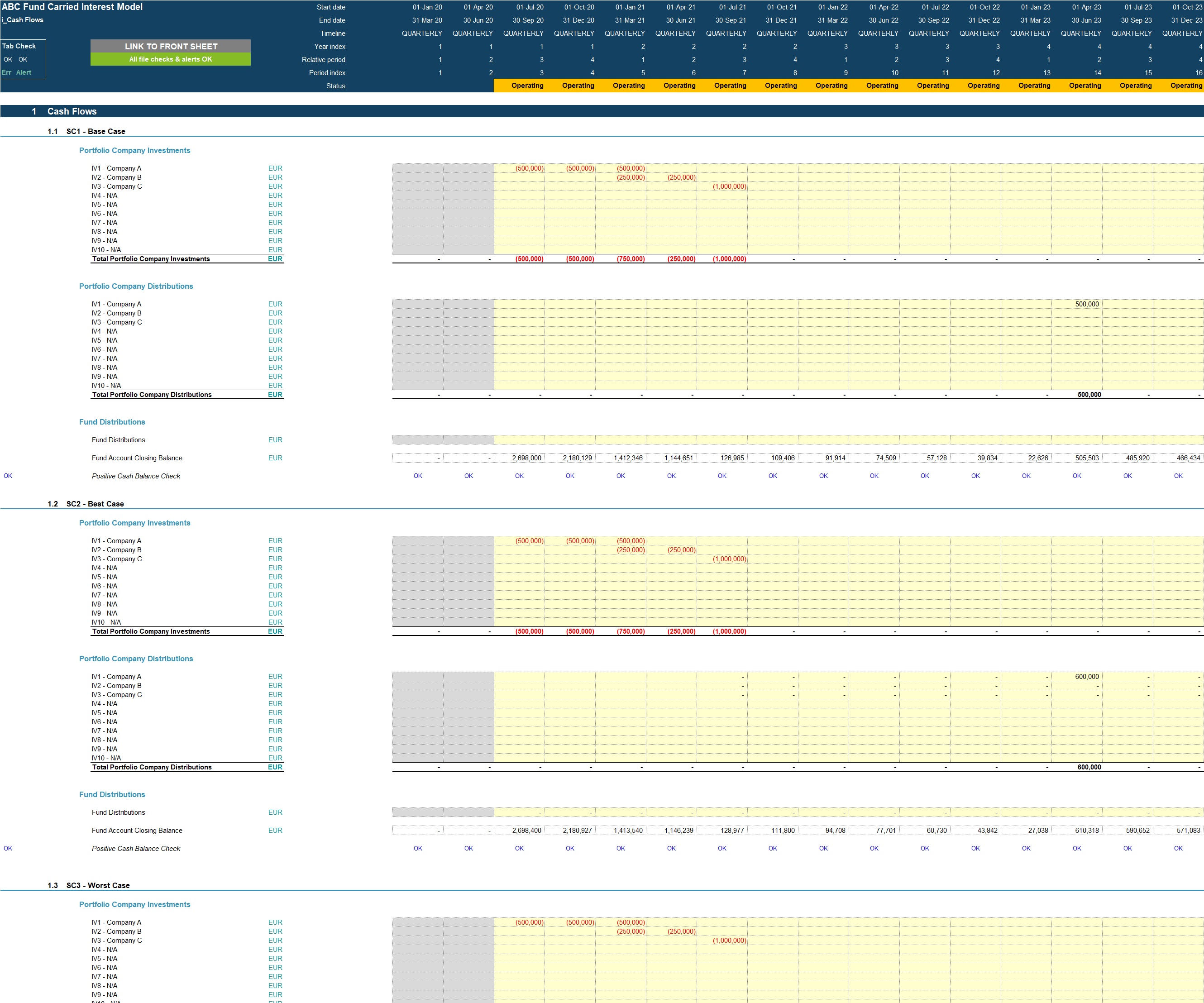

Cash Flow inputs include:

• Investment amounts by underlying portfolio company and scenario

• Distribution amounts by underlying portfolio company and scenario

• Fund distributions by scenario

• Fund operating expense cash flows

MODEL STRUCTURE

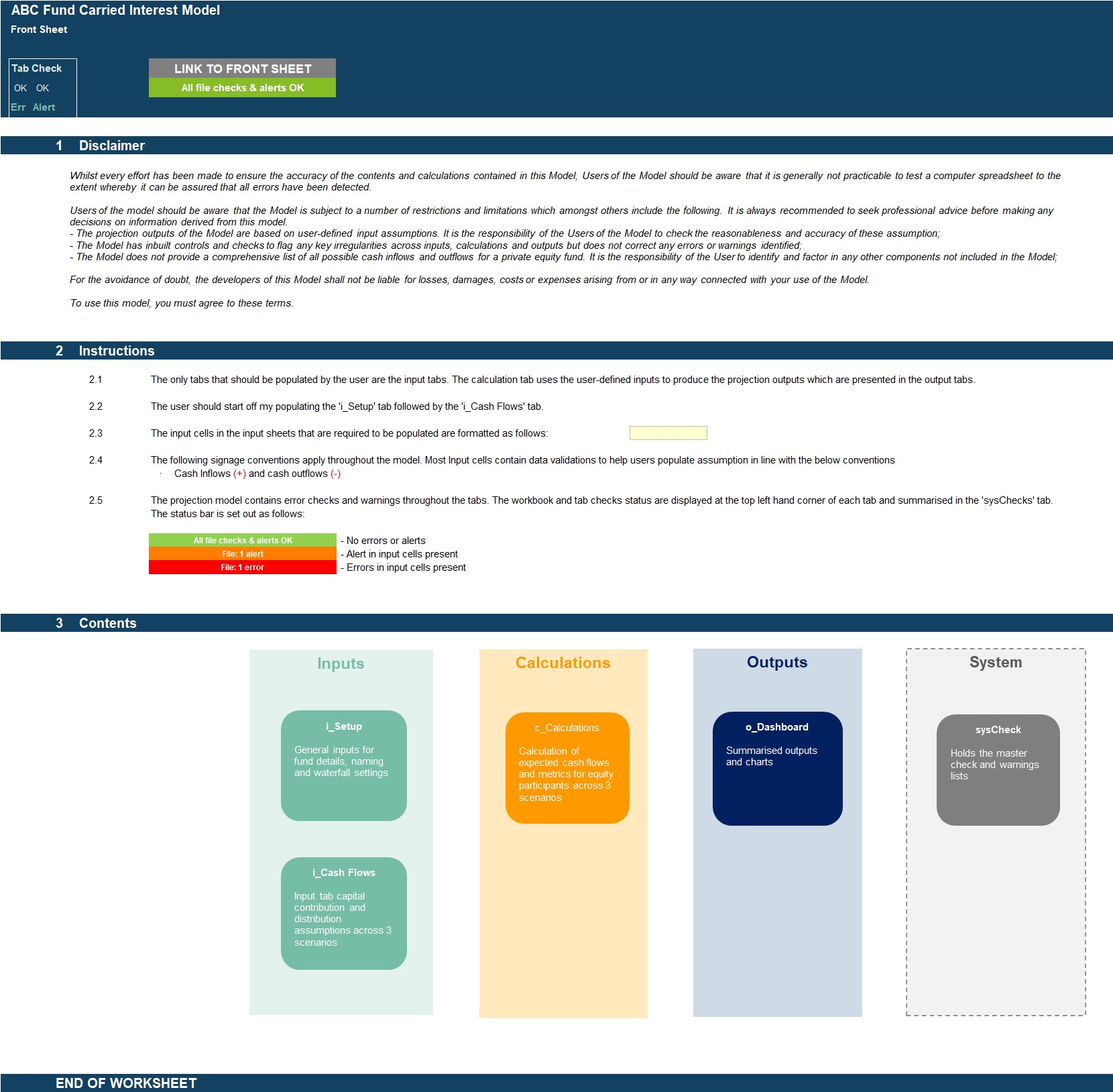

The model contains, 6 tabs split into input ('i_'), calculation ('c_'), output ('o_') and system tabs. The tabs to be populated by the user are the input tabs ('i_Setup' and 'i_Cash flows'). The calculation tab uses the user-defined inputs to calculate and produce the cap table outputs which are presented in ‘o_Dashboard'

System tabs include:

• A 'Front Sheet' containing a disclaimer, instructions and contents;

• A Checks dashboard containing a summary of checks by tab.

KEY FEATURES

Other key features of this model include the following:

• The model follows best practice financial modelling guidelines and includes instructions, checks and input validations;

• The model is not password protected and can be modified as required following download;

• The model is screened using specialised model audit software to help ensure formula consistency and significantly reduce risk of errors;

• The model allows for the following number of underlying categories for each line item (these can be easily expanded if required):

Scenarios – 3 scenarios;

Underlying portfolio company investments – 10 companies

• Fund Name and currency are fully customisable

• The model includes instructions, checks and input validations to help ensure input fields are populated accurately

• The model includes a checks dashboard which summarises all the checks included in the various tabs making it easier to identify any errors.

This model provides a comprehensive framework for accurately calculating fund distributions, catering to both Limited Partners and General Partners. With its robust scenario analysis and customizable inputs, it empowers users to simulate various investment outcomes and make informed financial decisions.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Investment Vehicles, Private Equity Excel: Fund Distribution Waterfall Model with Carried Interest Calculation Excel (XLSX) Spreadsheet, Projectify