Commercial Due Diligence (CDD) (PowerPoint PPT)

PowerPoint (PPT) 63 Slides

BENEFITS OF DOCUMENT

- Provides a structured approach to the complex Commercial Due Diligence process (within the broader context of the Direct Investment Value Chain).

- Identifies and explains the 7 areas of assessment in the full CDD process.

- Breaks down the 9 key elements that enable a successful CDD process.

DESCRIPTION

This product (Commercial Due Diligence [CDD]) is a 63-slide PPT PowerPoint presentation (PPT), which you can download immediately upon purchase.

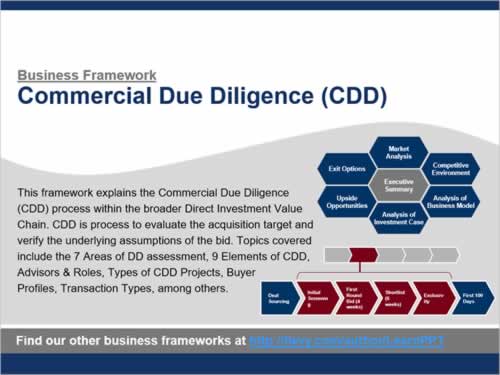

Commercial Due Diligence (CDD) is the process undertaken before a transaction is finalized to evaluate the target/investment and attain a high degree of confidence in the assumptions (e.g., financial, operational) underlying the bid. This process is important to acquiring companies as it provides a comprehensive understanding of the market dynamics, competitive landscape, and customer needs related to a potential acquisition or investment. CDD aids in making informed strategic decisions, optimizing investment outcomes, and mitigating the likelihood of unexpected post-transaction challenges.

More specifically, Due Diligence will do the following:

Give the acquirer an idea of the target management's capabilities.

Bring to light major risks and problems at the target—so called "skeletons in the closet."

Identify upsides.

For these reasons, it's crucial to follow a robust, proven approach to conducting Due Diligence. This PowerPoint presentation explains the full CDD process. We outline a 4-phase process to CDD (within the broader 5-phase Direct Investment Value Chain):

1. Initial Screening

2. First Round Bid

3. Shortlist

4. Exclusivity

This framework is developed within the advisory perspective of a management consulting firm, although it can also be used directly by the buying company. The deliverable produced at the end of the CDD engagement should cover 7 areas of assessment:

1. Executive Summary

2. Market Analysis

3. Competitive Environment

4. Analysis of Business Model

5. Analysis of Investment Case

6. Upside Opportunities

7. Exit Opportunities

The Due Diligence Process has 9 key elements:

1. Workplan

2. Milestones

3. Ideal Team Structure

4. Problem Solving Tips

5. Data Gathering Tips

6. Process Tips (Planning, Modeling)

7. Data Room

8. Management Presentations

9. Mindset

Additional topics discussed include Advisors & Roles, Types of CDD Projects, Buyer Profiles, Transaction Types, among others. This deck also includes relevant template slides for you to use in your own business presentations.

This presentation covers the critical aspects of initial screening, including preliminary evaluation, investment memorandum review, and first round review. It also delves into advisor roles, key success factors, and the importance of managing these effectively to ensure a smooth CDD process.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Due Diligence PowerPoint Slides: Commercial Due Diligence (CDD) PowerPoint (PPT) Presentation, LearnPPT Consulting

SLIDE DEEP DIVES

This document is available as part of the following discounted bundle(s):

Save %!

Commercial Due Diligence (CDD) Frameworks

This bundle contains 2 total documents. See all the documents to the right.