Toolkit for Commercial Due Diligence (PowerPoint PPTX Slide Deck)

PowerPoint (PPTX) 28 Slides

BENEFITS OF THIS POWERPOINT DOCUMENT

- Toolkit for Commercial Due Diligence

- Acquisitions and Investments

- Private Equity

DUE DILIGENCE PPT DESCRIPTION

This PowerPoint deck titled "Toolkit for Commercial Due Diligence" is a comprehensive, structured guide designed to equip professionals with the tools and methodologies needed to conduct thorough commercial due diligence in the context of mergers, acquisitions, and investments. The deck is a practical resource for analysts, investors, and corporate decision-makers who must evaluate a target company's market position, competitive advantages, and growth potential.

The presentation is organized into clear sections, each focusing on a critical aspect of the due diligence process. The first section introduces the concept of commercial due diligence and its importance in mitigating risks and identifying transaction opportunities. It outlines the key objectives, such as understanding the target's market landscape, evaluating its business model, and assessing the sustainability of its competitive advantages.

Subsequent slides detail the core components of a robust due diligence toolkit. These include market analysis techniques, such as assessing market size, growth trends, customer segmentation, and competitor analysis methodologies. The toolkit also covers financial performance analysis, including revenue streams, profitability, and potential risks related to pricing and customer concentration.

Much of the deck focuses on qualitative factors such as management and leadership evaluation, company culture, and customer satisfaction. Interviewing key stakeholders, including customers, suppliers, and industry experts, is emphasized as a way to gain deeper insights into the company's operational effectiveness and market reputation.

The deck also provides practical lessons learned by practitioners and potential red flags, and formulating actionable recommendations based on findings.

Overall, the "Toolkit for Commercial Due Diligence" PowerPoint deck is an essential resource for professionals seeking a holistic understanding of a target company and its potential for long-term success.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

MARCUS OVERVIEW

This synopsis was written by Marcus [?] based on the analysis of the full 28-slide presentation.

Executive Summary

The Toolkit for Commercial Due Diligence is a structured PowerPoint presentation designed for M&A professionals, emphasizing the critical role of due diligence in the acquisition process. This consulting-grade toolkit, comparable to McKinsey, Bain, or BCG-quality frameworks (not affiliated), equips users to evaluate market attractiveness, competitive positioning, and growth potential. It enables corporate executives and consultants to make informed decisions, assess risks, and identify value creation opportunities during mergers and acquisitions.

Who This Is For and When to Use

• Corporate executives involved in M&A strategy and execution

• Integration leaders responsible for post-acquisition activities

• Financial analysts assessing investment opportunities

• Consultants specializing in M&A advisory services

Best-fit moments to use this deck:

• During the initial assessment phase of potential acquisitions

• When evaluating market opportunities and competitive landscapes

• In preparation for negotiations and closing activities

• For guiding post-merger integration planning

Learning Objectives

• Define the components of commercial due diligence and their importance in M&A.

• Analyze market attractiveness and competitive positioning for target companies.

• Identify growth potential and operational improvement opportunities.

• Assess risks and opportunities associated with acquisitions.

• Develop actionable insights and recommendations based on due diligence findings.

• Create a structured approach to conducting due diligence efficiently.

Table of Contents

• Considering the Strategic Context (page 2)

• Components of a Due Diligence (page 8)

• Market Attractiveness (page 10)

• Customer Segmentation (page 12)

• Competitive Positioning (page 15)

• Growth Opportunities (page 22)

• Review of Management Forecasts (page 26)

• Lessons Learned (page 28)

Primary Topics Covered

• Strategic Context - Understanding the rationale behind mergers and acquisitions, including shareholder value creation and market positioning.

• Due Diligence Components - Key activities involved in the due diligence process, such as market research, competitor analysis, and customer interviews.

• Market Attractiveness - Evaluating market size, growth trends, and profitability to assess the viability of potential acquisitions.

• Customer Segmentation - Analyzing customer dynamics and segmentation to identify target market opportunities.

• Competitive Positioning - Assessing the target's competitive landscape and operational capabilities.

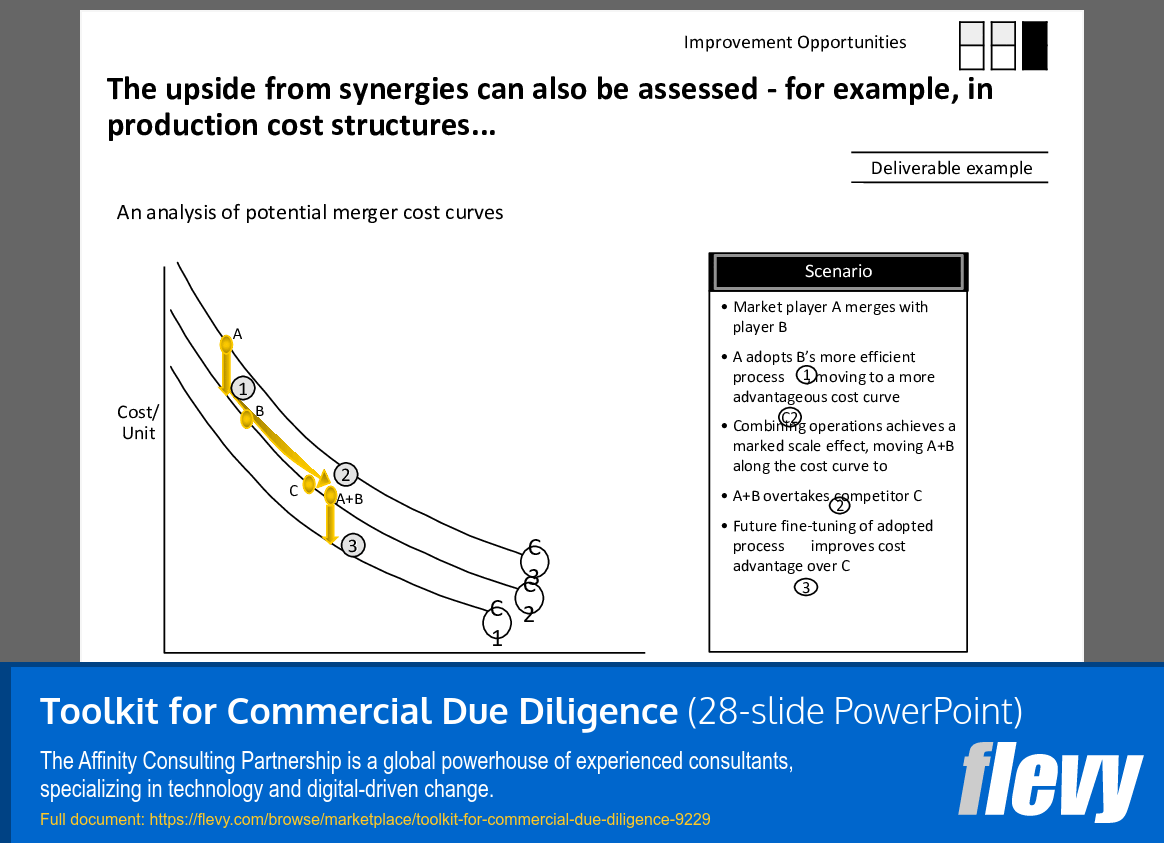

• Growth Opportunities - Identifying potential areas for growth and operational improvements post-acquisition.

Deliverables, Templates, and Tools

• Market attractiveness assessment template for evaluating potential acquisition targets.

• Customer segmentation analysis framework to identify key market segments.

• Competitive positioning matrix for benchmarking against industry peers.

• Growth opportunity identification tool to prioritize strategic initiatives.

• Management forecast review checklist to validate assumptions and projections.

• Lessons learned documentation to capture best practices from past due diligence efforts.

Slide Highlights

• Overview of the strategic context for M&A and its implications for due diligence.

• Detailed breakdown of the components involved in a typical due diligence process.

• Visual representation of market attractiveness factors, including size and growth trends.

• Customer segmentation analysis showcasing target revenue contributions by segment.

• Competitive positioning slide illustrating the target's strengths and weaknesses relative to competitors.

Potential Workshop Agenda

Due Diligence Overview Session (90 minutes)

• Introduce the importance of commercial due diligence in M&A

• Discuss key components and phases of the due diligence process

• Review case studies highlighting successful due diligence outcomes

Market Attractiveness Analysis Workshop (60 minutes)

• Analyze market size and growth trends for potential targets

• Conduct a competitive landscape assessment

• Identify key risks and opportunities in the target market

Customer Segmentation and Competitive Positioning Session (60 minutes)

• Segment customers to understand dynamics and revenue contributions

• Evaluate the target's competitive positioning and operational capabilities

• Discuss implications for integration and value creation

Customization Guidance

• Tailor market attractiveness assessments to reflect specific industry dynamics and trends.

• Adjust customer segmentation frameworks to align with the target's unique market characteristics.

• Modify competitive positioning matrices to include relevant competitors and market players.

• Update growth opportunity identification tools based on the target's strategic goals and capabilities.

Secondary Topics Covered

• Financial leverage considerations in M&A transactions.

• The role of private equity in the acquisition landscape.

• Effective strategies for merger integration and synergy realization.

• Importance of stakeholder engagement throughout the due diligence process.

FAQ

What is the purpose of commercial due diligence?

Commercial due diligence aims to assess the market attractiveness, competitive position, and growth potential of a target company, ensuring informed decision-making in M&A transactions.

How long does the due diligence process typically take?

The due diligence process generally spans 2 to 6 weeks, depending on the complexity of the target and the availability of data.

What are the key components of a due diligence assessment?

Key components include market research, customer and supplier interviews, competitor analysis, and financial performance reviews.

How can customer segmentation impact acquisition decisions?

Understanding customer segmentation helps identify revenue potential and growth opportunities, guiding strategic decisions during the acquisition process.

What factors contribute to market attractiveness?

Market attractiveness is influenced by size, growth trends, profitability, customer dynamics, and competitive intensity.

How do you assess a target's competitive position?

Assessing competitive position involves analyzing market share, pricing strategies, operational capabilities, and barriers to entry.

What are common challenges in conducting due diligence?

Challenges include obtaining critical data, aligning stakeholder interests, and validating management forecasts against market realities.

How can lessons learned from past due diligence efforts improve future assessments?

Documenting lessons learned helps refine processes, enhance data collection strategies, and improve overall due diligence effectiveness.

Glossary

• Commercial Due Diligence - The process of evaluating a target company's market position and potential during an acquisition.

• Market Attractiveness - The overall appeal of a market based on size, growth, and profitability.

• Customer Segmentation - The process of dividing a customer base into distinct groups based on characteristics and behaviors.

• Competitive Positioning - Analyzing a target's strengths and weaknesses relative to its competitors.

• Growth Opportunities - Potential areas for expansion or improvement identified during due diligence.

• Financial Leverage - The use of borrowed funds to increase the potential return on investment.

• Private Equity - Investment firms that acquire and manage private companies, often focusing on operational improvements and growth.

• Stakeholder Engagement - The process of involving key stakeholders in decision-making during M&A activities.

• Synergy Realization - The process of achieving cost savings or revenue enhancements through the integration of merged entities.

• Management Forecasts - Projections made by a company's management regarding future financial performance.

• Barriers to Entry - Obstacles that make it difficult for new competitors to enter a market.

• Market Share - The percentage of total sales in a market captured by a company or product.

DUE DILIGENCE PPT SLIDES

Source: Best Practices in Due Diligence PowerPoint Slides: Toolkit for Commercial Due Diligence PowerPoint (PPTX) Presentation Slide Deck, Affinity Consulting Partners