Transaction Services – FDD Quality of Earnings (QoE) Model (Excel XLSX)

Excel (XLSX) + Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

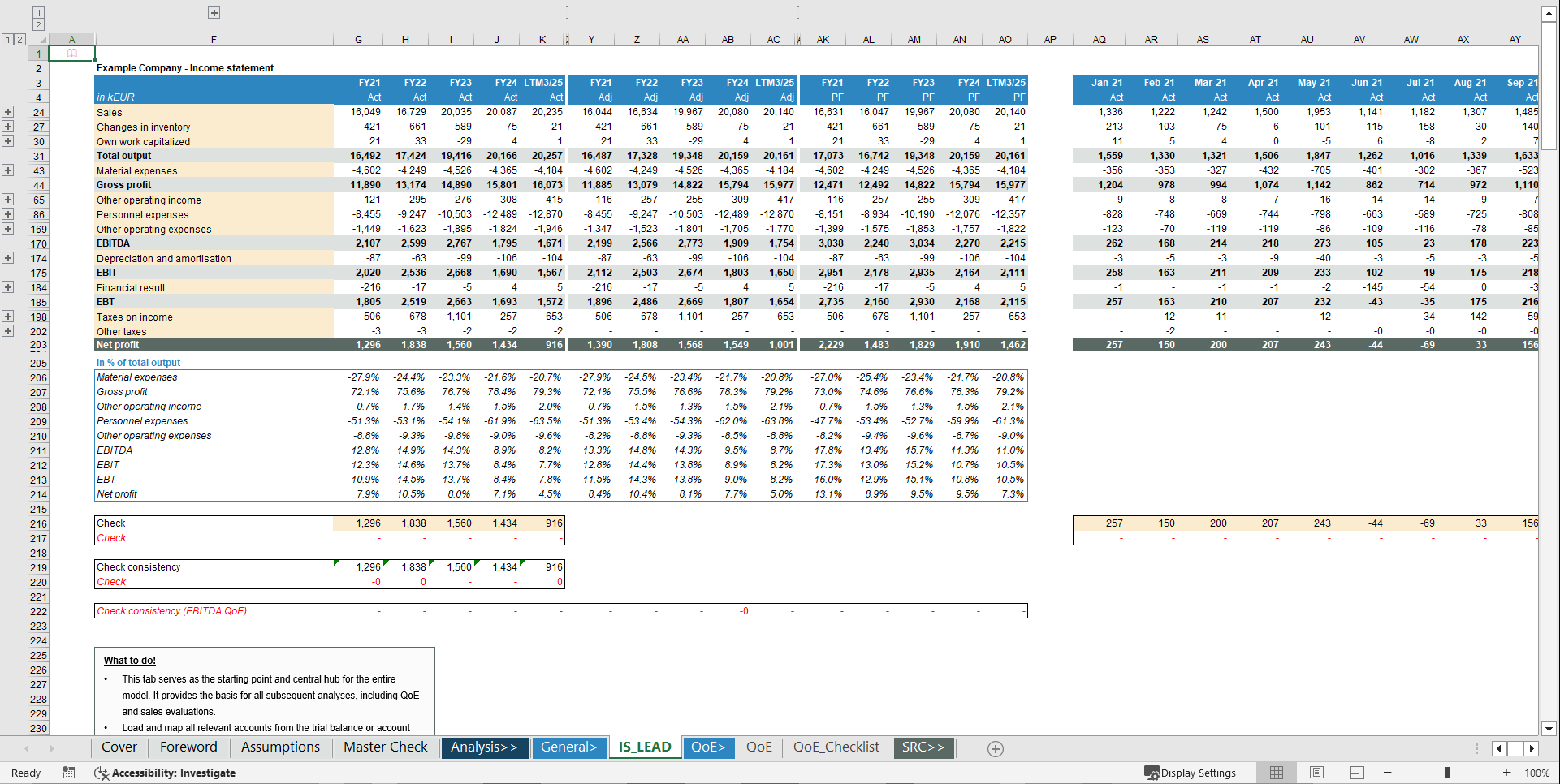

- Reconciles reported results to adjusted and pro-forma EBITDA through clear, transparent bridges.

- Captures reclassifications, normalisations and pro-forma items with consistent documentation and checks.

- Produces a compact QoE output ready for TS reports, due diligence and factbooks.

FINANCIAL ANALYSIS EXCEL DESCRIPTION

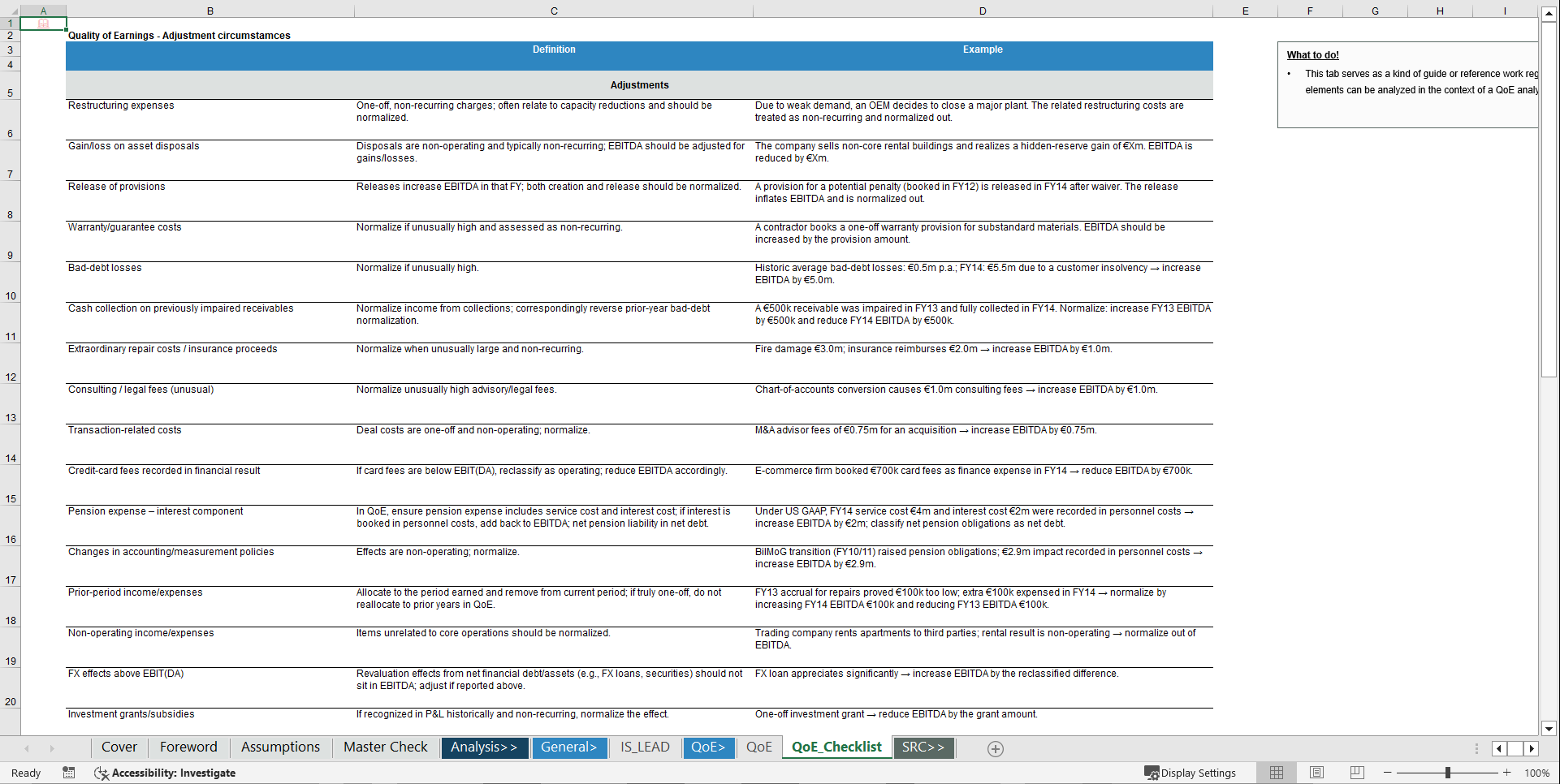

Purpose of the tool

This Excel-based Quality of Earnings (QoE) Model provides a structured framework to analyse the underlying earnings quality of a business by reconciling reported financials to adjusted and pro-forma results. It enables you to capture and classify reclassifications, normalising adjustments and pro-forma items in a transparent way and to link them back to the income statement via clear bridges and checks. The model focuses on EBITDA and earnings-related KPIs and shows reported, adjusted and pro-forma EBITDA and margins. It clearly distinguishes between cash vs. non-cash items and recurring vs. non-recurring effects. Each adjustment can be documented consistently with description, category and impact, making the logic easy to follow for both internal and external stakeholders. The tool is particularly useful for Transaction Services, buy-side and sell-side QoE reports, financial due diligence and factbook preparation, but it can also be applied in internal performance reviews where normalised earnings and transparency on adjustments are key. Each sheet includes a short "What to do / What to know" box with practical instructions, so you always know exactly what is expected on that tab and how it feeds into the overall model.

Key Outputs

The model provides reported, adjusted and pro-forma EBITDA and margins supported by clear bridge views. It separates bridge components for reclassifications, normalising adjustments and pro-forma items, and offers an overview of cash vs. non-cash adjustments as well as recurring vs. non-recurring items. Reconciliation checks between the income statement, adjustment schedules and the final QoE view ensure consistency, while a compact QoE overview is available for direct inclusion in reports, factbooks and presentations.

Key Inputs & Assumptions

As a foundation, the model uses income statement / trial balance data, ideally monthly and at account level. It relies on flags for QoE-relevant accounts and mapping to adjustment categories, as well as line-by-line adjustment entries in the QoE schedule (description, classification, cash/non-cash and amount). Optional assumptions can be used for grouping of adjustments or custom labelling of categories.

How to use

First, set the core parameters (time horizon, currency and basic options) in the Assumptions sheet. Then load the income statement / trial balance data into the IS_LEAD / source sheets and ensure full reconciliation. Next, identify and enter reclassifications, normalising adjustments and pro-forma items in the QoE adjustment tab. Finally, review the EBITDA bridges, margin views and the cash vs. non-cash overview as the basis for your QoE report or factbook.

Customization & support

The model is highly customisable and allows you to adapt categories, labels, grouping logic, KPIs and charts to your firm's QoE style, sector specifics or reporting standards. For more complex customisations or individual requirements such as firm-specific templates, integration into broader workbooks or additional analysis modules, feel free to reach out and we can discuss a tailored solution. Each download includes both a fully blank "Clean Template" for working directly with your own data and a pre-populated Example Template that illustrates the model's logic and calculations using realistic sample data. If you want to cover the full analysis scope—from Earnings/QoE and Working Capital to Net Debt plus Sales and customer analytics—you may also want to have a look at the "Transaction Services All-in-One Financial Analysis Workbook."

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Financial Analysis, Due Diligence Excel: Transaction Services – FDD Quality of Earnings (QoE) Model Excel (XLSX) Spreadsheet, Finance Model Hub