MRR Monthly Recurring Revenue Finance Model 3 Statement (Excel XLSX)

Excel (XLSX)

BENEFITS OF THIS EXCEL DOCUMENT

- Eliminates the need to create MRR project finance trackers from scratch and includes all common actual and projection components.

SAAS EXCEL DESCRIPTION

This 5-year 3-statement financial model for MRR is a critical metric for SaaS companies. It represents the average revenue you can expect to earn in a month from paying customers.

Unlike product-based companies that rely on one-time sales, SaaS MRR businesses depend on a steady income stream from subscribers.

New customers sign up (adding new MRR), while existing customers may leave (churn out). This dynamic process keeps the MRR in constant flux.

Here's a detailed description of each component of this model.

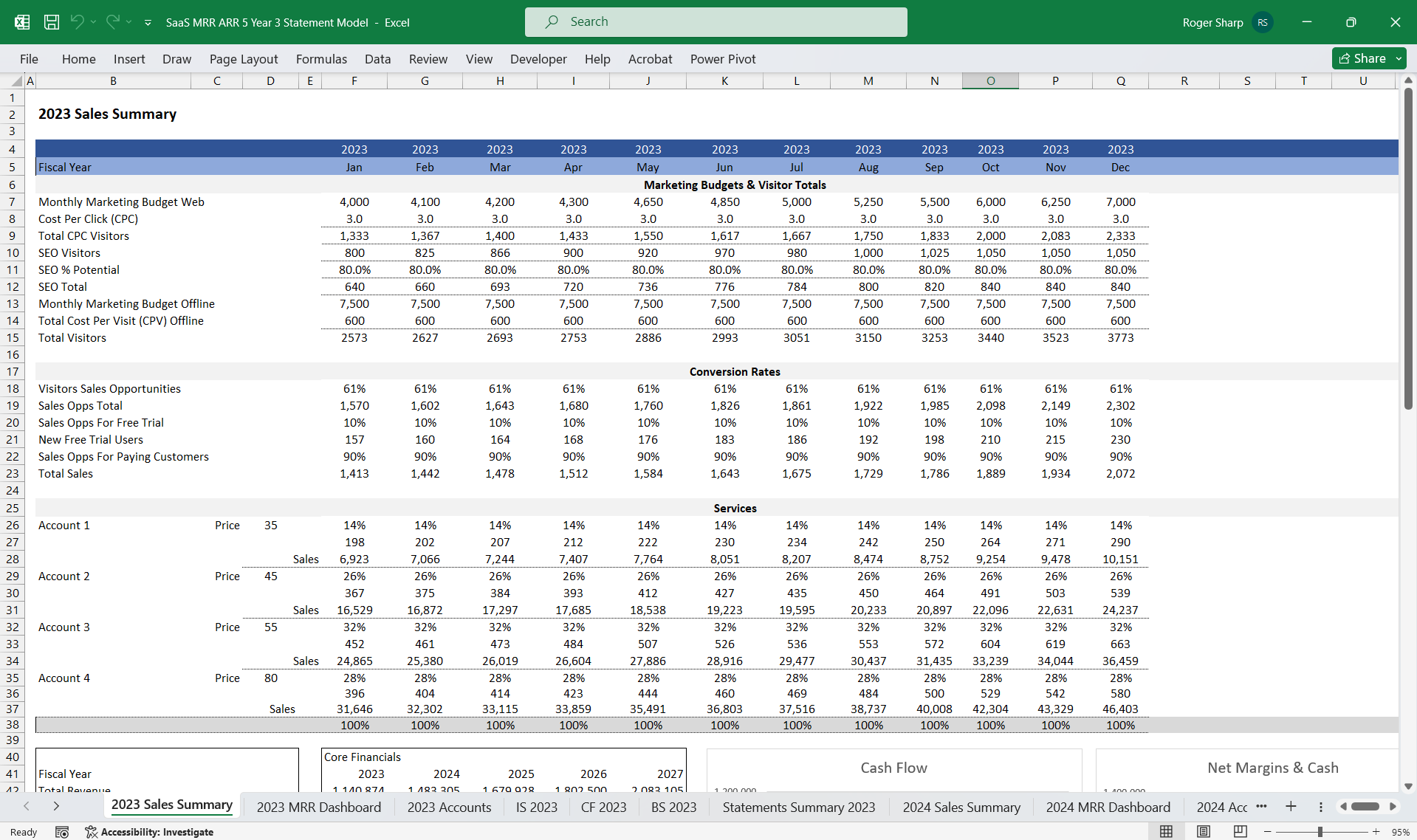

Marketing Budgets & Visitor Totals:

Adjust and view your marketing expenditure, monitor visitor numbers and how effective your marketing campaign is in helping customers find your subscription services.

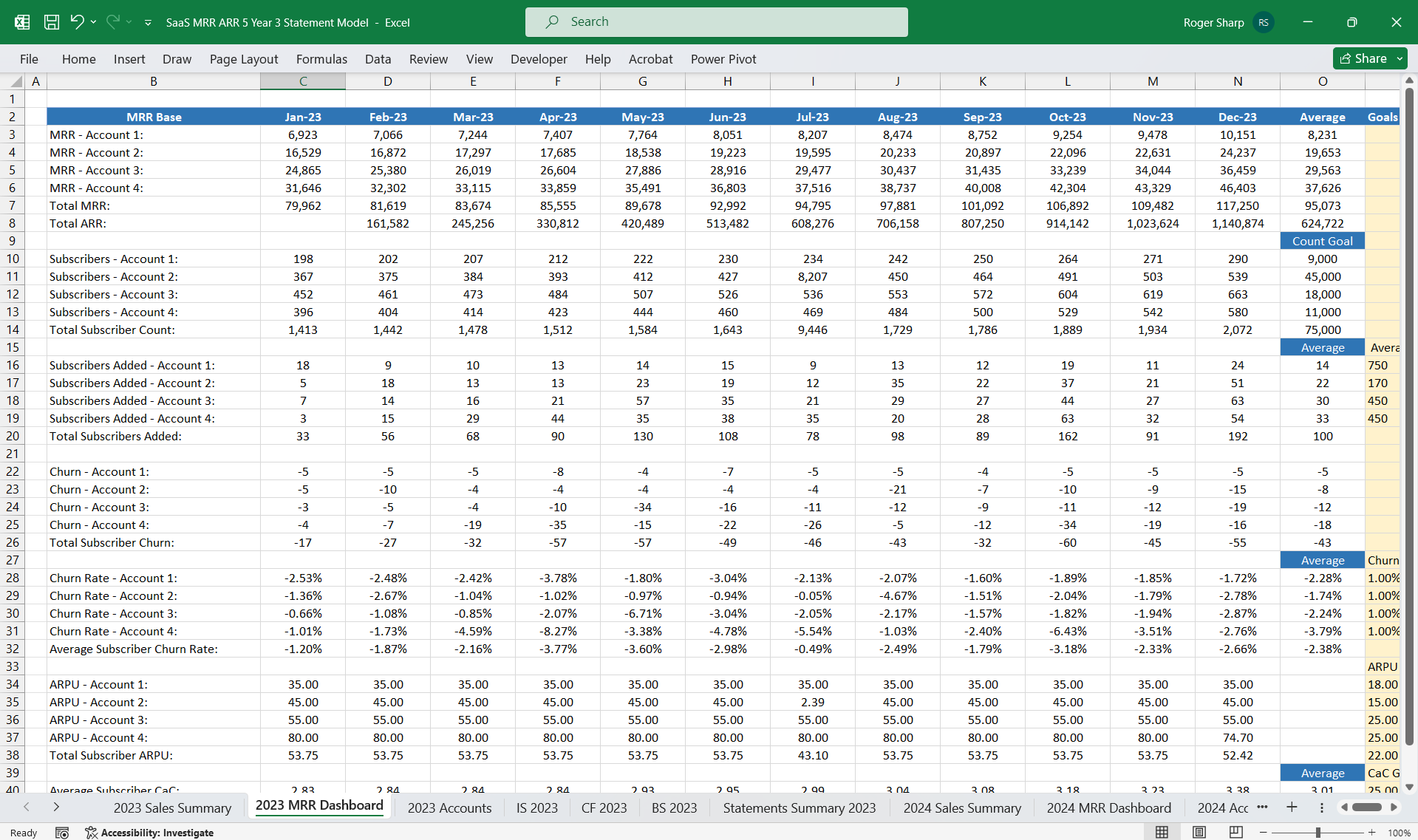

MRR Account Dashboard:

This entry represents the total Monthly Recurring Revenue generated from active subscriptions within your SaaS platform. It holds fundamental metrics for understanding the stability and growth of your subscription-based business model. MRR account subscriptions are typically categorized based on different subscription tiers or plans, each contributing a certain amount to the overall MRR.

Churn:

Churn refers to the rate at which customers cancel their subscriptions or stop using your service within a specific period. Tracking churn is crucial for assessing customer satisfaction, product-market fit, and revenue stability. Churn can be expressed as a percentage of MRR lost due to cancellations or non-renewals over a given period, such as monthly or annually.

Active Subscribers:

Active subscribers represent the number of customers who are actively using your SaaS platform and paying for their subscriptions within a specific timeframe, typically measured monthly. This metric provides insights into the health of your subscriber base and the overall adoption and retention of your service.

New Subscribers:

New subscribers indicate the number of customers who have signed up for your SaaS platform and started paying for their subscriptions within a particular period, such as a month or a quarter. Tracking new subscriber growth is essential for assessing the effectiveness of your marketing, sales, and customer acquisition efforts.

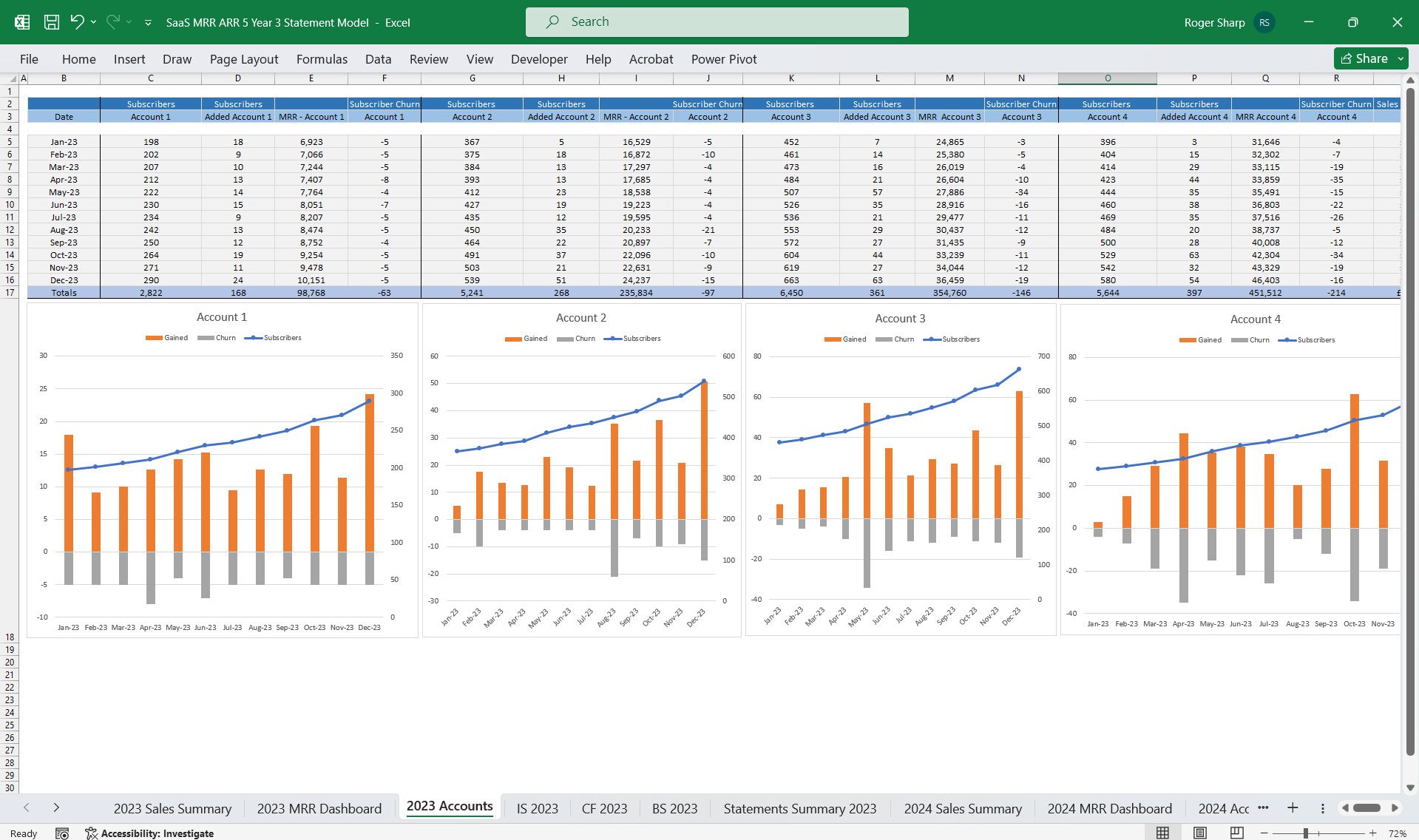

Accounts Tab: Further details of Account Subscribers, their monetary values, new subscribers and churn percentages.

Subscriptions for these 4 differing accounts are set at 35, 45, 55, and 80, similar to phone or broadband contracts.

Easily adjustable in the formula bar.

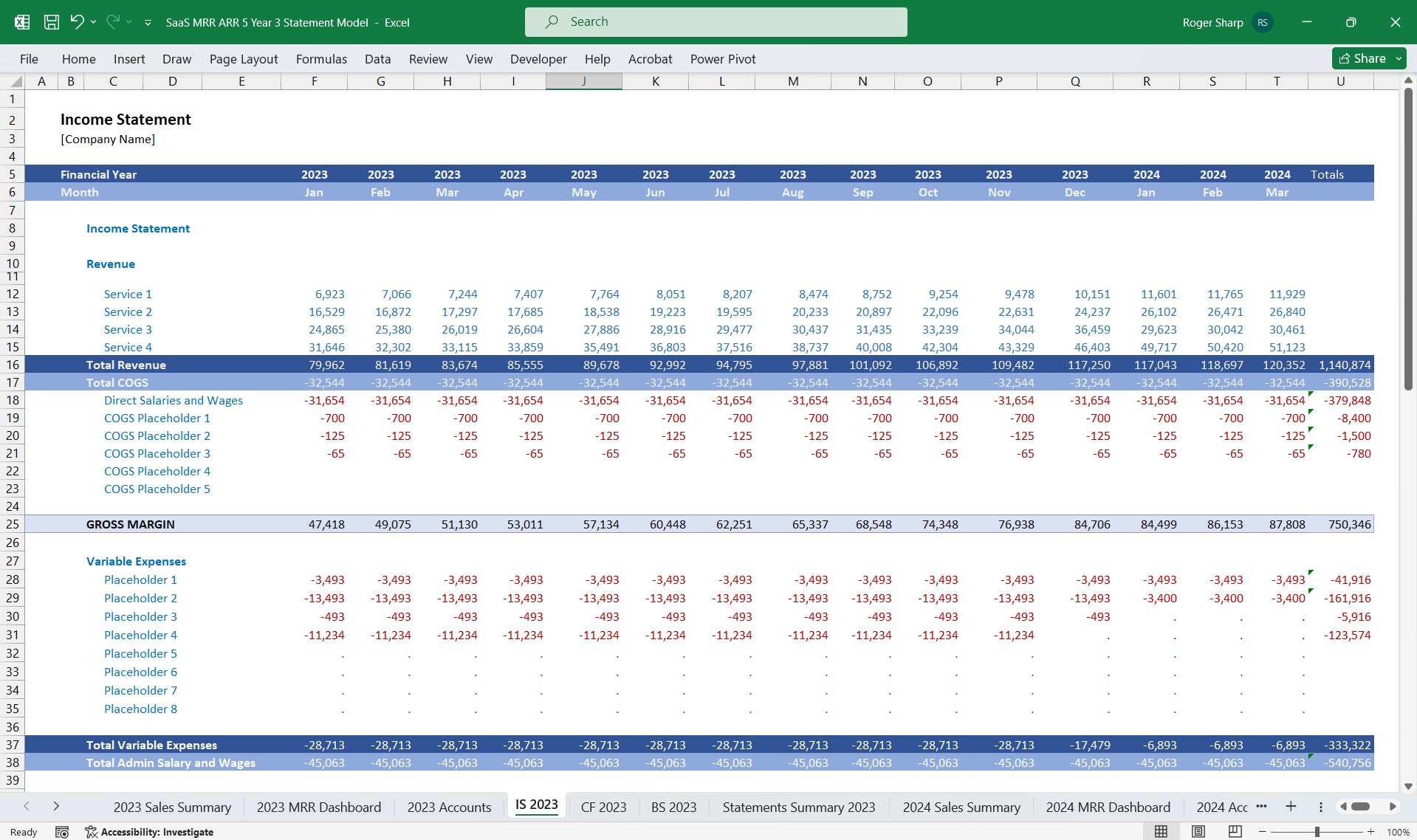

Income Statement:

The income statement, also known as the profit and loss (P&L) statement, summarizes a company's revenues, expenses, and profits over a specific period, typically monthly or annually. In the context of an MRR finance model, the income statement may include:

Revenue Forecasting: Utilize historical sales data and market trends to project future revenue streams. This can involve analyzing customer demographics, product performance, and pricing strategies.

Expense Projection: Estimate various operating expenses such as salaries, marketing costs, research and development expenses, and other overhead costs. These metrics can help identify cost-saving opportunities and optimize spending patterns.

Profit Margin Analysis: Calculate gross profit margin, operating profit margin, and net profit margin to assess the company's profitability. These data analytics can uncover insights into factors influencing profit margins and help optimize pricing strategies or cost structures.

Income Tax Calculation: Estimate income taxes based on projected taxable income and applicable tax rates. Analyze tax implications of different scenarios and tax planning strategies.

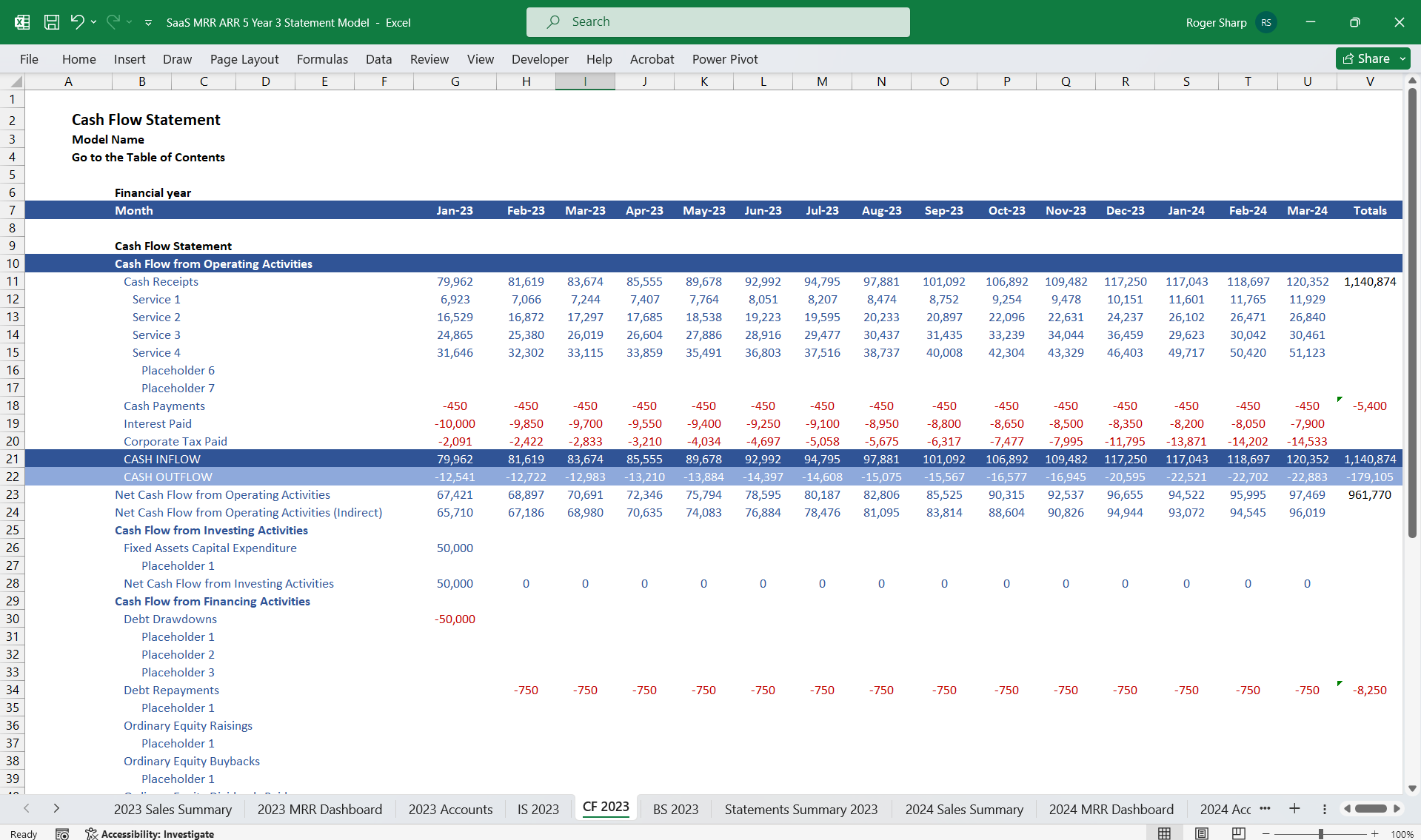

Cash Flow Statement:

The cash flow statement tracks the flow of cash into and out of a company during a specific period, categorizing cash flows into operating, investing, and financing activities. In a data analytics finance model, the cash flow statement may involve:

Operating Cash Flow Forecasting: Predict cash inflows and outflows from core business operations, considering factors such as sales revenue, operating expenses, and changes in working capital. Analyze cash conversion cycles and operating efficiency.

Investing Cash Flow Analysis: Evaluate cash flows related to investments in property, plant, and equipment, acquisitions, and divestitures. Use this model to assess the return on investment (ROI) of capital expenditures and identify value-enhancing investment opportunities.

Financing Cash Flow Projection: Forecast cash flows from financing activities such as debt issuance, equity financing, dividend payments, and share repurchases. Analyze capital structure decisions and financing alternatives.

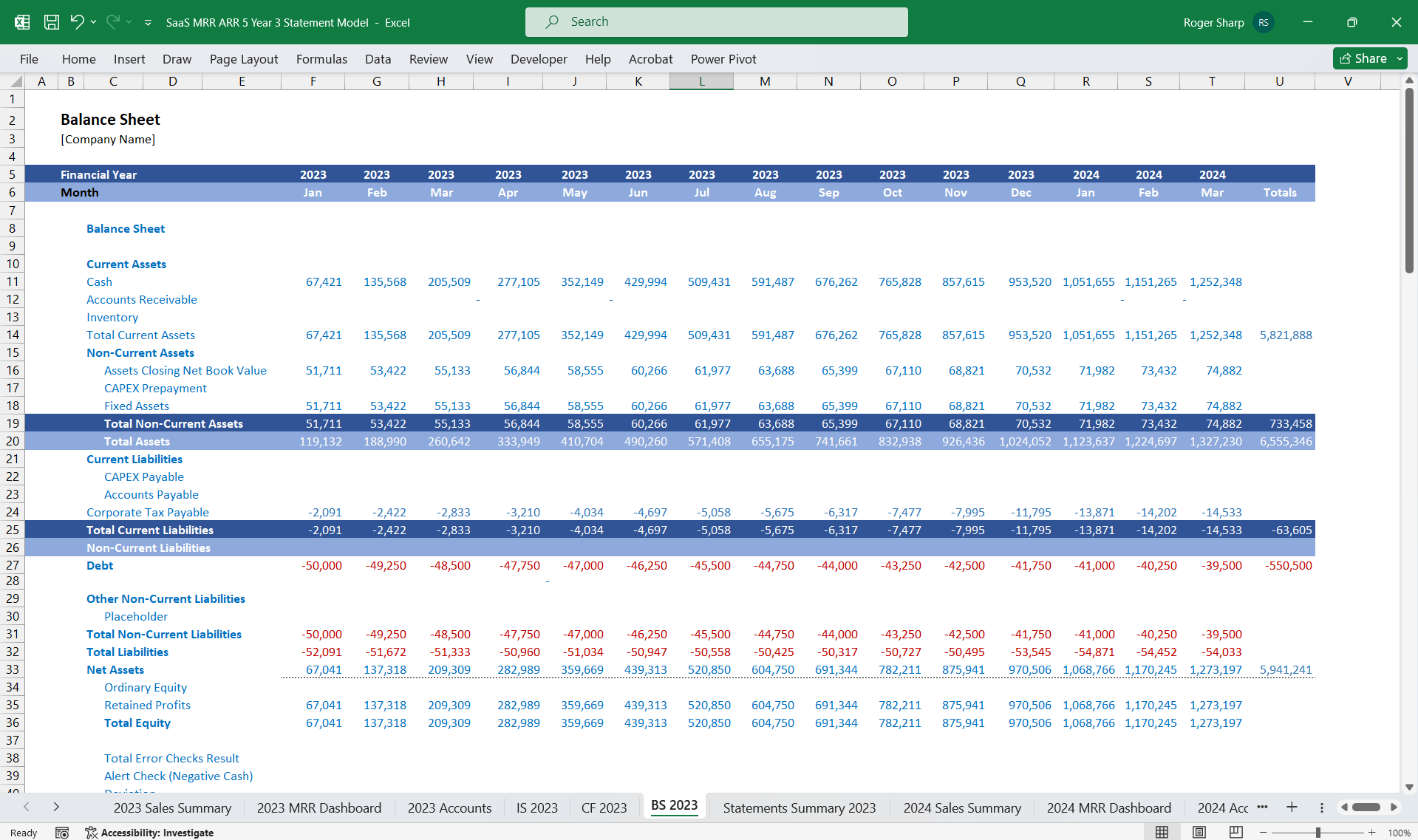

Balance Sheet:

The balance sheet provides a snapshot of a company's financial position at a specific point in time, showing its assets, liabilities, and shareholders' equity. In an MRR finance model, the balance sheet may include:

Asset Forecasting: Predict future asset levels such as cash, accounts receivable, inventory, and property, plant, and equipment (PP&E) based on historical trends and business projections. Detailed monitoring of MRR can help optimize inventory management and asset utilization.

Liability Projection: Estimate liabilities such as accounts payable, accrued expenses, short-term and long-term debt. Analyze payment patterns and debt repayment schedules to manage liquidity and debt levels effectively.

Equity Analysis: Calculate shareholders' equity by considering retained earnings, additional paid-in capital, and other equity components. This assists in analyzing shareholder value creation and optimizing capital structure decisions.

Working Capital Management: Evaluate working capital levels by comparing current assets to current liabilities. Use these analytics to optimize cash flow management, minimize working capital requirements, and improve liquidity.

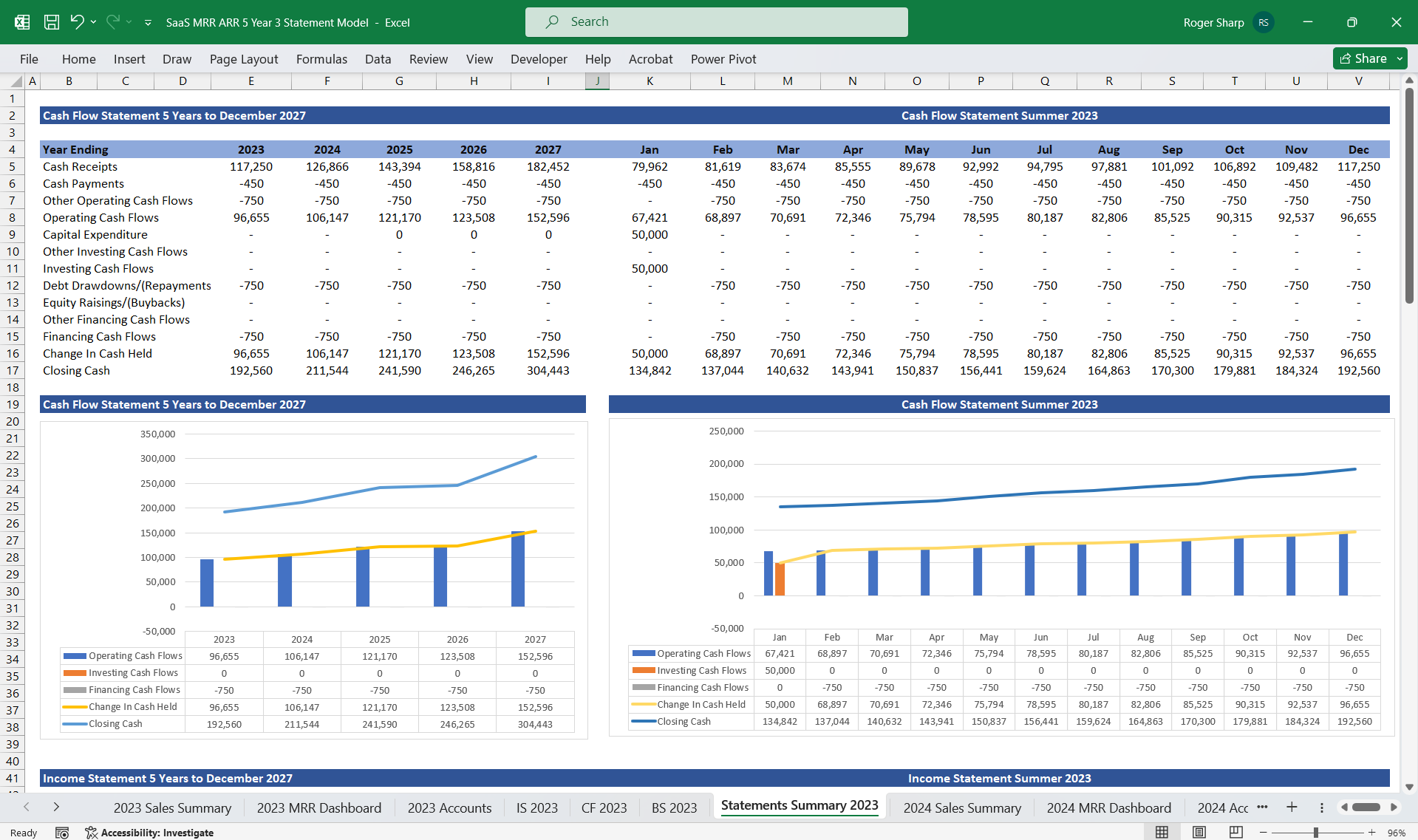

Conclusion:

A 5-year 3-statement financial model for MRR and ARR provides a holistic view of a company's financial performance, enabling stakeholders to make informed decisions, assess risks, and develop strategic plans. By leveraging tools and techniques, organizations can enhance the accuracy and reliability of their financial forecasts and drive sustainable growth and profitability.

Provides thorough oversight, tracking, and reporting of finances, including updates on budget utilisation and projections.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in SaaS Excel: MRR Monthly Recurring Revenue Finance Model 3 Statement Excel (XLSX) Spreadsheet, Willcox PMO