Gordon Growth Valuation Model (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

VALUATION MODEL EXAMPLE EXCEL DESCRIPTION

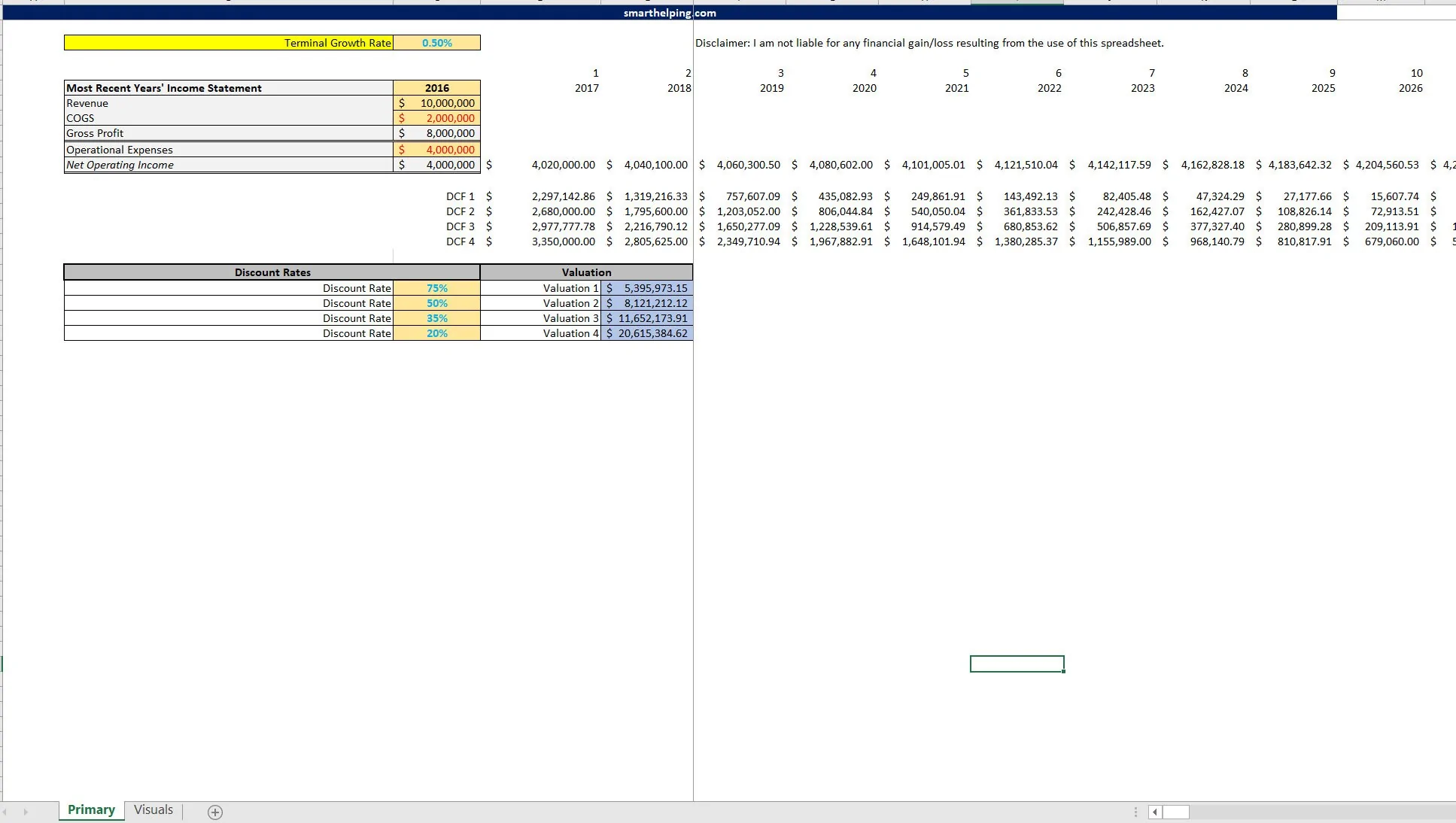

This template is designed for valuation. It uses DCF Analysis but without a terminal value. Oftentimes you will see a 3/5/10 year model with a terminal value at the exit period. T

his is to account for all future values the business/going-concern may have. The other way you can do this is to simply have the model extend out for many periods. This template goes out for 400 plus periods (which if modeled by month would be well over 30 years).

This is enough time so that the present value of discounted cash flows that far into the future will be very close to zero. The benefit of this model is that you don't have to rely on EBITDA or Sales multiples to determine a discounted future terminal value.

Instead you just play the scenario out with assumptions about free cash flow over the entire timeline.

The main inputs to this are:

• Current year

• Revenue

• COGS

• Gross Profit

• Operational Expenses

• Net Operating Income (not the above can be updated so this is free cash flow) but the point is you are solving for expected free cash flow per the given period

• Terminal growth rate of Net Operating Income or free cash flow

The above assumptions drive the future cash flows along with up to 4 separate discount rates that apply to the future cash flow (for a sensitivity analysis on valuation).

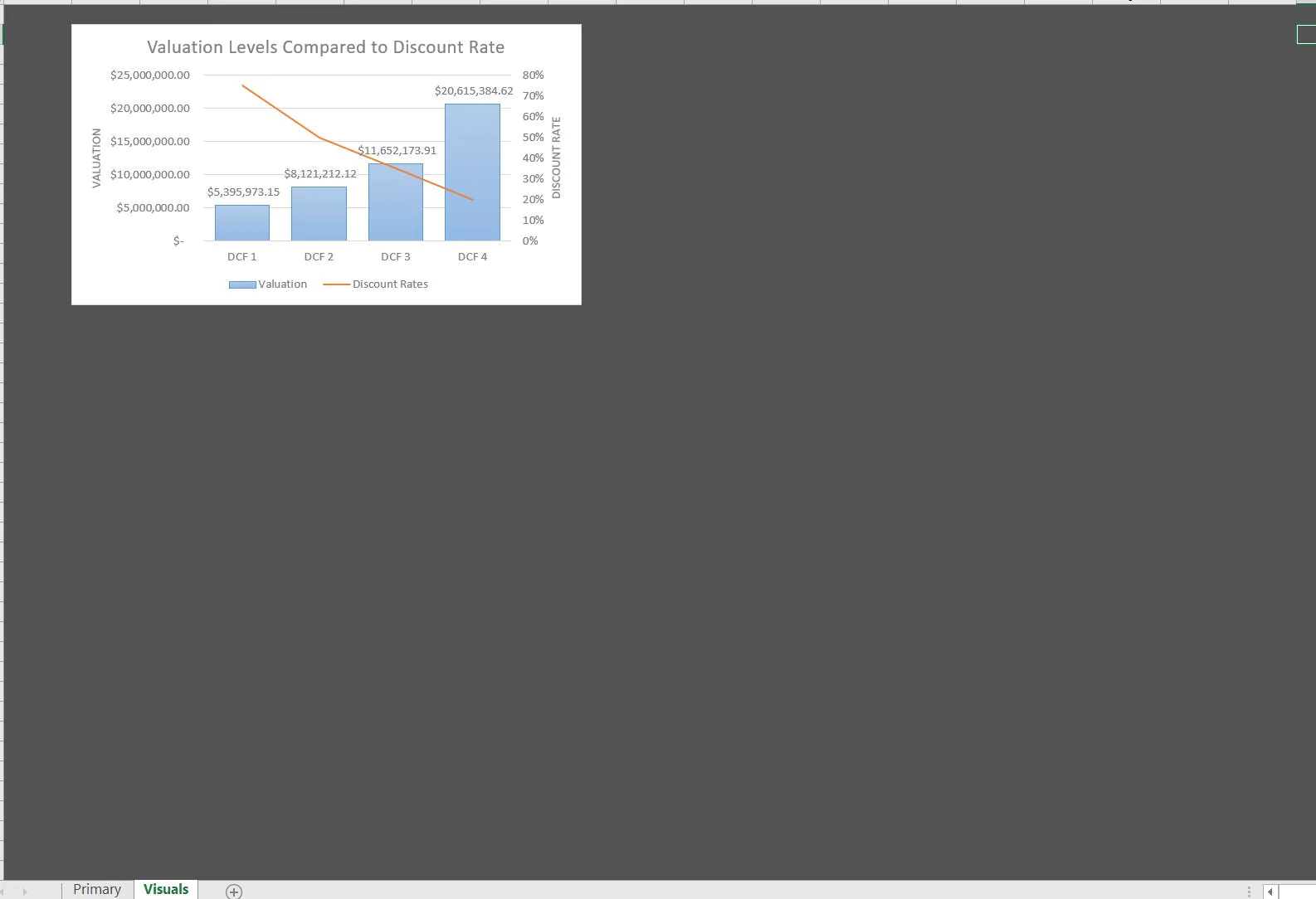

There is also a visualization to sum up the results based on the present value of each discount rate. This specific type of valuation is called the Gordon Growth Model.

It should be used under the following circumstances (but not limited to):

• Assume the cash flows can reasonably be assumed to grow at a constant rate

• If measuring a public company with dividends, those dividends should have stable growth rates It assumes the company lasts forever

• Examples of such companies or stocks typically involve established REIT (real estate investment trusts), oil and gas companies, or utilities. That is because the cash flow streams are predictable and not likely to have a ton of change based on external factors.

Also note, this is similar to a dividend discount model, but not exactly the same.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Valuation Model Example Excel: Gordon Growth Valuation Model Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping

This document is available as part of the following discounted bundle(s):

Save %!

General Valuation

This bundle contains 10 total documents. See all the documents to the right.