DCF Analysis with Sensitivity Tables (Excel XLSX)

Excel (XLSX)

VIDEO DEMO

VALUATION EXCEL DESCRIPTION

One of the oldest and most reliable way to value something is coming up with the present value of all future cash flows that the item will produce.

DCF Analysis templates are very useful for those trying to figure out the present value of future cash flows, the resulting IRR (internal rate of return) and NPV (net present value).

This template in particular does a really good job at two things:

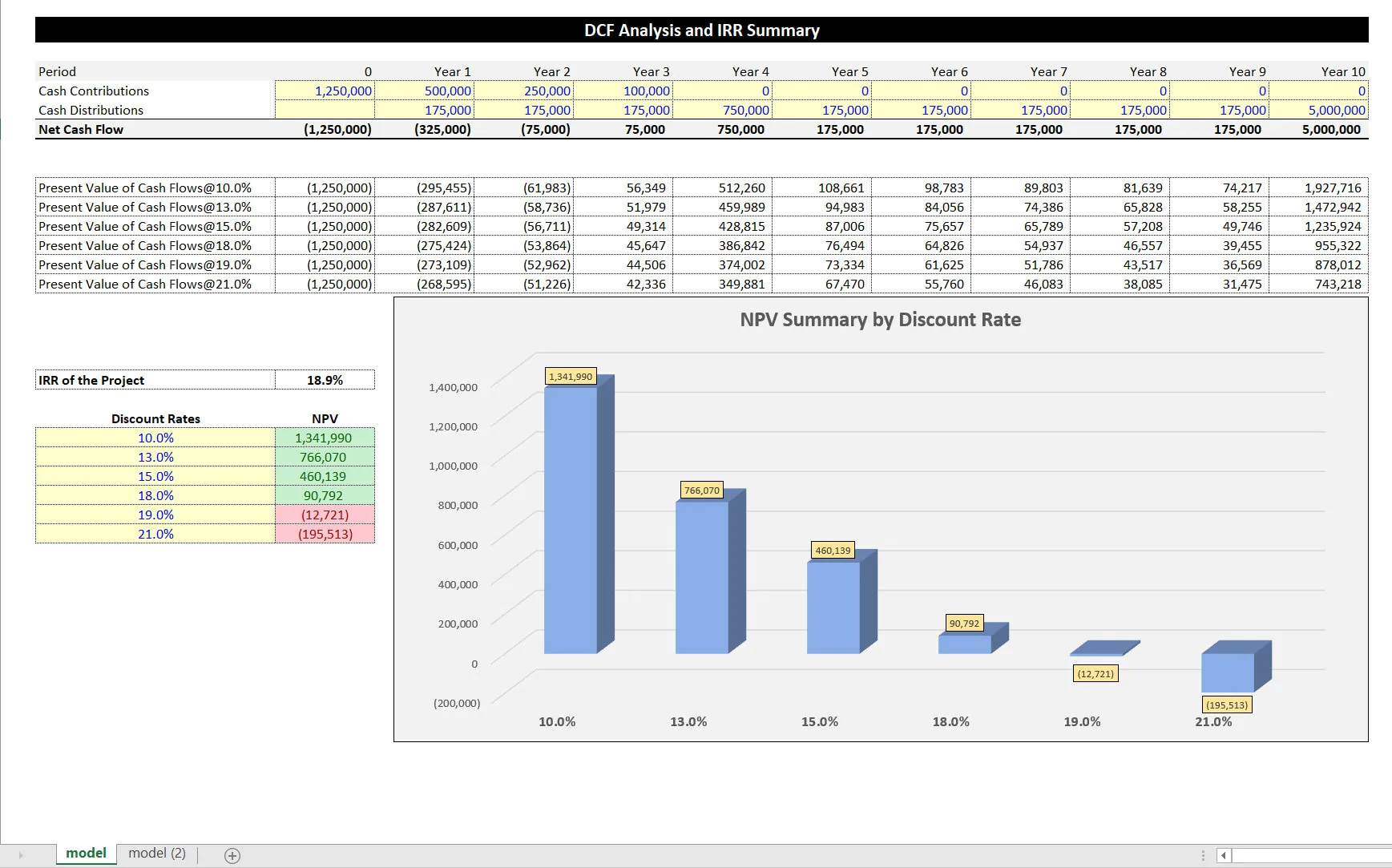

• Providing a clean input for cash in and outflows and a NPV at up to 6 different discount rates.

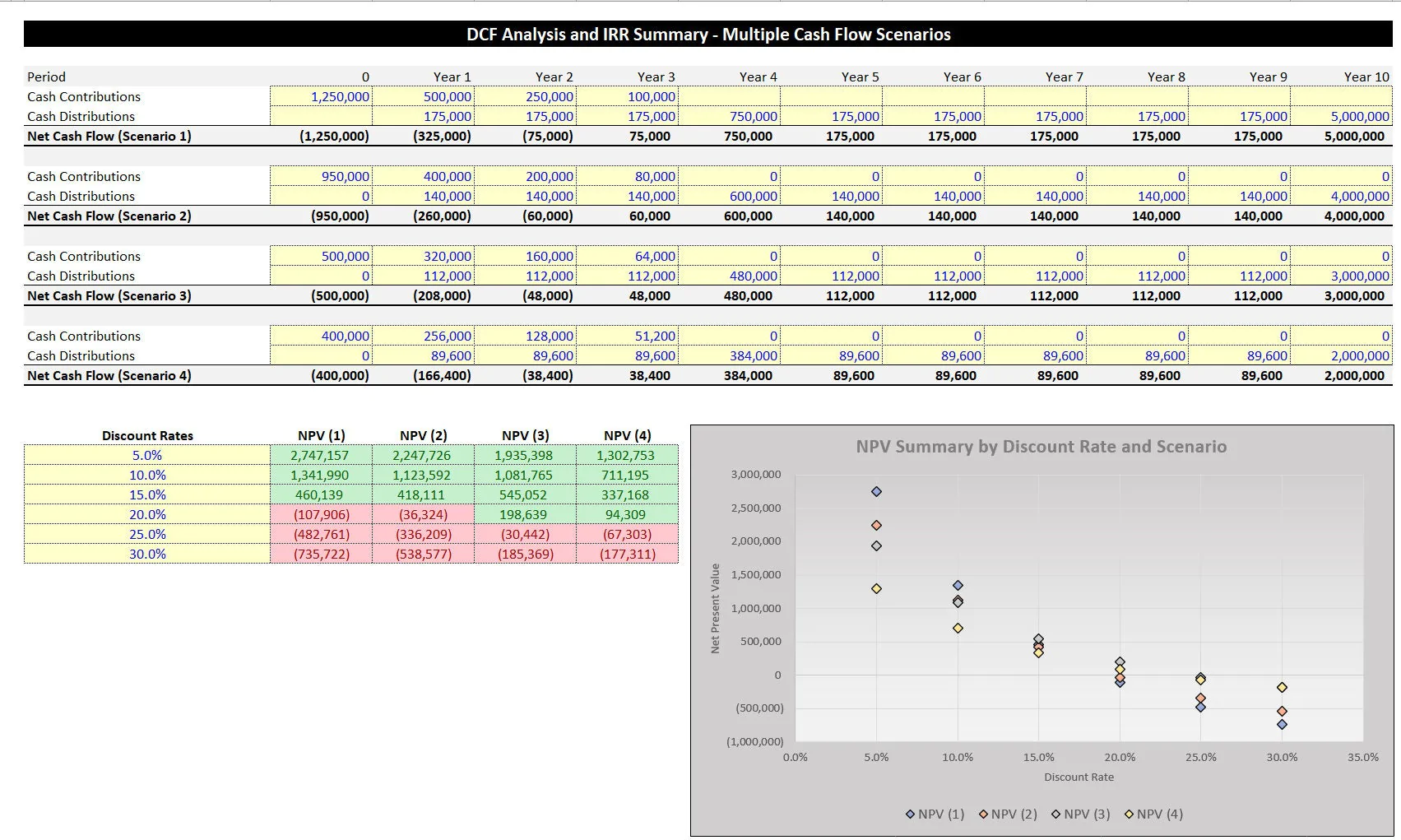

• Provides a second input tab that allows for up to 4 different cash in and outflows and a NPV for each of those at 6 different discount rates (24 total NPVs) for better context and comparison analysis.

The flows could be the same project with different scenarios or different projects that need to be compared side-by-side. The user can input the range of discount rates. The visualization on the first tab will display a 3D bar chart for each of the 6 NPVs for the single cash flow stream.

The visualization on the second tab will be a diamond plot chart that shows all 24 NPVs at the various discount rates for each of the 4 scenarios.

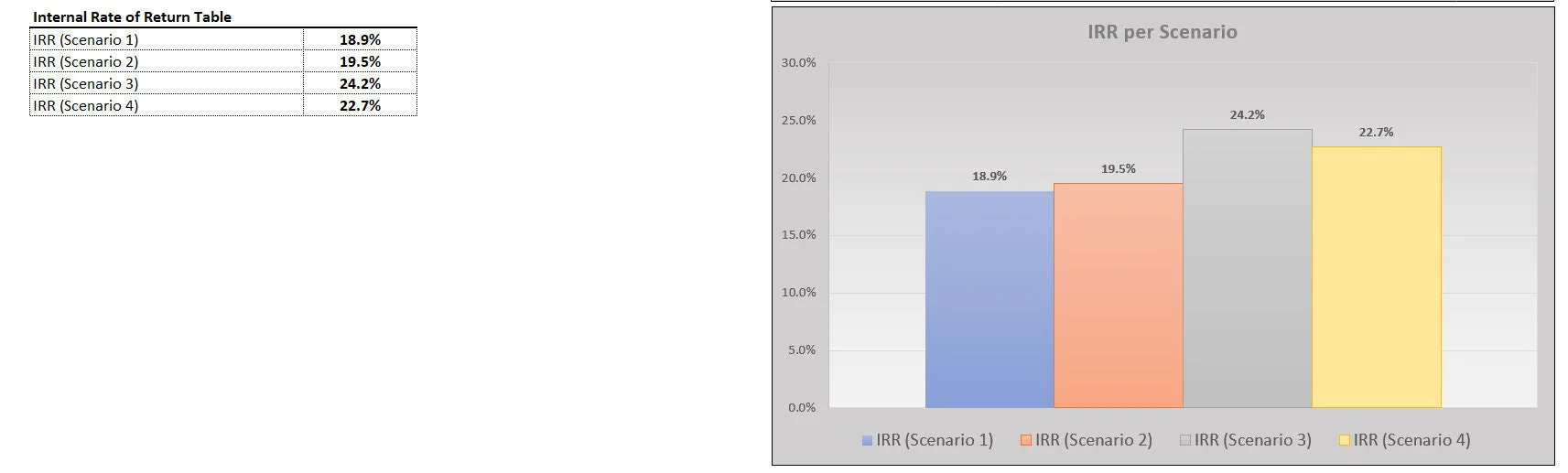

There is an additional visual on the second tab that also shows the IRR for each of the 4 cash flow streams. There are up to 10 periods for entry and will most commonly be used for annual cash flows.

If you want to show the values based on monthly cash flows, the formulas would need to be extended accordingly, but it wouldn't be overly complex to make this modification if needed. There is a Google Sheet version included in this as well.

The link is on the first model tab and if you want to use that, go through the link and then hit File > Make a Copy for your own editable sheet.

Got a question about the product? Email us at support@flevy.com or ask the author directly by using the "Ask the Author a Question" form. If you cannot view the preview above this document description, go here to view the large preview instead.

Source: Best Practices in Valuation Excel: DCF Analysis with Sensitivity Tables Excel (XLSX) Spreadsheet, Jason Varner | SmartHelping